Deed Of Donation Without Land Title

Description

How to fill out Mississippi Agreement For Donation Of Land To City?

There’s no longer any justification for spending hours searching for legal documents to meet your local state regulations.

US Legal Forms has gathered all of them in one location and streamlined their availability.

Our site provides more than 85,000 templates for any business and personal legal matters categorized by state and purpose. All forms are properly drafted and validated for legitimacy, so you can be assured of obtaining an up-to-date Deed of Donation Without Land Title.

Choose the most fitting pricing plan and either register for an account or sign in. Complete your subscription payment using a credit card or through PayPal to proceed. Choose the file format for your Deed of Donation Without Land Title and download it to your device. Print the form to fill it out manually or upload the document if you prefer using an online editor. Creating formal paperwork following federal and state laws is fast and straightforward with our library. Try US Legal Forms today to keep your documentation organized!

- If you are acquainted with our platform and already possess an account, ensure your subscription is active before accessing any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all acquired documents whenever needed by accessing the My documents tab in your profile.

- If you have never interacted with our platform before, the process will involve a few more steps.

- Here’s how new users can discover the Deed of Donation Without Land Title in our catalog.

- Examine the page content closely to confirm it contains the sample you seek.

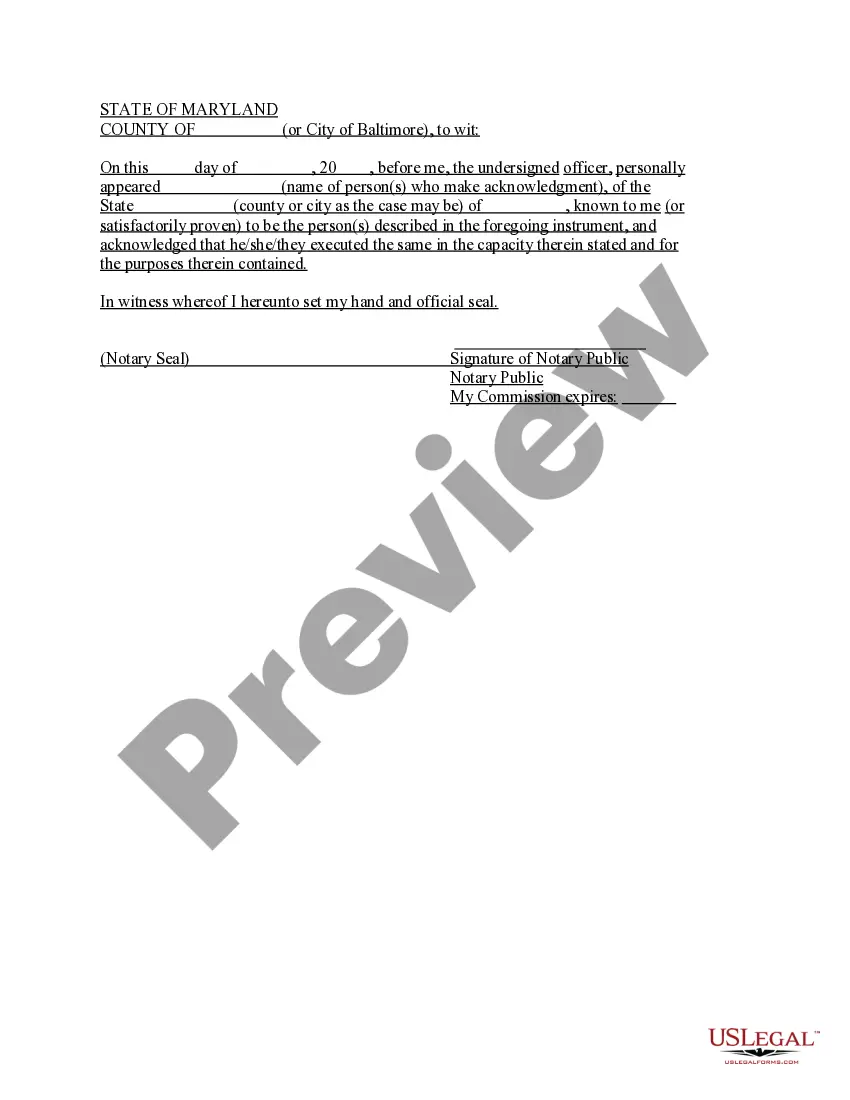

- To assist with this, utilize the form description and preview options if available.

- Use the Search bar above to find another template if the current one does not meet your needs.

- Hit Buy Now next to the template title once you identify the appropriate one.

Form popularity

FAQ

Donations in the Philippines follow certain rules under the Civil Code, which includes the requirement for consent from both parties and the clear definition of the donation's subject. A deed of donation without land title must still comply with relevant laws to ensure its validity. It is important to remember that certain donations may have tax implications, so consulting with a legal expert can be beneficial. Uslegalforms provides resources that help you navigate these rules effectively.

Retracting a donation, or taking back donated property, is possible under certain conditions, such as if the donee has not adhered to the agreed terms. Legal provisions exist that allow donors to reclaim property under specific circumstances. However, once a Deed of donation without land title is duly executed and accepted, consider it legally binding. Professional legal guidance can clarify your rights in these situations.

To create a valid Deed of donation in the Philippines, you’ll need to provide essential details such as the names of both the donor and donee, a description of the property, and any specific conditions associated with the donation. It's crucial to have the document notarized to ensure legality. Utilizing the uslegalforms platform can help streamline the process and ensure you meet all requirements for your Deed of donation without land title.

One significant disadvantage of a Deed of donation is the potential for disputes among heirs or beneficiaries. If not adequately communicated, the intentions behind the donation may lead to misunderstandings. Additionally, once the property is donated, the donor typically relinquishes control, which can be concerning. Knowing the terms when drafting your Deed of donation without land title can help minimize complications.

The tax for a Deed of donation in the Philippines is typically a percentage of the property’s value, often ranging from 0.5% to 2%. It’s important to assess the fair market value accurately to calculate the tax appropriately. Engaging with uslegalforms can furnish you with useful tools to help determine the necessary tax obligations for your Deed of donation without land title.

In general, a Deed of donation does not have an expiration date. Once executed, the deed effectively transfers ownership permanently unless revoked under specific legal conditions. This long-lasting effect is beneficial for both donors and recipients. Consider ensuring clarity in your Deed of donation without land title to avoid future disputes.

Yes, a Deed of donation can be revoked in the Philippines under certain conditions. If the donor proves that the donation was made due to mistake, fraud, or undue influence, they may have the right to retract it. Furthermore, if the donee fails to comply with the terms set forth in the deed, the donor may also reclaim the property. Always consult legal advice for specific situations regarding a Deed of donation without land title.

If a property is titled to a relative, you have several options available. You could discuss formally transferring ownership to your name through a deed of donation without land title or consider other legal avenues such as selling your share or creating a formal lease agreement. Legal assistance can clarify the best choice based on your specific situation.

Yes, a land title can indeed have two owners in the Philippines, often referred to as co-ownership. This means both parties share rights and responsibilities regarding the property. However, to manage this relationship effectively, it is essential to understand how each owner can use or transfer their share, especially if considering a deed of donation without land title.

Claiming ownership of land you have used for 20 years in the Philippines depends on specific circumstances. Under adverse possession laws, you may have a claim, especially if you have been occupying the land openly and continuously. Consulting with a legal professional can clarify your rights, and exploring a deed of donation without land title might be beneficial for formalizing ownership.