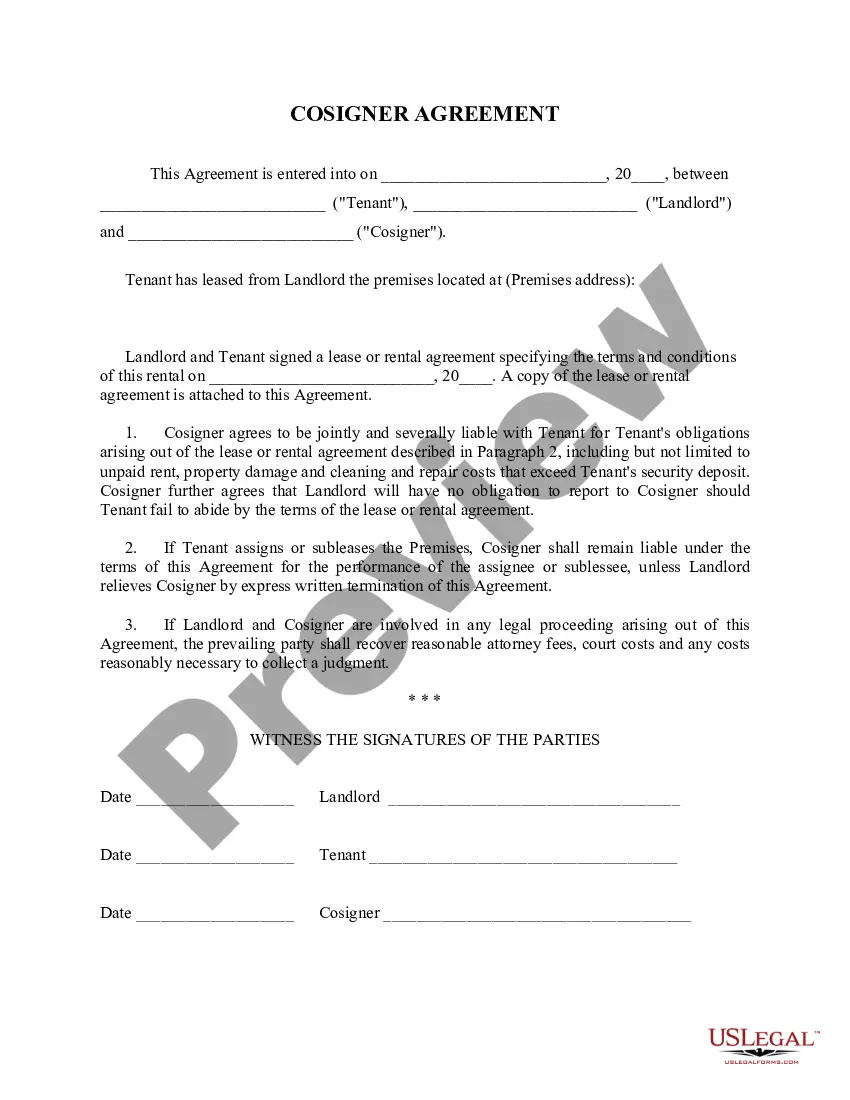

The cosigner is also sometimes be called a guarantor. A guaranty is a contract under which one person (guarantor) agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. Usually, the party receiving the guaranty will first try to collect or obtain performance from the debtor before trying to collect from the one making the guaranty (guarantor).

Cosigner For Apartment With Bad Credit

Description

How to fill out Cosigner For Apartment With Bad Credit?

No matter if you regularly deal with documents or occasionally need to submit a legal paper, it is crucial to have a valuable source where all the templates are connected and current.

One action to take regarding a Cosigner For Apartment With Bad Credit is to verify that it is the most recent version, as this determines its eligibility for submission.

If you want to make your quest for the latest document samples easier, search for them on US Legal Forms.

Utilize the search function to locate the form you seek.

- US Legal Forms is a repository of legal documents that includes almost any sample form you might need.

- Look for the templates you require, check their immediate relevance, and discover more about their application.

- With US Legal Forms, you gain access to approximately 85,000 document templates across various domains.

- Retrieve the Cosigner For Apartment With Bad Credit templates in just a few clicks and save them anytime in your profile.

- A US Legal Forms profile will enable you to access all the templates you need with increased ease and reduced frustration.

- Simply click Log In at the top of the website and open the My documents area containing all the forms you require at your fingertips, eliminating the need to spend time searching for the optimal template or verifying its applicability.

- To acquire a form without an account, follow these steps.

Form popularity

FAQ

While it may present challenges, getting approved for an apartment with a cosigner is usually easier than applying alone with bad credit. The cosigner’s credit and financial stability can alleviate concerns for landlords. Therefore, it's beneficial to have the right cosigner and present a comprehensive application.

Yes, two people can secure an apartment even if one has bad credit, especially with a cosigner for apartment with bad credit. The individual with a solid credit history can bolster the application. Additionally, providing proof of income and rental history may further support the application process.

A cosigner typically needs a good credit score, often above 650, to enhance your chances of approval for an apartment. Their strong financial standing can reassure landlords about the lease. However, exact requirements may vary by landlord, so check their specific criteria.

Yes, it is possible to get denied for an apartment with a cosigner. While a cosigner can significantly strengthen your application, landlords will still evaluate various factors like income and overall creditworthiness. Therefore, it's essential to ensure both you and your cosigner meet the required criteria.

Absolutely, you can find a cosigner for an apartment even if you have bad credit. Typically, someone with a solid credit history, like a family member or close friend, can serve as a cosigner. Their involvement not only enhances your application but also signals to landlords that they have support in meeting rental obligations.

Yes, you can still get denied even if you have a cosigner for an apartment with bad credit. Landlords evaluate the entire application, including income, rental history, and the cosigner's financial situation. If any aspect raises concerns, they may decide against approval.

To improve your chances of passing a rental application with bad credit, consider providing a strong rental history and steady income. Additionally, you may present a cosigner for an apartment with bad credit to help guarantee the lease. It's also helpful to explain any credit issues upfront and offer references to build trust with landlords.

The lowest credit score to buy a house with a cosigner usually starts around 620, depending on the lender’s requirements. A cosigner can help secure a mortgage by improving the overall creditworthiness of the application. If you face challenges due to bad credit, consider discussing options for cosigning and improvement strategies.

The lowest credit score a landlord will accept often starts around 580, but some may even go lower. Landlords typically evaluate applicants holistically, so having a cosigner for an apartment with bad credit can increase your chances. Providing documentation like proof of income or positive rental history may also bolster your application.

The minimum credit score to rent an apartment is usually between 580 and 620, though this can vary by location and landlord. Having a cosigner for an apartment with bad credit can help overcome a lower score and strengthen your application. Landlords often consider other factors alongside credit score, such as income and rental history.