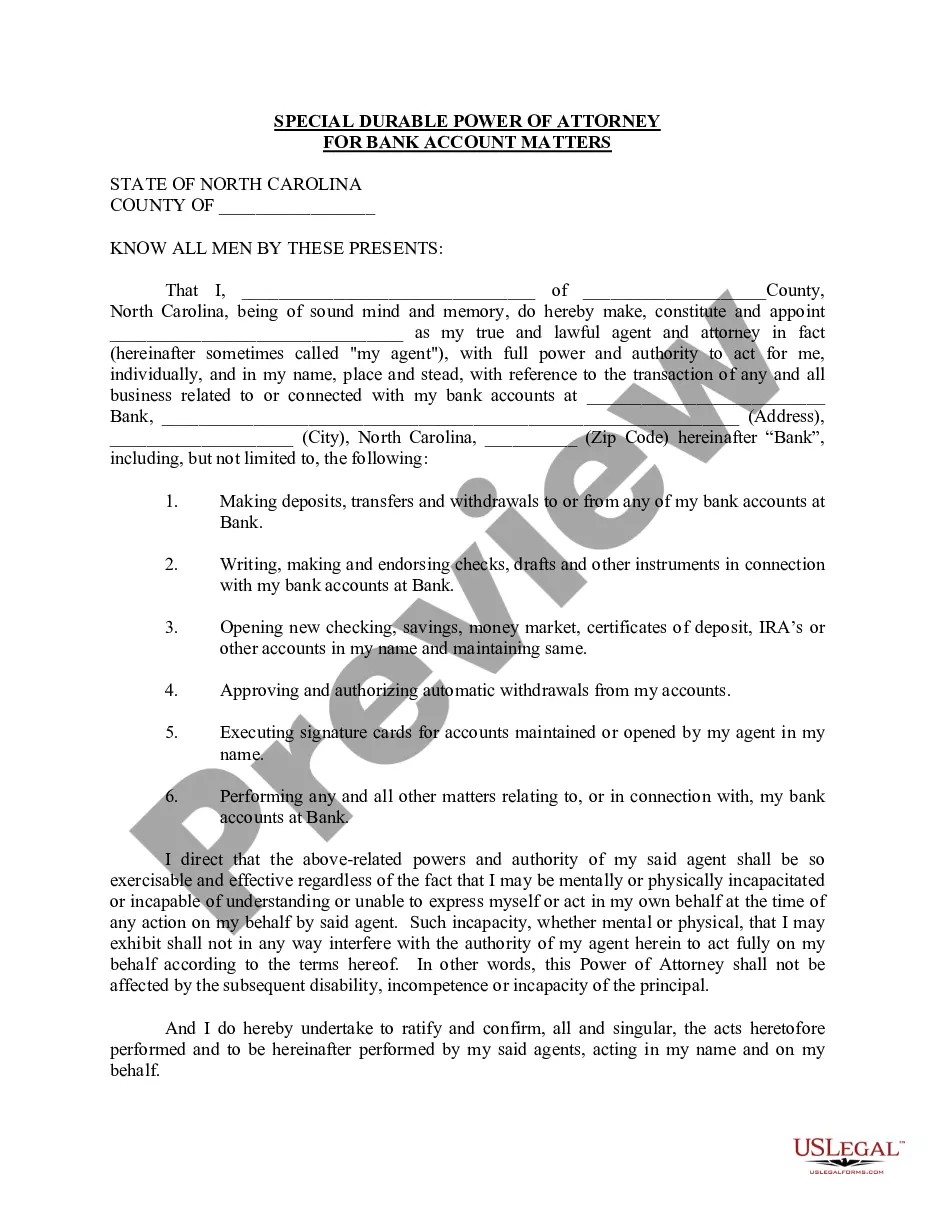

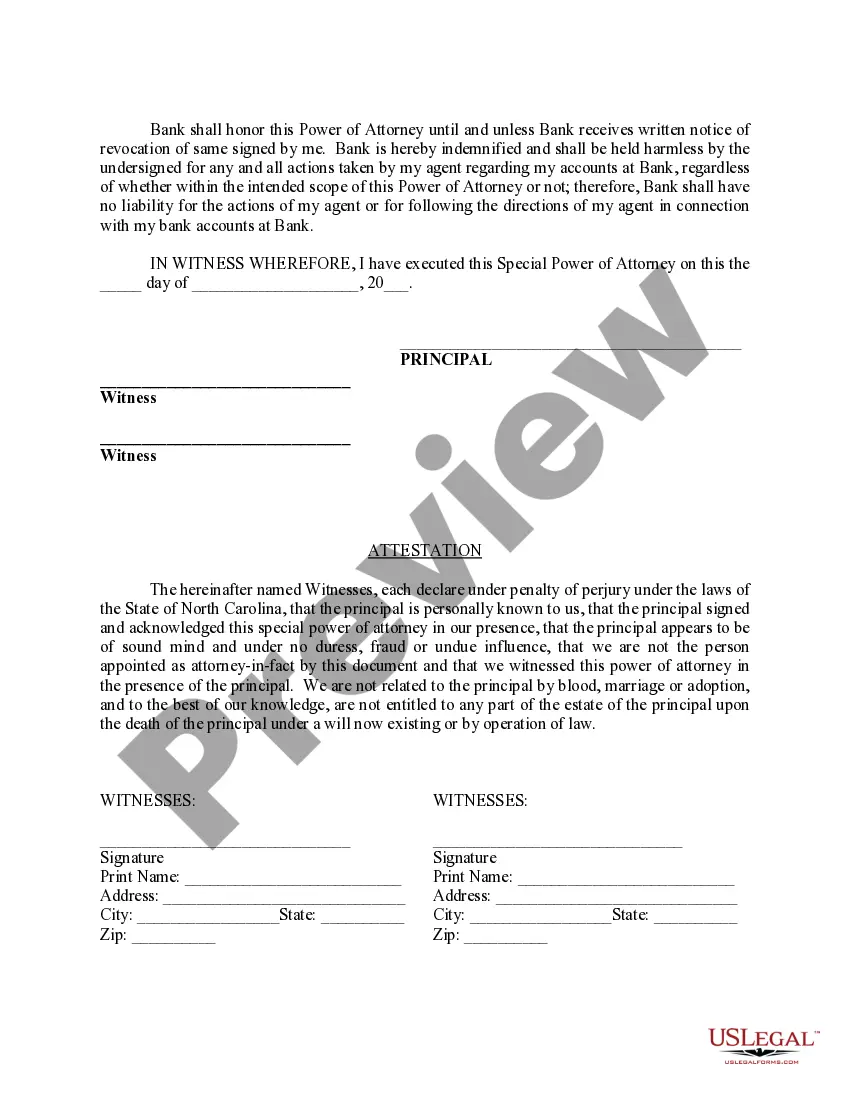

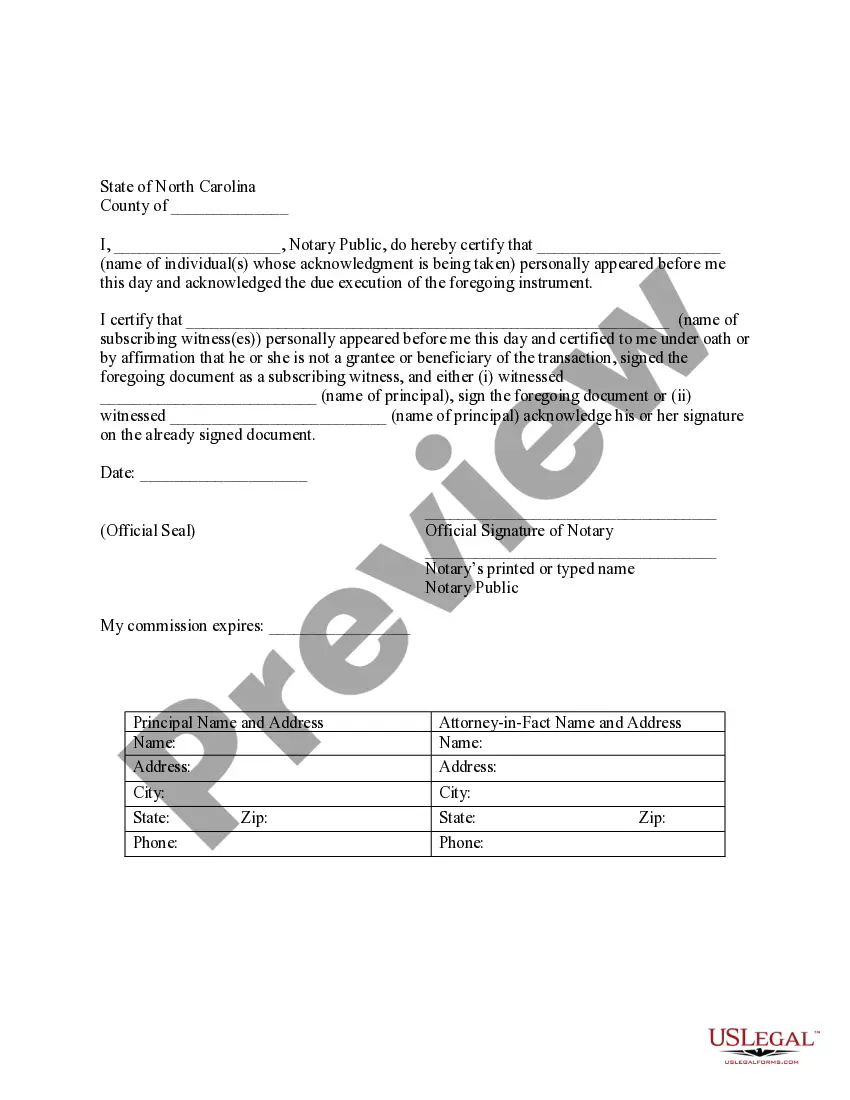

Special Durable Power of Attorney for Bank Account Matters

Power of Attorney and Health Care - General - North Carolina

(a)The provisions relating to the Statutory Short Form of General Power of Attorney are not exclusive and do not bar the use of any other or different form of power of attorney. Every power of attorney executed pursuant to the provisions of this Article and registered in an office of the register of deeds in this State shall be revoked by:

(1) The death of the principal; or

(2) Registration in the office of the register of deeds where the power of attorney has been registered of an instrument of revocation executed and acknowledged by the principal while he is not incapacitated or mentally incompetent, or by the registration in such office of an instrument of revocation executed by any person or corporation who is given such power of revocation in the power of attorney, or by this Article, with proof of service thereof in either case on the attorney-in-fact in the manner prescribed for service of summons in civil actions.

(b) Every power of attorney executed pursuant to the provisions of this Article which has not been registered in an office of the register of deeds in this State shall be revoked by:

(1)The death of the principal;

(2) Any method provided in the power of attorney;

(3) Being burnt, torn, canceled, obliterated, or destroyed, with the intent and for the purpose of revoking it, by the principal himself or by another person in his presence and by his direction, while the principal is not incapacitated or mentally incompetent;

(4) A subsequent written revocatory document executed and acknowledged in the manner provided herein for the execution of durable powers of attorney by the principal while not incapacitated or mentally incompetent and delivered to the attorney-in-fact in person or to his last known address by certified or registered mail, return receipt requested.

(c) As to acts undertaken in good faith reliance upon an affidavit executed by the attorney-in-fact stating that he did not have, at the time of exercise of the power, actual knowledge of the termination of the power by revocation pursuant to the provisions or by the principal's death, such affidavit is conclusive proof of the nonrevocation or nontermination of the power at that time. This section does not affect any provision in a power of attorney for its termination by the expiration of time or occurrence of an event other than an express revocation.

DURABLE POWER OF ATTORNEY

(32C-1-101through 32C-1-123)

Definition

A durable power of attorney is a power of attorney by which a principal designates another his attorney-in-fact in writing and the writing contains a statement that it is executed pursuant to the provisions of this Article or the words This power of attorney shall not be affected by my subsequent incapacity or mental incompetence, or This power of attorney shall become effective after I become incapacitated or mentally incompetent, or similar words showing the intent of the principal that the authority conferred shall be exercisable notwithstanding the principal's subsequent incapacity or mental incompetence.

Incapacity of Principal

All acts done by an attorney-in-fact pursuant to a durable power of attorney during any period of incapacity or mental incompetence of the principal have the same effect and inure to the benefit of and bind the principal and his successors in interest as if the principal were not incapacitated or mentally incompetent if the power of attorney has been registered.

No power of attorney shall be valid subsequent to the principal's incapacity or mental incompetence unless it is registered in the office of the register of deeds of that county in this State designated in the power of attorney, or if no place of registration is designated, in the office of the register of deeds of the county in which the principal has his legal residence at the time of such registration or, if the principal has no legal residence in this State at the time of registration or the attorney-in-fact is uncertain as to the principal's residence in this State, in some county in the State in which the principal owns property or the county in which one or more of the attorneys-in-fact reside.

Court Appointed Fiduciary

If a court of the principal's domicile appoints a conservator, guardian of the principal's person or estate, or other fiduciary charged with the management of all of the principal's property or all of his property except specified exclusions, the attorney-in-fact is accountable to the fiduciary as well as to the principal. The fiduciary has the same power to revoke or amend the power of attorney that the principal would have had if he were not incapacitated or mentally incompetent.

A principal may nominate, by a durable power of attorney, the conservator, guardian of his estate, or guardian of his person for consideration by the court if protective proceedings for the principal's person or estate are thereafter commenced. The court shall make its appointment in accordance with the principal's most recent nomination in a durable power of attorney except for good cause or disqualification.

Revocation

A power of attorney executed and registered in an office of the register of deeds in this State may be revoked by: The death of the principal; or Registration in the office of the register of deeds where the power of attorney has been registered of an instrument of revocation executed and acknowledged by the principal while he is not incapacitated or mentally incompetent; or By the registration in the office of the register of deeds of an instrument of revocation executed by any person or corporation who is given such power of revocation in the power of attorney with proof of service thereof in either case on the attorney-in-fact in the manner prescribed for service of summons in civil actions.A power of attorney which has not been registered in an office of the register of deeds in this State may be revoked by: The death of the principal; Any method provided in the power of attorney;

Being burnt, torn, canceled, obliterated, or destroyed, with the intent and for the purpose of revoking it, by the principal himself or by another person in his presence and by his direction, while the principal is not incapacitated or mentally incompetent; or

A subsequent written revocatory document executed and acknowledged in the manner provided herein for the execution of durable powers of attorney by the principal while not incapacitated or mentally incompetent and delivered to the attorney-in-fact in person or to his last known address by certified or registered mail, return receipt requested.

Acts undertaken in good faith reliance upon an affidavit executed by the attorney-in-fact stating that he did not have, at the time of exercise of the power, actual knowledge of the termination of the power by revocation or by the principal's death, such affidavit is conclusive proof of the non-revocation or non-termination of the power at that time.

The statutory provisions do not affect any provision in a power of attorney for its termination by the expiration of time or occurrence of an event other than an express revocation.