Ladybird Property Deed With Mortgage

Description

How to fill out Ladybird Property Deed With Mortgage?

Individuals frequently link legal documentation with something intricate that only an expert can manage.

In a certain sense, it's accurate, as creating a Ladybird Property Deed With Mortgage requires significant knowledge in subject criteria, including state and county laws.

However, with US Legal Forms, the situation has become more user-friendly: ready-made legal templates for any life and business scenario specific to state regulations are gathered in a single online repository and are now accessible to everyone.

Register for an account or Log In to move on to the payment page. Settle your subscription via PayPal or with your credit card. Choose the format for your document and click Download. Print your document or upload it to an online editor for quicker completion. All templates in our library are reusable: once acquired, they are stored in your profile. You can access them whenever needed through the My documents section. Explore all the benefits of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms offers over 85k current forms categorized by state and area of use, so searching for a Ladybird Property Deed With Mortgage or any other specific template only requires a few minutes.

- Previously registered users with an active subscription must Log In to their account and click Download to obtain the form.

- New users on the platform must first register for an account and subscribe before they can download any documents.

- Here is the step-by-step guide on how to obtain the Ladybird Property Deed With Mortgage.

- Carefully review the page content to ensure it meets your needs.

- Examine the form description or preview it using the Preview option.

- If the previous one does not meet your requirements, find another sample using the Search bar above.

- When you find the suitable Ladybird Property Deed With Mortgage, click Buy Now.

- Select a pricing plan that aligns with your needs and budget.

Form popularity

FAQ

Using a Ladybird property deed with mortgage while carrying a mortgage is manageable. The homeowner can retain full control of the property while designating heirs for future transfer. It's crucial to consult with a real estate attorney to understand the implications for your mortgage. US Legal Forms offers resources to help you navigate this process confidently.

A Ladybird property deed with mortgage allows the owner to keep their property while designating beneficiaries. The mortgage must be managed separately, as the lender's interest in the property remains. When the owner passes away, the property transfers directly to the beneficiaries, and the mortgage responsibility may fall on them. Understanding these aspects ensures a smooth transition, and platforms like US Legal Forms can provide valuable guidance.

Yes, a Ladybird property deed with mortgage can be revoked in Texas. The property owner retains the right to change or cancel the deed at any time during their lifetime. This flexibility makes it a popular choice for many. You can easily consult with legal experts or use platforms like US Legal Forms to ensure all necessary steps are followed.

The lady bird deed can be a wise option for many individuals, as it allows for a seamless transfer of property while avoiding probate. However, some may find it a potential trap if they do not fully understand the implications, especially concerning existing mortgages. It's crucial to consider how the lady bird property deed with mortgage impacts your estate plan and tax responsibilities. You might want to consult with professionals or explore resources on uslegalforms to make an informed decision.

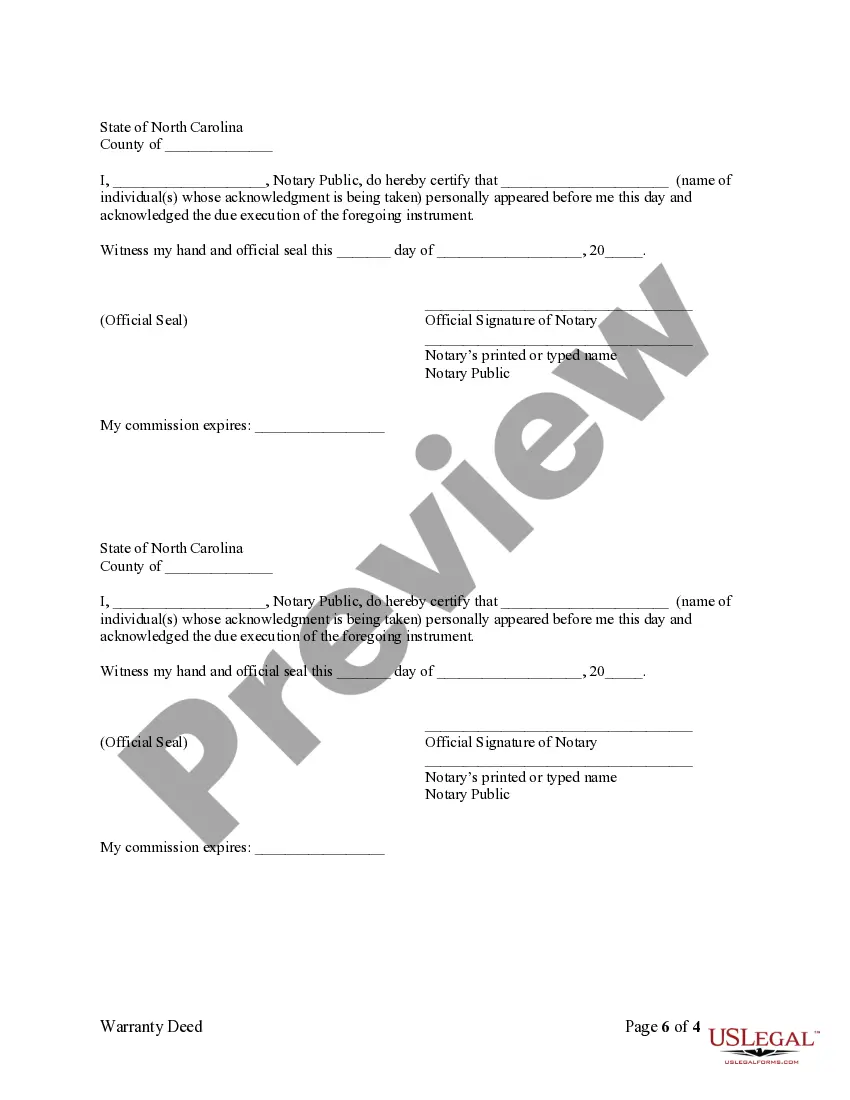

Creating a lady bird deed in Florida requires filling out a specific form that names the current owner and the designated beneficiaries. You must sign the deed in front of a notary public and then record it with the local county clerk's office for it to be valid. It is crucial to ensure the lady bird property deed with mortgage accurately reflects your intentions, as errors can complicate the transfer process. For assistance, uslegalforms offers resources and templates to help you navigate the creation of this deed smoothly.

After death, the lady bird deed transfers property directly to the designated beneficiaries without passing through probate. It is essential to keep the deed updated during your lifetime to ensure your chosen beneficiaries receive the property. Additionally, you should notify the beneficiaries about the existence of the lady bird property deed with mortgage to help them understand their new responsibilities. If you're unsure how to manage the process, uslegalforms can provide guidance and necessary documents to simplify the transfer.

A ladybird property deed with mortgage generally takes precedence over a will in Florida. This means that the property will pass directly to the designated beneficiaries upon your passing, sidestepping probate. Ensure that your estate planning documents are aligned to avoid any conflicts.

Many users on platforms like Reddit have shared their experiences setting up a ladybird property deed with mortgage in Florida. These discussions often highlight both success stories and challenges faced during the process. Engaging in such communities can provide valuable insights if you're considering this option.

A ladybird property deed with mortgage can provide some protection against Medicaid claims in Florida. However, it's crucial to understand that Medicaid may still have the right to recover funds from your estate after your passing. Consulting with a professional can clarify how a ladybird deed impacts your Medicaid eligibility.

A disadvantage of a ladybird property deed with mortgage in Florida is that it may complicate the mortgage process. If a property has a mortgage, some lenders might view the ladybird deed as a potential risk. It's essential to discuss these concerns with a qualified attorney or an estate planning expert.