Agreement Form Montana Withholding

Description

How to fill out Montana Premarital Agreements Package?

There's no longer a necessity to squander time searching for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in a single location and made them easily accessible.

Our site offers over 85k templates for various business and individual legal situations categorized by state and purpose. All forms are properly prepared and validated for authenticity, so you can trust in acquiring an up-to-date Agreement Form Montana Withholding.

Click Buy Now next to the template title once you identify the correct one. Select the most suitable subscription plan and create an account or Log In. Make payment for your subscription using a credit card or via PayPal to proceed. Choose the file format for your Agreement Form Montana Withholding and download it to your device. Print your form for manual completion or upload the sample if you prefer working with an online editor. Preparing official documentation according to federal and state laws and regulations is swift and straightforward with our library. Try US Legal Forms now to maintain your documentation organized!

- If you are acquainted with our service and already possess an account, ensure your subscription is current before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever required by navigating to the My documents tab in your profile.

- If you've never utilized our service before, the procedure will require a few additional steps to finalize.

- Here’s how new users can acquire the Agreement Form Montana Withholding from our catalog.

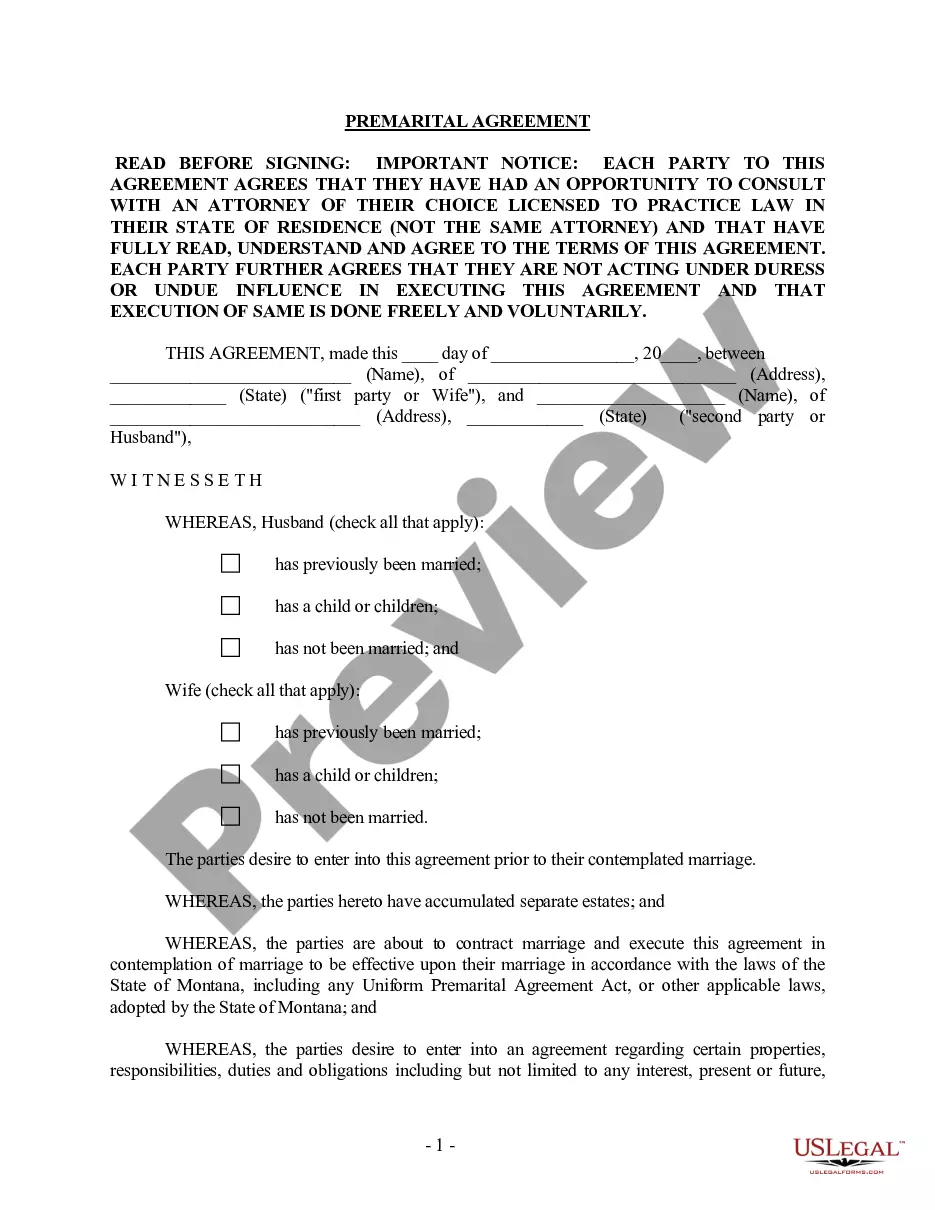

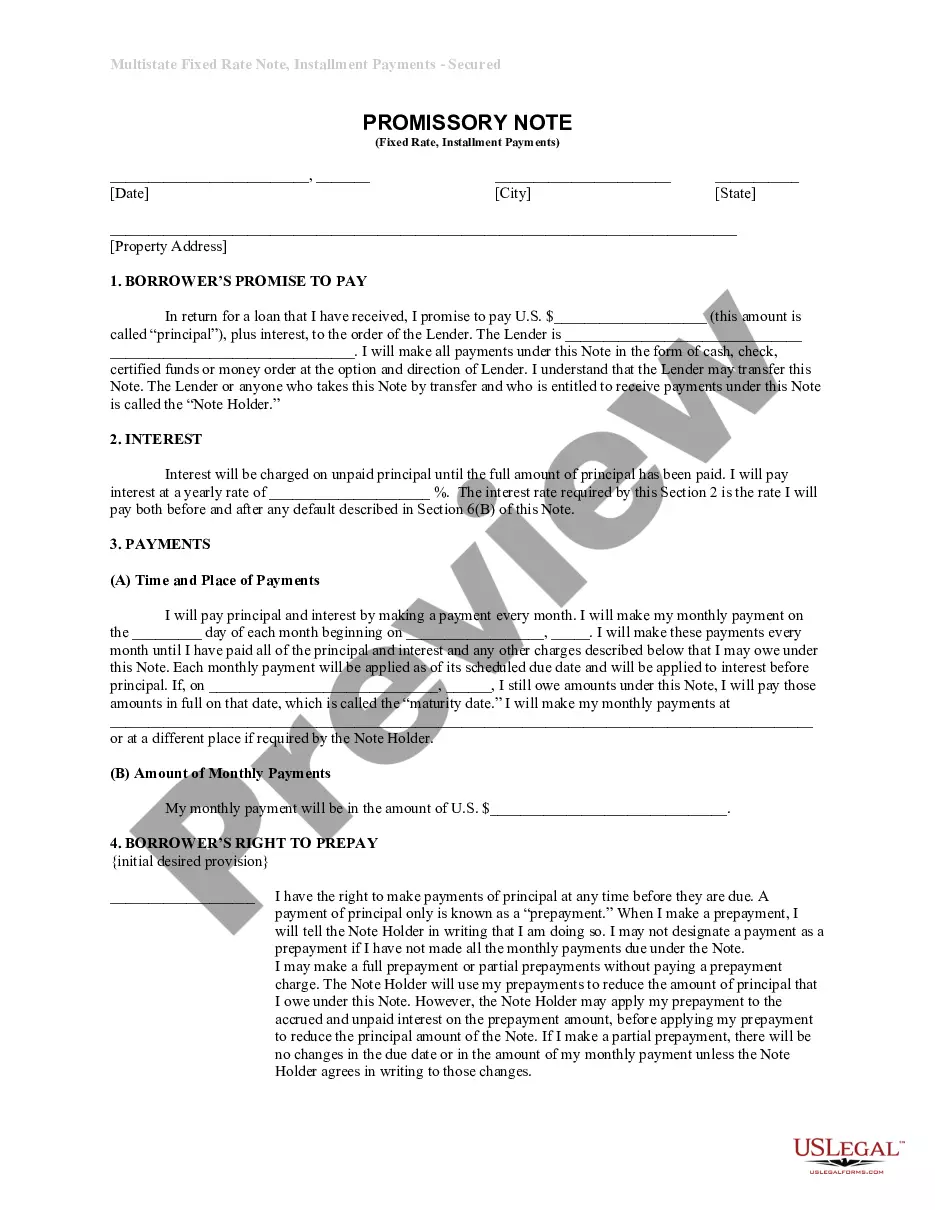

- Carefully examine the page content to confirm it includes the sample you need.

- To do this, use the form description and preview options if available.

- Use the Search bar above to find another sample if the current one didn’t meet your needs.

Form popularity

FAQ

The 2022 tax rates range from 1% to 6.75%. Employees who make more than $18,400 will hit the highest tax bracket. Montana doesn't have any local taxes, so you only have to withhold for state taxes.

How to Complete the New Form W-4Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number.Step 2: Indicate Multiple Jobs or a Working Spouse.Step 3: Add Dependents.Step 4: Add Other Adjustments.Step 5: Sign and Date Form W-4.

If you are a new business, register online with the Montana Department of Labor and Industry. You can also register via phone at 1-800-550-1513. If you already have a Montana UI Account Number, you can look this up online or by contacting the agency at 406-444-3834.

How to file a W-4 form in 5 StepsStep 1: Enter your personal information. The first step is filling out your name, address and Social Security number.Step 2: Multiple jobs or spouse works.Step 3: Claim dependents.Step 4: Factor in additional income and deductions.Step 5: Sign and file with your employer.

Montana Employee's Withholding Allowance and Exemption Certificate (Form MW-4) A completed Form MW-4 is used by employers to determine the amount of Montana income tax to withhold from wages paid. This form allows each employee to claim allowances or an exemption to Montana wage withholding when applicable.