Tesla Lawsuit

Description

How to fill out Mississippi Voir Dire Questions In Medical Malpractice Suit?

Whether for corporate needs or personal matters, every individual must deal with legal circumstances at some stage in their life.

Filling out legal documents requires meticulous care, starting from choosing the correct form template.

After saving it, you can fill out the form using editing software or print it and complete it by hand. With a vast US Legal Forms catalog available, you do not have to waste time looking for the right template online. Utilize the library’s simple navigation to locate the appropriate template for any situation.

- Locate the template you require by utilizing the search bar or catalog browsing.

- Review the form's description to confirm it aligns with your circumstance, region, and county.

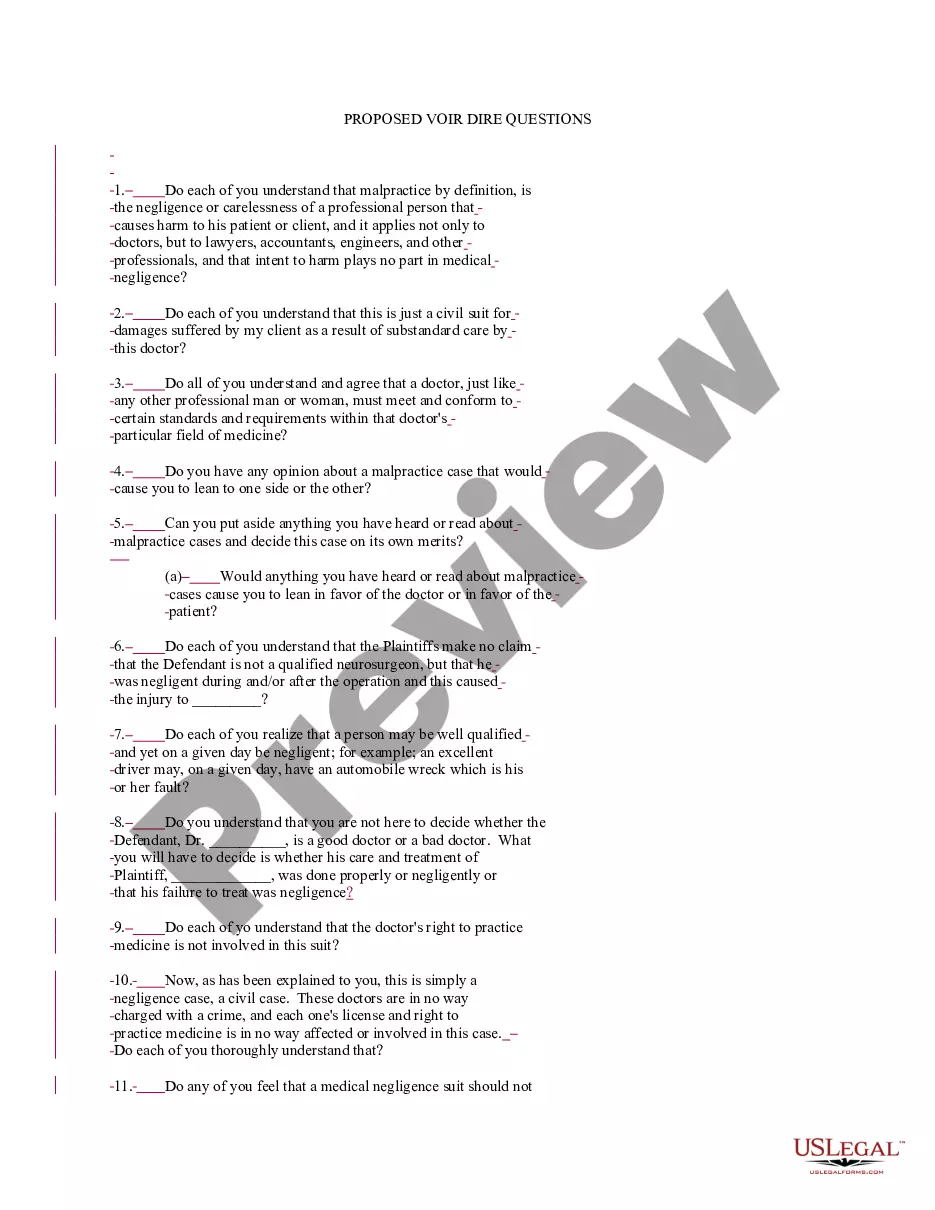

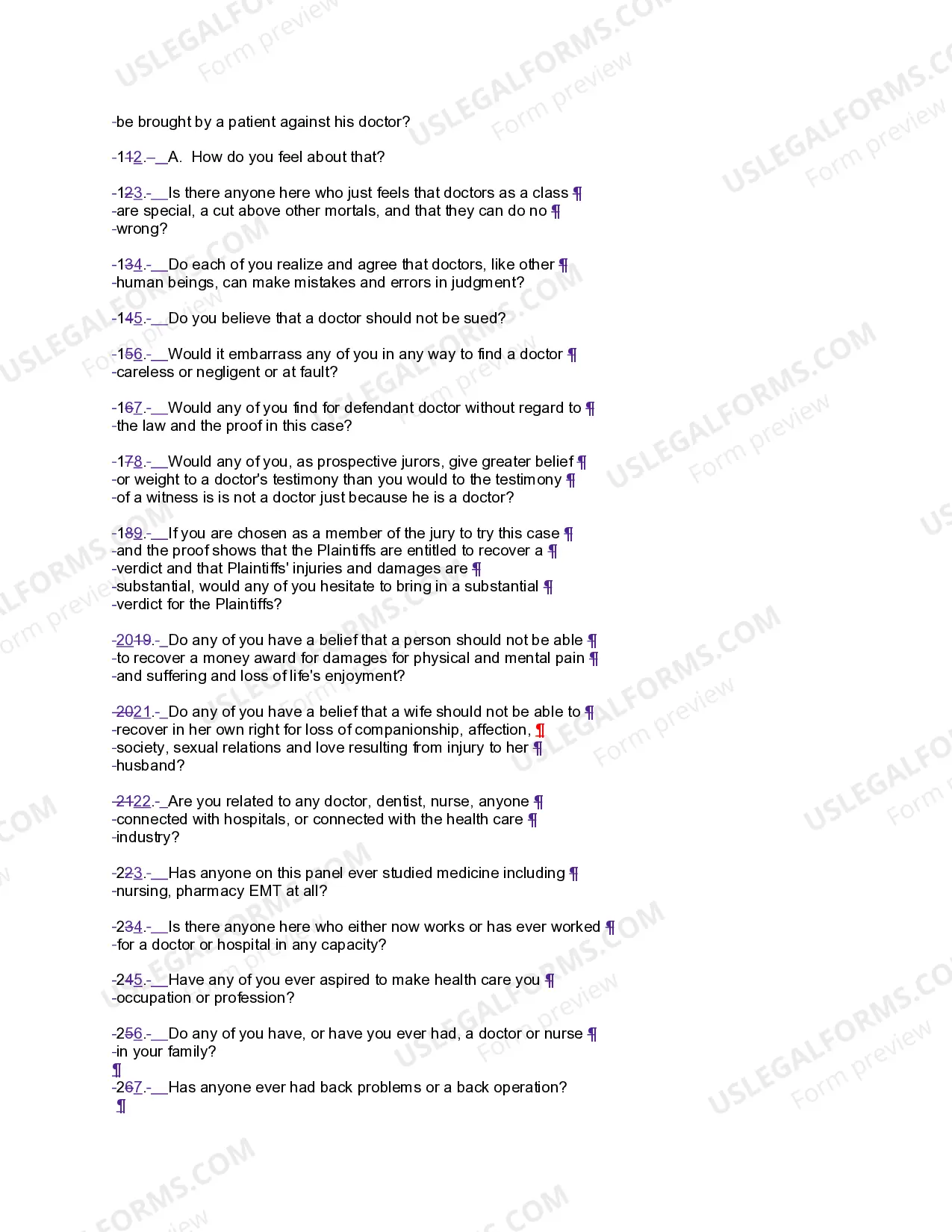

- Click on the form's preview to inspect it.

- If it is not the correct form, return to the search tool to find the Tesla Lawsuit sample you require.

- Download the template if it meets your standards.

- If you possess a US Legal Forms account, simply click Log in to retrieve previously saved templates in My documents.

- If you do not yet have an account, you can obtain the form by clicking Buy now.

- Choose the correct pricing option.

- Fill out the account registration form.

- Select your payment option: you can utilize a credit card or PayPal account.

- Choose the file format you desire and download the Tesla Lawsuit.

Form popularity

FAQ

Eberhard left Tesla due to various internal conflicts and business strategy disagreements, particularly during the company's early years. His departure was part of a larger narrative involving management changes and funding struggles. This backdrop is essential in understanding the complexities surrounding the Tesla lawsuit and the company's evolution.

With certain limited exceptions, a South Carolina certificate of authority is required if a company does business in the state of South Carolina regardless of where the company is located.

They will seize, garnish, attach, or sell your property or wages, unless the collection agency or credit intends to do so, and it is legal to do so (garnishment is currently prohibited in South Carolina for the collection of most debts):

Statute of Limitations by State Statute of Limitations by State (in years)South Carolina33South Dakota66Tennessee63Texas4450 more rows ?

Setoff Debt & GEAR? South Carolina law requires the SCDOR to assist qualifying entities in collecting debts through two collection programs: Setoff Debt and GEAR. Setoff Debt allows the SCDOR to assist in collecting debts owed to claimant agencies by garnishing South Carolina Individual Income Tax refunds.

Some states offer more protection for debtors. In South Carolina, your employer can't fire you for an attempted garnishment that results from "consumer debt." (S.C.

Summary Court in South Carolina is also known as Magistrate Court - the Judge is called a Magistrate. Credit card companies, finance companies and other debt collectors (called "creditors") can file lawsuits to collect debt from you in these courts if the amount is less than $7500.

Residents of South Carolina fall under the Federal Debt Collections Protection Act, which prohibits collection agencies from harassing borrowers or using unfair or misleading tactics to collect debts.