Life Estate Deed Form North Carolina Format

Description

How to fill out North Carolina Warranty Deed To Child Reserving A Life Estate In The Parents - Husband And Wife Grantors?

Getting a go-to place to access the most current and appropriate legal templates is half the struggle of handling bureaucracy. Discovering the right legal files demands accuracy and attention to detail, which is the reason it is crucial to take samples of Life Estate Deed Form North Carolina Format only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to be concerned about. You can access and check all the information about the document’s use and relevance for your situation and in your state or region.

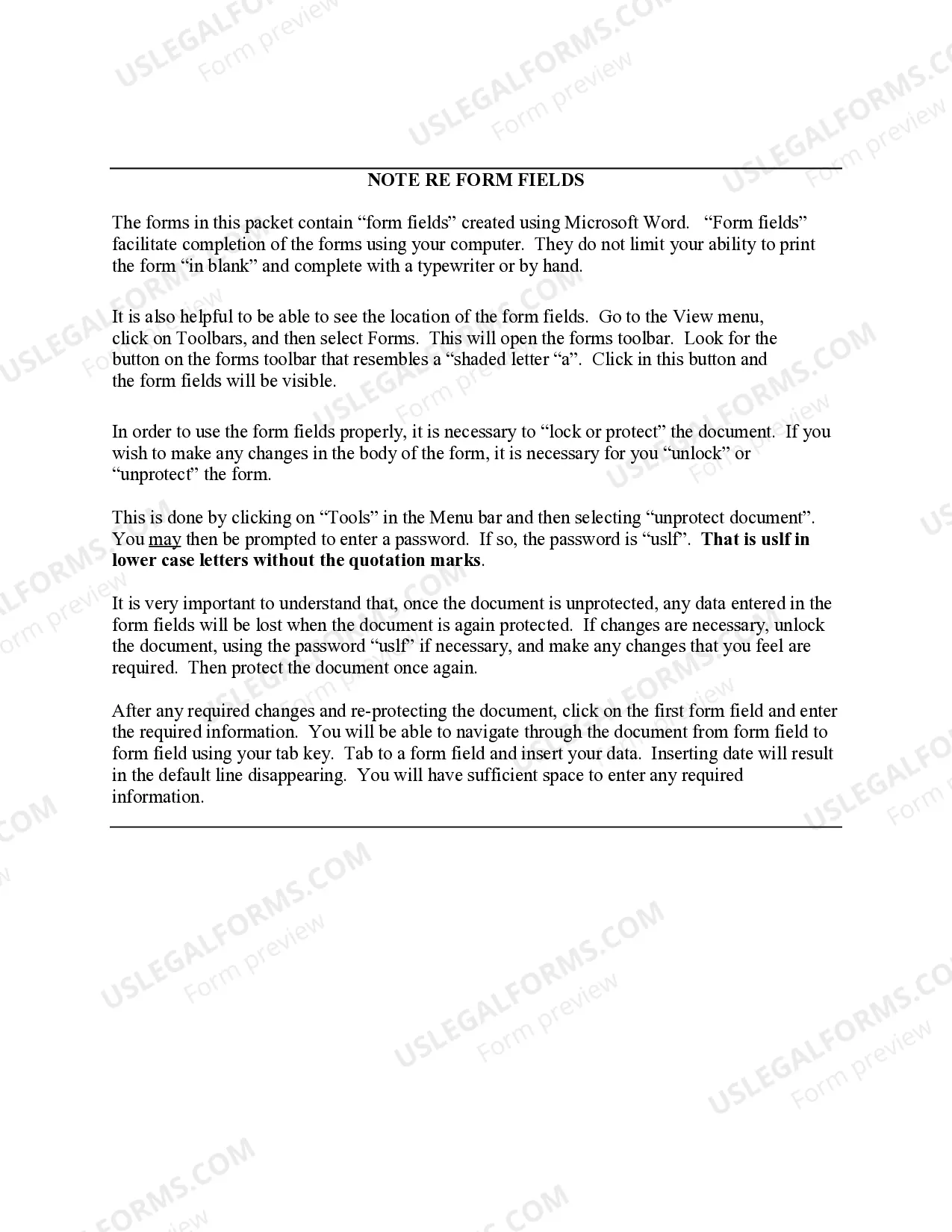

Consider the listed steps to complete your Life Estate Deed Form North Carolina Format:

- Utilize the catalog navigation or search field to locate your template.

- Open the form’s description to check if it fits the requirements of your state and region.

- Open the form preview, if there is one, to make sure the form is definitely the one you are looking for.

- Return to the search and look for the appropriate template if the Life Estate Deed Form North Carolina Format does not suit your requirements.

- If you are positive regarding the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and gain access to your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Select the pricing plan that suits your preferences.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (bank card or PayPal).

- Select the file format for downloading Life Estate Deed Form North Carolina Format.

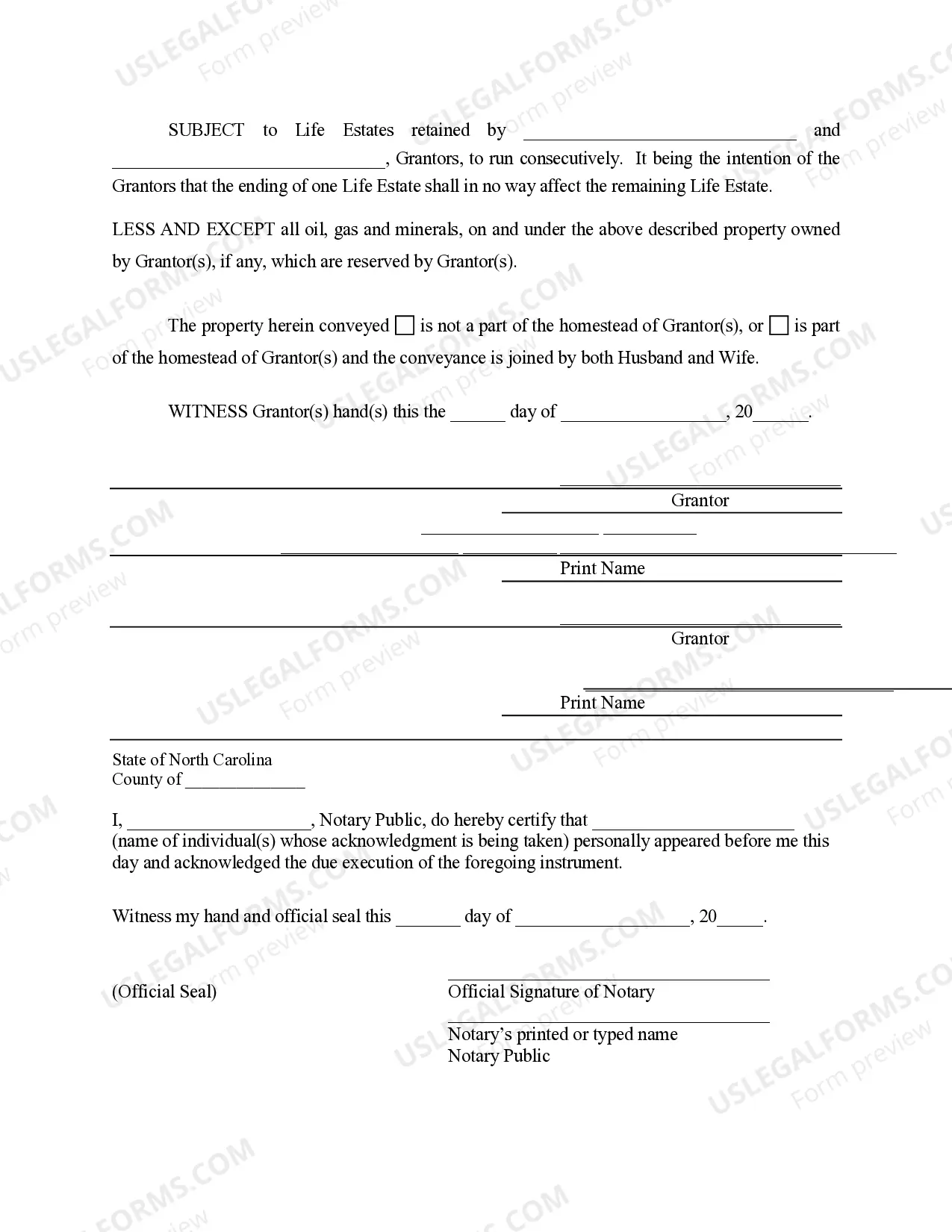

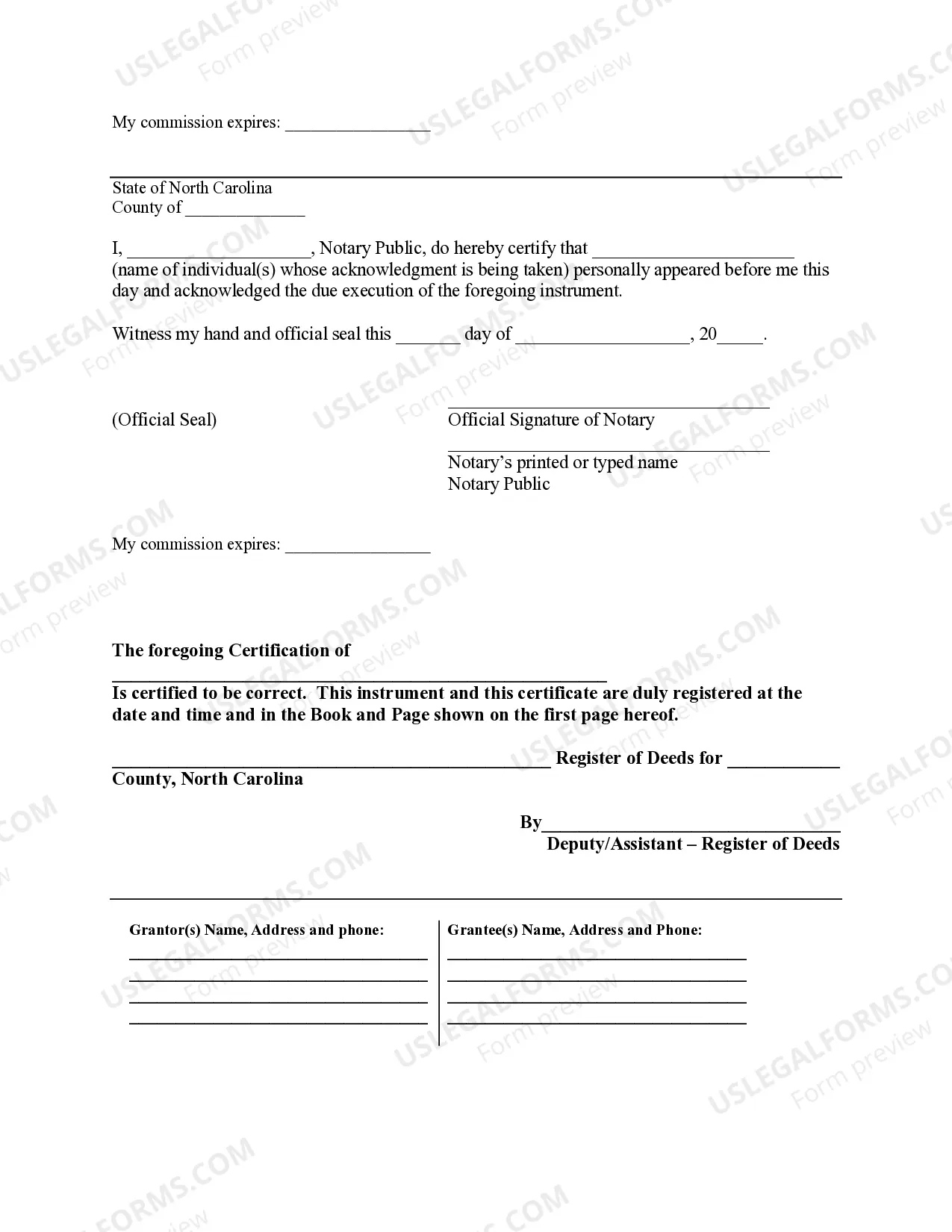

- When you have the form on your device, you can alter it using the editor or print it and finish it manually.

Remove the hassle that accompanies your legal documentation. Explore the comprehensive US Legal Forms catalog where you can find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

A life estate helps avoid the probate process upon the life tenant's death. The property will automatically transfer to the remainderman, making the process simple and easy ? a will isn't needed for the transfer to happen.

Can I prepare my own deed and have it recorded? North Carolina law allows you to prepare a Deed of Conveyance for any real property to which you have legal title. However, the conveyance of real property is a legal matter that should be given under and with the advise of legal counsel.

The deed must contain, at minimum, an identification of the grantor and grantee, consideration (usually the amount of money paid) and a legal description of the real estate. It may refer to the real estate by lot number as shown on a recorded plat or by a lengthy metes and bounds description prepared by a surveyor.

Life Estates are simple and inexpensive to establish; merely requiring that a new Deed be recorded. Life Estates avoid probate; the property automatically transfers to your heirs upon the death of the last surviving Life Tenant. Transferring title following your death is a simple, quick process.

Life Estate Deed to Avoid MERP in North Carolina You can work with an estate planning attorney to set life estate deeds up and avoid paying MERP by conveying 1% of the home to an adult child. However, this deed must include the owner designation JTWROS or ?joint tenants with a right of survivorship.?