North Carolina Power Of Attorney Form Gen-58

Description

How to fill out North Carolina Acknowledgment By Attorney In Fact?

Maneuvering through the complexities of formal documents and templates can be challenging, particularly when one does not engage in that field professionally.

Even locating the appropriate template for a North Carolina Power Of Attorney Form Gen-58 will be labor-intensive, as it must be valid and accurate to the last detail.

Nevertheless, you will significantly reduce the time spent acquiring a suitable template if it originates from a source you can trust.

Acquire the appropriate form in a few straightforward steps.

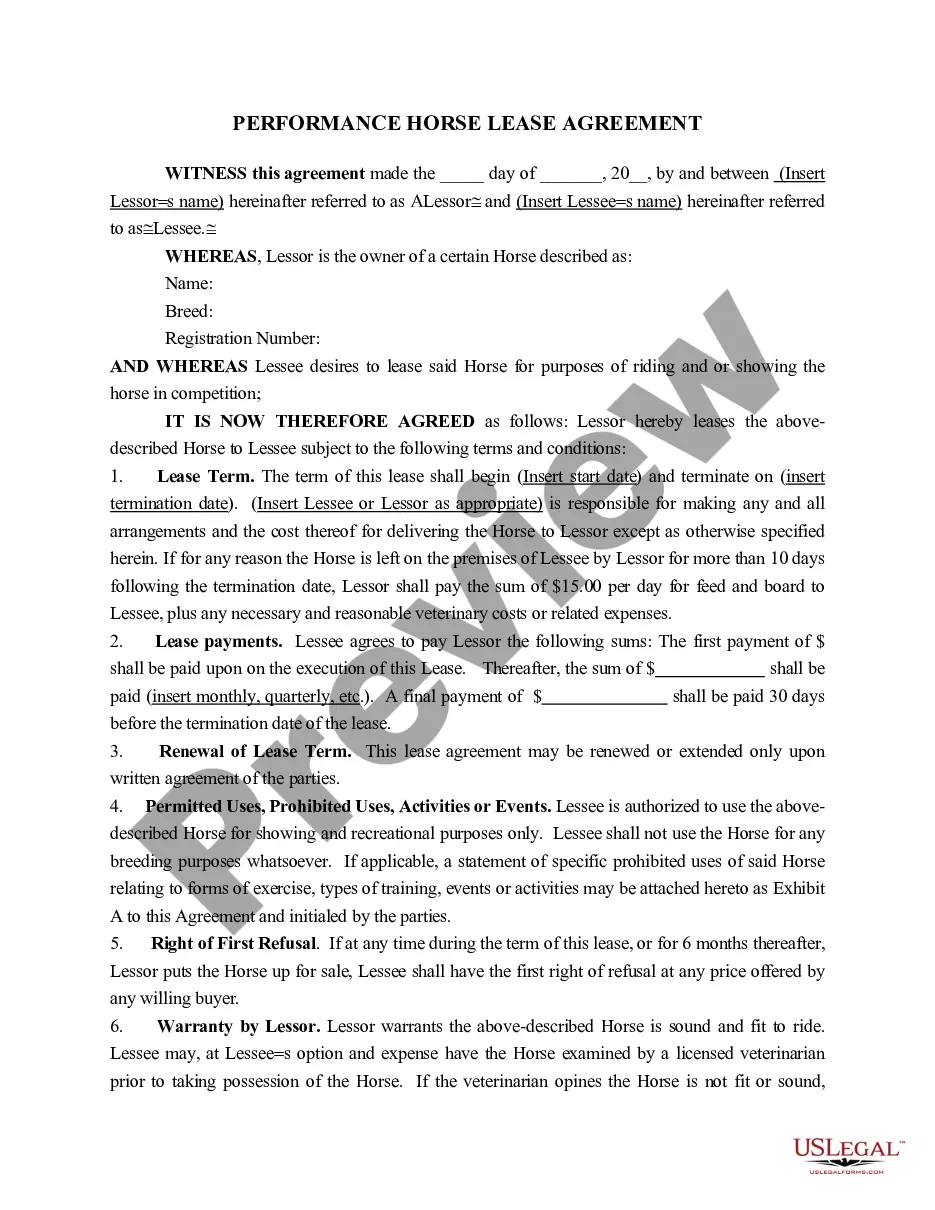

- US Legal Forms is a platform that streamlines the process of finding the correct forms online.

- US Legal Forms serves as a centralized location to obtain the most current samples of documents, check their usage, and download these samples for completion.

- This is a repository with over 85,000 forms applicable in various fields.

- When searching for a North Carolina Power Of Attorney Form Gen-58, you will not have to doubt its relevance, as all forms are validated.

- Creating an account at US Legal Forms will guarantee that you have all the essential samples at your fingertips.

- You can store them in your history or add them to the My documents directory.

- You can retrieve your saved forms from any device by clicking Log In on the library site.

- If you still lack an account, you can always search again for the template you require.

Form popularity

FAQ

This document provides information to taxpayers for completing the GEN-58 which grants authority to an individual to represent a taxpayer before the Department of Revenue and to receive and inspect confidential tax information, which may include federal tax information.

The SCDOR will accept the federal 2848 for South Carolina purposes. Be sure to note any differences in the forms. Complete the form to be South Carolina specific, including references to South Carolina tax forms.

A power of attorney must always be signed in front of a notary public. If you wish, it can be recorded at the county register of deeds office in North Carolina where it is to be used.

A POA declaration gives a representative the right to: Talk to us about your account. Receive and review your confidential account information. Represent you in FTB matters. Request copies of information we receive from the IRS.

This form cannot be e-filed and must be mailed to the address on the form. Partnership - The due date can be extended by filing an SC8736 Request for Extension of Time to File South Carolina Return for Fiduciary and Partnership. The SCDOR will also accept a federal Form 7004 marked for South Carolina purposes.