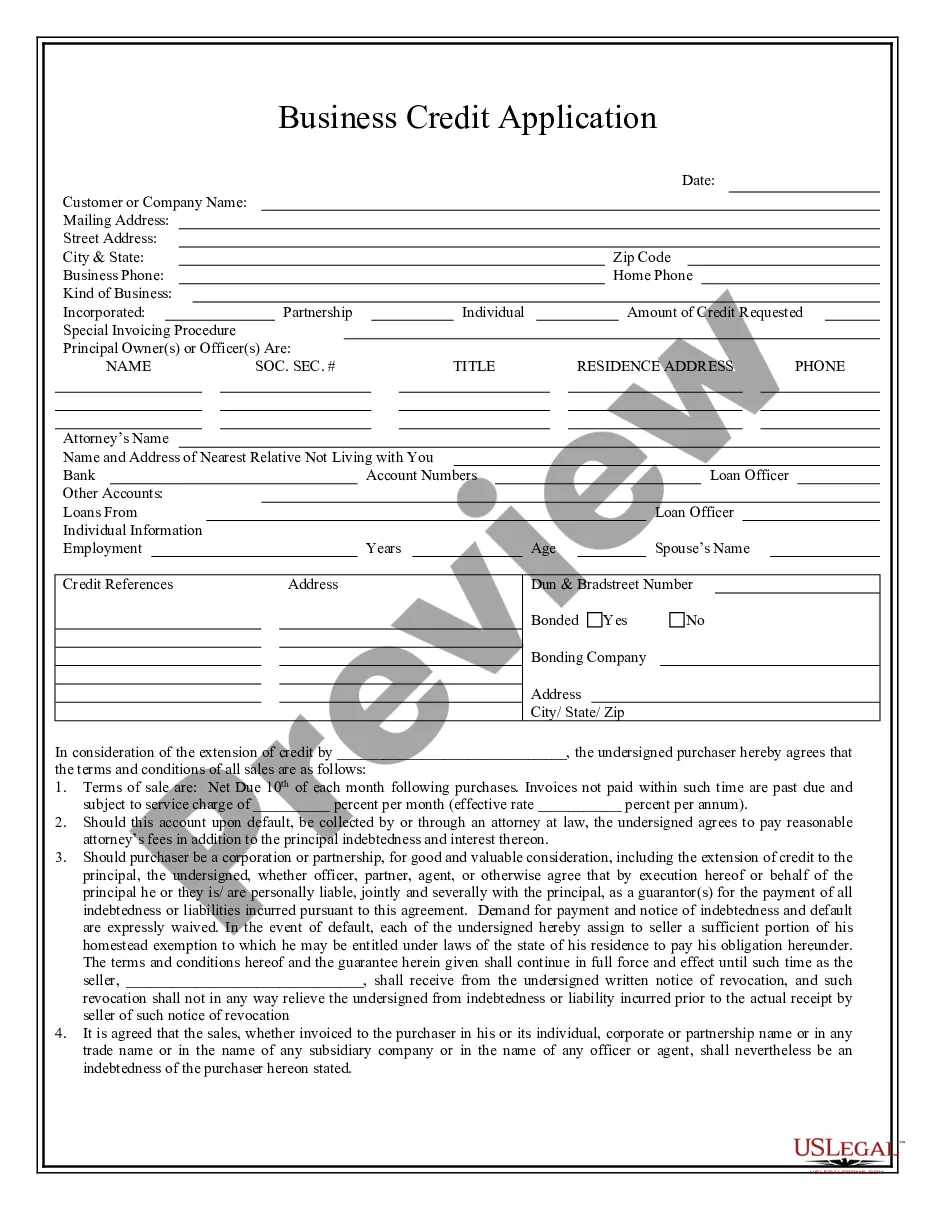

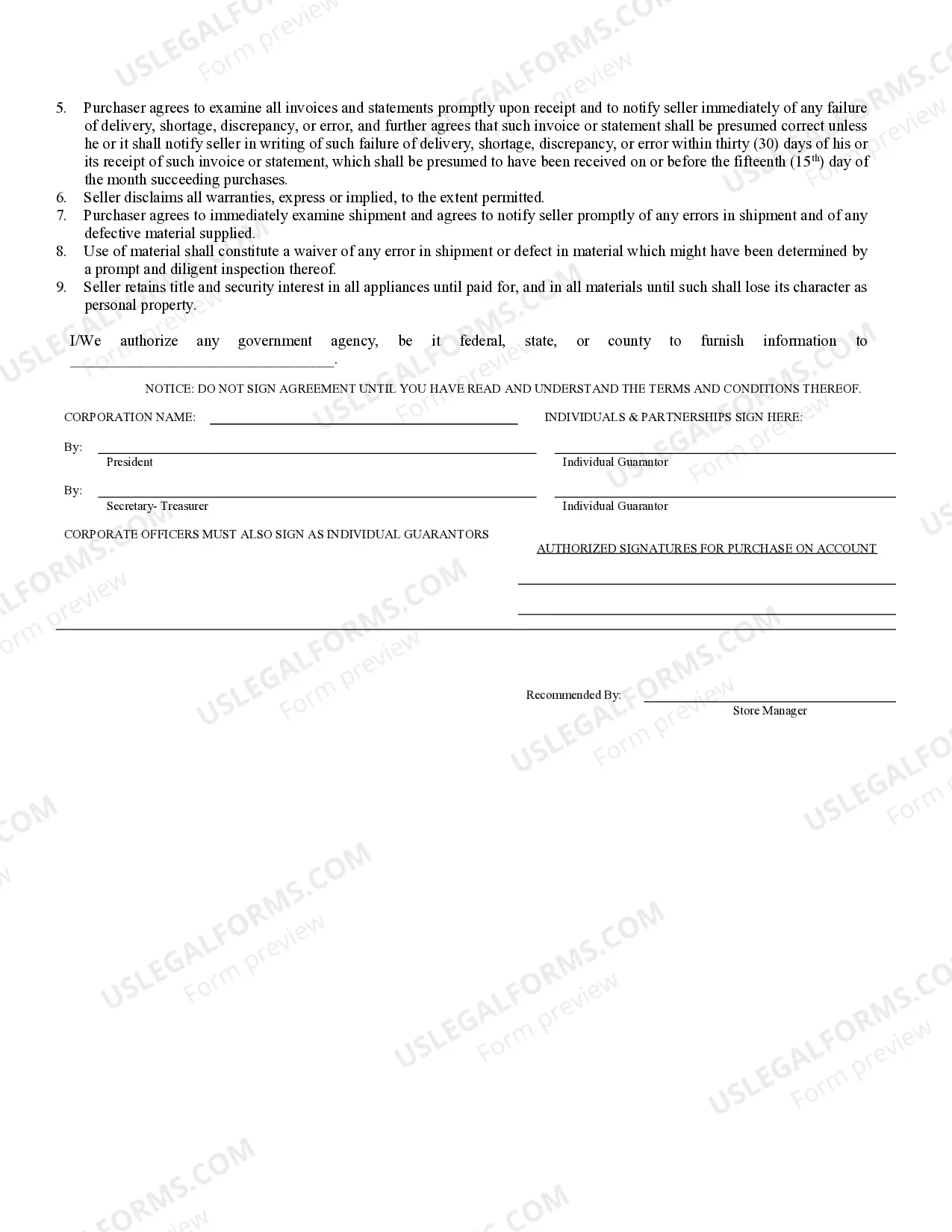

This is a Business Credit Application for an individual seeking to obtain credit for a purchase from a business. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and retention of title for goods sold on credit by the Seller.

Starting A Business In Nebraska Foreign Corporation Doing

Description

How to fill out Starting A Business In Nebraska Foreign Corporation Doing?

What is the most reliable service to acquire the Starting A Business In Nebraska Foreign Corporation Doing and other current versions of legal documents? US Legal Forms is the answer!

It's the finest collection of legal paperwork for any situation. Each template is professionally drafted and verified for adherence to federal and local regulations. They are organized by region and state of use, making it simple to find the one you need.

US Legal Forms is an excellent choice for anyone needing to manage legal documentation. Premium users can gain even more as they complete and approve previously saved documents electronically at any time using the built-in PDF editing tool. Give it a try today!

- Experienced users of the platform only need to Log In to the system, verify if their subscription is active, and click the Download button next to the Starting A Business In Nebraska Foreign Corporation Doing to obtain it.

- Once saved, the template remains available for future use within the My documents tab of your profile.

- If you don't yet have an account with our library, here are the steps you need to follow to create one.

- Form compliance review. Before you acquire any template, ensure it aligns with your use case requirements and complies with your state or county's laws. Review the form description and use the Preview feature if available.

Form popularity

FAQ

Yes, Nebraska is considered a good state to start a business, especially for those pursuing opportunities as a foreign corporation. With its low tax rates, diverse economy, and supportive local government, entrepreneurs can find a conducive environment for growth. The state also offers various resources and assistance programs aimed at helping businesses thrive. Therefore, if you're considering starting a business in Nebraska, you are making a wise choice.

While the best state to start a small business can vary by industry, many entrepreneurs find Nebraska an attractive option. The state offers a favorable business climate, competitive costs, and a supportive community for startups. Furthermore, when starting a business in Nebraska as a foreign corporation, you benefit from a strategic location and access to key markets. Make sure to check local regulations and resources to determine if it suits your business needs.

The best business to start in Nebraska depends on market demand and personal interests, but agriculture, technology, and manufacturing are promising sectors. With a strong agricultural base, food production ventures can thrive. Additionally, online and e-commerce businesses are becoming increasingly popular, especially in today's digital landscape. Conducting thorough market research can help you identify opportunities that match your goals when starting a business in Nebraska as a foreign corporation.

To start a business in Nebraska, especially as a foreign corporation, you need to register your business and obtain the necessary licenses. First, decide on a business structure, then file the appropriate formation documents with the Nebraska Secretary of State. After that, you'll want to secure any required local permits and licenses, which can vary based on your business type and location. Utilizing resources like uslegalforms can streamline your registration process.

Starting a business in Nebraska as a foreign corporation can provide you with the advantages of forming an LLC. An LLC offers personal liability protection, meaning your personal assets are safeguarded from business debts or lawsuits. Additionally, it allows for flexible management structures and pass-through taxation, which can simplify your finances. Overall, choosing an LLC can enhance your credibility and make your business more appealing to potential investors.

Each state has its own processing times for LLC approvals, but many states, including Nebraska, aim for a rapid response. Generally, online filings are approved within a few business days, while mail submissions can take weeks. Understanding the specific timelines for your state can aid in efficient business planning. This knowledge is vital as you embark on starting a business in Nebraska foreign corporation doing.

The approval timeframe for an LLC in Nebraska usually ranges from 1 to 3 business days for online applications. If you submit your application by mail, expect a longer wait, possibly extending a few weeks. Staying organized and ensuring all documentation is accurate will help in reducing delays. Being aware of this timeline is a crucial element when starting a business in Nebraska foreign corporation doing.

The approval process for an LLC in Nebraska typically takes about 1 to 3 business days if done online. However, mail-in applications may take longer, potentially up to several weeks. Timely submission of all required documents helps expedite the approval. By understanding this timeline, you can plan your steps effectively when starting a business in Nebraska foreign corporation doing.

To start an LLC in Nebraska, you need to file the Articles of Organization with the Secretary of State. Additionally, you must choose a unique name for your LLC that complies with state naming rules. Obtaining an Employer Identification Number (EIN) from the IRS is also necessary for tax purposes and opening a business bank account. This process is essential when starting a business in Nebraska foreign corporation doing.

Yes, you can start a corporation by yourself, as a single individual can be the sole owner. When starting a business in Nebraska as a foreign corporation, you'll need to follow specific steps, including filing the necessary paperwork with the state. This allows you to fully control your business and make key decisions without needing partners. To streamline the process, consider US Legal Forms for reliable assistance with your paperwork.