Oil And Gas Lease Form 88 Withdrawal

Description

How to fill out Mississippi Producers 88 Paid Up Lease Pooling Provision SP (4-75)?

Bureaucracy demands precision and exactness.

Unless you manage the completion of documents such as the Oil And Gas Lease Form 88 Withdrawal on a daily basis, it may result in some perplexity.

Choosing the appropriate sample from the start will ensure that your document submission proceeds smoothly and avert any inconveniences of resubmitting a file or entirely redoing the task.

Scan the descriptions of the forms and save the ones you need at any time. If you lack a subscription, finding the desired sample will require a few additional steps: Find the template using the search bar. Ensure the Oil And Gas Lease Form 88 Withdrawal you've located is valid for your state or county. Open the preview or look through the description that contains the details on how to use the sample. If the result corresponds with your search, click the Buy Now button. Select the suitable option from the proposed pricing plans. Log In to your account or create a new one. Complete the purchase using a credit card or PayPal payment method. Save the form in the file format of your selecting. Finding the correct and updated samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic issues and simplify your work with forms.

- You can always acquire the correct sample for your documentation at US Legal Forms.

- US Legal Forms is the largest online collection of forms, boasting over 85 thousand samples across different topics.

- You can retrieve the latest and most relevant version of the Oil And Gas Lease Form 88 Withdrawal by simply searching on the website.

- Locate, store, and save templates in your profile or review the description to ensure you possess the right one accessible.

- With a US Legal Forms account, it becomes simple to obtain, store in one spot, and navigate the templates you keep for quick access.

- When on the website, click the Log In button to verify your identity.

- Then, go to the My documents page, where your forms history is archived.

Form popularity

FAQ

Accordingly, when you see the words Paid-Up Lease, this normally means that you will receive an upfront bonus for which the oil and gas company does not have to do anything during the initial or primary term of the lease.

The convention is to simply multiply the trailing 12-month cash flow figure generated by the subject property or collection of properties by three (3) and the result presumably represents the market value of such properties.

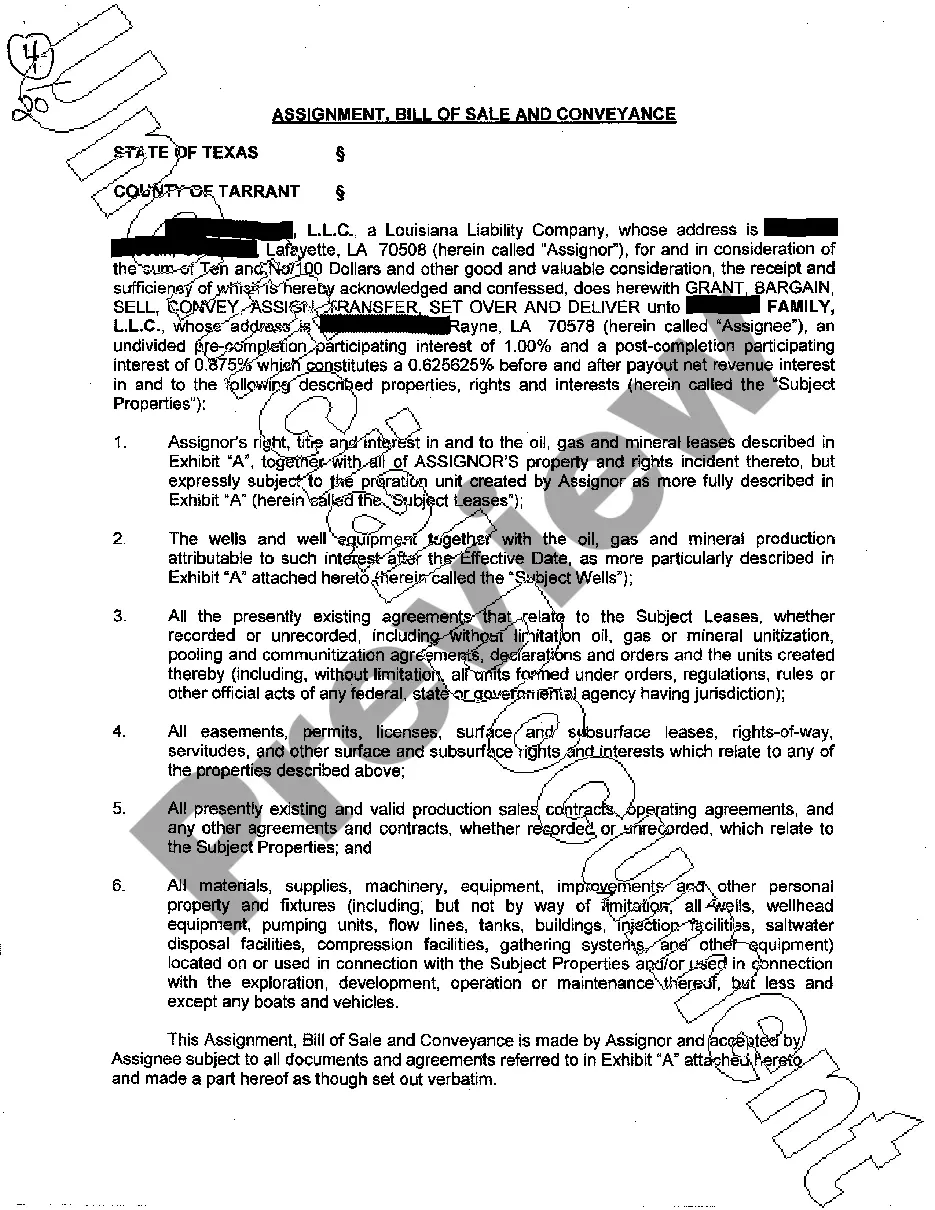

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

8/8ths / 8/8ths Basis: a term used to describe either the full Working Interest or full Net Revenue Interest with respect to a given Tract. Pursuant to an Oil and Gas Lease, the Lessor retains the Lessor Royalty.

To calculate your oil and gas royalties, you would first divide 50 by 1,000, and then multiply this number by . 20, then by $5,004,000 for a gross royalty of $50,040. Once you calculate your gross royalty amount, compare it to the number you see on your royalty check stubs.