New Hampshire Lien Waiver Form

Description

Form popularity

FAQ

In North Carolina, there are generally two types of lien waivers: conditional and unconditional waivers. Conditional waivers apply only when a specific condition is met, such as receipt of payment. Familiarizing yourself with the types of lien waivers available can enhance your understanding of the New Hampshire lien waiver form and its application in property transactions.

The primary difference between conditional and unconditional lien waivers lies in their terms. A conditional lien waiver only takes effect upon receipt of a payment, while an unconditional waiver confirms that payment has been received, providing immediate release of claims. Understanding this difference is critical when using a New Hampshire lien waiver form to protect your financial interests.

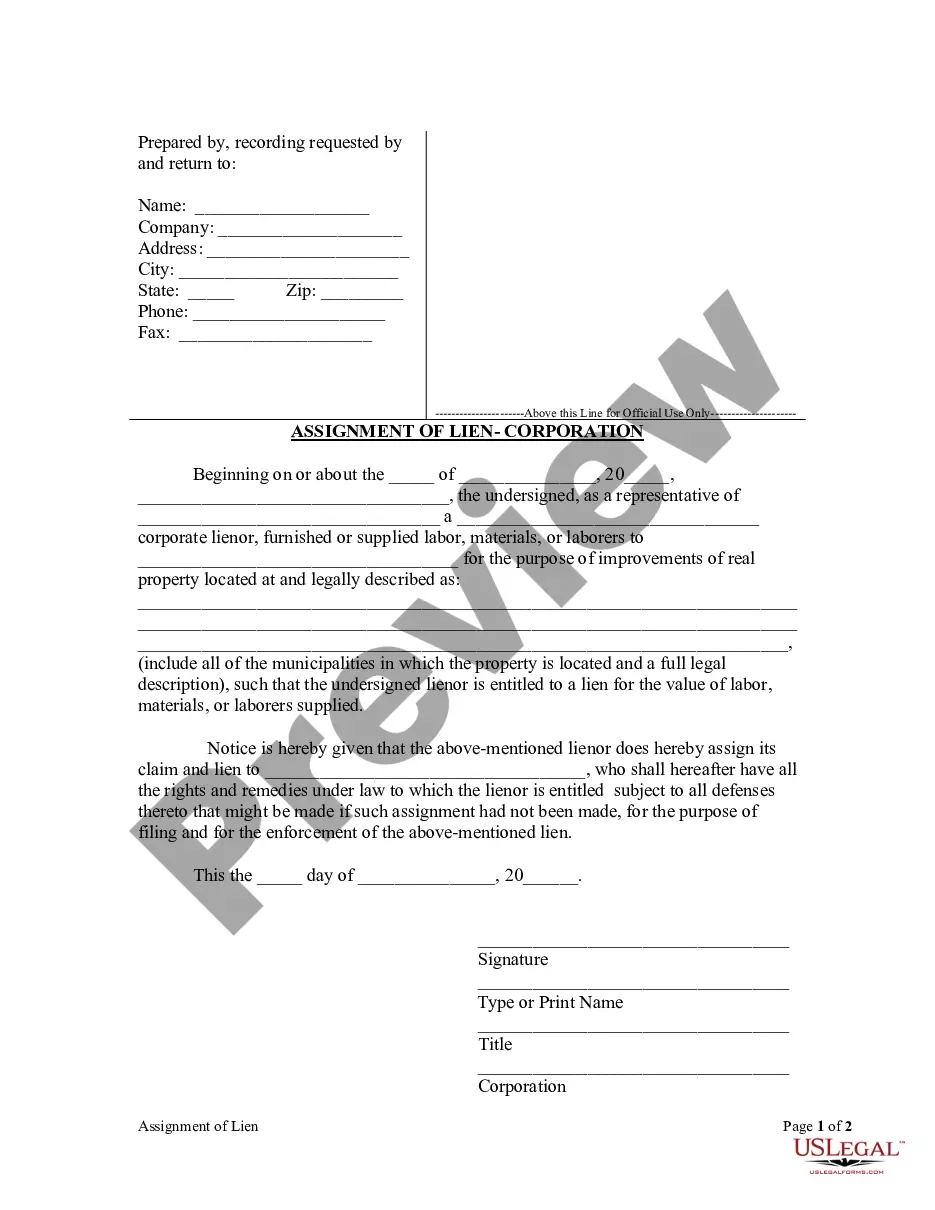

Filling out a waiver form requires you to clearly state the parties involved, the payment amount, and any conditions applied to the waiver. Be thorough in providing all necessary information, such as dates and signatures. Utilizing a New Hampshire lien waiver form simplifies this process by guiding you through the required details, ensuring proper completion.

An unconditional release is a type of lien waiver that confirms payment has been received, releasing all claims against the property for that payment. This release provides peace of mind by assuring owners that no future claims can be made for the settled amount. When drafting an unconditional release, consider utilizing a New Hampshire lien waiver form to ensure clarity and compliance.

The best type of lien waiver for property owners often depends on the circumstances of a specific project. However, unconditional lien waivers can offer immediate protection to property owners, as they release any claims to payment. When using a New Hampshire lien waiver form, it's essential to choose the type that aligns with your project requirements.

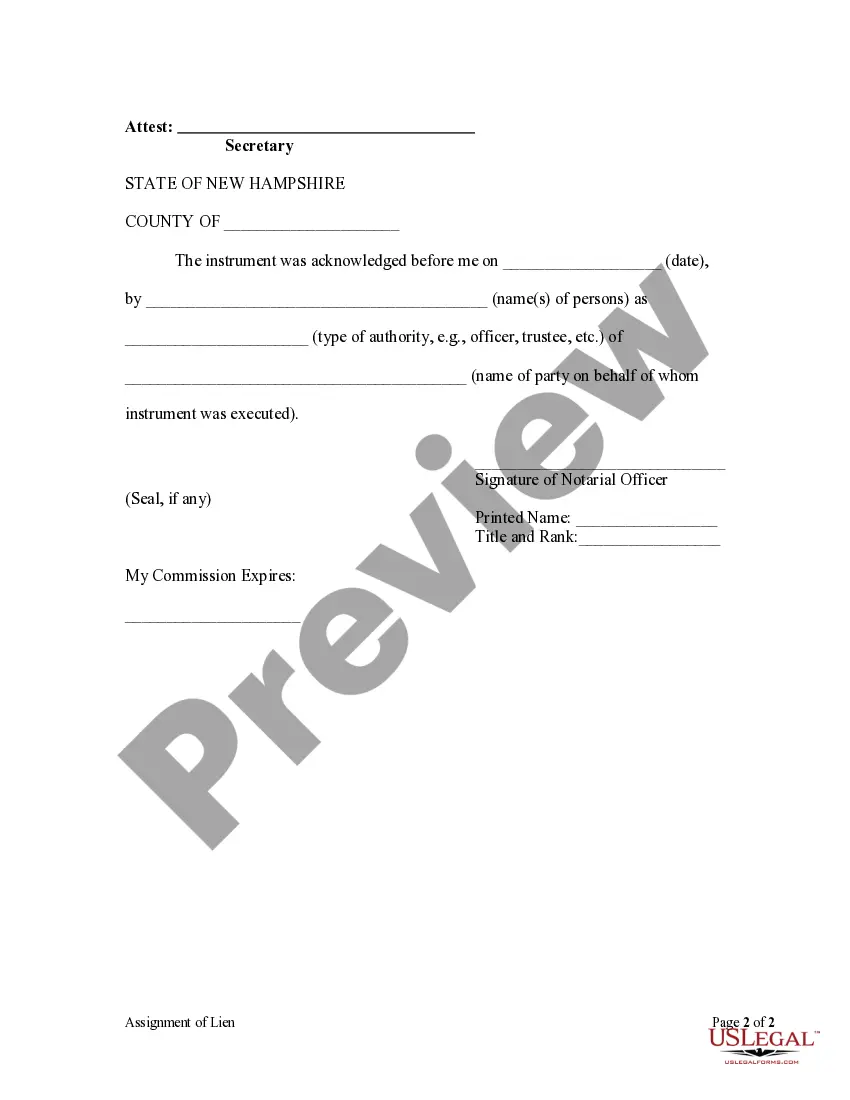

Yes, in Massachusetts, lien waivers usually require notarization to ensure their validity. This process helps prevent disputes over the authenticity of the waiver. It is important to compare this with New Hampshire lien waiver forms, which may have different notarization requirements, so read the specific instructions carefully.

To file a lien in New Hampshire, you must complete and submit a lien document to the appropriate county registry of deeds. Ensure you follow the guidelines set by state law to validate your lien. Using a New Hampshire lien waiver form can help you avoid potential disputes by formalizing agreements with contractors before filing any liens.

To place a lien on your property in New Hampshire, you must first prepare and file the appropriate lien forms. It’s essential to gather all supporting documentation, such as details of the debt owed and related contracts. Once filed with the county registry of deeds, the lien becomes part of the public record. Platforms like USLegalForms provide guidance and forms to facilitate this process.

In New Hampshire, a lien generally lasts for five years from the time it is filed, although it may be extended under certain circumstances. To maintain the validity of the lien, it’s crucial to file any necessary extensions before the initial five years expire. Familiarizing yourself with the regulations surrounding liens can prevent potential issues regarding property ownership.

New Hampshire does not classify itself as a super lien state. In a super lien state, certain liens, like homeowners association liens, take priority over other types of liens. New Hampshire law provides a structured approach to liens, ensuring that all parties are aware of their rights and obligations through processes like the New Hampshire lien waiver form.