Corporation Contract Sample For Contractor

Description

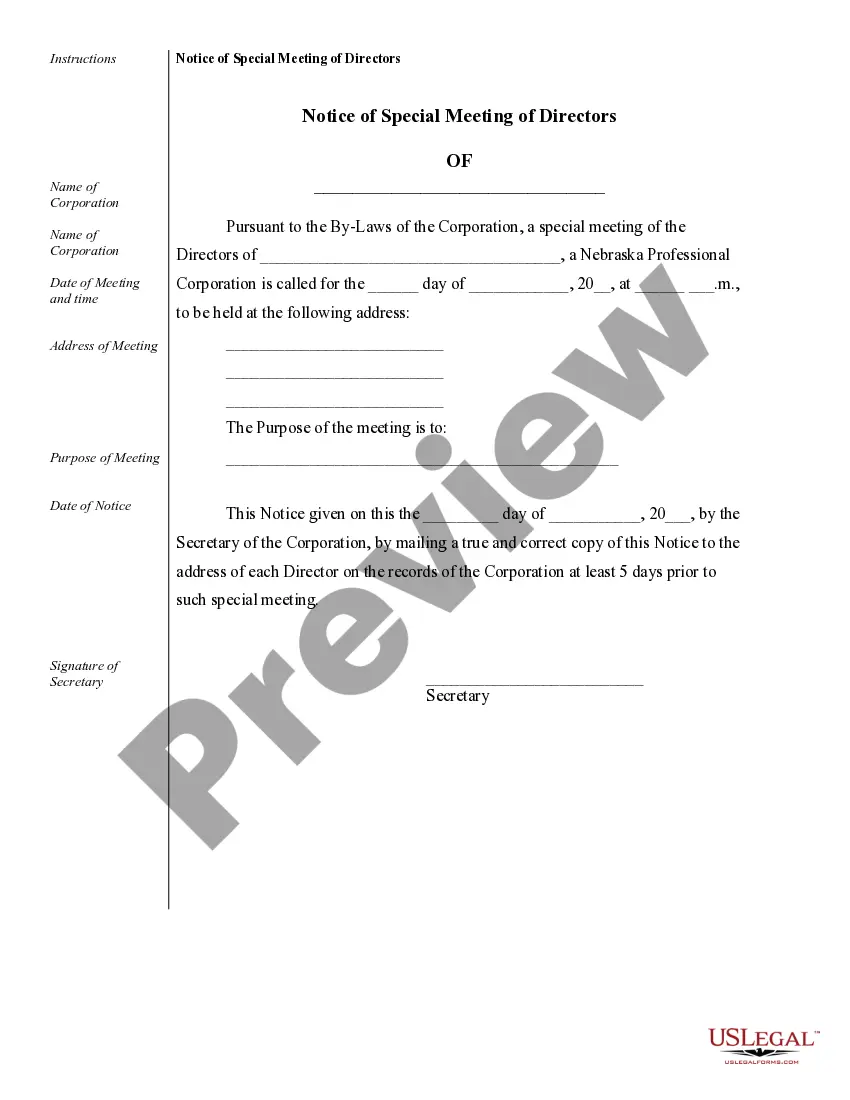

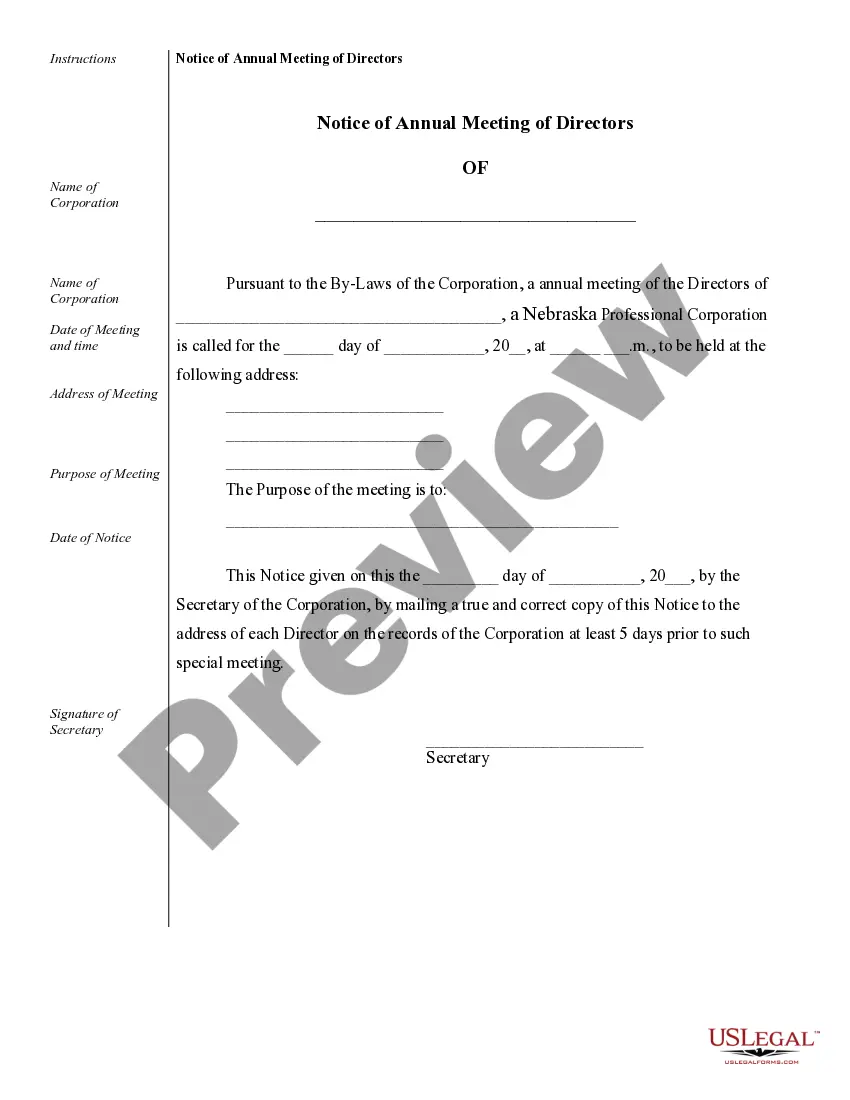

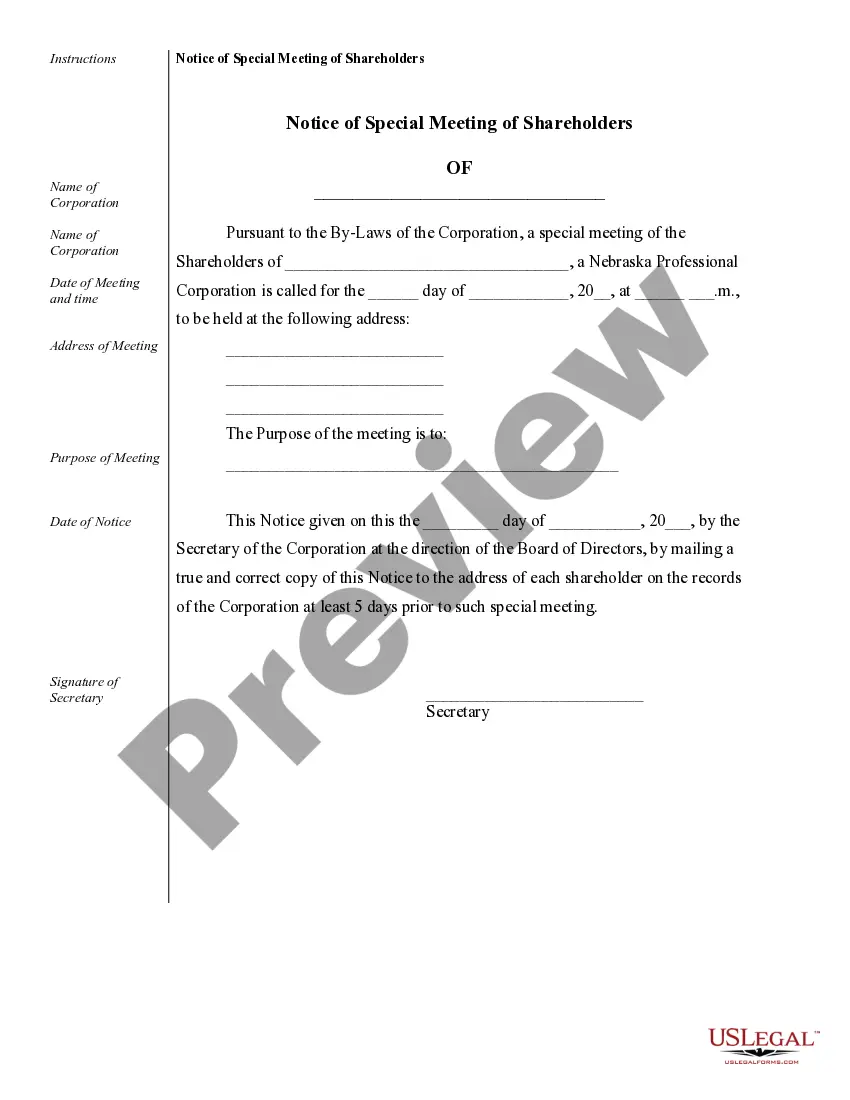

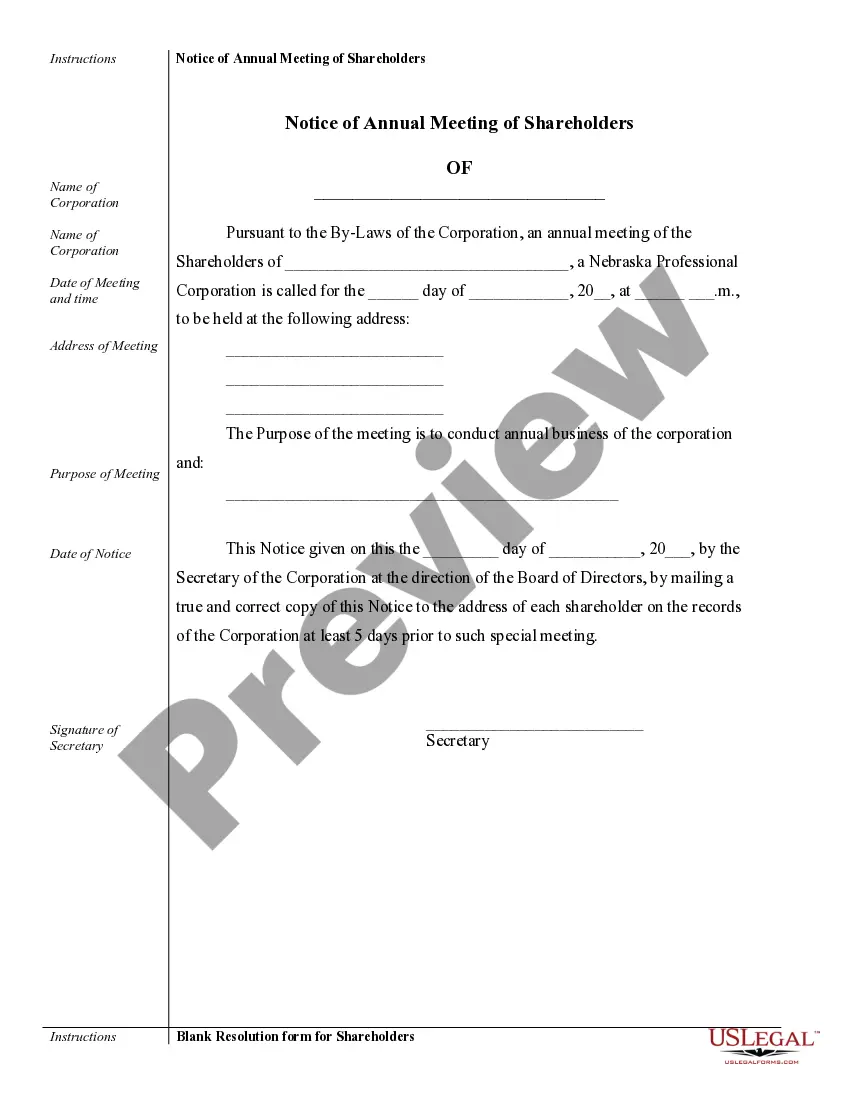

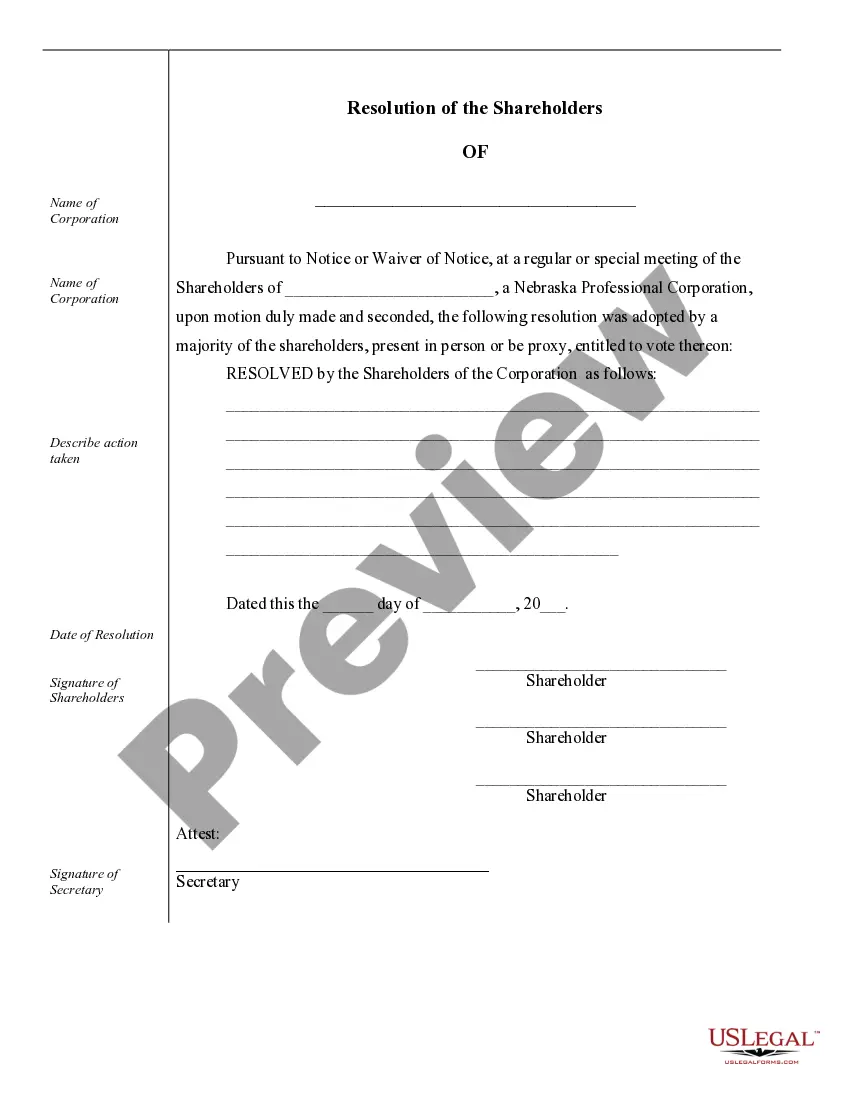

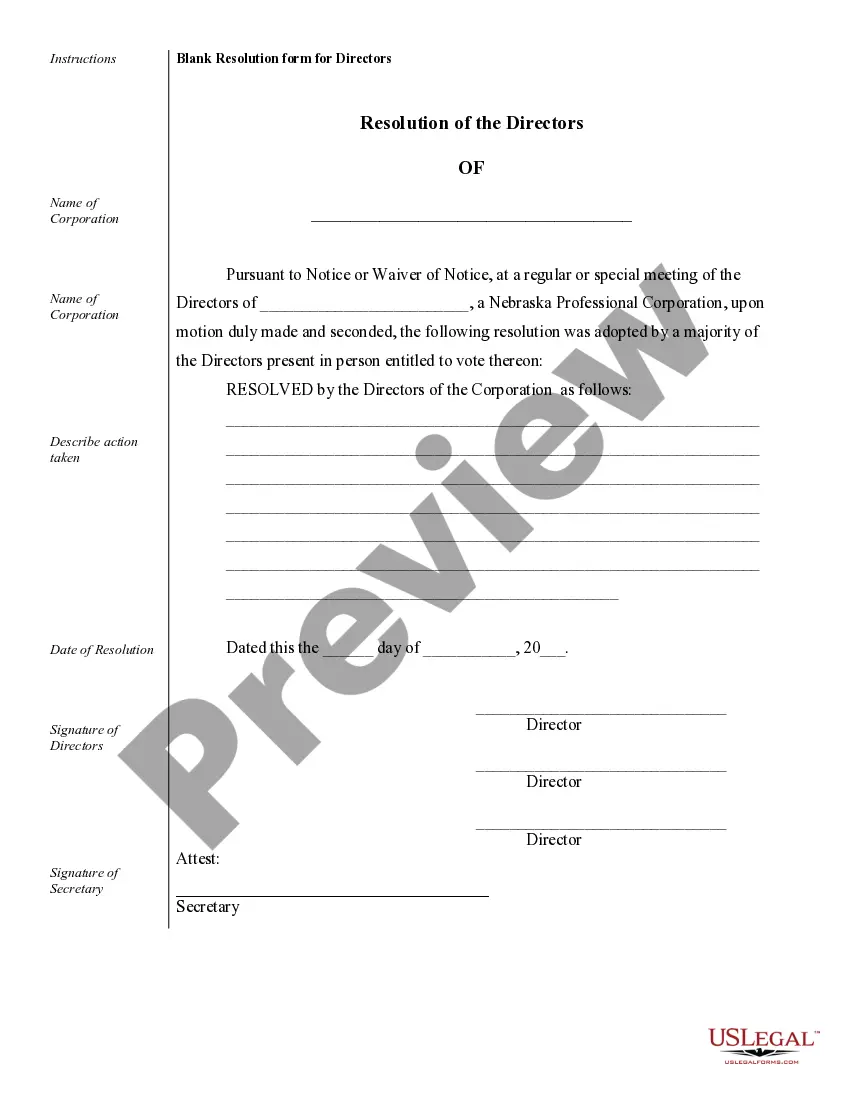

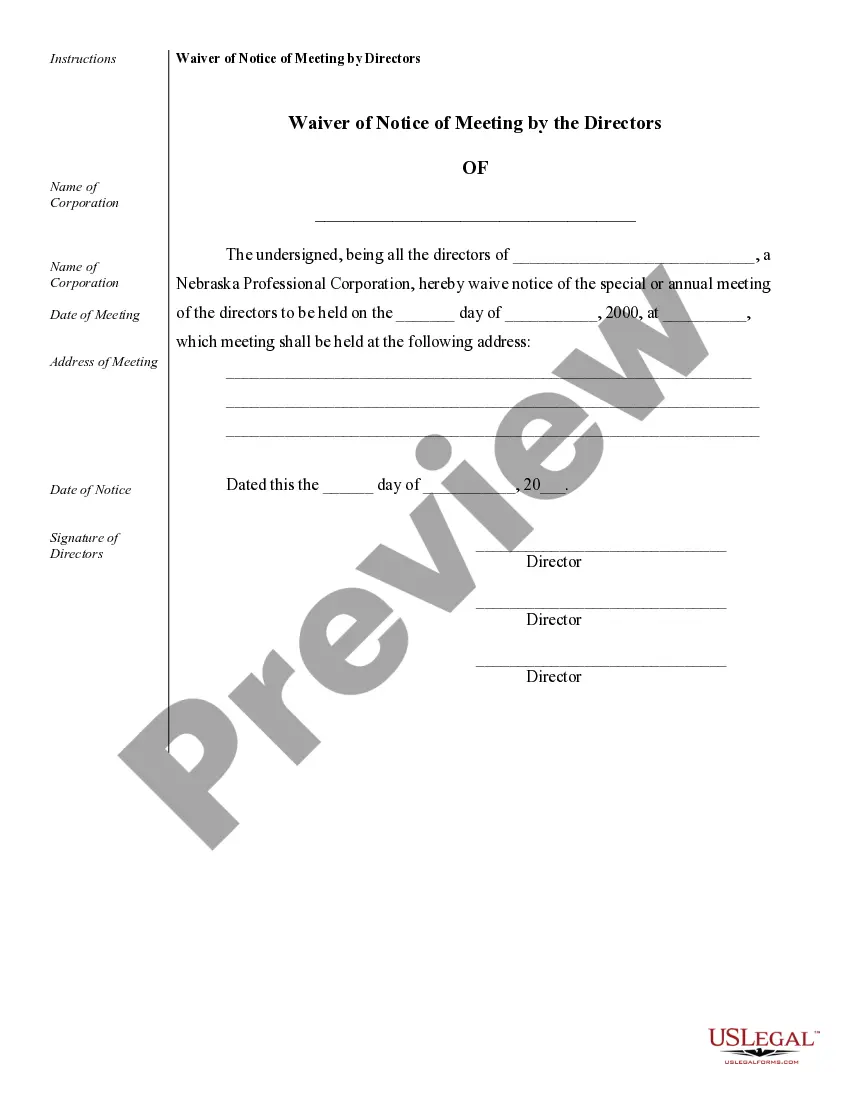

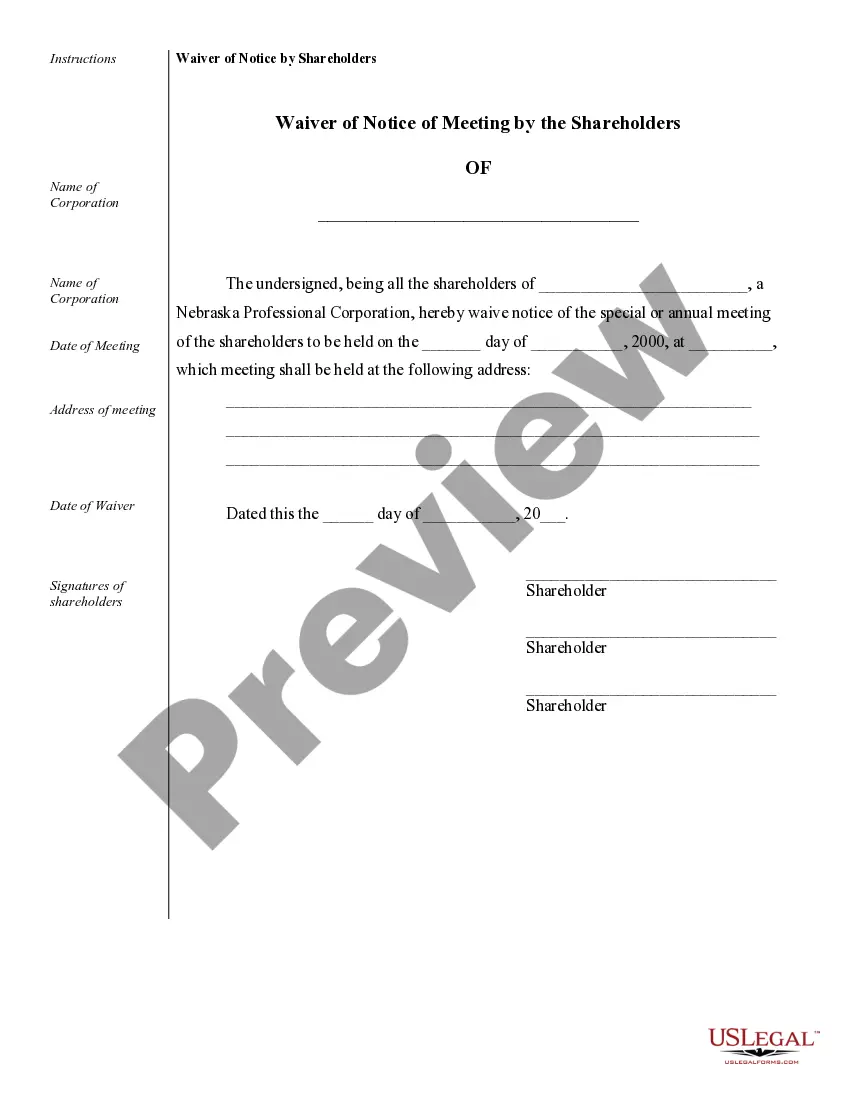

How to fill out Sample Corporate Records For A Nebraska Professional Corporation?

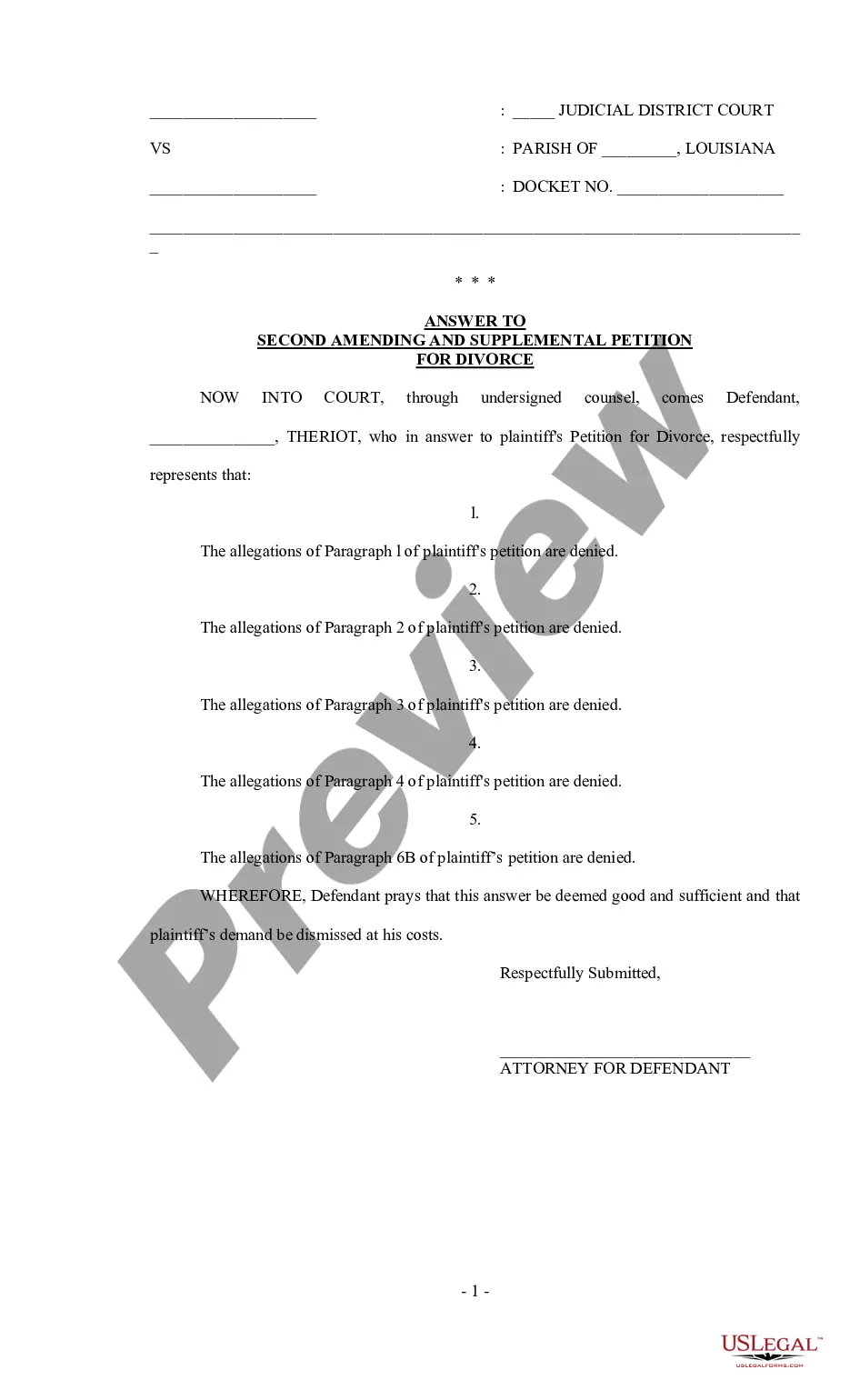

Which service is the most reliable for acquiring the Corporation Contract Sample for Contractors and other recent types of legal documents? US Legal Forms is your answer! It boasts the most comprehensive assortment of legal templates for any situation.

Each template is skillfully prepared and evaluated for adherence to federal and local statutes and regulations. They are organized by jurisdiction and state of application, making it simple to find what you require.

Alternative form search. If you encounter any discrepancies, use the search function in the header to find an alternative template. Click Buy Now to select the appropriate one.

- Seasoned users of the site just need to Log In to the platform, verify their subscription status, and hit the Download button next to the Corporation Contract Sample for Contractor to retrieve it.

- After being downloaded, the template will be stored for future access in the My documents section of your account.

- If you do not yet have an account with our library, follow these steps to create one.

- Form compliance verification. Before acquiring any template, ensure it meets your usage requirements and complies with your local or state guidelines. Review the form description and utilize the Preview option if it is provided.

Form popularity

FAQ

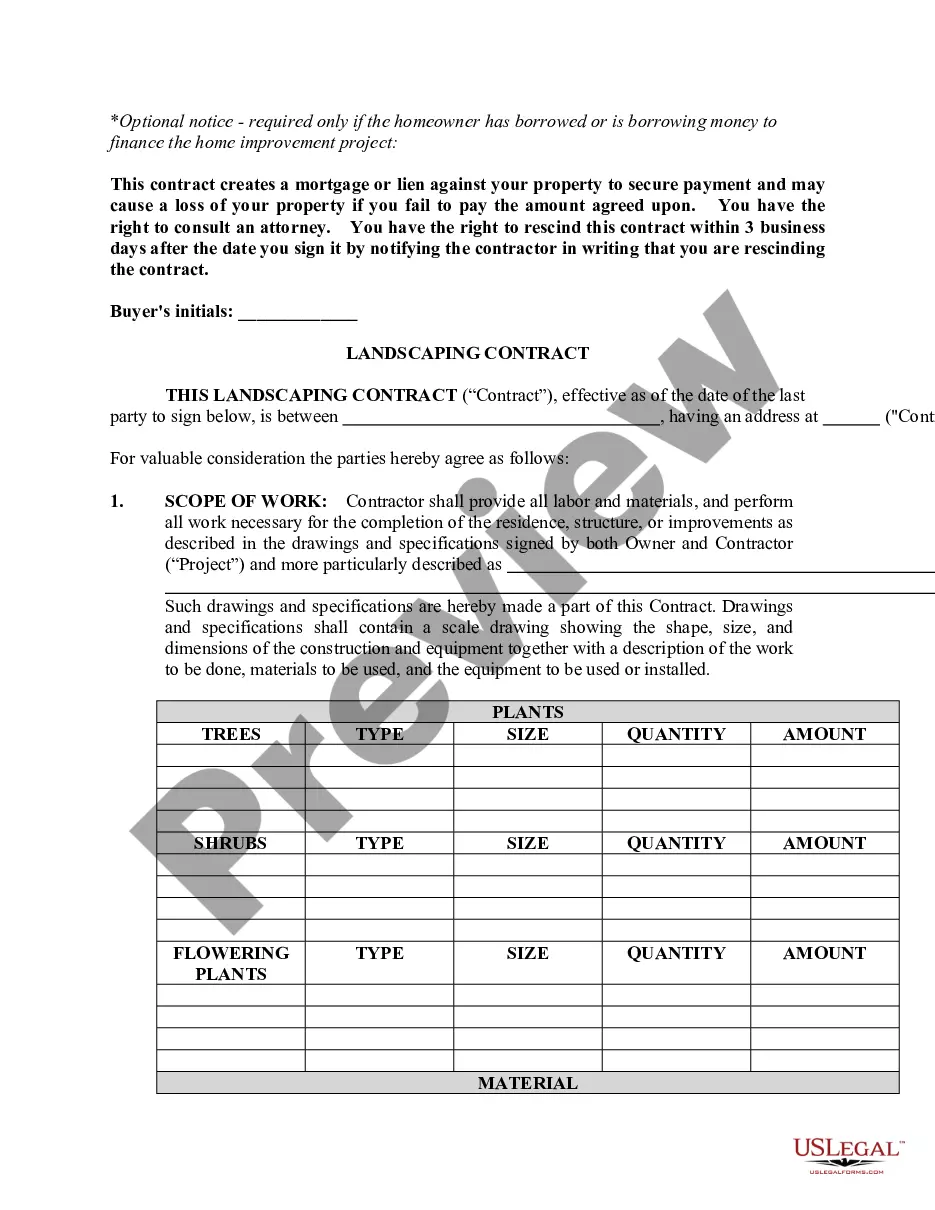

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

The entire agreement should cover the following:General information about the contractor and client.Services and scope of work.Permission to hire subcontractors.Equipment and facilities.Compensation for the services provided.Expenses, travel, and reimbursement policies.Effective date of the agreement.More items...?

A contract should contain everything agreed upon by you and your licensed contractor. It should detail the work, price, when payments will be made, who gets the necessary building permits, and when the job will be finished. The contract also must identify the contractor, and give his/her address and license number.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Independent contractors generally report their earnings to the IRS quarterly using Form 1040-ES, Estimated Tax for Individuals. This covers both their federal income tax and self-employment tax liabilities. They may also have to pay state and local taxes according to their state and local government guidelines.