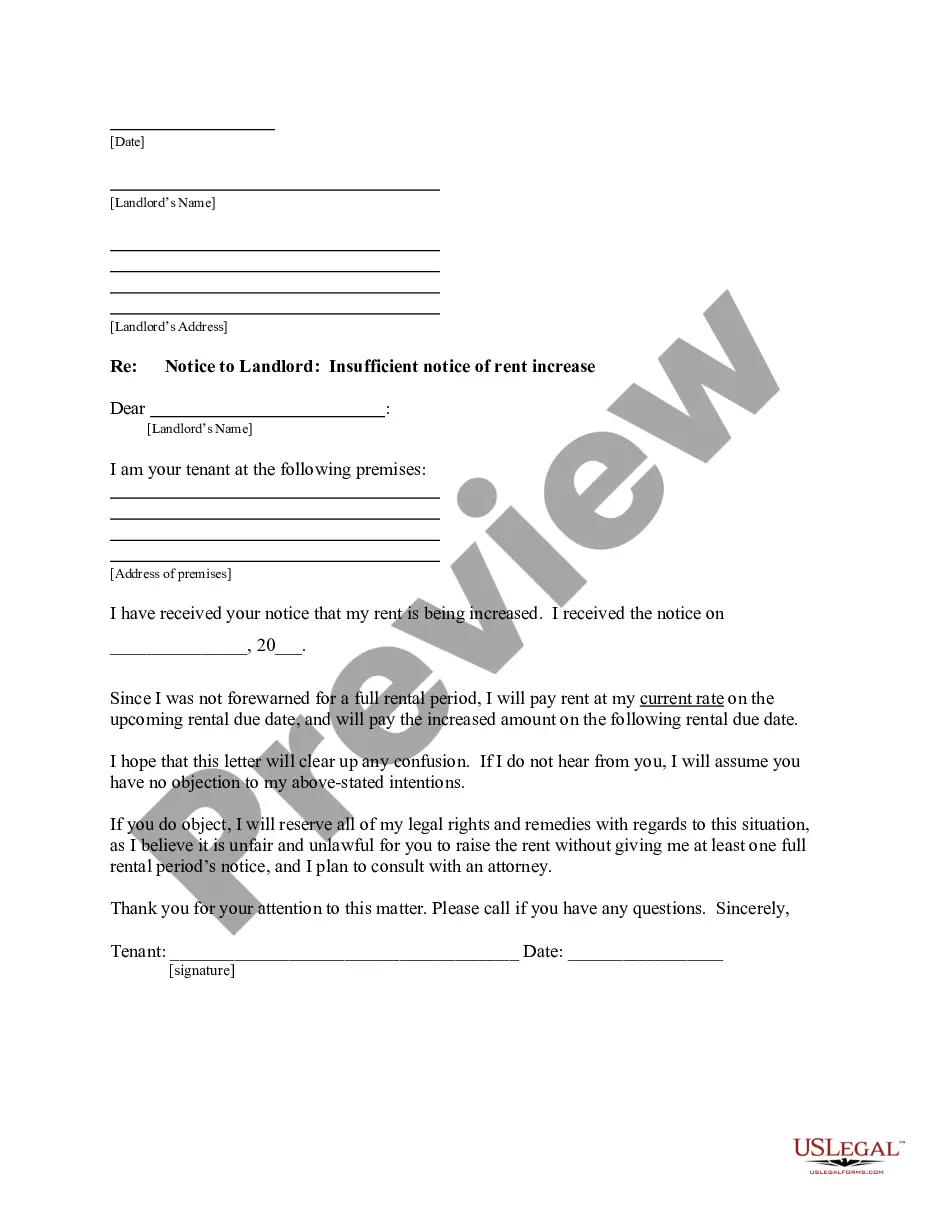

It is a letter from Tenant to Landlord containing a notice to landlord to improper notice of a rent increase was given for the month-to-month lease. This notice informs Landlord that according to law the rent increase will not take effect until a date different used by the landlord.

Friendly Rent Increase Letter Sample For Tenants

Description

How to fill out Nebraska Letter From Tenant To Landlord About Insufficient Notice Of Rent Increase?

Managing legal documents can be daunting, even for the most skilled professionals.

When you are seeking a Friendly Rent Increase Letter Sample For Tenants and lack the time to invest in locating the appropriate and current version, the process can become stressful.

Access state- or county-specific legal and organizational documents.

US Legal Forms addresses any needs you may have, from personal to business documentation, all in one location.

If it's your initial experience with US Legal Forms, create a free account to gain unlimited access to the entire library's benefits.

- Utilize advanced tools to complete and manage your Friendly Rent Increase Letter Sample For Tenants.

- Gain access to a valuable collection of articles, guides, and resources concerning your situation and requirements.

- Save time and energy in locating the documents you need by utilizing US Legal Forms’ enhanced search and Preview tool to find and obtain your Friendly Rent Increase Letter Sample For Tenants.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and retrieve it.

- Visit the My documents tab to view the documents you have previously downloaded and manage your folders as desired.

- A powerful web form library can revolutionize the experience for anyone aiming to handle these matters efficiently.

- US Legal Forms stands out as a leader in online legal documents, featuring over 85,000 state-specific legal forms accessible to you at any time.

- With US Legal Forms, you can.

Form popularity

FAQ

How to Write ( Fill Out ) a Living Trust Form Step 1: Fill out the grantor information. ... Step 2: Indicate the purpose of the trust. ... Step 3: Include trustee information. ... Step 4: List beneficiaries and make specific gifts. ... Step 5: Sign and notarize the completed document.

In Virginia, the cost of setting up a basic Revocable Living Trust generally ranges from $1,000 to $3,000. More complex trusts may cost even more. Online platforms like Snug provide more affordable options for creating wills and trusts, offering transparent pricing and quality estate planning services.

To make a living trust in Virginia, you: Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries?that is, who will get the trust property. Create the trust document.

Anyone can make a trust in Virginia as long as they follow the requirements as listed in the statute. The settlor must have the proper mental capacity and must intend to create the trust. Furthermore, the settlor must name a beneficiary for the trust and a trustee to manage it.

A handwritten trust document may be valid if it's properly signed and executed, but a typed document will be clear and easy to read and is always best. Keep it simple. The more basic your trust, the better. Don't include anything beyond the basic information required by the state.

To create a living trust in the state of Virginia, you must have a written trust document signed in the presence of a notary. The trust won't be official until you have transferred your assets into it. Living trusts may offer up a variety of benefits that will help you in the long run.

Creating a living trust in Virginia occurs when you create a written trust document and sign it in the presence of a notary. The trust is not official until you transfer assets into it. A living trust can offer a variety of benefits that may appeal to you. Consider what is best for you.

Charges vary from lawyer to lawyer based on their fees, as well as the complexity of your overall estate. In the end, expect to pay $1,000 or more. If you decide to go the DIY route, your costs will likely fall to around $200 to $500, depending on which online program you prefer.