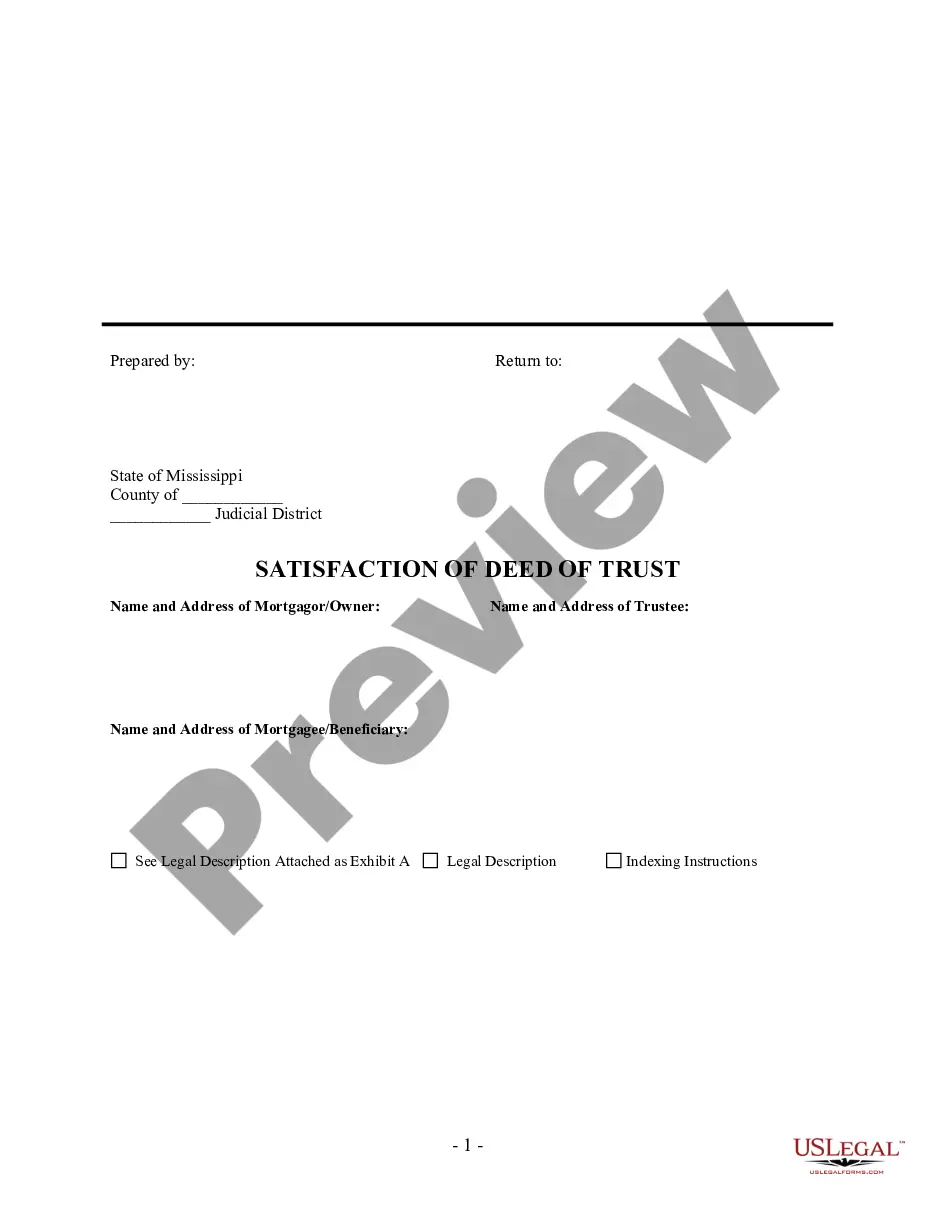

Release Of Deed Of Trust Form With Two Points

Description

How to fill out Mississippi Satisfaction, Release Or Cancellation Of Deed Of Trust By Individual?

It’s no secret that you can’t become a legal expert overnight, nor can you grasp how to quickly prepare Release Of Deed Of Trust Form With Two Points without having a specialized set of skills. Putting together legal documents is a long process requiring a specific training and skills. So why not leave the preparation of the Release Of Deed Of Trust Form With Two Points to the pros?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court papers to templates for internal corporate communication. We know how crucial compliance and adherence to federal and local laws are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our platform and obtain the document you require in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Release Of Deed Of Trust Form With Two Points is what you’re searching for.

- Begin your search over if you need a different template.

- Set up a free account and choose a subscription plan to buy the form.

- Choose Buy now. As soon as the payment is through, you can get the Release Of Deed Of Trust Form With Two Points, complete it, print it, and send or mail it to the designated people or entities.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

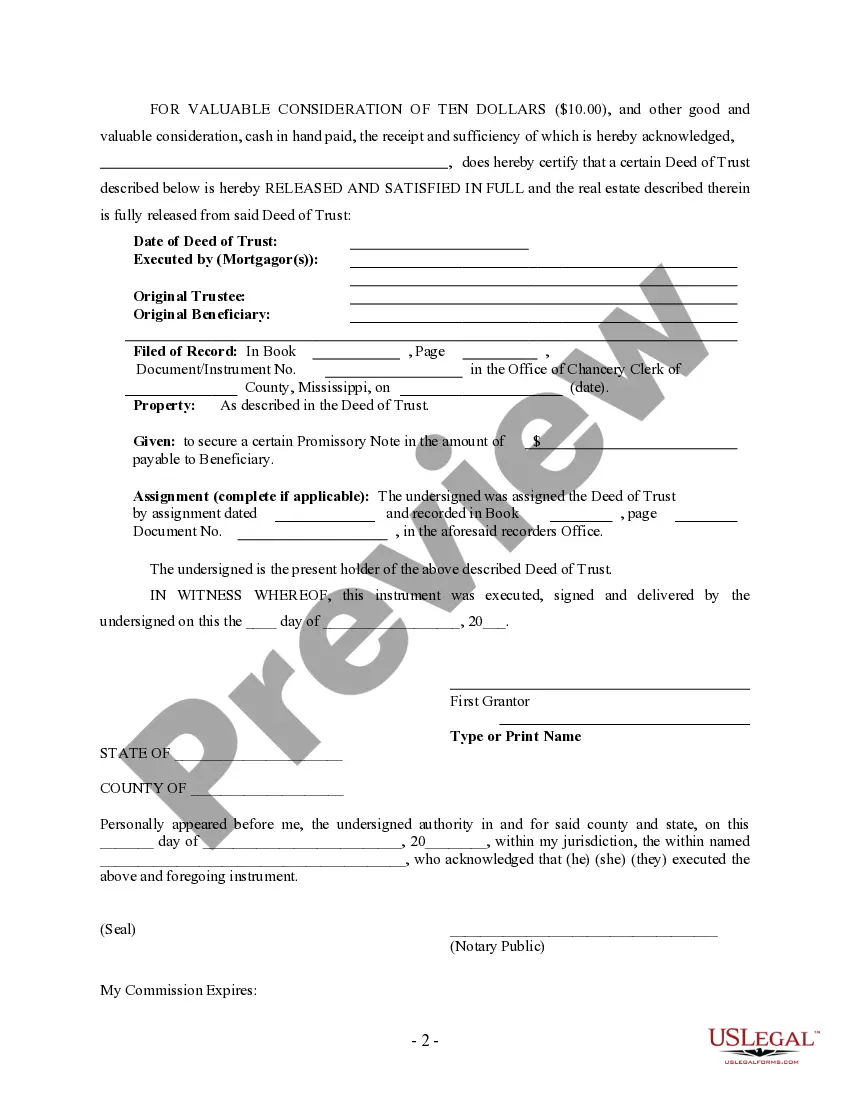

A Release of Deed of Trust is a written request by the mortgage company or lender, their agent or attorney or a title insurance company to the Public Trustee. The purpose of the release is to remove all or a portion of the property from the lien created by a Deed of Trust.

When a real estate loan is satisfied, the lender executes a Request for Release of Deed of Trust with the Public Trustee for the county in which the property is located. The Public Trustee makes sure that the release is accurate and complete, executes the release, and records it with the County Clerk and Recorder.

What Is A Deed Of Trust? A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.