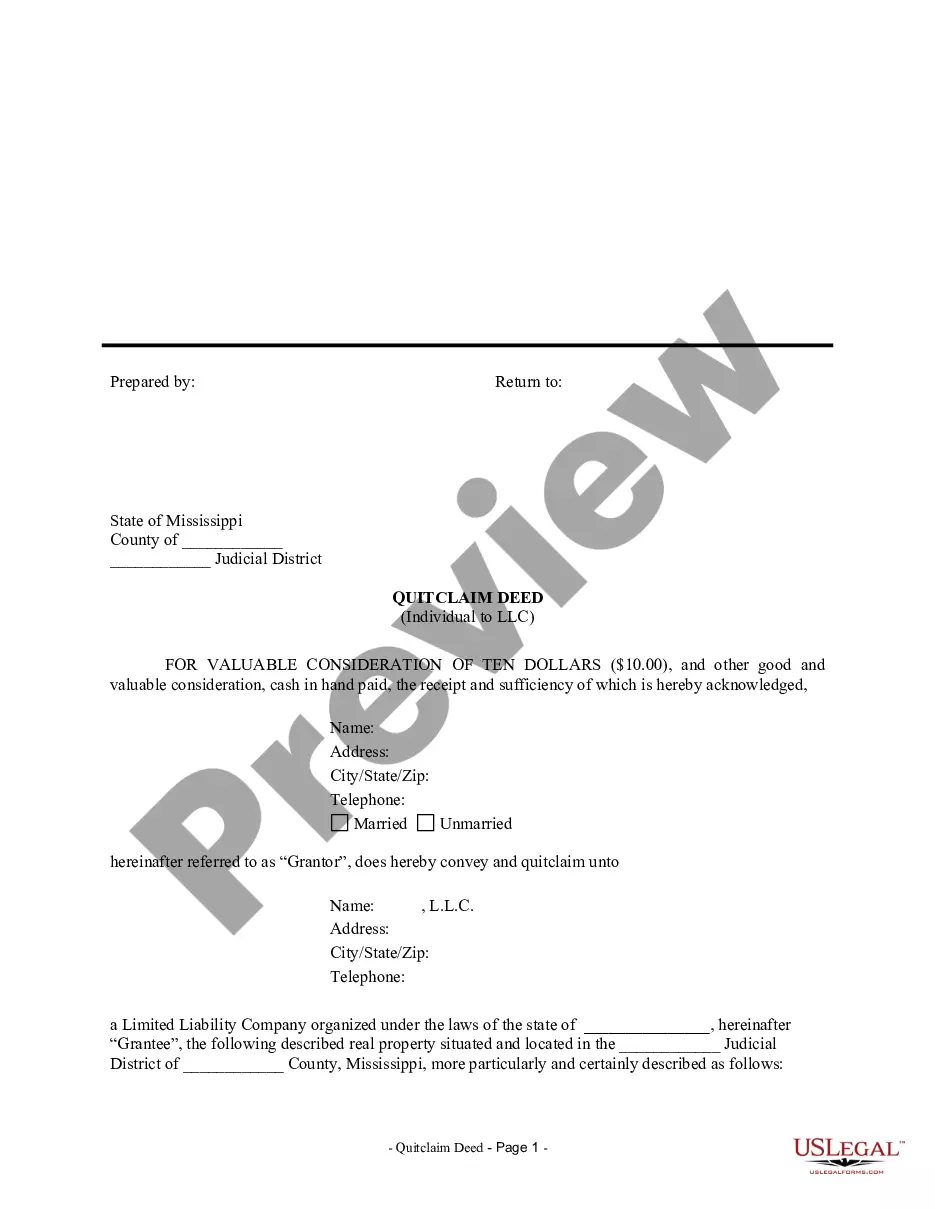

Quitclaim Deed From Llc To Individual

Description

How to fill out Mississippi Quitclaim Deed From Individual To LLC?

No matter if you handle documents often or occasionally need to submit a legal paper, it is crucial to have a source where all the examples are pertinent and current.

The first step to utilize a Quitclaim Deed From Llc To Individual is to verify that it is the most recent version, as this determines its eligibility for submission.

If you want to make your hunt for the most recent document examples easier, look for them on US Legal Forms.

Avoid the confusion of dealing with legal documents. All your templates will be arranged and validated with an account at US Legal Forms.

- US Legal Forms is a compilation of legal documents encompassing nearly every example you may seek.

- Search for the forms you need, assess their relevance immediately, and discover more about their application.

- With US Legal Forms, you have access to over 85,000 form templates across various fields.

- Acquire the Quitclaim Deed From Llc To Individual examples in just a few clicks and save them at any time in your account.

- A US Legal Forms account will provide you with easy access to all the samples you require with additional ease and less hassle.

- Simply click Log In in the site header and access the My documents section with all the documents you need at your disposal, eliminating the time spent searching for the appropriate template or verifying its relevance.

- To obtain a form without an account, follow these directions.

Form popularity

FAQ

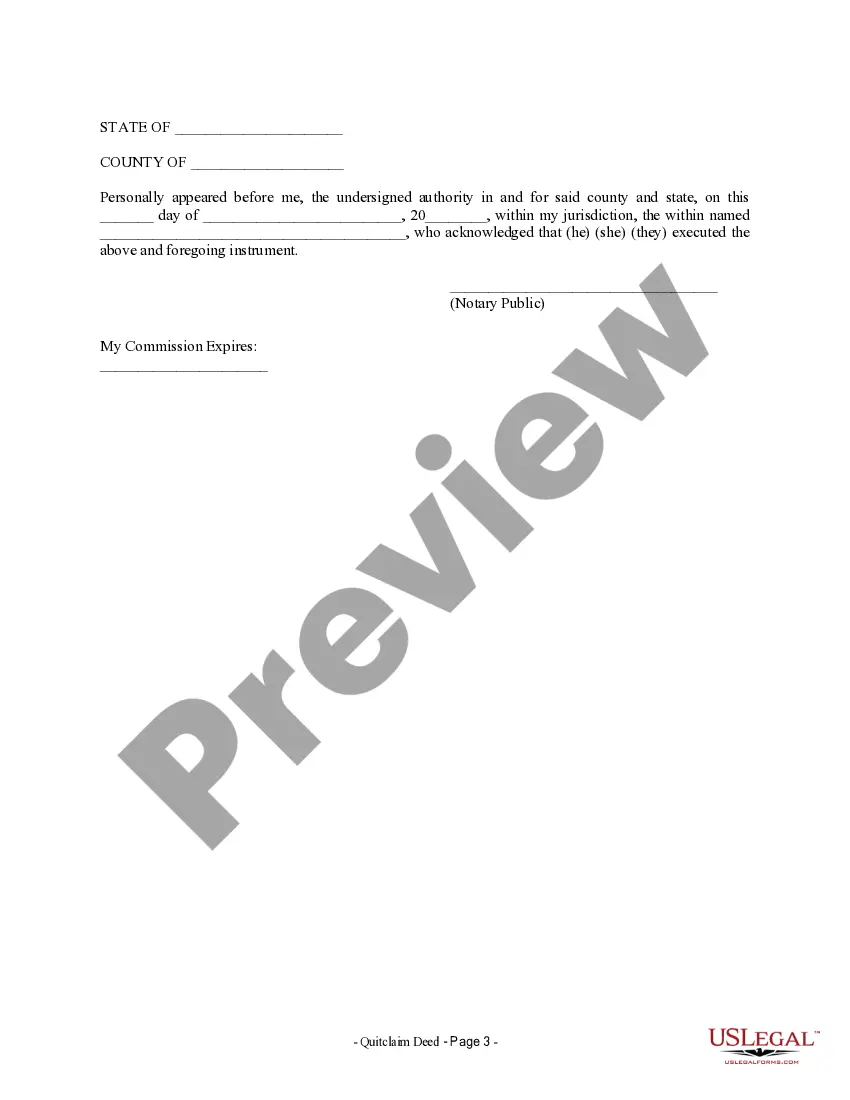

The property owner, also known as the grantor, initiates a quitclaim deed. In the case of a quitclaim deed from an LLC to an individual, the LLC acts as the grantor. The grantor must complete the deed and provide it to the individual receiving the property. If you seek assistance in this process, consider using US Legal Forms, as they can help to streamline the creation and filing of your deed.

To transfer property in Virginia, start by obtaining the appropriate deed form needed for the transfer, such as a quitclaim deed from LLC to individual. Fill out the details accurately, including the property description and the names of the parties involved. After signing the deed, you must record it with the local clerk's office to make it legally effective. Always consider consulting a professional or using platforms like US Legal Forms for guidance.

Yes, you can transfer a deed without an attorney, but it is essential to understand the process thoroughly. When transferring a quitclaim deed from an LLC to an individual, accuracy in documentation is vital. You should ensure that all forms are correctly filled to avoid any legal complications in the future. If you feel uncertain, using services like US Legal Forms can guide you in preparing the necessary documents.

Certainly, transferring property from an LLC to an individual is a common practice, often accomplished through a quitclaim deed. This deed simplifies the transfer process, allowing the individual to take ownership without the need for a lengthy transactional process. Utilizing platforms like uslegalforms can greatly assist with creating and filing the necessary documents efficiently.

Yes, an individual can execute a quitclaim deed to transfer property into an LLC. This process allows for a straightforward change in ownership, provided the deed is properly drafted and recorded. Using a quitclaim deed from individual to LLC can help establish the business’s control over the property, enhancing asset protection.

Transferring ownership of an LLC requires following your state's specific regulations, often outlined in the operating agreement. Typically, members may need to draft an amendment or an assignment of interest document, clearly stating the change in ownership. If real estate is involved, a quitclaim deed from LLC to individual might also be necessary to finalize the transfer.

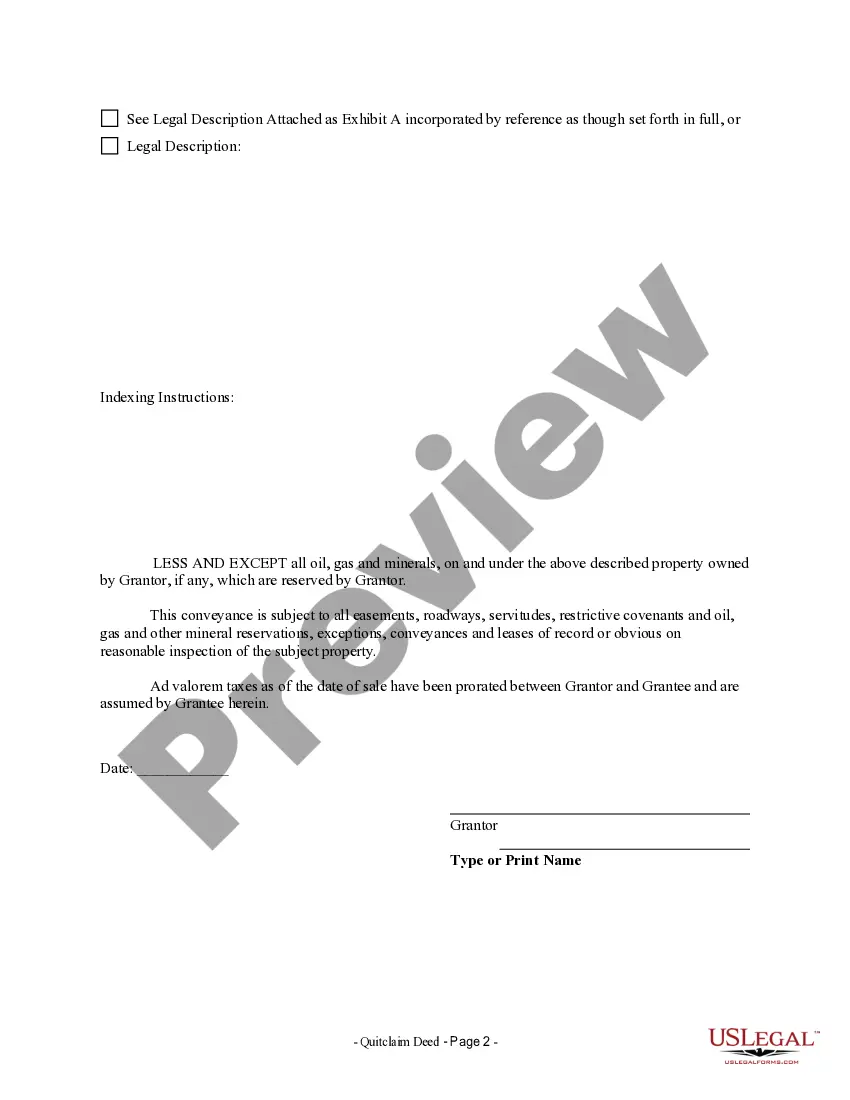

While a quitclaim deed offers simplicity, it has notable drawbacks. It does not guarantee that the property title is clear, exposing the grantee to potential claims against the title. Furthermore, if you use a quitclaim deed from LLC to individual, the individual may inherit existing liabilities associated with the property, which could complicate matters.

Individuals facilitating a quick transfer of property to family members or settling disputes benefit greatly from a quitclaim deed. This form allows for easy changes in ownership without the need for extensive legal processes. Additionally, a quitclaim deed from LLC to individual can simplify asset transfers during estate planning, providing significant advantages for those involved.

Transferring property to an LLC in California can have various tax implications, including potential reassessment of property taxes. Generally, if a quitclaim deed from the LLC to an individual is used, the property tax basis may reset, impacting future tax assessments. Consulting with a tax professional is wise to fully understand these consequences before making the transfer.

To transfer property to an LLC in Florida, you typically need to prepare a deed, such as a quitclaim deed. Ensure the deed lists the LLC as the grantee and include appropriate legal descriptions. After completing the deed, file it with the county clerk's office to officially record the transfer. This process establishes clear ownership for your LLC.