Ms Rule With Phone Number

Description

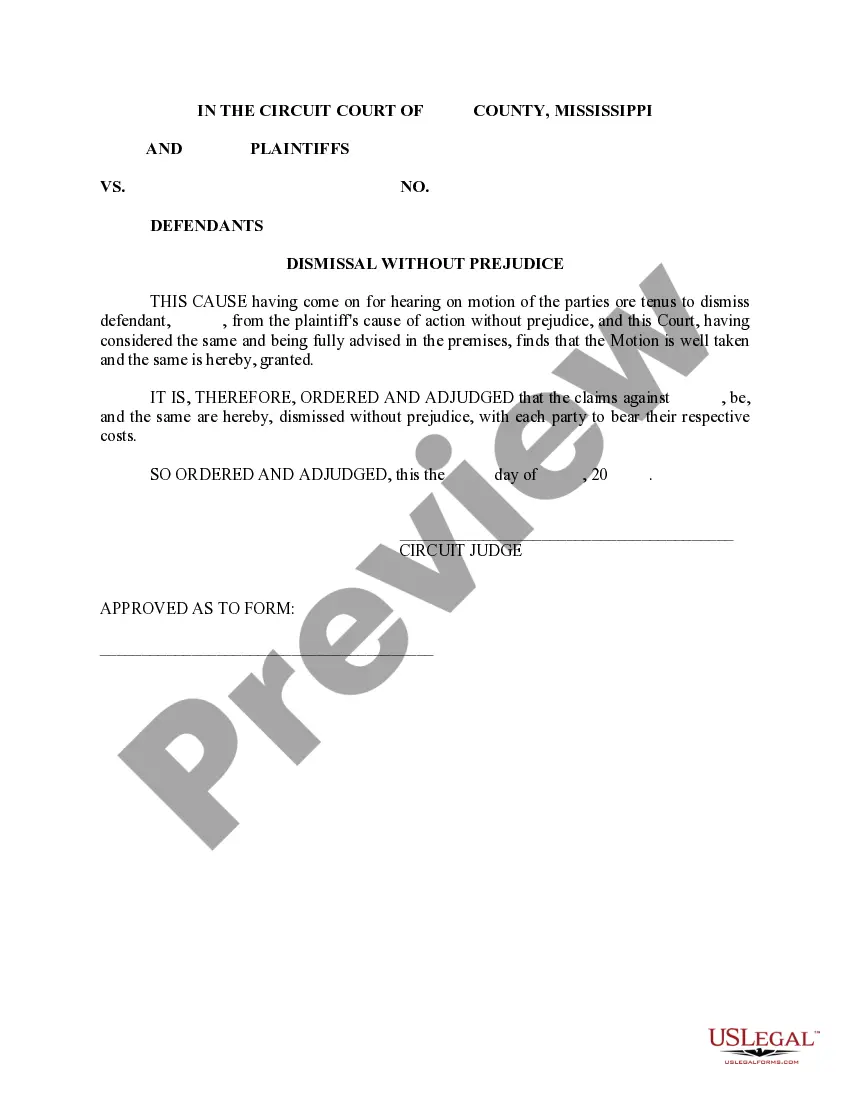

How to fill out Mississippi Notice Of Dismissal - Rule 41 (A)?

Acquiring legal document examples that adhere to federal and local laws is essential, and the internet provides numerous choices to select from.

However, what’s the advantage of spending time searching for the properly prepared Ms Rule With Phone Number template online if the US Legal Forms digital library already compiles such documents in one location.

US Legal Forms is the largest online legal repository with over 85,000 editable templates created by lawyers for various business and personal situations.

Examine the template using the Preview option or through the text outline to confirm it meets your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts stay updated with legislative changes, ensuring that your forms are current and compliant when acquiring a Ms Rule With Phone Number from our site.

- Obtaining a Ms Rule With Phone Number is straightforward and fast for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you require in the appropriate format.

- If you are new to our platform, follow the instructions below.

Form popularity

FAQ

Interest is 1% per month from the time the tax was due until it is paid. There is no limit to the amount of interest that may be charged. Penalty is 10% on the amount of tax due.

Mississippi Withholding Account Number and Filing Frequency Your Withholding Account Number will begin with 1. You can also retrieve your account number and filing frequency by contacting the agency at 601-923-7088.

When entering your MS withholding account information into Zenefits, please ensure the letter ID is provided. You can locate this in your filing requirements letter received upon registration, online, or by calling 601-923-7700.

Claiming personal exemptions: (a) Single Individuals enter $6,000 on Line 1. (b) Married individuals are allowed a joint exemption of $12,000. If the spouse is not employed, enter $12,000 on Line 2(a).

All Mississippi LLCs are taxed as a pass-through entity by default, which means all of the business' revenue is reported on the members' individual tax returns. In addition to the federal 15.3% self-employment tax, Mississippi LLC members pay the Mississippi personal income tax rate, which starts at 4%.