Fiduciary Deed Nh Withholding

Description

How to fill out New Hampshire Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

Creating legal documents from ground zero can frequently feel somewhat daunting. Certain situations might demand extensive investigation and considerable funds expended.

If you seek a more direct and cost-effective method of composing Fiduciary Deed Nh Withholding or any other documentation without the hassle of navigating obstacles, US Legal Forms is always available to assist you.

Our online archive of over 85,000 current legal documents covers nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can immediately access state- and county-specific templates carefully prepared for you by our legal experts.

Utilize our platform whenever you require dependable and trustworthy services from which you can quickly find and download the Fiduciary Deed Nh Withholding. If you are familiar with our site and have previously established an account with us, simply Log In to your account, select the form, and download it or re-download it later from the My documents section.

US Legal Forms boasts a flawless reputation and over 25 years of experience. Join us today and simplify the process of document execution!

- Review the form preview and descriptions to confirm that you have found the document you need.

- Ensure the form you select complies with the regulations of your state and county.

- Select the appropriate subscription option to obtain the Fiduciary Deed Nh Withholding.

- Download the document. Then fill it out, validate, and print it.

Form popularity

FAQ

Gains and losses on disposition of property shall be netted and reported with receipts. For each asset comprising the reported "Balance in Hands of Fiduciary," excluding all Tangible Personal Property, the Fiduciary shall provide Proof of Assets.

In many places, the seller is the one obligated to pay the transfer taxes, but the rules vary. ?In some states, like Pennsylvania, this expense is typically split between the buyer and seller,? Popowitz says.

Fiduciary deeds are just one of several types of deeds used in property transfers. This type is used to transfer property such as real estate when the owner can't sign a deed for legal or other reasons. Fiduciary deeds are commonly employed when settling estates and the original owner of the property is deceased.

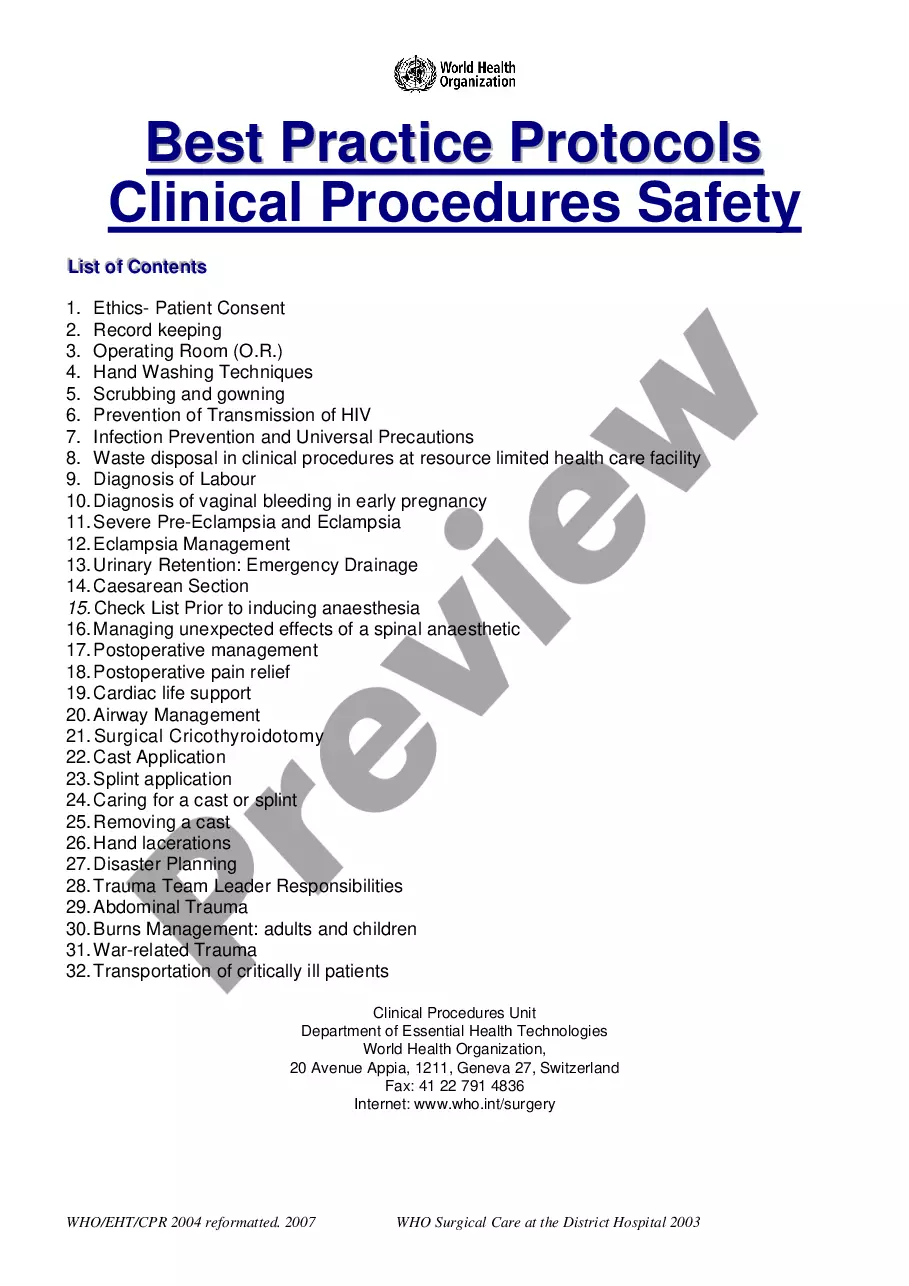

This form is used to show the court the details of the assets of an estate, whether for an estate administration, guardianship, conservatorship or trust. It should contain an itemization of real and personal properties and their values.

The tax is imposed on both the buyer and the seller at the rate of $. 75 per $100 of the price or consideration for the sale, granting, or transfer. What types of transactions are taxable?