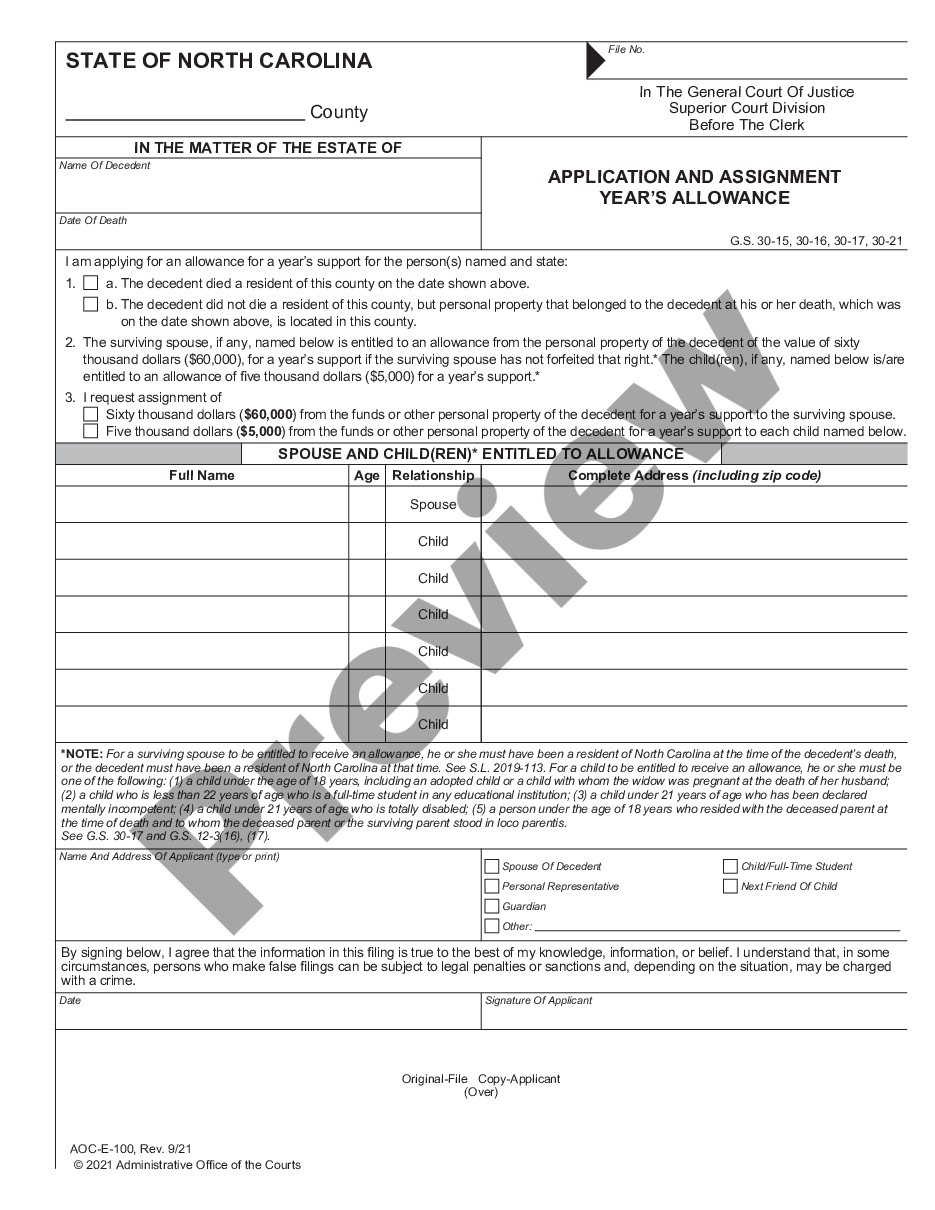

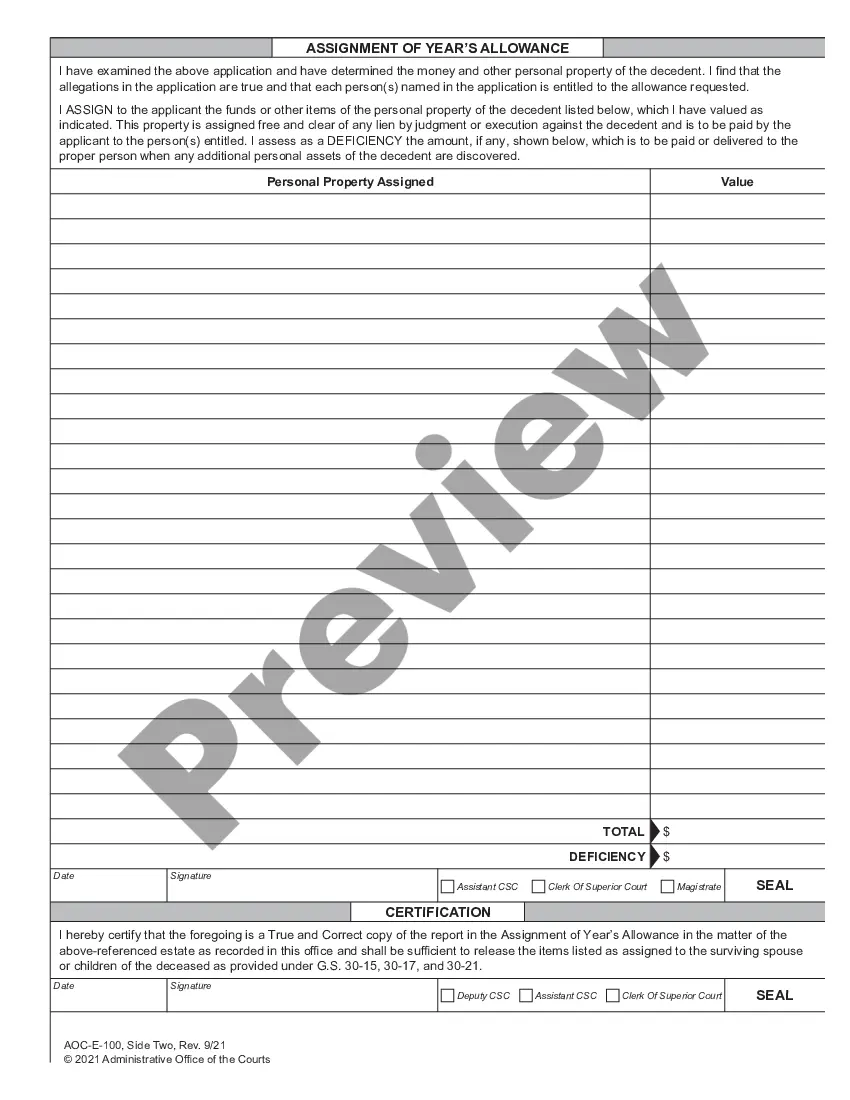

Application And Assignment Year's Allowance: This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

Application And Assignment Year's Allowance For Doubtful Accounts

Description

How to fill out Application And Assignment Year's Allowance For Doubtful Accounts?

Individuals frequently link legal documentation with something intricate that solely an expert can manage.

In some respects, this is accurate, as creating Application And Assignment Year's Allowance For Doubtful Accounts requires considerable proficiency in subject-related factors, including state and municipal laws.

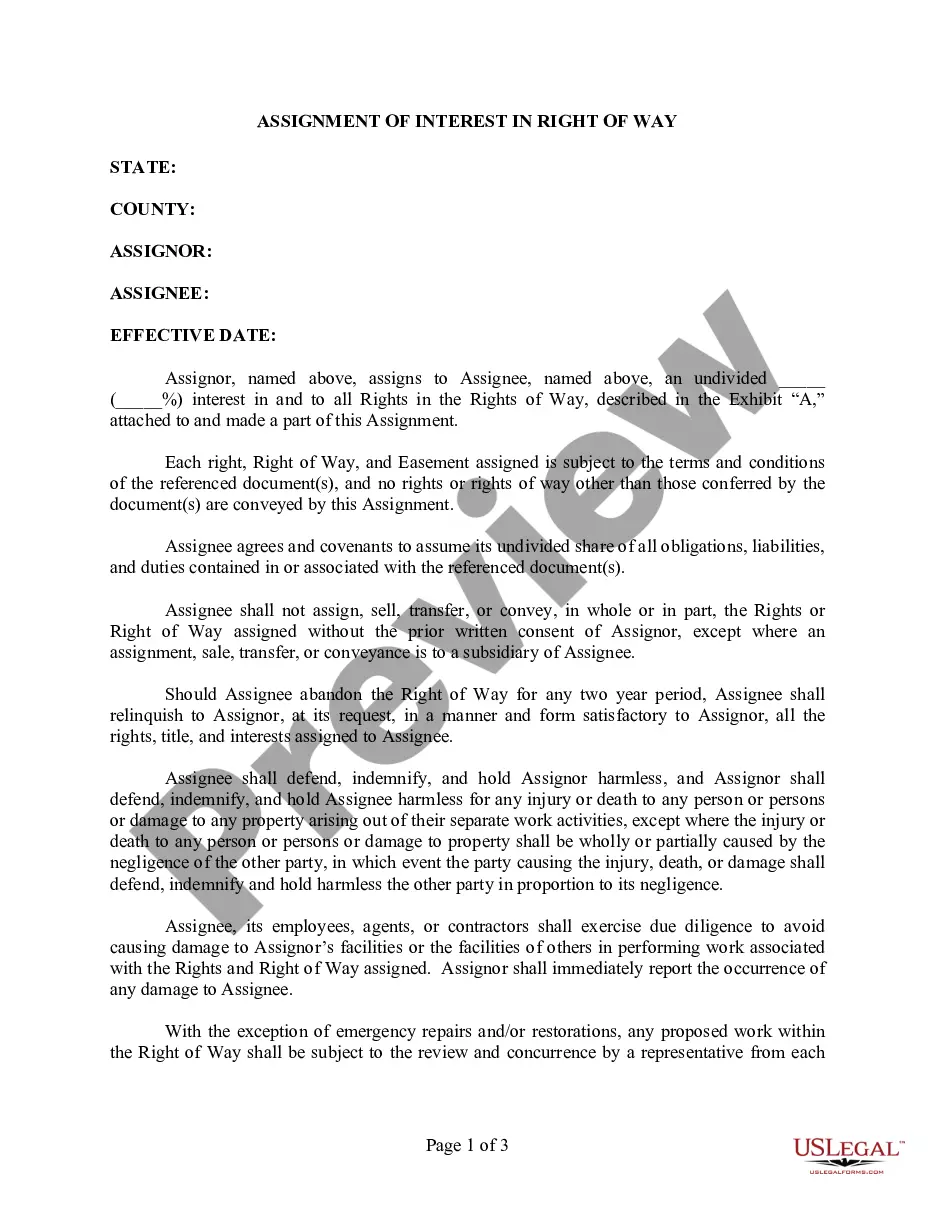

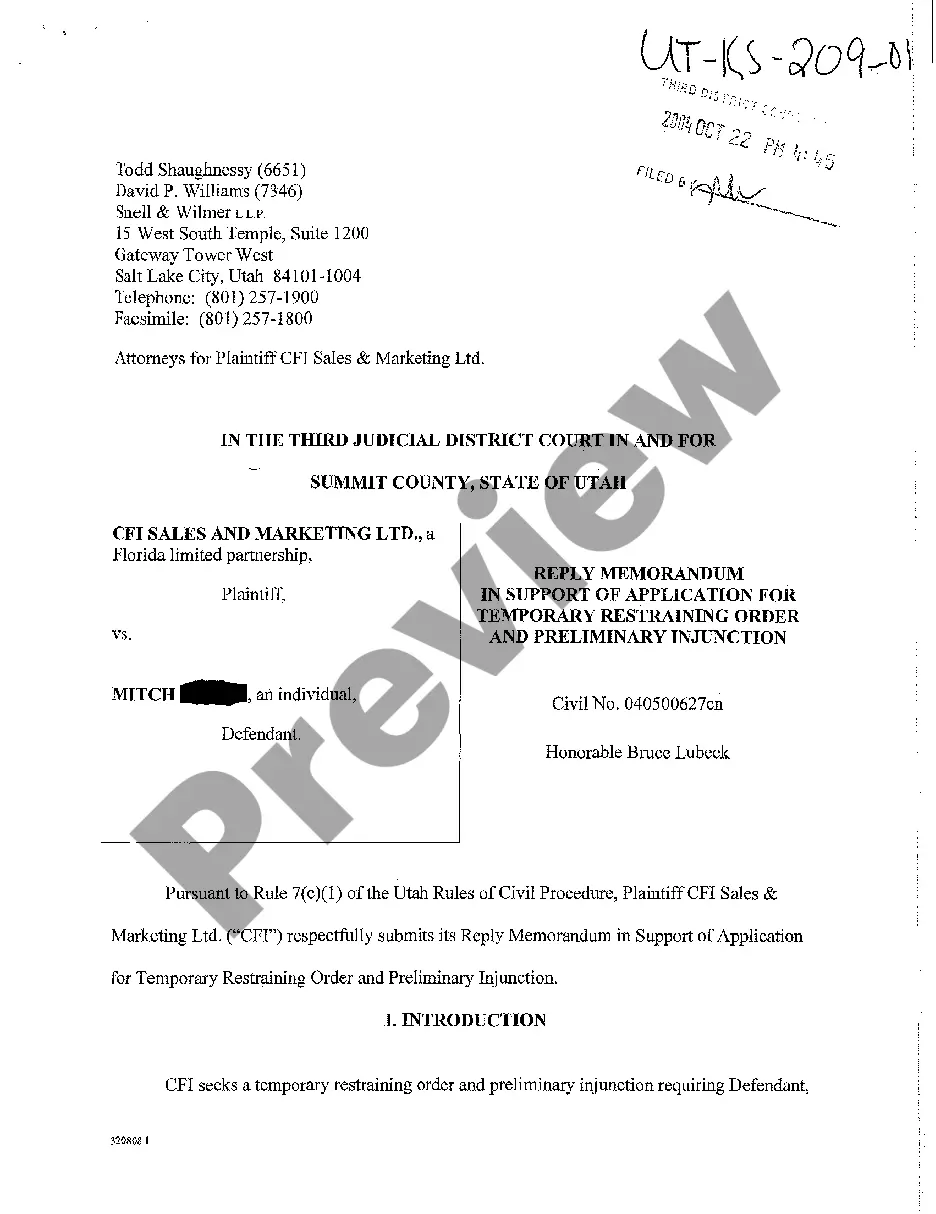

However, with US Legal Forms, the process has become simpler: ready-to-use legal templates for various life and business events tailored to state statutes are compiled in a single online directory and are now accessible to everyone.

Create an account or Log In to move to the payment page. Process your subscription payment via PayPal or with your credit card. Choose the format for your document and click Download. Print your document or upload it to an online editor for faster completion. All templates in our catalog are reusable: once bought, they remain stored in your profile, and you can access them anytime through the My documents tab. Explore the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current documents organized by state and purpose, making it quick to find Application And Assignment Year's Allowance For Doubtful Accounts or any other specific example within minutes.

- Previously registered users with an active subscription must Log In to their account and select Download to acquire the form.

- New users to the platform must first establish an account and subscribe before they can download any files.

- Here’s a detailed guide on how to obtain the Application And Assignment Year's Allowance For Doubtful Accounts.

- Review the page content thoroughly to confirm it meets your requirements.

- Study the form description or preview it using the Preview function.

- Find another document using the Search field above if the previous one does not meet your needs.

- Select Buy Now once you locate the suitable Application And Assignment Year's Allowance For Doubtful Accounts.

- Pick a pricing plan that suits your preferences and financial situation.

Form popularity

FAQ

The Year's Allowance A surviving spouse is entitled to an upfront payment of a sum of money set by statute from the deceased spouse's personal property estate. In 2019, this allowance increased from $30,000 to $60,000.

Spouses in North Carolina Inheritance LawIf you have no living parents or descendants, your spouse will inherit all of your intestate property. If you die with parents but no descendants, your spouse will inherit half of intestate real estate and the first $100,000 of personal property.

An Application for a Year's Allowance for the surviving spouse and/or dependent child(ren) may be filed with the clerk at any time within one (1) year of the decedent's death. The allowance will be from cash or personal property or a combination of both, but does not include real estate.

NCGS 30-15 provides that a surviving spouse shall be entitled to an allowance of the value of $60,000 from the personal property of the deceased spouse to support the surviving spouse. The surviving spouse must apply for this allowance through the Clerk of Court within one year of the deceased spouse's death.

Thus, in North Carolina, the elective share amount is as follows: 15% if the couple was married for less than 5 years; 25% if the couple was married for more than 5 but less than 10 years; 33% if the couple was married for more than 10 but less than 15 years; and.