New Hampshire Disclosure Forecast

Description

Form popularity

FAQ

Filing an NH annual report is straightforward. Businesses must submit their annual report to the Secretary of State by the anniversary date of their formation. Using the NH QuickStart platform can guide you through the process and help ensure you include all necessary information in line with the New Hampshire disclosure forecast, keeping you compliant and informed.

Yes, if you operate a business in New Hampshire, you will need to file a business profits tax return, as the state imposes a tax on business income. This requirement ensures that businesses contribute to state revenue, even though there is no personal income tax. You can learn more about managing your obligations and understanding the New Hampshire disclosure forecast by using the resources provided by NH QuickStart.

If your income consists solely of wages, you do not need to file a New Hampshire tax return, as there is no state income tax on wages. However, if you receive interest and dividends, filing may be necessary. You can stay informed and effortlessly navigate these requirements through the New Hampshire disclosure forecast available on the NH QuickStart platform.

No, residents of New Hampshire are not required to file a state income tax return, as the state does not impose a tax on wages. However, if you have interest or dividend income, you may need to file specific forms. Utilizing resources like the NH QuickStart platform can ensure you meet all requirements in alignment with the New Hampshire disclosure forecast.

In New Hampshire, the taxable income primarily includes interest and dividends. This unique structure means that wages and salaries are not subject to income tax, allowing for different financial planning strategies. It’s important to understand your income sources to stay informed about the New Hampshire disclosure forecast and any taxes you may owe.

As of now, ongoing discussions are occurring regarding the future of the interest and dividend tax in New Hampshire. Although changes have been proposed, nothing has been finalized, which means the tax remains in effect for the time being. Staying updated with the New Hampshire disclosure forecast will help you anticipate any potential changes that could affect your tax obligations.

Filing NH DP 10 is necessary if you have any taxable interest or dividends above the threshold set by the New Hampshire Department of Revenue. This form assists in reporting your income accurately, which is essential for understanding the New Hampshire disclosure forecast. If you are unsure about your income levels, consulting the NH QuickStart platform can help clarify your filing requirements.

NH QuickStart is a user-friendly online platform designed to help individuals and businesses in New Hampshire manage their tax and legal paperwork efficiently. By simplifying the process, it enables users to swiftly navigate the complex requirements associated with the New Hampshire disclosure forecast. The platform helps you access all necessary forms and guides, ensuring you stay compliant and informed.

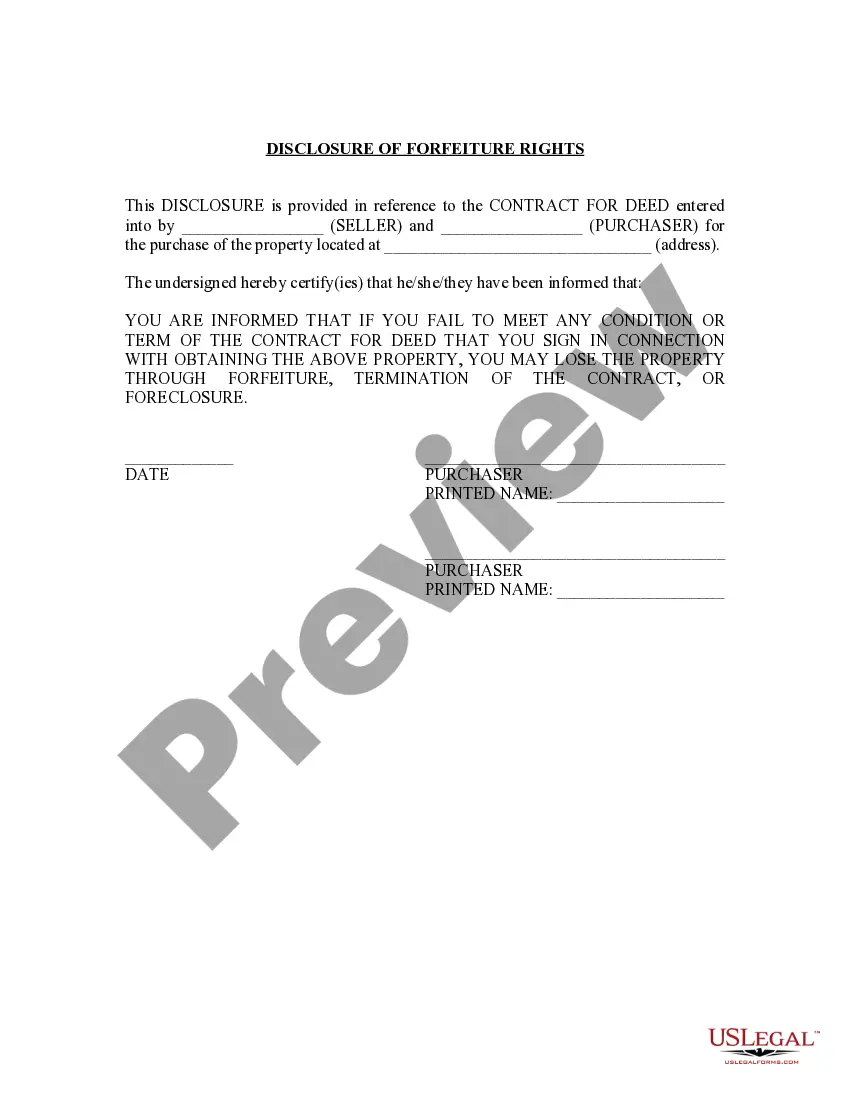

Disclosure requirements typically refer to the information that sellers must provide about the property's condition, zoning regulations, and potential hazards. In New Hampshire, these requirements ensure that all parties are aware of any issues that could impact property value. For those navigating the process, the New Hampshire disclosure forecast serves as a valuable tool to understand what information must be communicated, ensuring smoother transactions.

In New Hampshire, disclosure requirements involve informing potential buyers about the physical condition of the property as well as any legal issues. Sellers must disclose past repairs, potential zoning restrictions, and any neighborhood-specific information that may affect property value. Keeping up with the New Hampshire disclosure forecast can protect both parties from misunderstandings down the line.