Montana Dissolution/withdrawal Certificate

Description

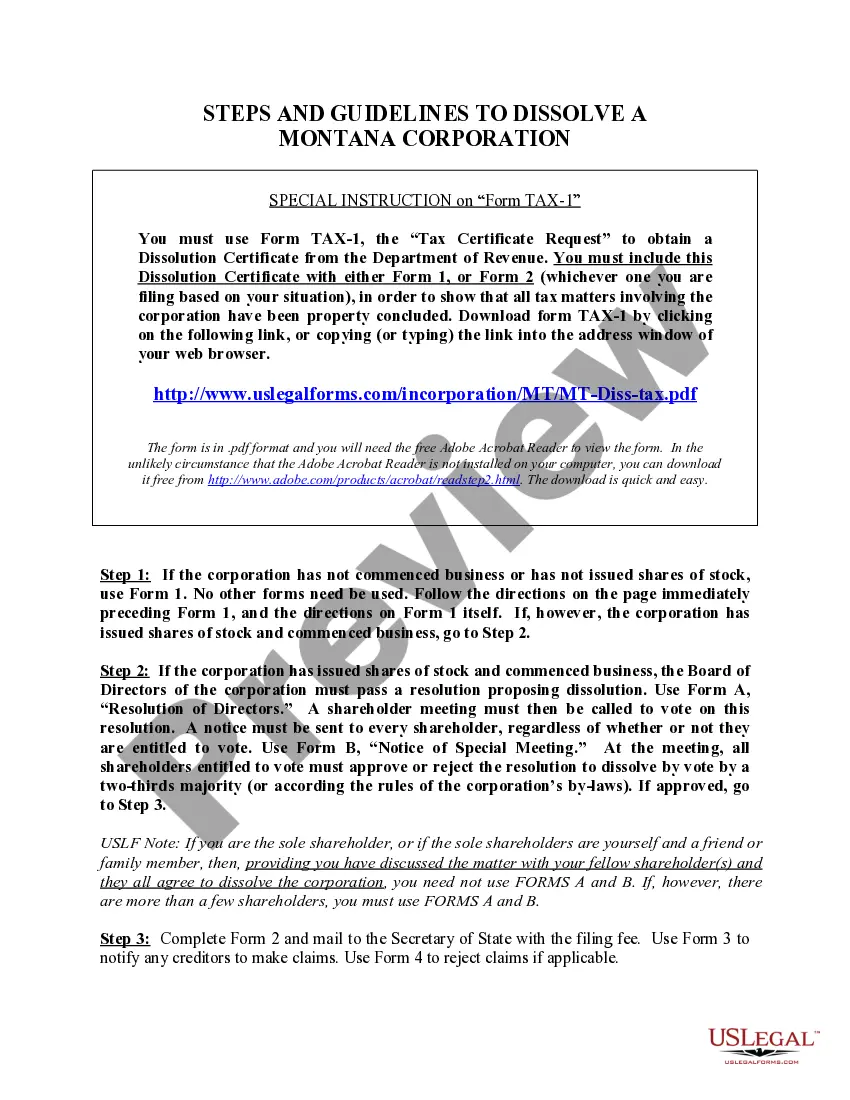

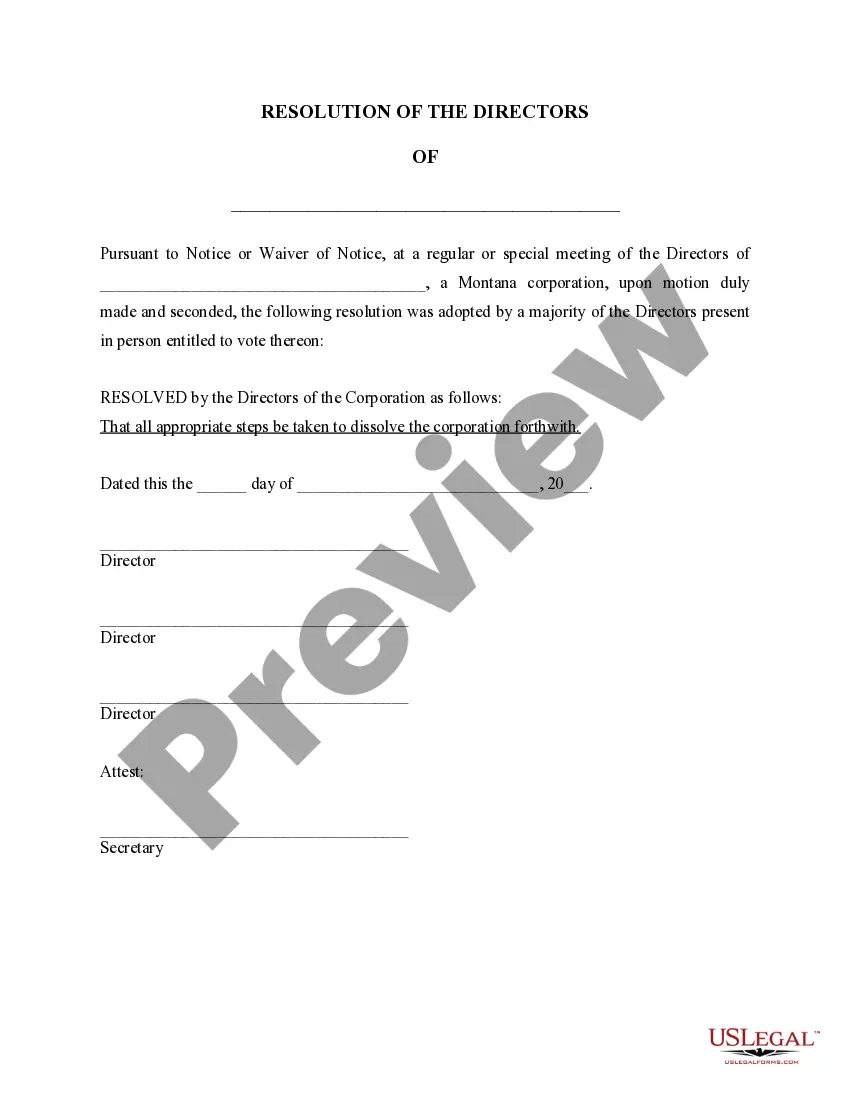

How to fill out Montana Dissolution Package To Dissolve Corporation?

Employing legal templates that adhere to national and local regulations is essential, and the internet provides numerous choices to select from.

However, what's the advantage of spending time searching for the properly prepared Montana Dissolution/Withdrawal Certificate sample online when the US Legal Forms digital library has already compiled such templates in one location.

US Legal Forms stands as the premier online legal database featuring over 85,000 fillable templates created by attorneys for various professional and personal matters. They are easy to navigate with all documents organized by state and intended use. Our specialists keep up with legislative changes, ensuring that you can always trust your form is current and compliant when obtaining a Montana Dissolution/Withdrawal Certificate from our site.

Click Buy Now when you've found the correct form, and select a subscription plan. Create an account or Log In and make a payment via PayPal or a credit card. Choose the appropriate format for your Montana Dissolution/Withdrawal Certificate and download it. All documents obtained through US Legal Forms are reusable. To re-download and fill out previously saved forms, access the My documents tab in your profile. Utilize the most extensive and user-friendly legal document service!

- Acquiring a Montana Dissolution/Withdrawal Certificate is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you require in your preferred format.

- If you are new to our site, follow the steps below.

- Examine the template using the Preview option or through the text description to verify it meets your requirements.

- Search for a different sample using the search feature at the top of the page if necessary.

Form popularity

FAQ

Dissolving a nonprofit in Montana involves several steps, starting with a board resolution to cease operations. After this, you must file the necessary paperwork with the state, including a Montana dissolution/withdrawal certificate to confirm the dissolution. It's also important to settle any outstanding debts and distribute remaining assets according to your nonprofit's bylaws. Utilizing USLegalForms can simplify this process by providing clear instructions and necessary forms to ensure compliance with state regulations.

The timeline for obtaining an uncontested divorce in Montana typically ranges from a few weeks to a few months. After filing the necessary paperwork, there is a mandatory waiting period of 30 days before the court finalizes the divorce. This timeframe may vary based on the court's schedule and whether all documents are submitted correctly. For those seeking to navigate this process smoothly, a Montana dissolution/withdrawal certificate can help, and USLegalForms provides templates and resources to assist you.

To request a tax clearance in Montana, you must contact the Montana Department of Revenue and submit the appropriate request form. This clearance certifies that all your tax liabilities have been addressed, which is especially important when dissolving a business. Acquiring a Montana dissolution/withdrawal certificate is often part of this process. For streamlined assistance and form access, consider exploring the offerings on US Legal Forms, where you can find relevant templates to facilitate your request.

To dissolve your LLC in Montana, you must file the Articles of Dissolution with the Secretary of State. Ensure that all financial obligations and taxes are settled, as a Montana dissolution/withdrawal certificate is often required to confirm completion. After submitting the necessary documents, you will receive confirmation of the dissolution. For comprehensive help with this process, consider using US Legal Forms, which provides templates and guidance tailored to your needs.

Yes, Montana provides an e-file authorization form that enables you to file your taxes electronically. This form simplifies the process, allowing you to submit your tax documents online, which can save you time and effort. If you need assistance with the e-filing process or related documentation, visiting US Legal Forms can be beneficial as they offer resources and templates to help you navigate these requirements smoothly.

Filing a quitclaim deed in Montana involves a few straightforward steps. First, ensure you complete the quitclaim deed form accurately, including the names of the grantor and grantee, along with a legal description of the property. Next, you must have the document notarized to validate it legally. Finally, submit the signed quitclaim deed to the local county clerk and recorder's office for recording, ensuring you receive a copy for your records. For comprehensive guidance, consider using US Legal Forms, which provides resources and templates to help with the Montana dissolution/withdrawal certificate process.

(1) The department may issue a tax certificate, referred to as a "Title 15 Certificate," to a domestic corporation or limited liability company (LLC) that has been involuntarily dissolved by the Montana Secretary of State (MSOS) if the business has filed all required tax returns and reports and has paid all taxes, ...

Montana Withholding Account Number If you are a new business, register online with the Montana Department of Revenue. If you already have a Montana Withholding Account Number, you can find it online or by contacting the agency at 406-444-6937 or DORe-Services@mt.gov.

How do you dissolve/terminate a Montana Limited Liability Company? To terminate your domestic LLC in Montana, you must provide the completed Articles of Termination for a Limited Liability Company form to the Secretary of State by mail, fax or in person, along with the filing fee.

(1) The department may issue a tax certificate, referred to as a "Title 15 Certificate," to a domestic corporation or limited liability company (LLC) that has been involuntarily dissolved by the Montana Secretary of State (MSOS) if the business has filed all required tax returns and reports and has paid all taxes, ...