Lien Discharge Bond With

Description

Form popularity

FAQ

To discharge a mechanic's lien in New York, you must file a lien discharge bond with the county clerk where the lien was recorded. This bond acts as a guarantee that the lien will be satisfied and allows the property owner to clear their title. It’s important to ensure that the bond amount matches the lien amount or greater. Using the US Legal Forms platform simplifies this process by providing the necessary forms and guidance to facilitate filing your lien discharge bond efficiently.

A mechanic's lien release bond in Florida is a specific bond that can be used to remove a mechanic's lien from your property. This type of bond ensures that if the lien claimant prevails in their claim, the bond company will cover the necessary amounts. It serves as a safeguard for property owners who want to eliminate mechanic's liens while still protecting the rights of contractors. If you're dealing with such a situation, obtaining a lien discharge bond with can simplify the resolution process.

Having a lien on your property means that a creditor has a legal claim to your asset due to unpaid debts. This claim can restrict your ability to sell, transfer, or refinance the property until the lien is resolved. The presence of a lien can impact your creditworthiness and financial freedom. If you encounter a lien issue, consider obtaining a lien discharge bond with to help clear your property title.

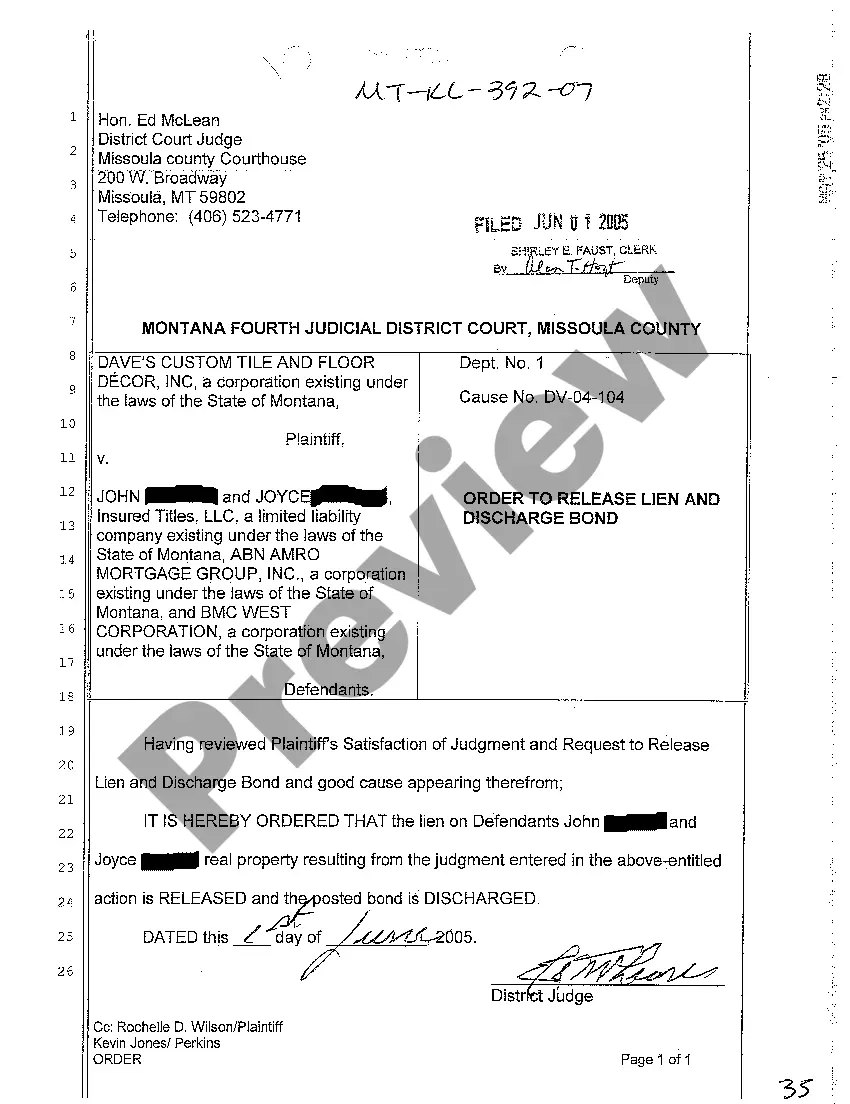

A release of bond is a legal document that confirms the discharge of a lien or obligation backed by a bond. In this context, it signifies that the bondholder no longer has any claims against the property concerning the original debt. This document serves as proof that the financial obligation has been met. Utilizing a lien discharge bond with can facilitate the release of such bonds smoothly.

Releasing a lien means officially removing the legal claim that a creditor has on a property. This process usually occurs after the debt has been settled, indicating that you have fulfilled your obligation. Once a lien is released, you can enjoy unencumbered ownership of your asset. For a smoother release process, you might consider using a lien discharge bond with established procedures.

A lien is a legal right or interest that a lender has in the borrower's property, granted until the debt obligation is satisfied. Essentially, it serves as security for the lender, allowing them to claim the property if the borrower defaults on their payments. Understanding the implications of a lien can help you navigate financial obligations effectively. If a lien is placed on your property, consider exploring the option of a lien discharge bond with to resolve the issue.

The discharge of lien refers to the legal process where a lien is removed from a property. When you discharge a lien, you essentially release the claim that a creditor has on your property due to a debt. This action allows you to regain full ownership rights without encumbrances. You can initiate the discharge process by obtaining a lien discharge bond with appropriate legal documentation.

A surety bond is a legal agreement that guarantees the fulfillment of an obligation or the payment of a debt. If the party responsible fails to meet the bond's terms, the surety company will cover the loss, thereby protecting the other party involved. When discussing lien discharge bond with a surety, it means securing a bond that allows for the removal of a lien on a property. This bond not only safeguards the interests of the lienholder but also facilitates smoother transactions.

Bonding around a lien means securing a bond that protects your interests while a lien is in place. This process allows you to effectively replace the lien with a financial guarantee, ensuring creditors receive compensation if needed while allowing you to continue using the property. By understanding how to bond around a lien, you can protect your rights and maintain access to your assets without disruption. Explore more about lien discharge bond with our resources at US Legal Forms.

To bond around a lien in Texas, you must typically file a lien discharge bond with the local court. This involves submitting the necessary paperwork and paying any associated fees. Once approved, the bond allows you to proceed with your project while temporarily removing the lien from your property. For detailed assistance, US Legal Forms can provide templates and guidance on obtaining a lien discharge bond with minimal hassle.