Personal Asset Blank With A Trust

Description

How to fill out Mississippi Security Agreement - Personal Property In Connection With Asset Purchase Agreement?

- Log in to your existing US Legal Forms account and check your subscription status. If your subscription is inactive, renew it according to your payment plan.

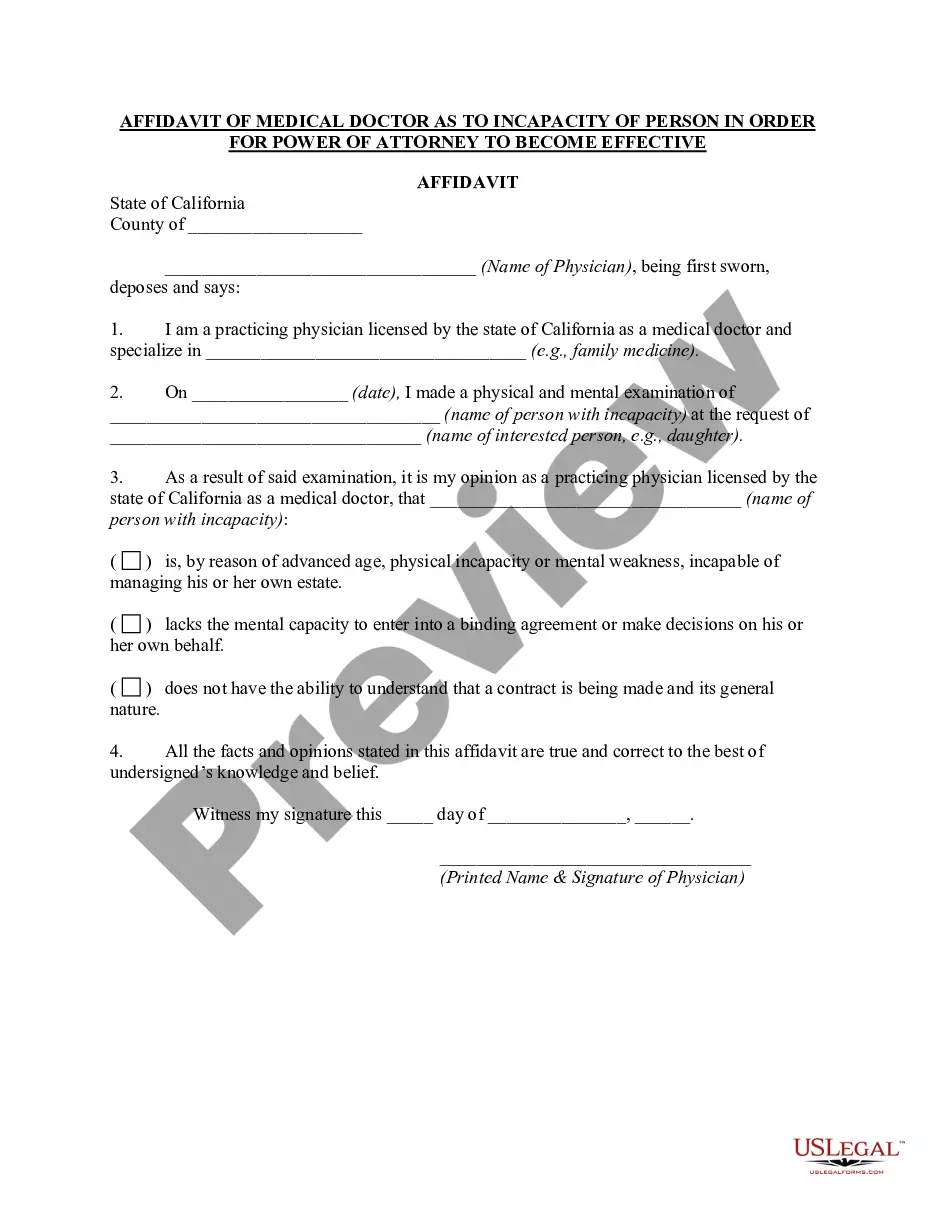

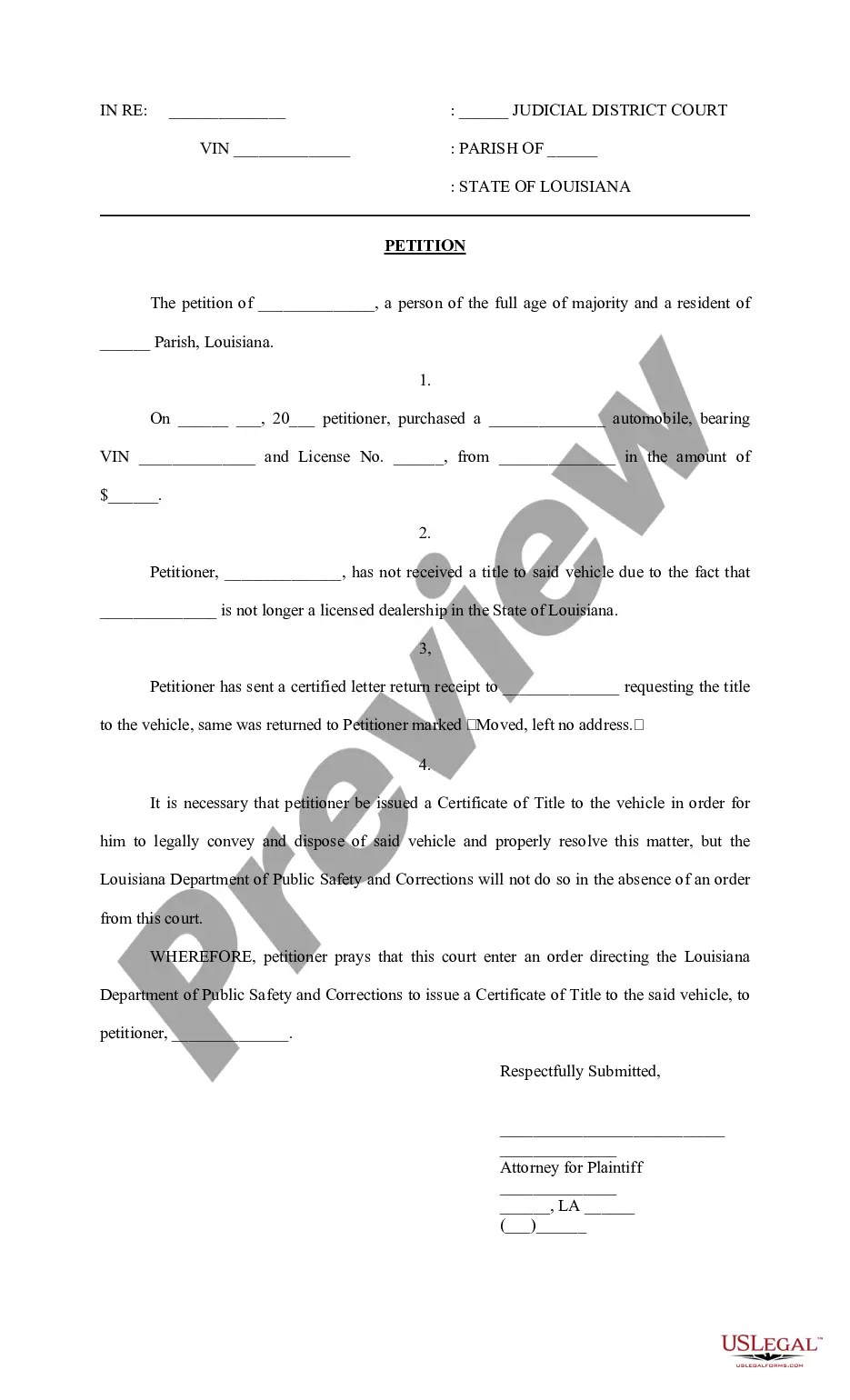

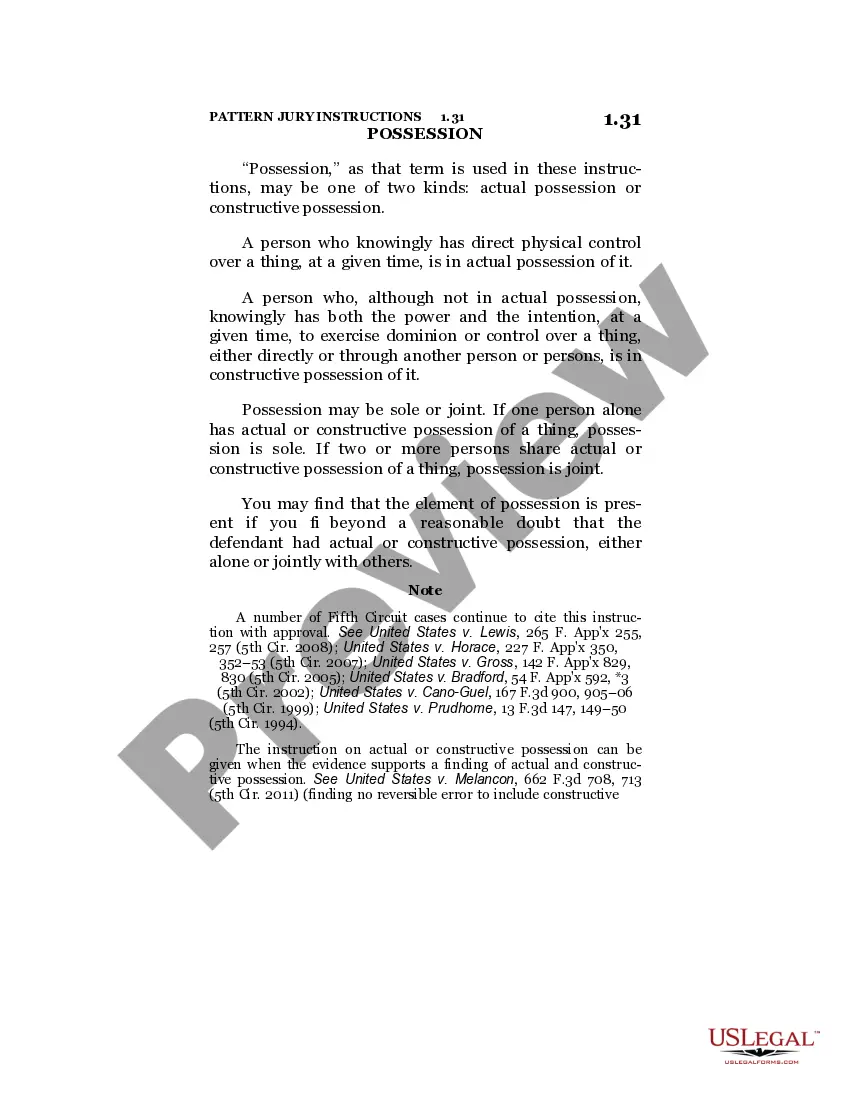

- Browse the library to locate the personal asset blank with a trust form. Utilize the Preview mode for a detailed description to ensure it meets your specific needs and local jurisdiction requirements.

- If needed, perform a search for alternative document templates and select the appropriate one.

- Purchase the document by clicking the 'Buy Now' button. Choose a subscription plan that suits your requirements and create an account to access the full legal library.

- Complete the payment process using your credit card or PayPal to finalize your subscription.

- Download the completed form to your device. Access it anytime through the 'My Forms' section of your account for future reference.

Using US Legal Forms not only simplifies the document acquisition process but also provides you with a diverse library of over 85,000 editable legal forms and packages. This ensures you have the correct and comprehensive documentation needed for effective estate planning.

Take control of your estate planning today by utilizing US Legal Forms for your personal asset blank with a trust. Start your journey now!

Form popularity

FAQ

A major disadvantage of a trust is the potential for higher administrative burdens. Setting up and maintaining a trust requires time and effort, including managing investments and tax filings. However, this effort can lead to better protection of your personal asset blank with a trust, making the initial challenges worthwhile.

The new IRS rules focus on transparency and tax compliance concerning trust income and distributions. These amendments may affect how you report your personal asset blank with a trust on your tax returns. It’s essential to stay informed about these changes to maximize your benefits and stay compliant.

Certain assets, such as a primary residence with a mortgage or retirement accounts, may not be suitable for a trust. Additionally, assets that require personal oversight or direct management might be better kept outside a trust. Evaluating your personal asset blank with a trust is crucial, as the right strategy will vary depending on your unique situation.

Generally, a trust does not need to file a tax return if it has no income. However, specific rules may apply based on your state's regulations. It's beneficial to consult with a tax professional to understand how your personal asset blank with a trust may be affected by these rules, ensuring compliance in all aspects.

Some people view trusts as problematic due to misconceptions. They believe trusts complicate the estate planning process or impose restrictions on asset use. However, when managed properly, a trust can effectively safeguard your personal asset blank with a trust, providing clarity and security for your family.

Putting assets in a trust requires a few key steps. First, you must create the trust itself, detailing your intentions and the assets to be included. Next, you need to formally transfer ownership of those assets into the trust, often through legal documents. Using resources from US Legal Forms can simplify this process by providing templates and guidance, ensuring your personal asset blank with a trust is properly established.

To list assets in a trust, you should begin by identifying all the properties and accounts you wish to include. Make a detailed inventory of your assets, as this will help in creating a comprehensive personal asset blank with a trust. Professional services, such as those provided by US Legal Forms, can guide you in drafting and organizing the trust documents with your assets clearly enumerated. Once completed, ensure the trust agreement complies with state laws.

Certain assets may not belong in a personal asset blank with a trust. For instance, retirement accounts, such as IRAs and 401(k)s, often require designated beneficiaries and should not be placed in a trust. Additionally, life insurance policies should generally be kept outside the trust unless specific strategies are being employed. Always consult a financial advisor for tailored advice on asset placement.

Assets in a trust are typically listed in the trust agreement. This document, often created with the help of professionals, outlines what personal asset blank with a trust includes. It is important to reflect the current status of the assets in this legal document to ensure a smooth distribution process later. Regular updates to this list are essential for maintaining accuracy.

Hiding assets in a trust is often not advisable, as it can lead to legal complications. Instead, using a personal asset blank with a trust properly can provide legitimate strategies for asset protection. Strategies might include establishing different types of trusts or using various trust structures to shield your assets legally. Seeking assistance from US Legal Forms can help you explore these viable options without risking legal issues.