Limited Company Llc For Non Resident

Description

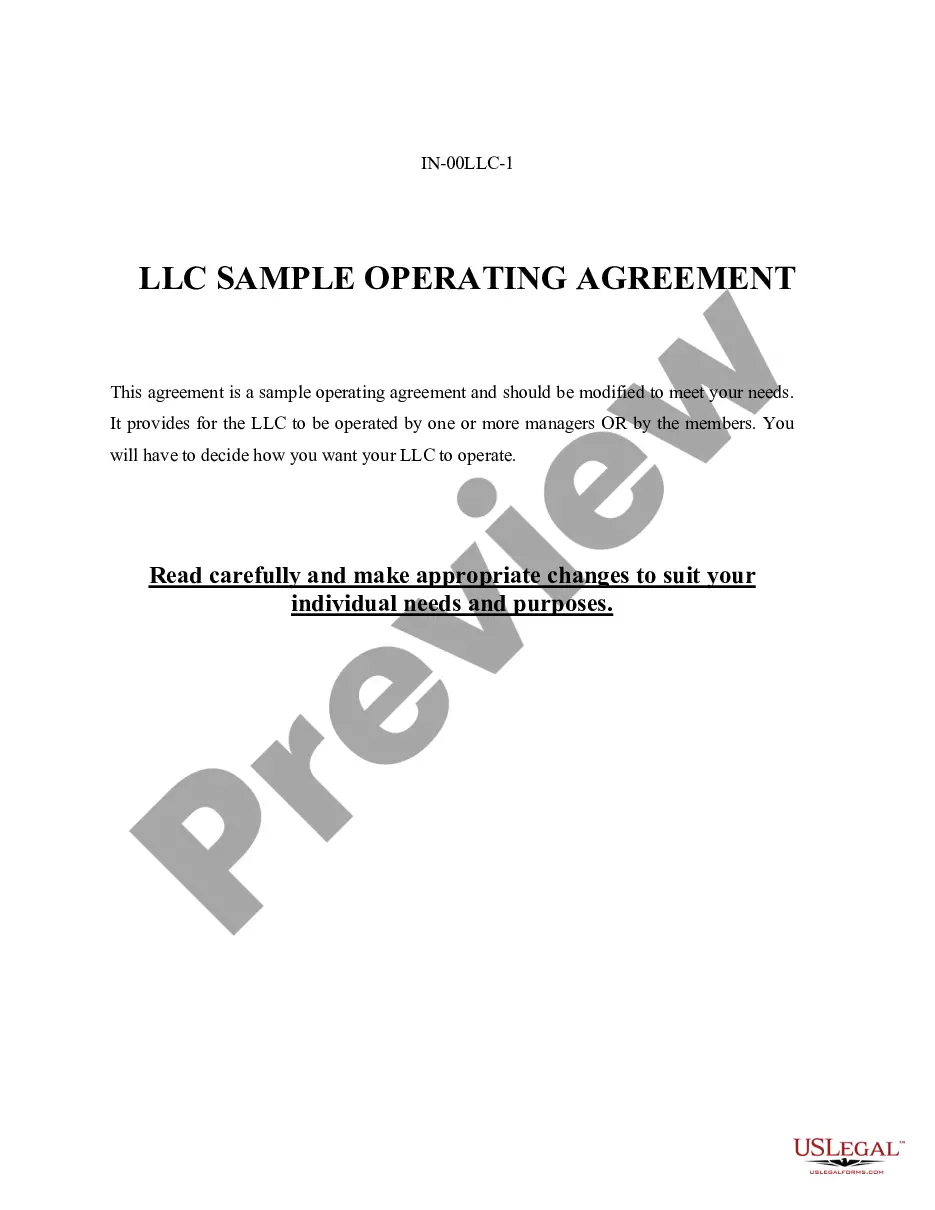

How to fill out North Carolina Limited Liability Company LLC Operating Agreement?

- If you have an existing US Legal Forms account, log in and download the required template by clicking on the Download button. Ensure your subscription is up to date; renew if necessary.

- If you're new to US Legal Forms, start by checking the preview mode of the desired form. Make sure it matches your specific needs and complies with local jurisdiction regulations.

- Should you need another form, utilize the Search tab to find the correct template. Once satisfied, proceed to the next step.

- Make your purchase by clicking on the Buy Now button and choose your preferred subscription plan. Registration is required to access the comprehensive library.

- Enter your payment details using a credit card or PayPal to complete the purchase.

- Download your document. Save it for completion and access it anytime from the My Forms section of your profile.

By utilizing US Legal Forms, you gain access to a robust collection of over 85,000 easy-to-fill forms, which empowers you and your legal counsel to execute your documents quickly and efficiently.

Don't hesitate to transform the complexity of forming your LLC into a straightforward process. Visit US Legal Forms today and discover how simple getting started can be!

Form popularity

FAQ

Yes, non-US residents can definitely open a limited company LLC for non-residents in the United States. This option is popular among international entrepreneurs seeking to tap into the US market. Utilizing services like USLegalForms can simplify the entire process, making it easier for you to get started.

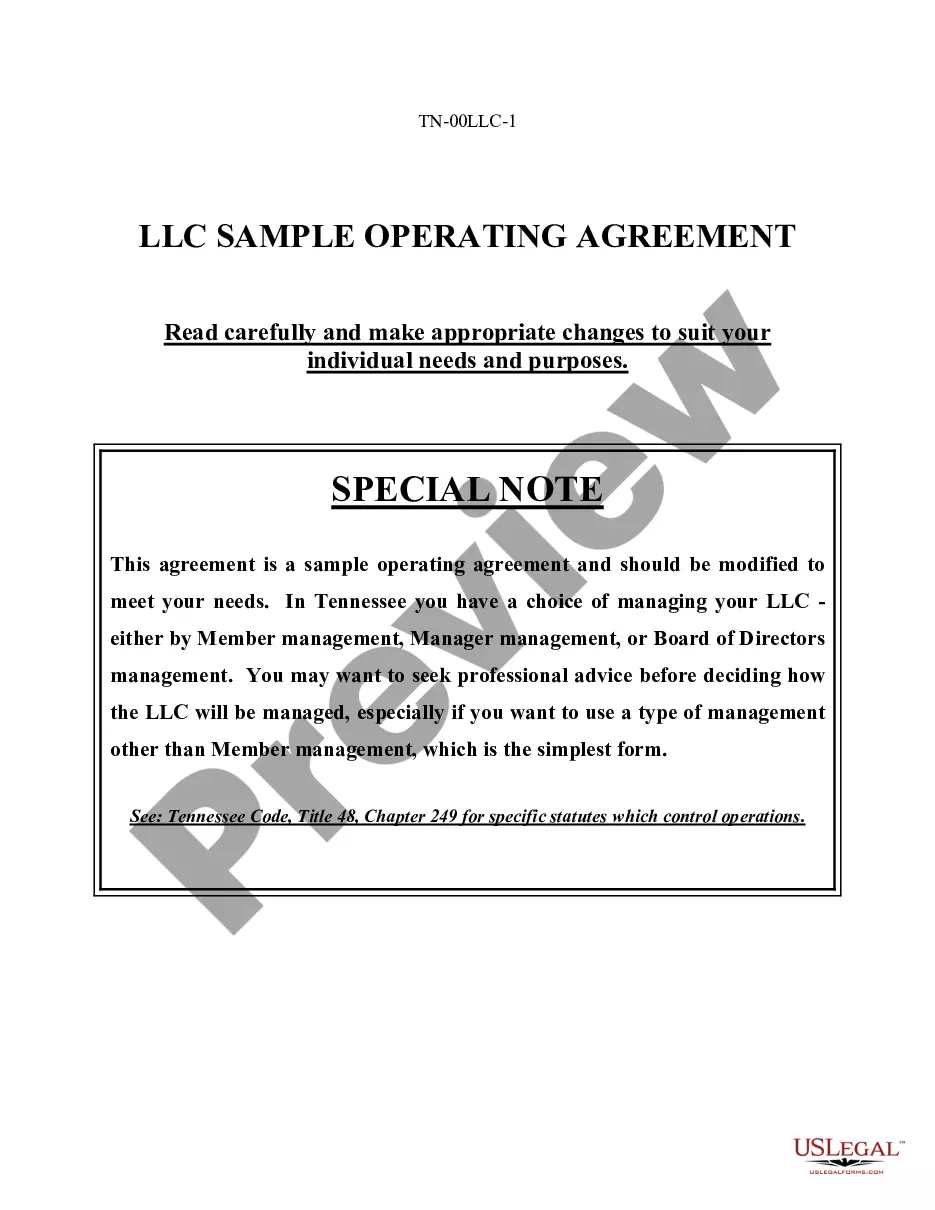

To form an LLC in a state where you do not reside, start by researching the requirements for establishing a Limited company LLC for non-resident. Complete the necessary documentation, including filing for a registered agent and the Articles of Organization. Utilizing platforms like US Legal Forms can streamline your experience by providing clear instructions and access to required forms.

Forming an LLC in a different state involves choosing the entity structure as a Limited company LLC for non-resident. You will need to file the Articles of Organization in that state and may require a registered agent to receive service of process. Tools such as US Legal Forms offer resources and templates to ensure that you complete the process correctly and efficiently.

Non-US residents can register an LLC by selecting a preferred state to establish their Limited company LLC for non-resident. They must provide personal identification, a valid address, and fulfill state-specific requirements. It can be beneficial to use a service like US Legal Forms, which guides you through necessary documentation and helps you fulfill regulatory obligations with ease.

To register a business in a state where you don't reside, you must choose the state where you want to form your Limited company LLC for non-resident. Next, complete the necessary paperwork, which typically includes the Articles of Organization. You may also need a registered agent in that state to handle legal documents. Online services, like US Legal Forms, can simplify this process and provide the necessary forms.

When registering a foreign LLC, states like Delaware, Nevada, and Wyoming are often considered the best options. These states offer favorable laws, low costs, and efficiency in establishing a Limited company LLC for non residents. Furthermore, they provide strong legal protections and various benefits. Assess your business goals to choose the most beneficial state for your needs.

The tax rate for a Limited company LLC for non residents varies based on the state where you register. Non-resident LLCs may be subject to federal taxes on income effectively connected to a U.S. trade or business. Some states have no state income tax, while others might impose a corporate tax. Consulting a tax professional can clarify your specific obligations.

For non-residents, Delaware and Wyoming are frequently regarded as the best states for establishing a Limited company LLC. Delaware offers a well-established legal framework and efficient courts for business matters. Wyoming, on the other hand, provides low fees and strong privacy protections. Review your specific business requirements to make the ideal choice.

Yes, the state where you set up a Limited company LLC for non residents can significantly impact your business operations and taxes. Different states have varying regulations, fees, and tax structures. Additionally, some states offer more privacy for members and greater ease in processing applications. Always choose a state that aligns with your business strategy.

The best state to open a Limited company LLC for non residents often depends on specific business needs. Many choose Delaware for its business-friendly laws and no income tax on LLCs not operating in the state. Nevada is also popular due to its low tax environment and strong privacy protection. Ultimately, consider your business goals and consult a professional for tailored advice.