General Warranty With With A

Description

How to fill out North Carolina General Warranty Deed For With Relinquishment Of Dower?

- If you're a returning user, log into your US Legal Forms account. Ensure your subscription is active before downloading your desired form by clicking the Download button.

- For new users, first explore the Preview mode and form description to confirm you select the correct document that aligns with your needs and local jurisdiction.

- Should you find discrepancies, utilize the Search bar above to locate alternative templates. If the right one is found, continue to the next step.

- Proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. You’ll need to create an account for full access.

- Finalize your purchase by entering your payment details, either through credit card or PayPal.

- Download the form to your device, and you can always access it later via the My Forms section.

By following these steps, you can efficiently navigate the US Legal Forms platform and acquire the necessary legal documentation. This ensures that your general warranty and other legal needs are promptly addressed.

Don't hesitate! Start your journey with US Legal Forms today and experience the benefits of tailored legal solutions.

Form popularity

FAQ

Yes, a general warranty deed is generally considered a good option for property transfers. It safeguards the buyer's interests by offering protections that other deed types may not provide. When looking to secure a real estate deal, a general warranty deed can be a reliable choice, assuring you of your rights in ownership.

Homebuyers often benefit the most from a warranty deed, as it provides protection against future title claims. This assurance fosters peace of mind, allowing buyers to invest in their future without fear of potential legal entanglements. For added support, uslegalforms can help you navigate the specifics of warranty deeds, ensuring you make informed decisions.

A general warranty deed warrants that the grantor holds clear title to the property and has the right to sell it. Moreover, it assures that there are no outstanding claims that could affect your ownership. Through this warranty, you gain clarity and security, making general warranty deeds a preferred choice in real estate transactions.

One notable disadvantage of a warranty deed is that it can create liability for the seller if any title issues arise later. Should any undisclosed claims surface, the seller must address them, potentially leading to legal disputes. Therefore, it's essential for both parties to evaluate the transaction carefully, and platforms like uslegalforms can facilitate understanding and conveyance of information.

Someone may choose a special warranty deed for various reasons, including its quicker and more straightforward process. For sellers, it reduces their liability, as they are only responsible for issues that occurred during their ownership, thereby minimizing risk. Additionally, this type of deed might be more accepted in specific contexts where the properties involved have a less complex title history.

To obtain a general warranty deed, you typically need to work with a real estate attorney or use a reputable platform like USLegalForms. The process generally includes drafting the deed to meet state requirements and ensuring it contains all necessary legal elements. Finally, you must have it executed and recorded with the local county clerk to complete the transaction.

A buyer would likely prefer a general warranty deed over a quitclaim deed because it offers comprehensive protection against past ownership claims. Unlike a quitclaim deed, which carries no guarantees, a general warranty deed ensures that the seller is responsible for any issues that arise, giving the buyer confidence in their investment. Therefore, for significant transactions, this type of deed is often seen as the safer choice.

One key disadvantage of a special warranty deed is that it only protects the buyer from claims during the seller's ownership. This limited warranty can expose the buyer to potential issues that existed before the seller acquired the property. Furthermore, some buyers may find this lesser protection unsatisfactory compared to a general warranty deed, which provides broader coverage.

Yes, a special warranty deed can be changed to a general warranty deed, but this process typically requires the involvement of legal professionals. You may need to create a new deed that explicitly states the transfer includes a general warranty. This ensures that the property is protected against claims that arose before you owned it, providing greater peace of mind.

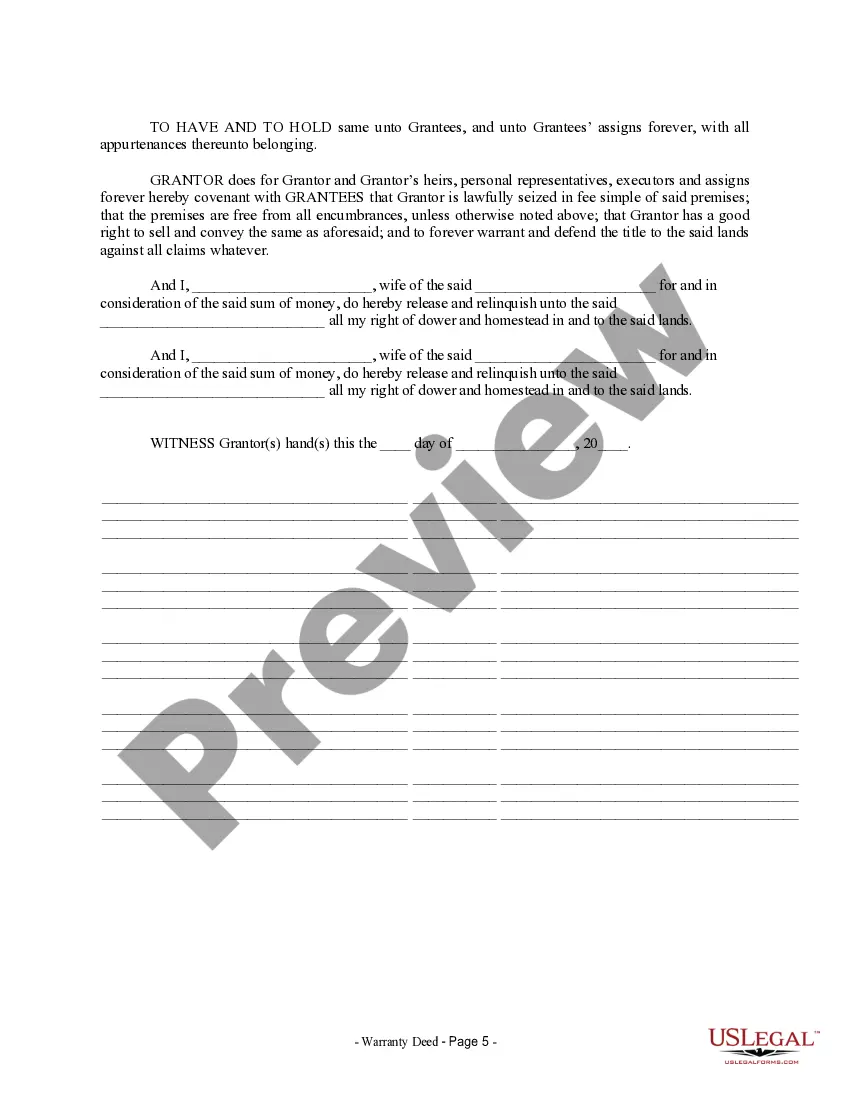

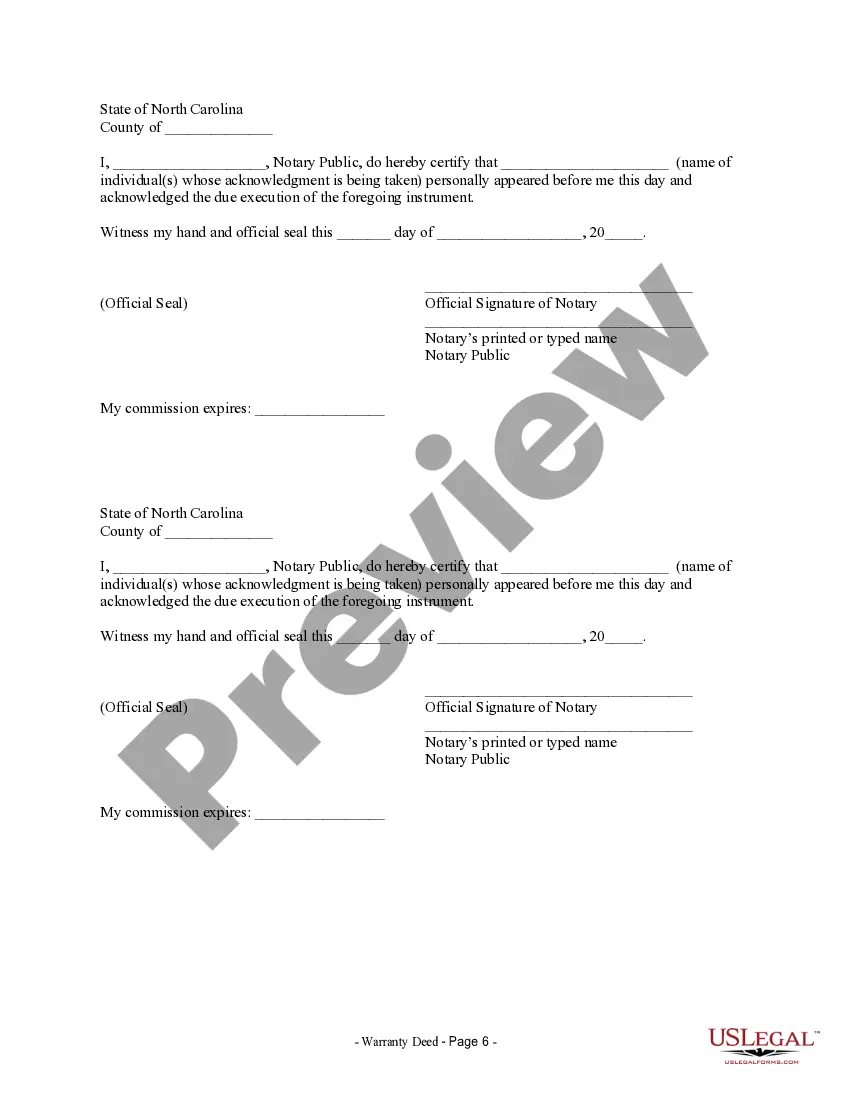

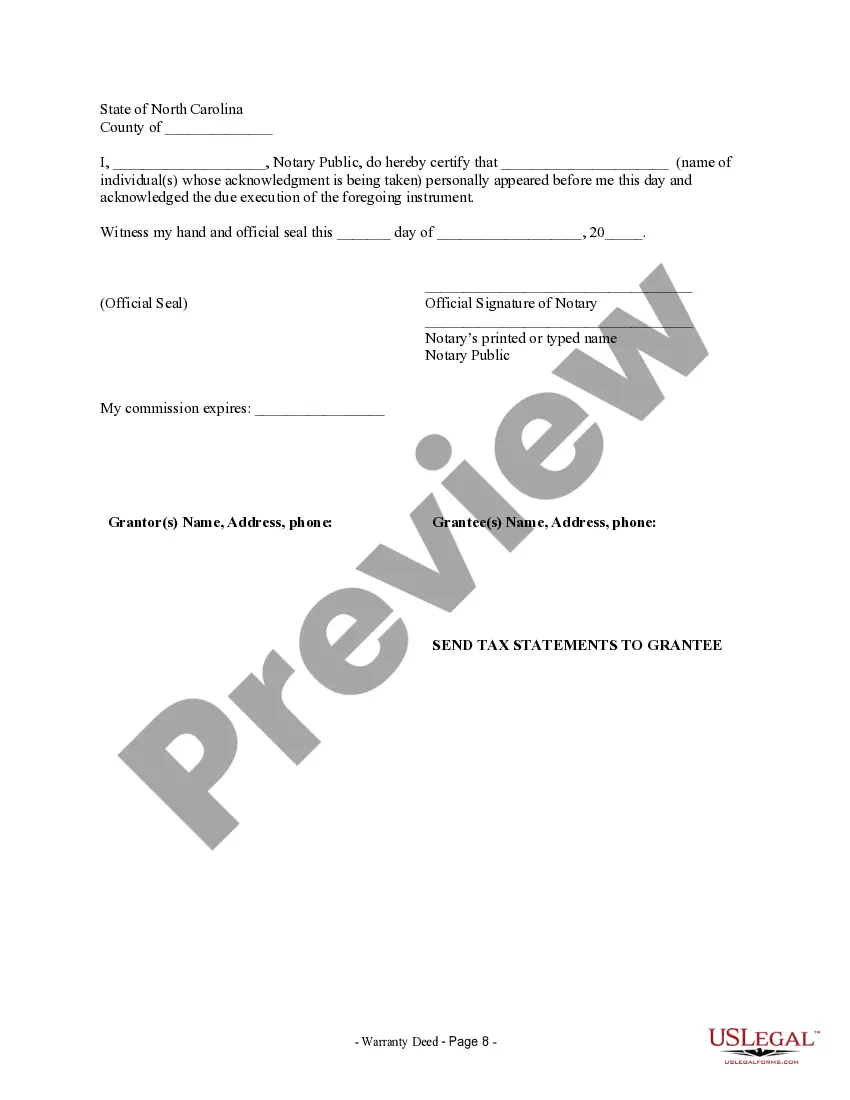

Filing a general warranty deed involves several steps, starting with completing the deed accurately. After that, it needs to be signed in the presence of a notary, which legitimizes the document. Finally, you must file it with the appropriate county office to ensure it is recorded publicly. Platforms like US Legal Forms simplify this process, providing templates and guidance for a smooth filing experience.