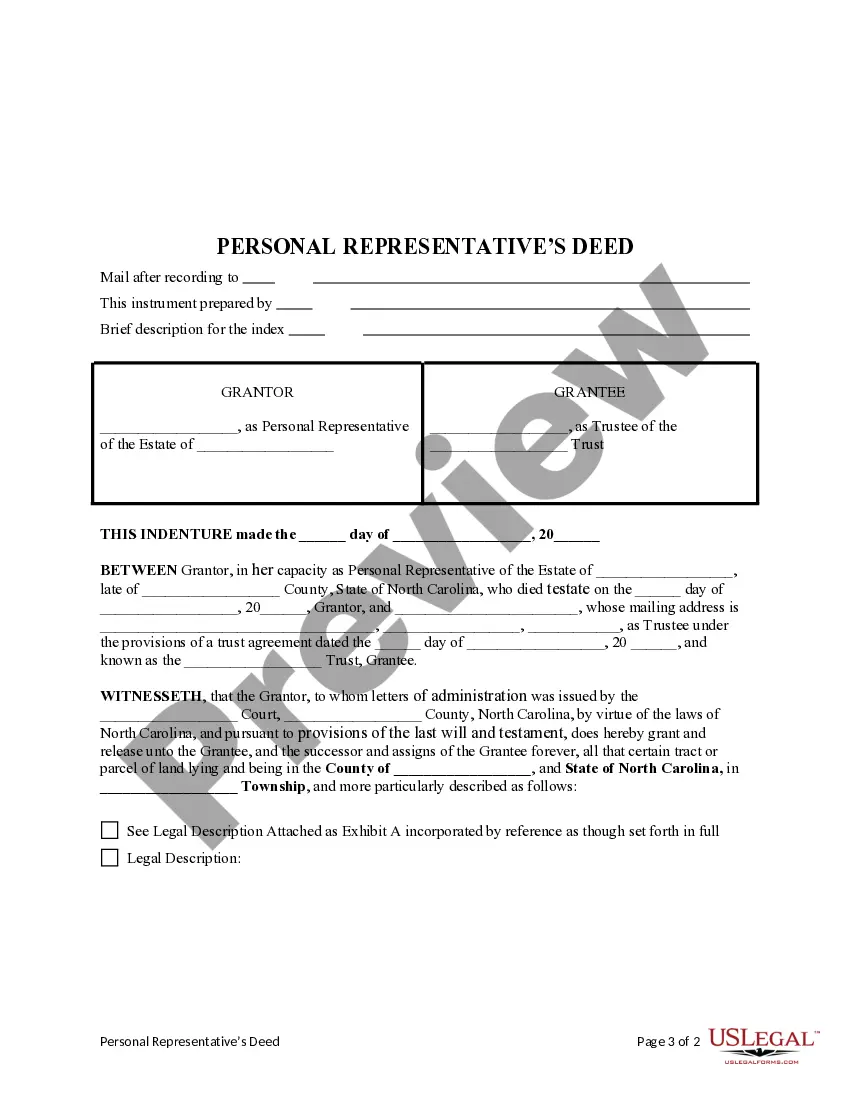

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is a trust for the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Personal Representative Deed Without Bond

Description

How to fill out Personal Representative Deed Without Bond?

How to acquire professional legal documents that adhere to your state regulations and prepare the Personal Representative Deed Without Bond without hiring an attorney.

Numerous services online offer templates to address various legal scenarios and formalities.

However, it might require some time to determine which of the available samples satisfies both your use case and legal requisites. US Legal Forms is a trustworthy service that assists you in locating formal documents crafted according to the latest updates in state laws, allowing you to save money on legal help.

If you do not have an account with US Legal Forms, follow the instructions below: Review the webpage you have accessed and ascertain if the form meets your requirements. To achieve this, utilize the form description and preview options if available. Look for another template in the header indicating your state, if necessary. Click the Buy Now button upon finding the appropriate document. Choose the most suitable pricing plan, then Log In or create an account. Select your payment method (by credit card or via PayPal). Change the file format for your Personal Representative Deed Without Bond and click Download. The obtained templates will remain under your control: you can always revisit them in the My documents section of your profile. Sign up for our platform and generate legal documents independently like a seasoned legal expert!

- US Legal Forms is not a typical online library.

- It's an extensive collection of over 85,000 verified templates for diverse business and personal situations.

- All documents are categorized by domain and state to facilitate a swifter and more convenient search process.

- It also incorporates robust tools for PDF editing and digital signatures, enabling users with a Premium subscription to swiftly complete their paperwork online.

- It requires minimal effort and time to acquire the essential documentation.

- If you already possess an account, Log In and confirm that your subscription is current.

- Download the Personal Representative Deed Without Bond using the designated button adjacent to the file name.

Form popularity

FAQ

The probate process in Arizona can take several months to a year or more, especially when there is no will. This duration often depends on the complexity of the estate and whether any disputes arise among potential heirs. To streamline the process, consider using a personal representative deed without bond, which can help avoid lengthy legal requirements and facilitate a smoother transition of assets. It's advisable to consult with a knowledgeable probate attorney to navigate these timelines effectively.

When there is no will in Arizona, the state's intestacy laws determine the heirs. Typically, the deceased's spouse and children inherit first, followed by parents, siblings, and other relatives depending on the family tree. It's important to understand these laws, as they can impact the distribution of the estate significantly. In such cases, a personal representative deed without bond could provide a straightforward method for managing the estate without unnecessary delays or complications.

If there is no will, you can still become an executor by petitioning the probate court. The court will look for a suitable person to serve as the personal representative, and typically, this can be a close relative or an interested party. It's important to provide any documentation that supports your claim, such as proof of relationship to the deceased. Utilizing a personal representative deed without bond can also facilitate this process, reducing the financial requirements placed on you.

To become an executor of an estate in Arizona, you need to be named in the deceased person's will or, if there is no will, you can apply to the court to be appointed. It's helpful to gather important documents, such as the death certificate and the will, if one exists. Once you have the necessary paperwork, you can file a petition with the probate court. Additionally, you may consider a personal representative deed without bond to simplify the probate process, especially if there are no disputes among heirs.

An heirs bond is a financial guarantee often required for heirs who are taking on the responsibilities of managing an estate. This bond protects the interests of the estate until the distribution is complete. In situations where a personal representative deed without bond is applicable, heirs may find this requirement unnecessary, streamlining their process.

Signing a Waiver of Personal Representatives Bond can simplify the management of an estate. It indicates that you agree to serve without the requirement for a surety bond, saving time and legal costs. This choice is especially beneficial when dealing with straightforward estates, fitting perfectly with the concept of a personal representative deed without bond.

In immigration, a bond refers to a financial guarantee that ensures an individual will comply with legal requirements, often related to their immigration status. This type of bond can be crucial for those seeking to stay legally in the US while their cases are processed. Unlike a personal representative deed without bond, immigration bonds are typically mandated.

A representative bond is a type of surety bond required from individuals acting in fiduciary roles, such as executors or administrators. This bond protects the interests of the estate and its beneficiaries. Opting for a personal representative deed without bond can alleviate the stress of managing such requirements.

There are several types of bonds including surety bonds, performance bonds, and personal representative bonds. Each serves different purposes, but in the context of a personal representative deed without bond, the focus is on the absence of a requirement for a surety bond. This allows representatives to carry out their duties efficiently without additional financial burdens.

'Without bond' in a will indicates that no surety bond is required for the personal representative to manage the estate. This means the representative can operate without extra financial guarantees, which can streamline the probate process. Families often prefer this option to minimize costs and expedite affairs.