Assumption Deed Of Trust

Description

How to fill out Nebraska Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

There’s no longer a need to spend hours searching for legal documents to adhere to your local state laws.

US Legal Forms has compiled all of them in a single location and simplified their accessibility.

Our website provides over 85,000 templates for any business and personal legal situations categorized by state and field of use. All forms are expertly drafted and verified for accuracy, so you can trust in acquiring a current Assumption Deed Of Trust.

Choose the suitable subscription plan and create an account or Log In. Complete the payment for your subscription with a credit card or via PayPal to proceed. Select the file format for your Assumption Deed Of Trust and download it to your device. Print your form to fill it out manually or upload the sample if you prefer to complete it in an online editor. Preparing legal documents under federal and state regulations is quick and simple with our platform. Try US Legal Forms today to keep your paperwork organized!

- If you are acquainted with our platform and already possess an account, ensure that your subscription is active before accessing any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documents at any time by accessing the My documents tab in your profile.

- If you’ve never used our platform before, the process will take a few additional steps to complete.

- Here’s how first-time users can acquire the Assumption Deed Of Trust from our catalog.

- Review the page content closely to ensure it contains the sample you need.

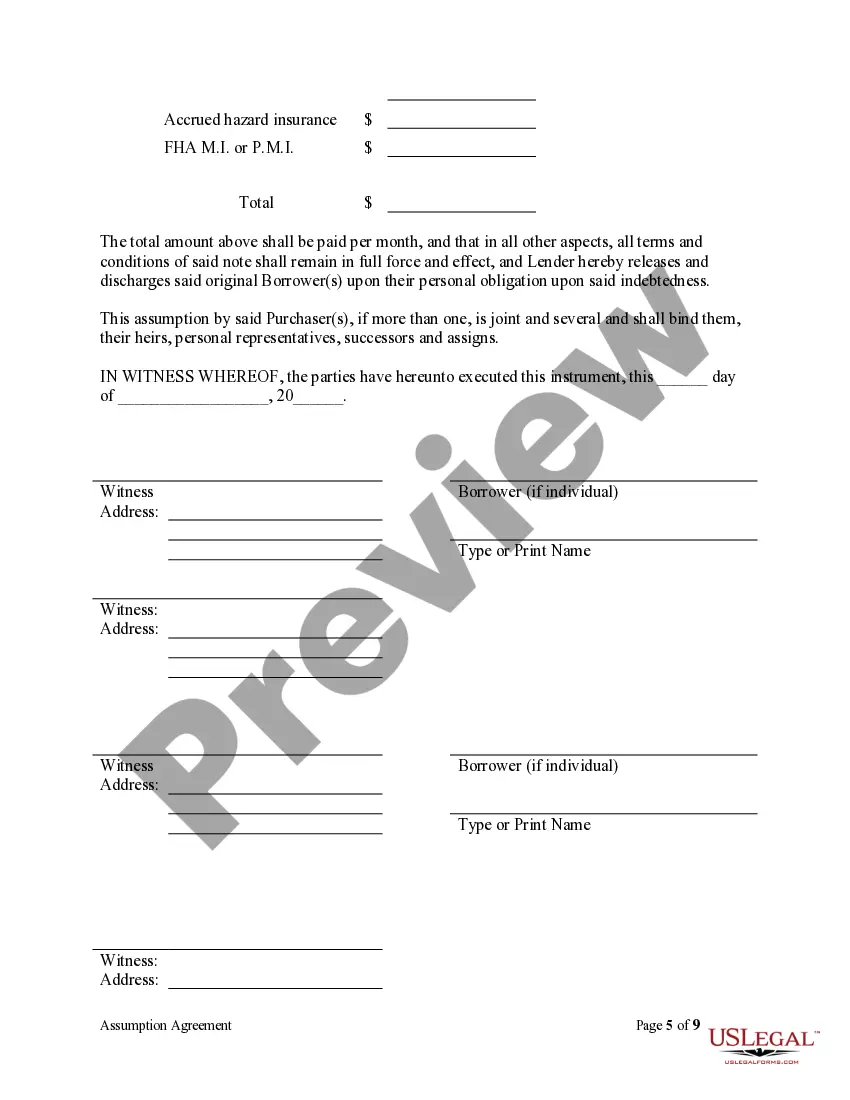

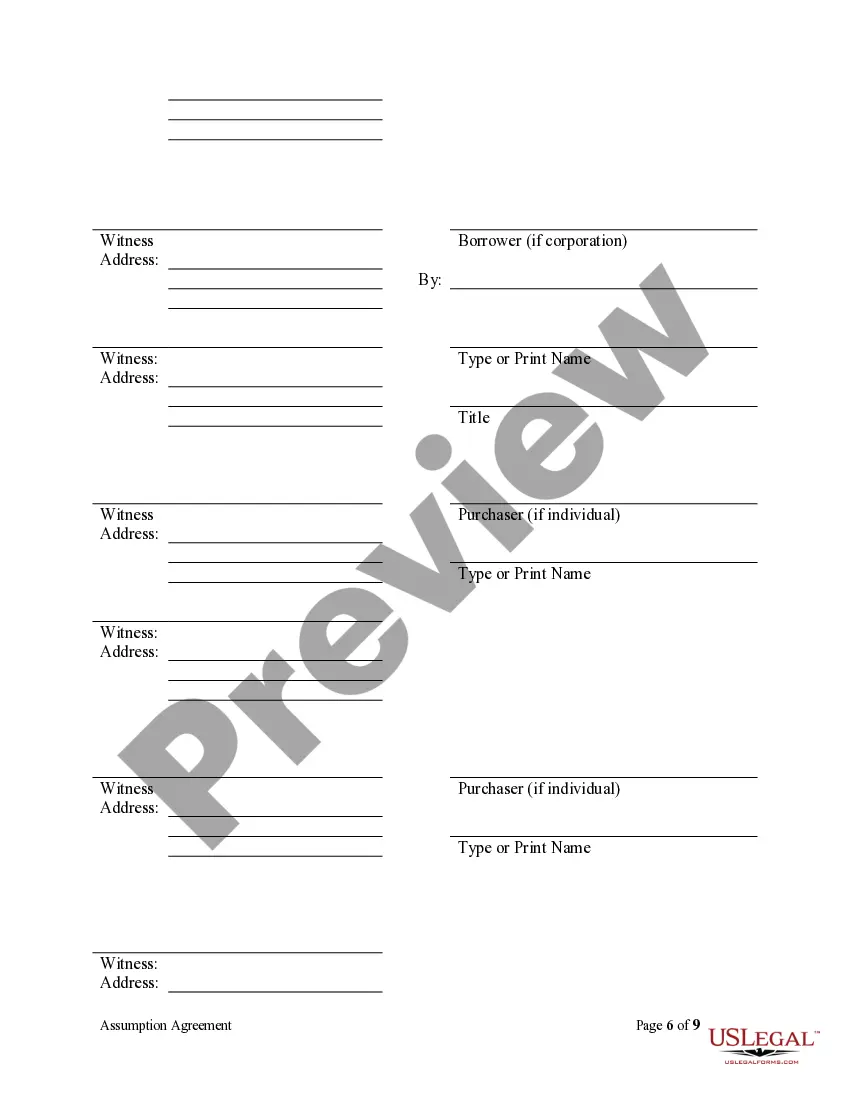

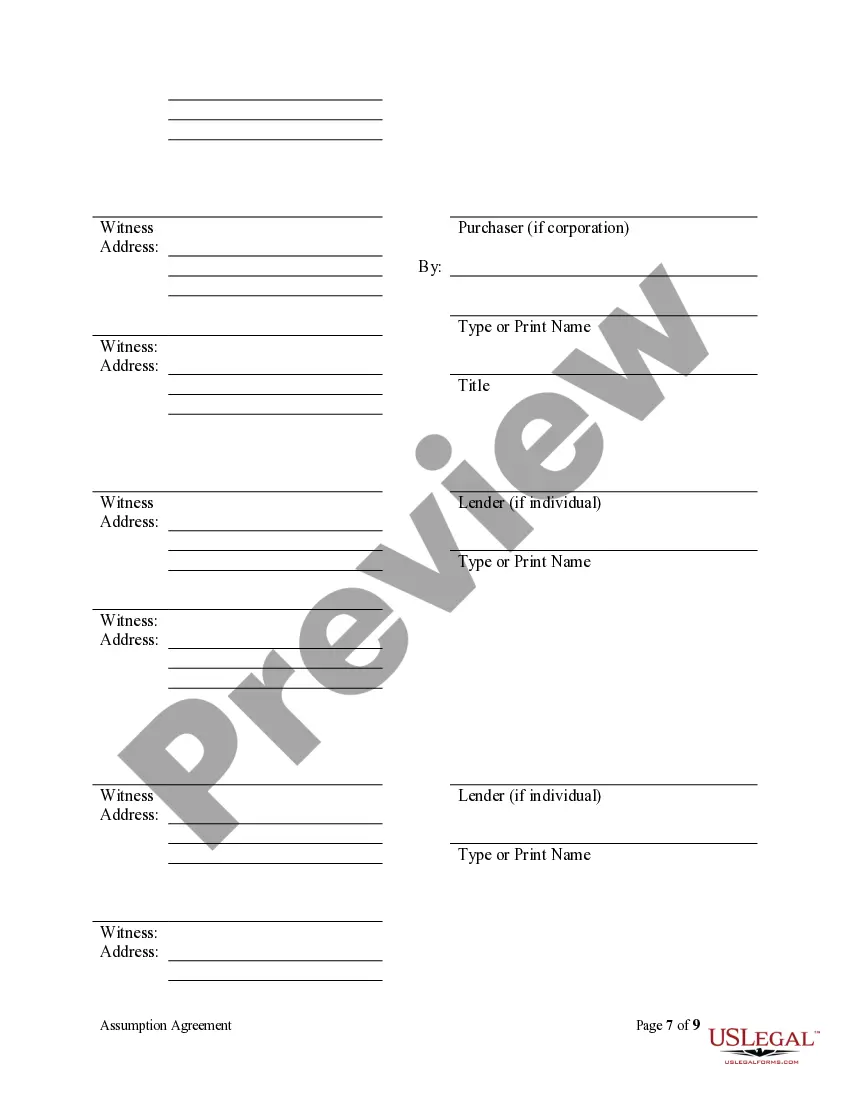

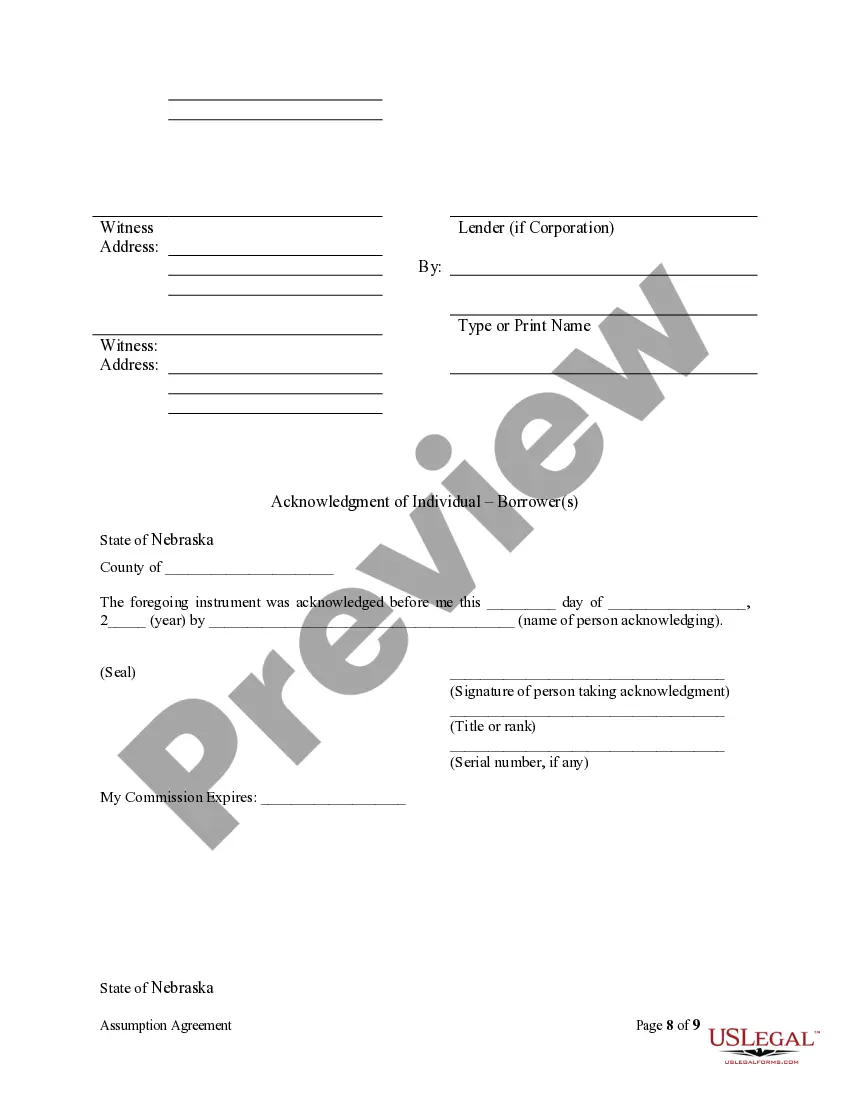

- To do this, utilize the form description and preview options if available.

- Use the search bar above to look for another sample if the previous one didn’t meet your needs.

- Click Buy Now next to the template name once you find the appropriate one.

Form popularity

FAQ

To assume a mortgage in Texas, you must first obtain the lender's consent, as not all loans allow for assumption. After securing approval, you’ll need to complete an assumption deed of trust, detailing the transfer of responsibility from the original borrower to you. This document must then be signed by all parties involved and recorded with the county clerk. To simplify this process, consider using US Legal Forms, which offers templates to guide you through creating an assumption deed of trust.

The strength of a deed can depend on the context and the specific legal requirements at play. However, a properly executed deed of trust often holds near the highest level of security in real estate transactions. This document provides legal assurances for lenders and outlines clear rights and responsibilities, making it a crucial aspect of any assumption deed of trust.

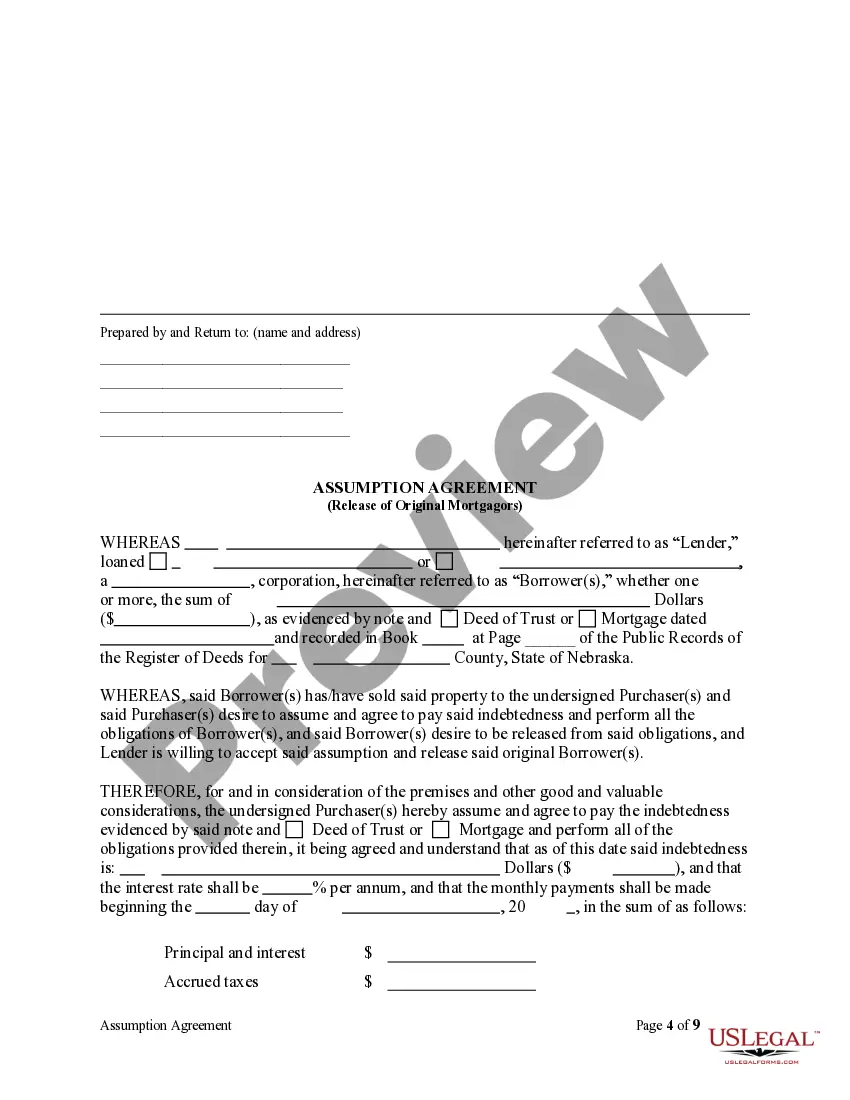

The assumption agreement serves to formally document the transfer of mortgage obligations from one party to another. This document outlines the terms agreed upon for the assumption of the deed of trust and protects the interests of all parties involved. Understanding the purpose of an assumption agreement can help negotiate more favorable terms during real estate transactions.

The assumption deed is a legal document that allows one party to take over the obligations of a mortgage from another party. This document is critical in real estate transactions, especially when a buyer wants to assume an existing mortgage. By understanding the assumption deed of trust, you can ensure a smoother transfer of property ownership while taking on existing financial responsibilities.

In Texas, a deed of trust to secure assumption is typically signed by the original borrower, the new borrower, and the lender. Each party plays a crucial role in formalizing the agreement and transferring the obligation. Additionally, a well-prepared assumption deed of trust ensures that all legal requirements are met, protecting all parties involved.