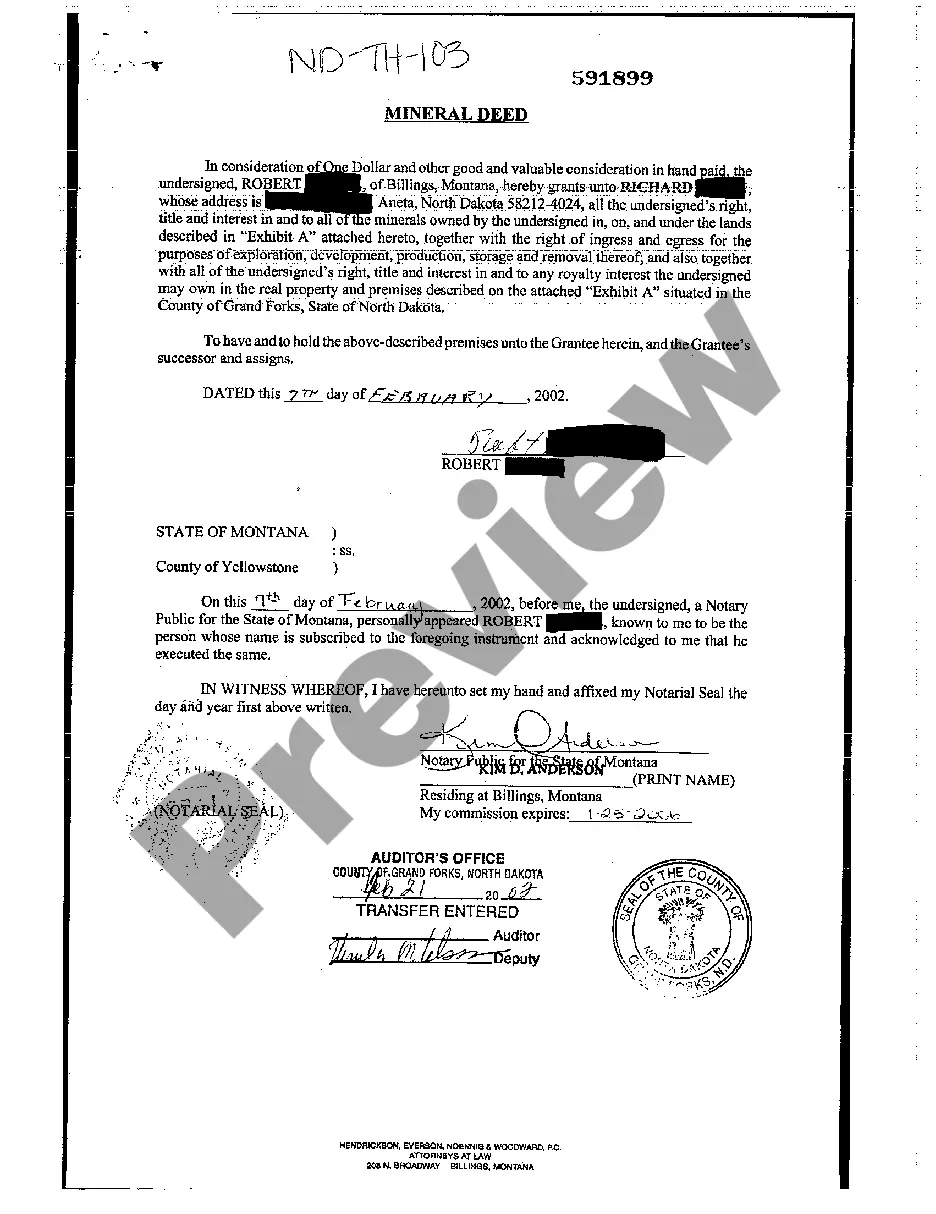

Inherited Mineral Rights North Dakota For Sale

Description

How to fill out North Dakota Mineral Deed Individual To Individual?

It’s no secret that you can’t become a law expert overnight, nor can you grasp how to quickly prepare Inherited Mineral Rights North Dakota For Sale without having a specialized background. Putting together legal documents is a long process requiring a specific education and skills. So why not leave the creation of the Inherited Mineral Rights North Dakota For Sale to the professionals?

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court papers to templates for in-office communication. We understand how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all forms are location specific and up to date.

Here’s how you can get started with our website and obtain the document you need in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option available) and check the supporting description to determine whether Inherited Mineral Rights North Dakota For Sale is what you’re looking for.

- Start your search over if you need a different template.

- Register for a free account and choose a subscription plan to buy the template.

- Pick Buy now. As soon as the payment is through, you can get the Inherited Mineral Rights North Dakota For Sale, complete it, print it, and send or mail it to the necessary individuals or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

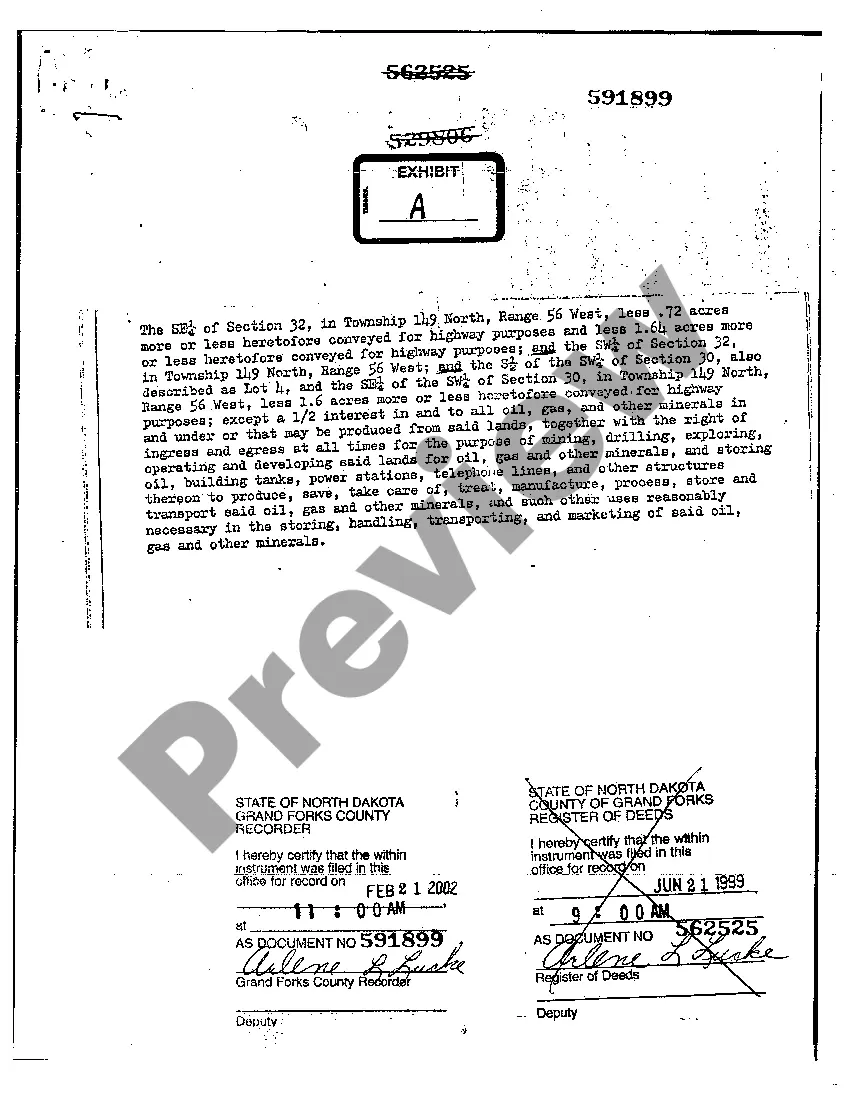

A mineral rights owner does not necessarily have to own the land property itself but must have a legal agreement with the property owner. In North Dakota, mineral rights can be transferred in three ways: deed, probate or court action.

How do I transfer mineral rights in North Dakota? To convey or transfer ownership of mineral rights to a new owner, the current owner of the rights has to engage a title insurance company or an attorney at a district court to perform a search of the property title.

You'll need to complete Schedule D to report your total capital gains. In this case, the tax treatment of selling mineral rights is similar to other capital gains.

The Internal Revenue Service (IRS) classifies all royalties earned from oil, gas, and mineral properties as taxable income. Most often, taxpayers will report royalty income on Schedule E, either as rents and royalties or working interest. Sometimes, they may opt to report it as both and do so on Schedule C.

The first step in claiming your inherited mineral rights is to find the deed or title to the property. This document will outline who owns the mineral rights and how you can transfer them. Once you have the deed or title, you must contact the appropriate state agency to make a claim.