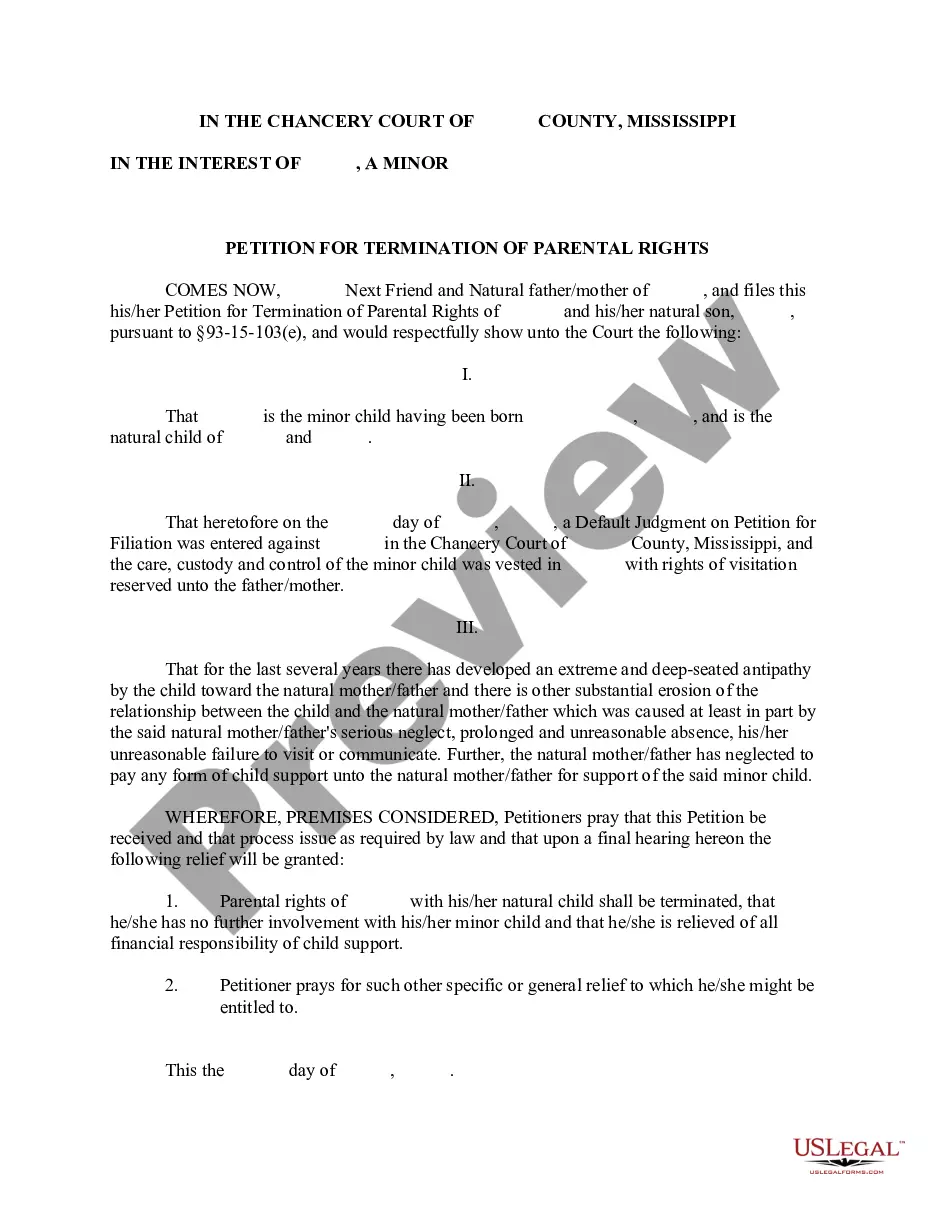

Voluntary Termination Of Parental Rights Mississippi With Step Parent Adoption

Description

How to fill out Mississippi Petition For Termination Of Parental Rights?

The Voluntary Cessation Of Parental Rights Mississippi With Step Parent Adoption presented on this page is a versatile legal specimen crafted by experienced attorneys in accordance with federal and state laws and regulations.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific documents for any corporate and personal circumstance. It is the quickest, most uncomplicated, and most reliable method to acquire the documentation you require, as the service ensures bank-level data security and anti-malware safety.

Complete and sign the documents. Print the template to fill it out by hand. Alternatively, use an online multi-functional PDF editor to quickly and accurately complete and sign your form digitally. Re-download your documentation when necessary by accessing the My documents section in your account to redownload any forms you've previously downloaded.

- Search for the document you need and examine it.

- Review the file you searched and preview it or assess the form description to ensure it meets your requirements. If it doesn’t, utilize the search option to find the appropriate one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Select the pricing plan that best suits you and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and verify your subscription to continue.

- Obtain the editable template.

- Choose the format you prefer for your Voluntary Cessation Of Parental Rights Mississippi With Step Parent Adoption (PDF, Word, RTF) and download the sample onto your device.

Form popularity

FAQ

If there is no biological father listed on the birth certificate, the process for your husband to adopt your child becomes more straightforward. Typically, this means there are no existing parental rights to terminate legally. Your husband can proceed with an adoption petition in court, and the judge will evaluate the best interests of the child. For detailed guidance on voluntary termination of parental rights in Mississippi with stepparent adoption, consider using UsLegalForms to navigate through the necessary legal documentation.

To purchase a $200,000 house, you need a down payment of at least $40,000 (20% of the home price) to avoid PMI on a conventional mortgage. If you're a first-time home buyer, you could save a smaller down payment of $10,000?20,000 (5?10%).

Home sellers often prefer to work with buyers who have at least a 20% down payment. A bigger down payment indicates your finances are more likely to be in order, so you might have an easier time finding a mortgage lender. This can give you an edge over other buyers, especially if the home you want is in a hot market.

Definition of 'Master Mortgage' The Master Mortgage is a document created when a property is purchased for the first time. It is filed in the public land records and its purpose is to keep track of the initial mortgage and of any liens that might be associated with the property.

But for the most part, the minimum investment comes to 3% of the purchase price. Applying that percentage to the current median home price in California ($833,910) would equal a down payment of around $25,000.

Your down payment is the first part of your home's purchase price that you pay at closing. Your mortgage lender will pay the remaining balance. Typically, mortgage lenders in New Hampshire want you to contribute 20% of the purchase price as a down payment.

Types of Conventional Loans in NH Loan TypeRequirementsConventional 973% down. No income limits.HomeReady®3% down. Applicants must be at or below the geographical area's median income, unless home is located in an underserved area.90% loanOne loan with 10% down. PMI required.4 more rows