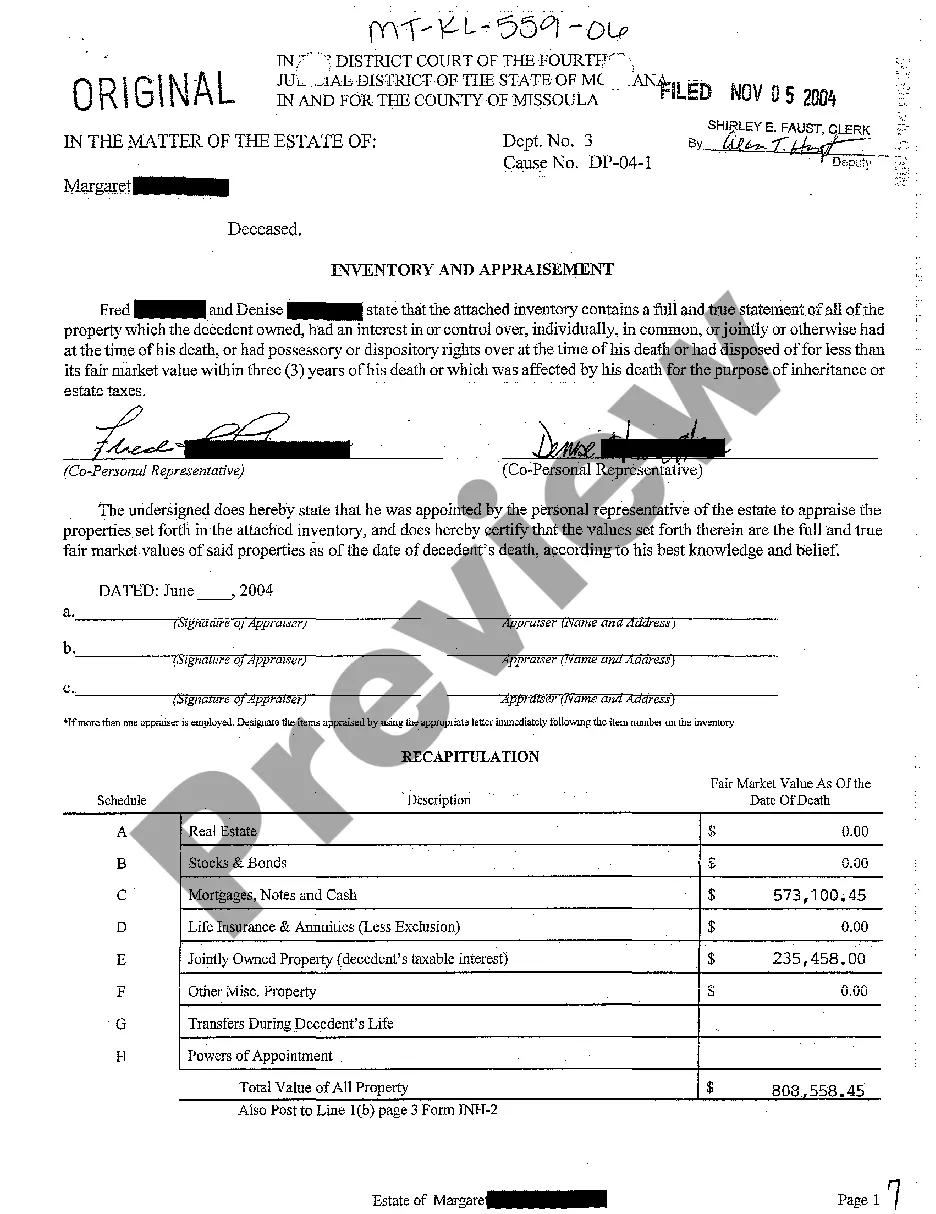

Inventory And Appraisement Form With Decimals

Description

How to fill out Montana Inventory And Appraisement?

It’s no secret that you can’t become a legal professional overnight, nor can you figure out how to quickly draft Inventory And Appraisement Form With Decimals without having a specialized background. Creating legal forms is a long venture requiring a particular education and skills. So why not leave the creation of the Inventory And Appraisement Form With Decimals to the professionals?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court paperwork to templates for internal corporate communication. We know how important compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our platform and obtain the document you need in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and read the supporting description to determine whether Inventory And Appraisement Form With Decimals is what you’re looking for.

- Begin your search again if you need any other template.

- Register for a free account and choose a subscription plan to purchase the form.

- Choose Buy now. As soon as the payment is through, you can download the Inventory And Appraisement Form With Decimals, complete it, print it, and send or mail it to the necessary people or entities.

You can re-access your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-be it financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

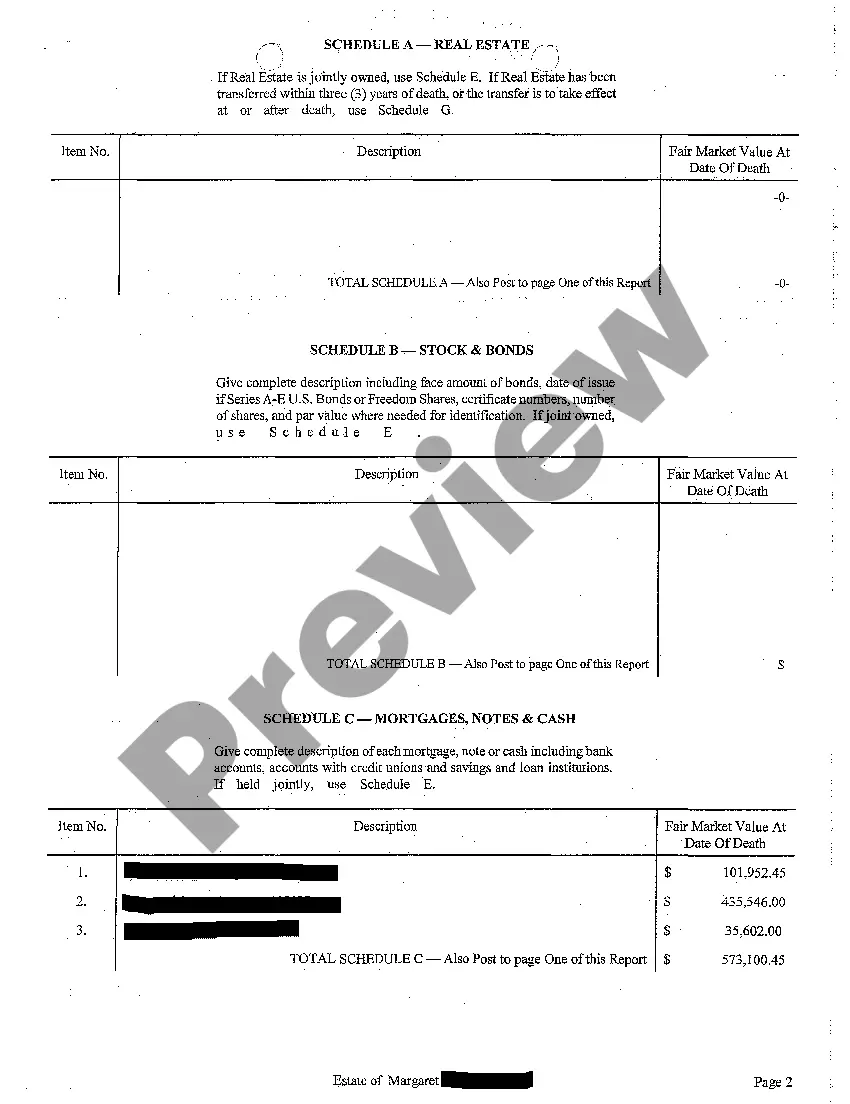

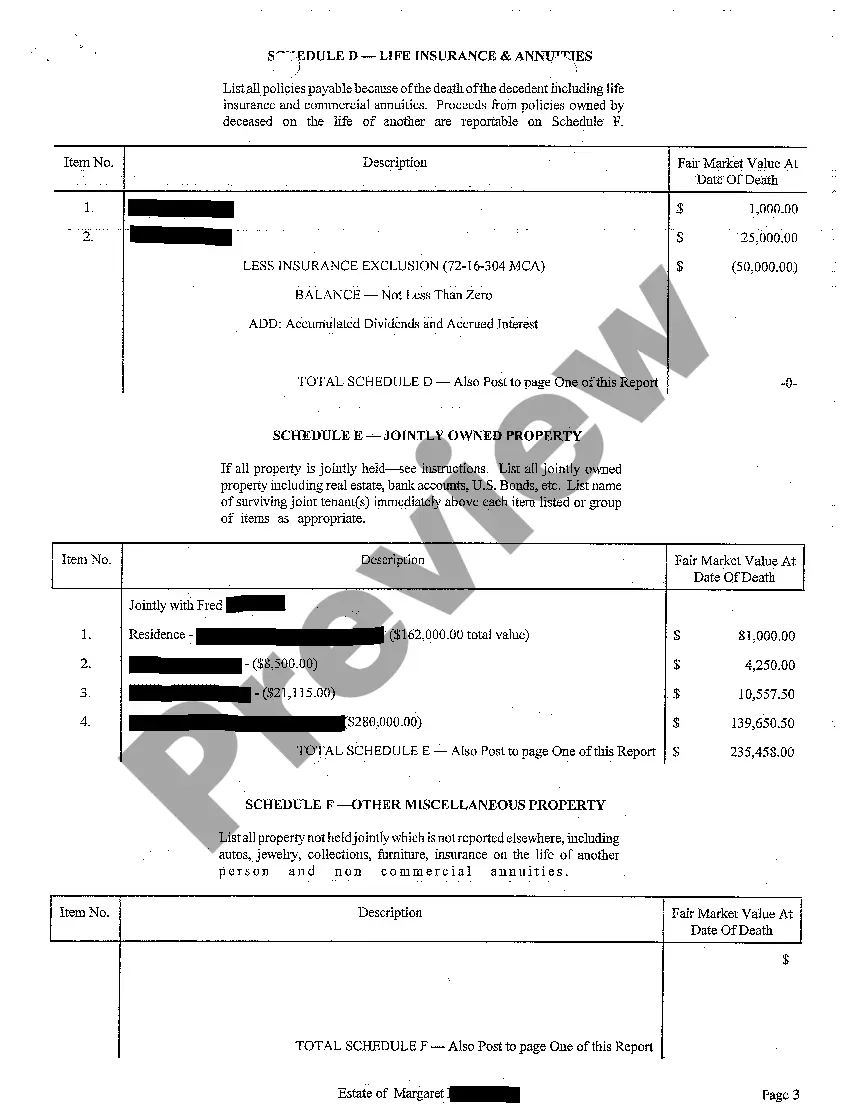

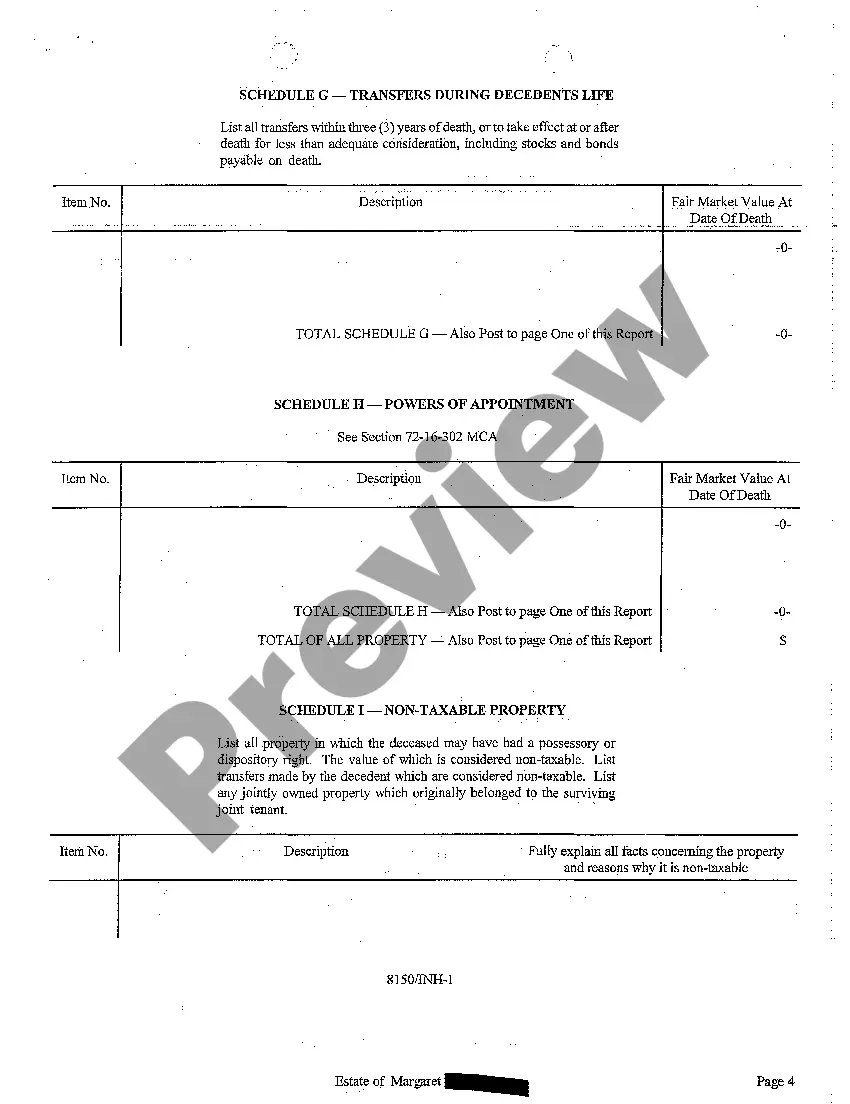

It includes all kinds of assets, such as real estate, personal property, bank accounts, stocks, bonds, life insurance policies, retirement accounts, and any other assets that the decedent owned.

On the 90-day inventory form, you will need to list the following information: The decedent's county of residence. The decedent's name. Any accounts in the sole name of the decedent and their value. Any joint accounts, the percentage the decedent owned, and their value.

The court will not accept a simple list of items. For example, an inventory entry for real property will need to include the address, legal description of the property, copy of the deed and a fair market appraisal of the property by a professional appraiser.

Generally speaking, assets not accounted for by the estate plan include the following: Pension plans. Savings bonds. Living trust assets. 401 (k) accounts. Savings accounts (in select circumstances)

But any estate lawyer will tell you that there are many assets that will not be included in your estate. Some of these assets include investment accounts, life insurance proceeds, non-probate assets, and jointly titled real estate assets. Often, these assets add up to more than the probate estate.