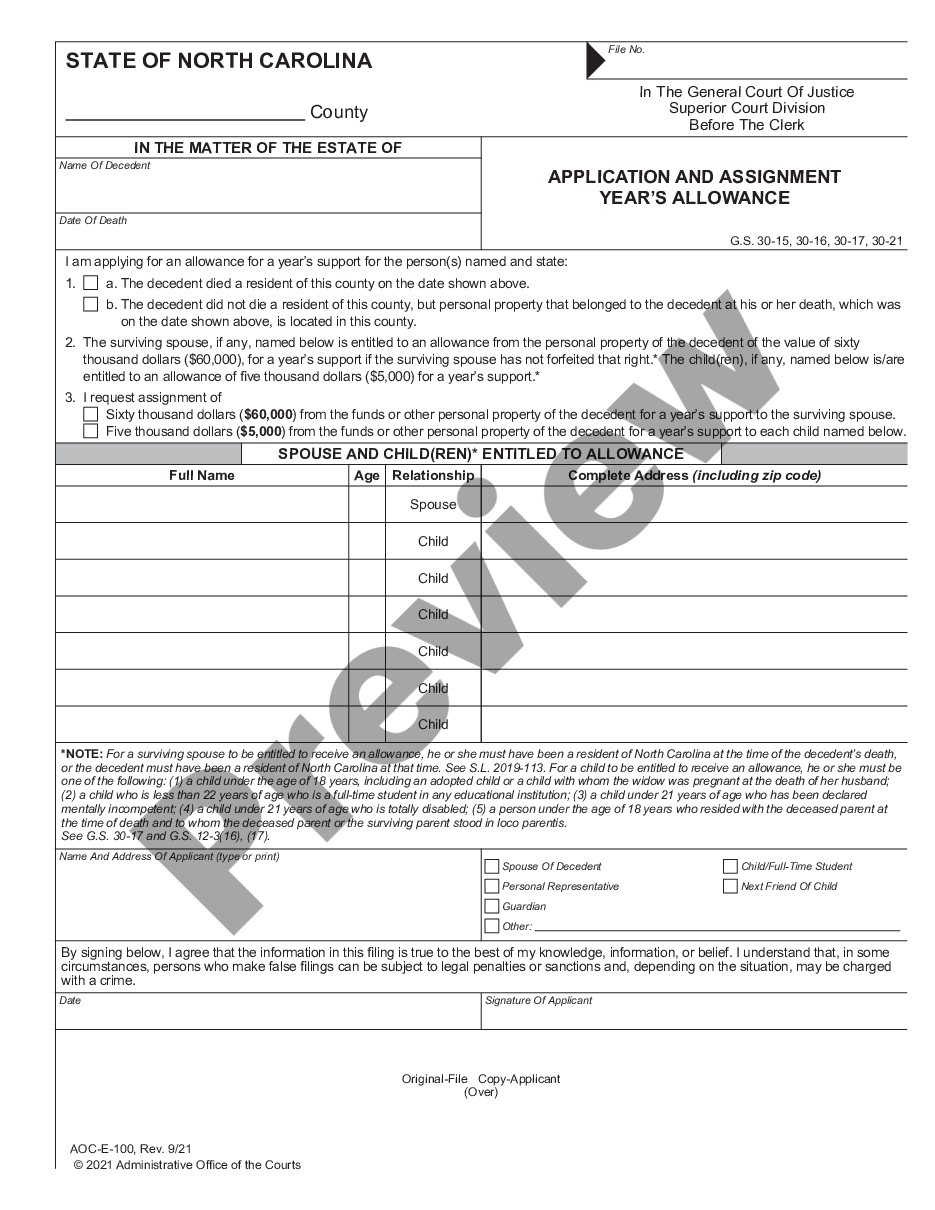

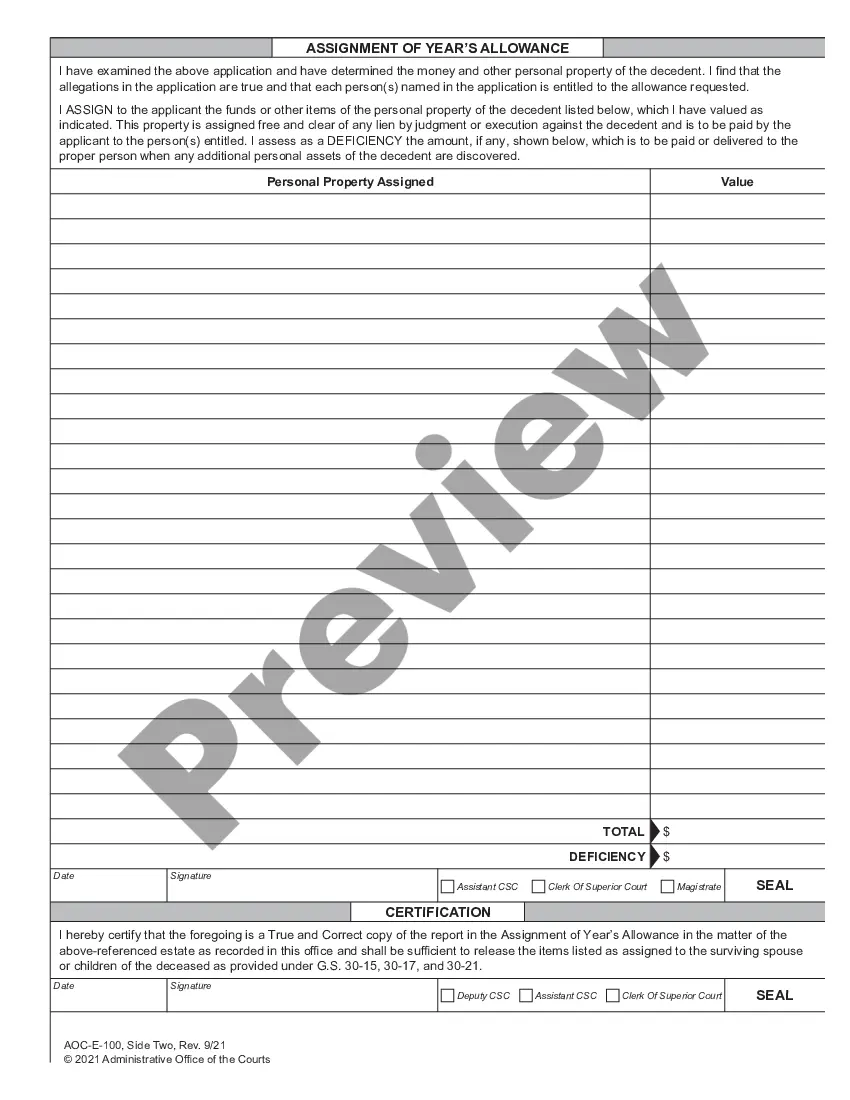

Application And Assignment Year's Allowance Formula

Description

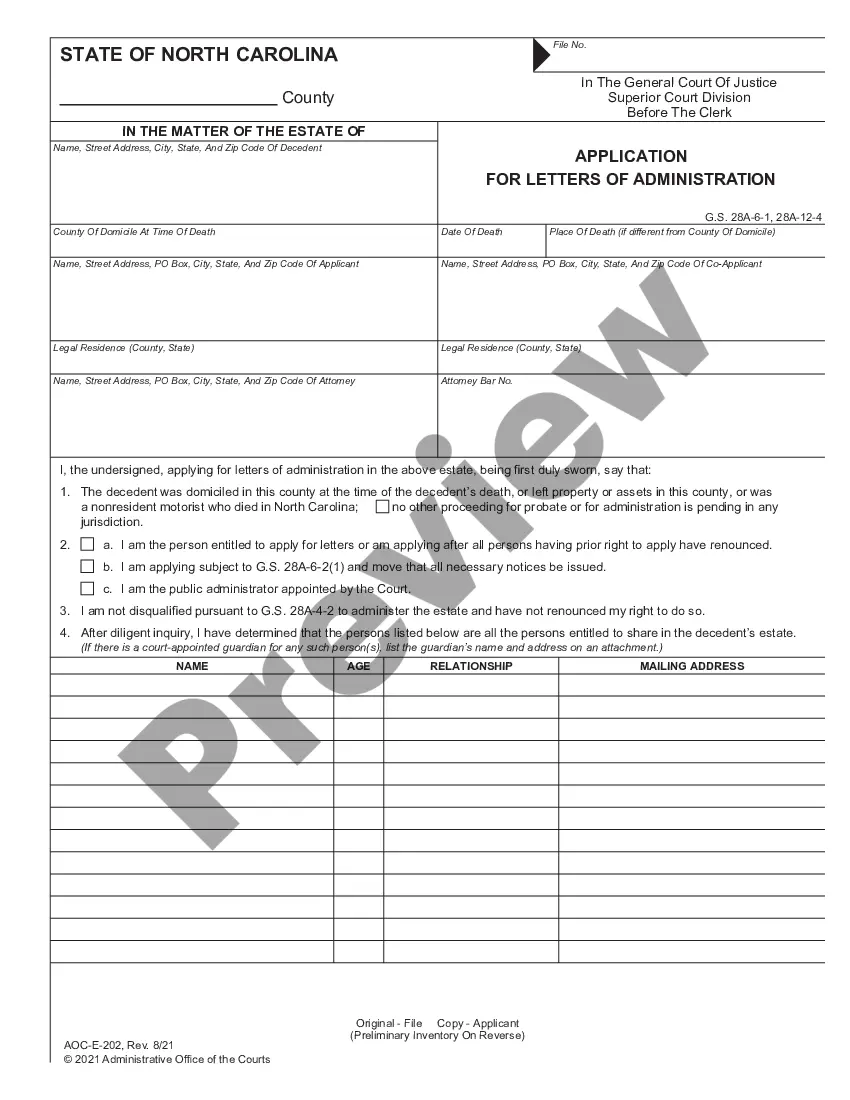

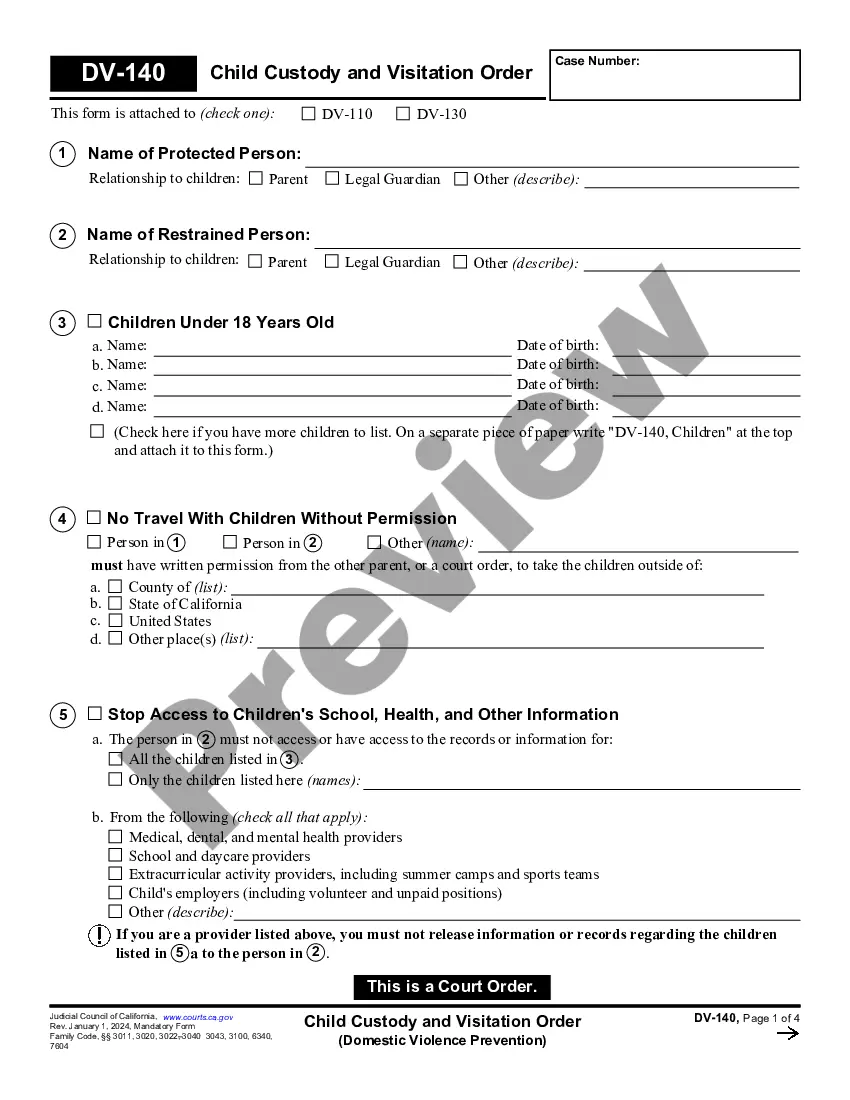

How to fill out North Carolina Application And Assignment Year's Allowance?

There's no longer a necessity to squander hours searching for legal documents to satisfy your regional state prerequisites.

US Legal Forms has gathered all of them in one location and optimized their availability.

Our website offers over 85,000 templates for any business and personal legal matters categorized by state and usage area. All forms are expertly drafted and verified for accuracy, allowing you to trust that you are acquiring an up-to-date Application And Assignment Year's Allowance Formula.

Select Buy Now next to the template name when you discover the right one. Choose your preferred pricing plan and create an account or Log In. Complete your subscription payment with a card or via PayPal to continue. Choose the file format for your Application And Assignment Year's Allowance Formula and download it to your device. Print your form for manual completion or upload the sample if you prefer to edit it online. Preparing official documents in compliance with federal and state rules is quick and effortless with our platform. Try US Legal Forms today to keep your documentation organized!

- If you are acquainted with our platform and already possess an account, make sure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also return to all obtained documents at any time needed by accessing the My documents tab in your profile.

- If you have not utilized our platform before, the process will require a few more steps to complete.

- Here's how new users can locate the Application And Assignment Year's Allowance Formula in our catalog.

- Carefully examine the page content to ensure it includes the sample you need.

- To do this, utilize the form description and preview options, if available.

- Use the Search field above to browse for another template if the current one does not suit you.

Form popularity

FAQ

Spouses in North Carolina Inheritance LawIf you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

NCGS 30-15 provides that a surviving spouse shall be entitled to an allowance of the value of $60,000 from the personal property of the deceased spouse to support the surviving spouse. The surviving spouse must apply for this allowance through the Clerk of Court within one year of the deceased spouse's death.

North Carolina law provides for a year's allowance for the surviving spouse and dependent children of a deceased individual. Under North Carolina law, the surviving spouse of the Decedent is entitled to the first $60,000 (this was increased from $30,000 beginning on January 1, 2019) of the estate.

Primary tabs. Family allowance gives a surviving spouse and children access to a passing spouse or parent's estate in the interim between passing and the distribution of the estate. The family allowance gives spouses and children necessary financial support that is determined by statute in each state.

An Application for a Year's Allowance for the surviving spouse and/or dependent child(ren) may be filed with the clerk at any time within one (1) year of the decedent's death. The allowance will be from cash or personal property or a combination of both, but does not include real estate.