Llc In Mississippi With Pool

Description

Form popularity

FAQ

Mississippi can be an excellent choice for forming an LLC due to its favorable business environment and relatively low fees. The state offers simplicity in both formation and ongoing compliance, making it easy for startups. Additionally, the lack of a franchise tax for most LLCs enhances its appeal. If you're considering forming an LLC in Mississippi with pool, USLegalForms can provide the tools and guidance you need to navigate the process smoothly.

Yes, Mississippi does permit the formation of single member LLCs, which can be beneficial for individuals starting their own business. This structure provides liability protection while maintaining flexibility in management and taxation. Additionally, a single member LLC allows you to establish your business's identity and separate your personal finances. For assistance with forming an LLC in Mississippi with pool, explore the resources available at USLegalForms.

In Mississippi, LLCs are typically taxed as pass-through entities, meaning the profits and losses pass through to the owners' personal tax returns. This structure allows for simpler tax filing and potentially lower overall tax liability. However, if you choose to have your LLC taxed as a corporation, different tax regulations apply. For more detailed guidance on LLCs in Mississippi with pool, consider using USLegalForms for resources and support.

Forming an LLC in Mississippi provides several advantages, including personal liability protection and tax flexibility. This structure helps shield your personal assets from business debts, making it particularly beneficial for those managing a pool business. Additionally, an LLC offers a simplified operational process, which can be a real advantage for entrepreneurs in the pool industry.

Yes, Mississippi law requires that pools have proper barriers, such as fences, to enhance safety. This rule applies particularly to residential pools and serves to prevent accidental drownings. If you own an LLC in Mississippi with a pool, ensuring these safety measures are in place is crucial for compliance and protection.

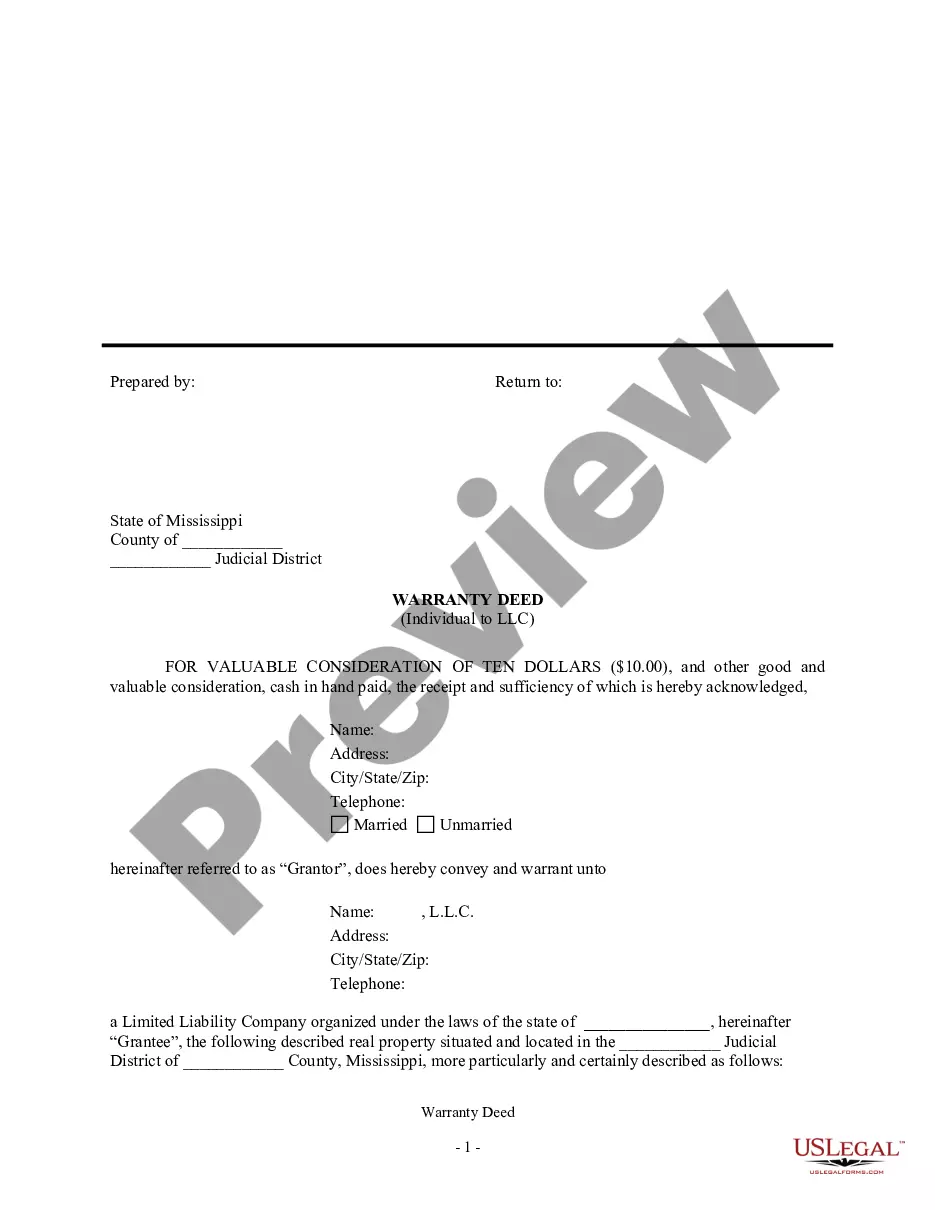

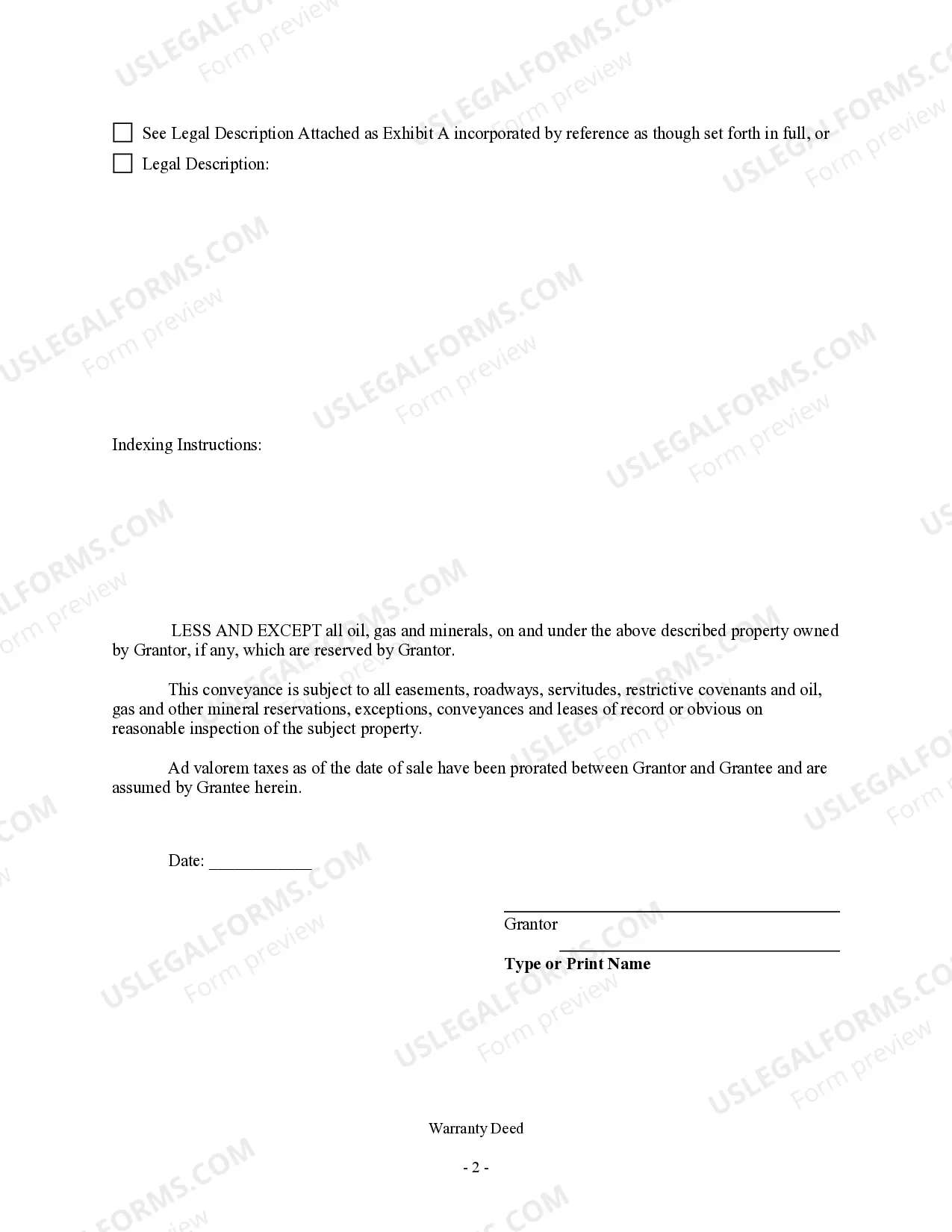

To start an LLC in Mississippi, you need a unique business name, a registered agent, and to file the Certificate of Formation. You should also consider creating an operating agreement, even though it’s not required by law. Platforms like US Legal Forms can assist in this process by providing the necessary documents and guidelines. If you aim to form an LLC in Mississippi with pool, preparing these elements ahead of time will set you on the path to success.

In Mississippi, LLCs are subject to a state income tax that ranges from 3% to 5%. This rate applies to the net income of the business. It's important to think about these tax implications when creating your business plan. If you operate an LLC in Mississippi with pool, ensuring you understand your tax obligations will help you maintain compliance and avoid penalties.

To register your LLC in Mississippi, you must file a Certificate of Formation with the Secretary of State. This can be done online or by submitting paper documents. Additionally, choosing platforms like US Legal Forms can simplify this process, providing step-by-step instructions and necessary templates. If you have plans for an LLC in Mississippi with pool, it's essential to ensure proper registration to avoid future complications.

No, Mississippi does not legally require LLCs to have an operating agreement. However, it is highly recommended to create one, as it outlines the management structure and operating procedures of your LLC. An operating agreement can prevent potential disputes among members and provide clarity. This is especially important for those forming an LLC in Mississippi with pool, where clear agreements around usage and responsibility can enhance your operations.

The process to establish an LLC in Mississippi typically takes about two to four weeks, depending on the method of filing. If you choose to file online, you might receive confirmation more quickly than if you submit paper forms. To expedite the process, consider using platforms like US Legal Forms, which provide guidance and resources to streamline your LLC formation. This can be especially beneficial if you're looking into an LLC in Mississippi with pool.