Nc Dissolve Llc Withdrawal

Description

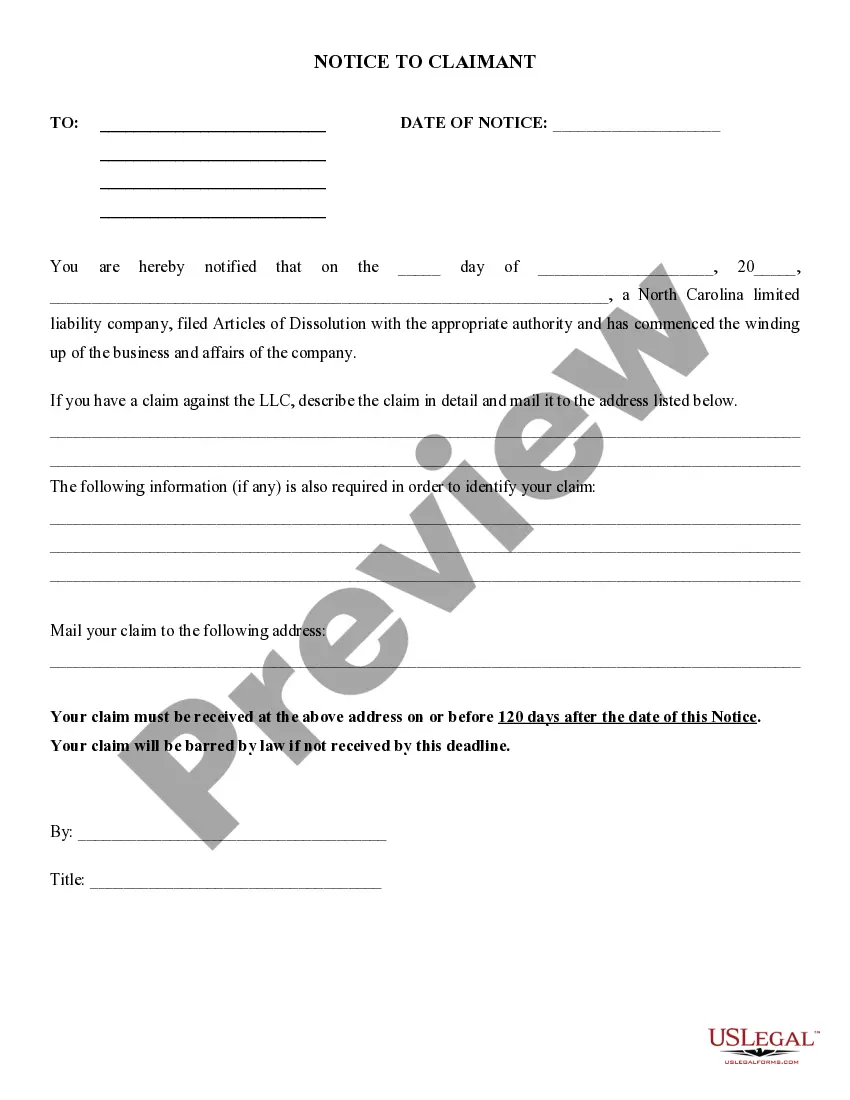

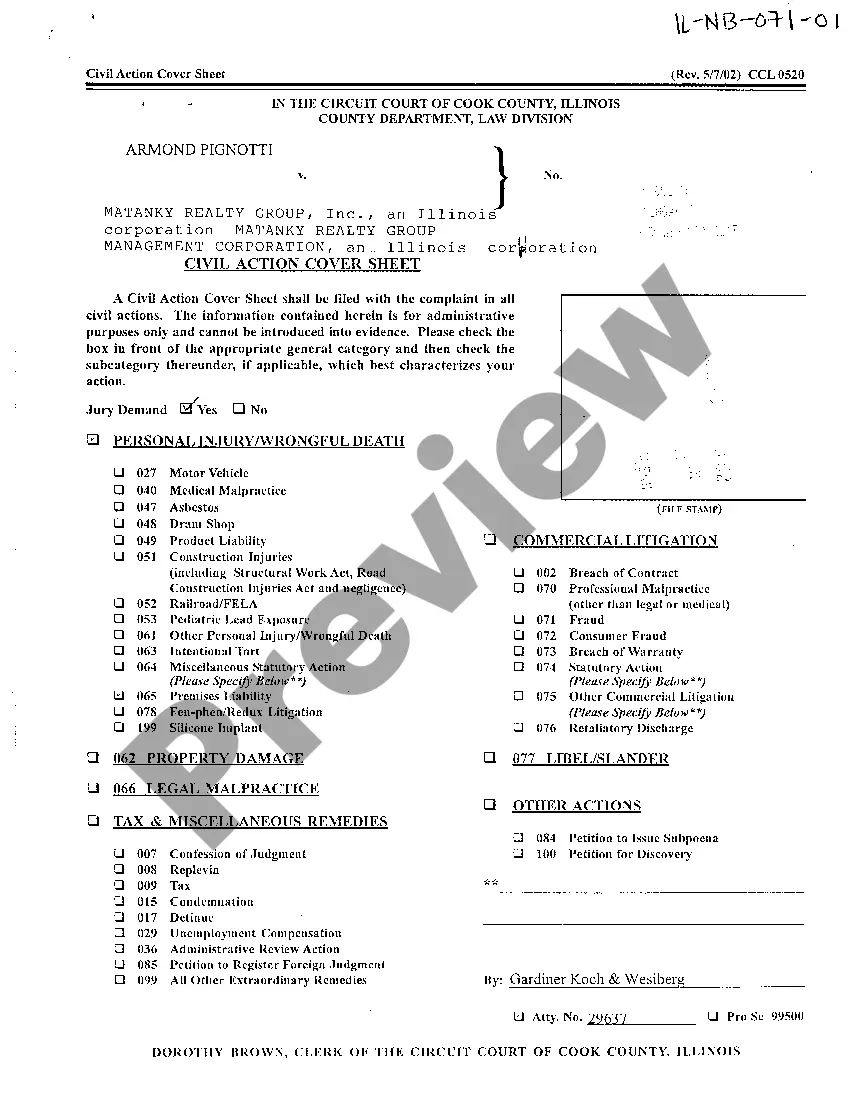

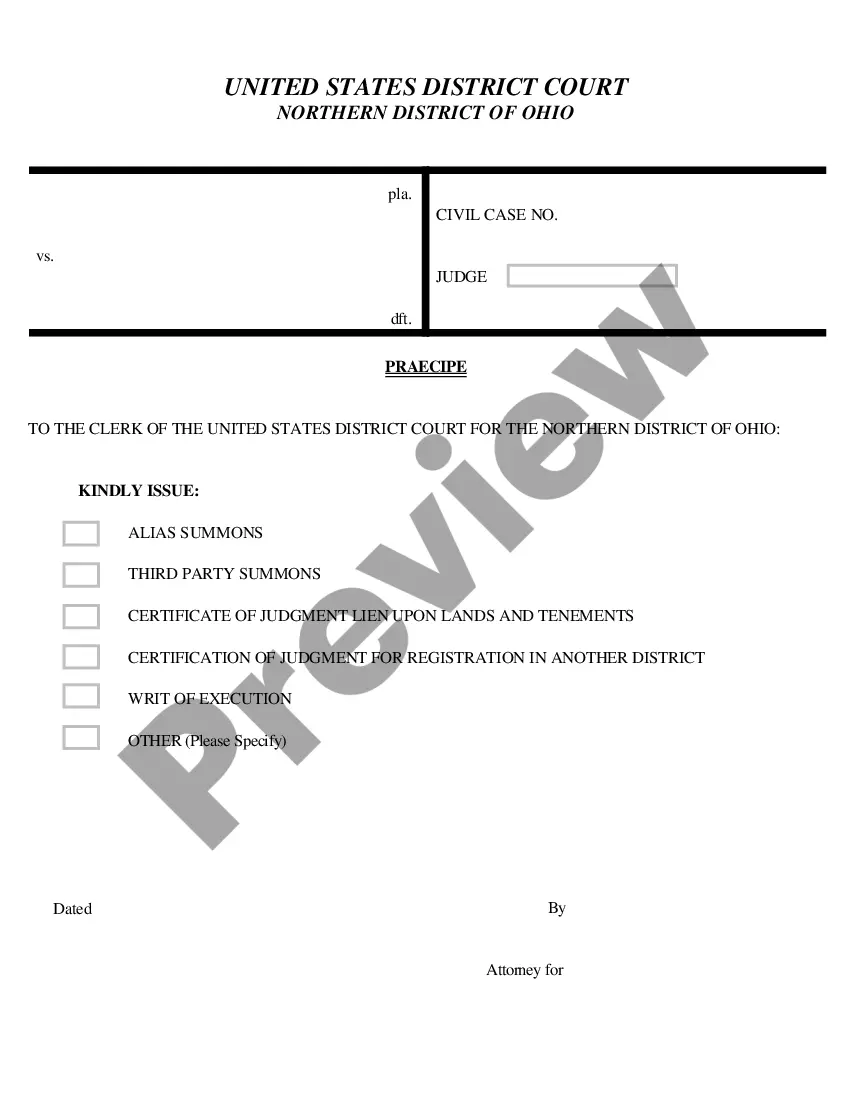

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

Finding a reliable source for the most up-to-date and pertinent legal templates is a significant part of navigating bureaucracy.

Identifying the appropriate legal documents requires precision and meticulousness, which is why it's crucial to obtain samples of Nc Dissolve Llc Withdrawal exclusively from credible providers, such as US Legal Forms. An incorrect template could squander your time and delay your circumstances.

Once you have the form on your device, you can modify it using the editor or print it out and fill it in by hand. Eliminate the stress associated with your legal documentation. Discover the extensive US Legal Forms collection where you can locate legal templates, verify their relevance to your situation, and download them instantly.

- Utilize the catalog navigation or search bar to locate your template.

- Examine the form’s description to ensure it aligns with your state's and region's requirements.

- Preview the form, if available, to verify that it is the template you need.

- Return to the search to find the correct template if the Nc Dissolve Llc Withdrawal does not meet your needs.

- If you are confident about the form’s suitability, proceed to download it.

- As an authorized user, click Log in to verify your identity and access your selected templates in My documents.

- If you have yet to create an account, click Buy now to purchase the template.

- Select the pricing option that fits your needs.

- Continue with the registration process to finalize your purchase.

- Complete your transaction by choosing a payment method (credit card or PayPal).

- Select the file format for downloading the Nc Dissolve Llc Withdrawal.

Form popularity

FAQ

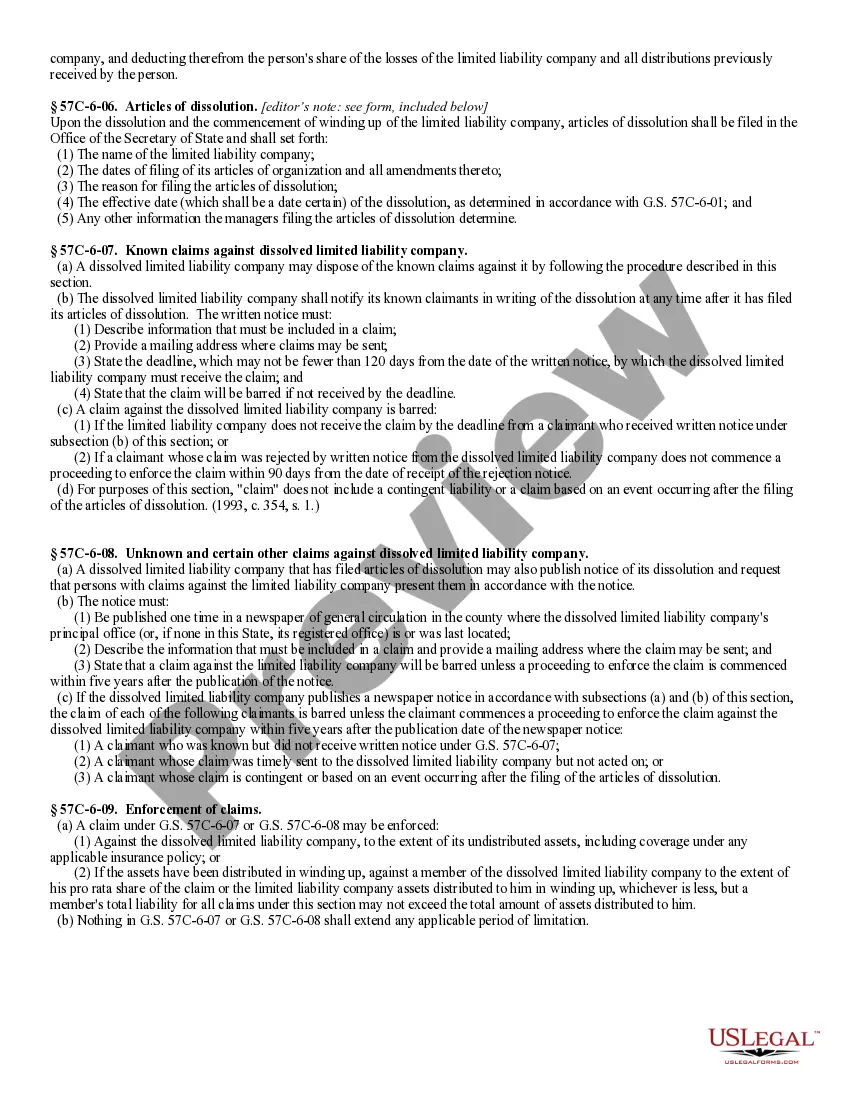

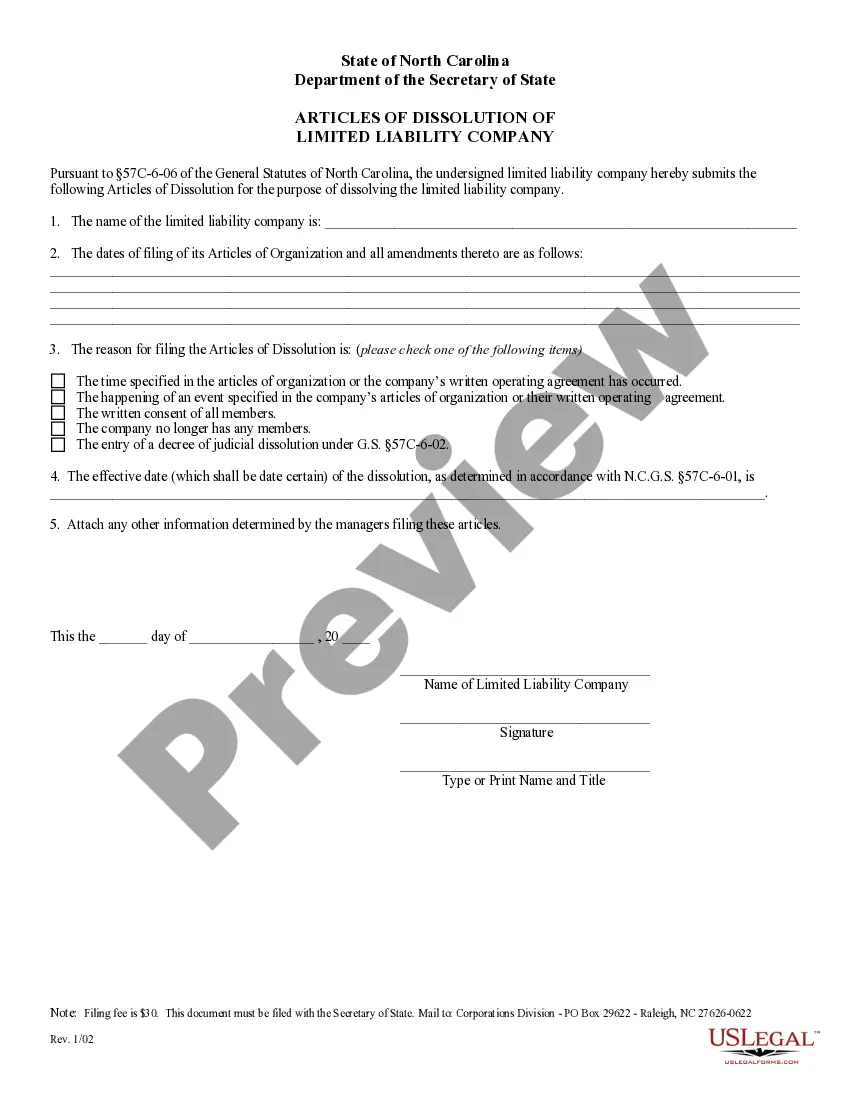

1. Filing fee is $30. This document must be filed with the Secretary of State. 2.

If you want to close a North Carolina business, you do so by voluntarily filing Articles of Dissolution for the entity type (Business Corporation, Nonprofit Corporation, Limited Liability Company (LLC)).

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

If a company has a Certificate of Authority to transact business in North Carolina and wants to withdraw that company from conducting business in North Carolina, the company will need to file an Application for Certificate of Withdrawal.

If you want to close a North Carolina business, you do so by voluntarily filing Articles of Dissolution for the entity type (Business Corporation, Nonprofit Corporation, Limited Liability Company (LLC)).