Second Deed Of Trust With Hud

Description

How to fill out Second Deed Of Trust With Hud?

There’s no further justification to invest hours searching for legal records to adhere to your local state laws.

US Legal Forms has assembled all of them in one location and enhanced their accessibility.

Our platform provides over 85k templates for any business and personal legal matters organized by state and area of use.

Complete the process quickly and easily with our platform for preparing formal documents under federal and state regulations. Try US Legal Forms today to keep your paperwork organized!

- All forms are expertly crafted and verified for accuracy, ensuring you receive an up-to-date Second Deed Of Trust With Hud.

- If you are acquainted with our platform and already possess an account, verify that your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also access all saved documents at any time by opening the My documents tab in your profile.

- If you haven't utilized our platform before, the process will involve a few additional steps to finalize.

- Here’s how new users can find the Second Deed Of Trust With Hud in our catalog.

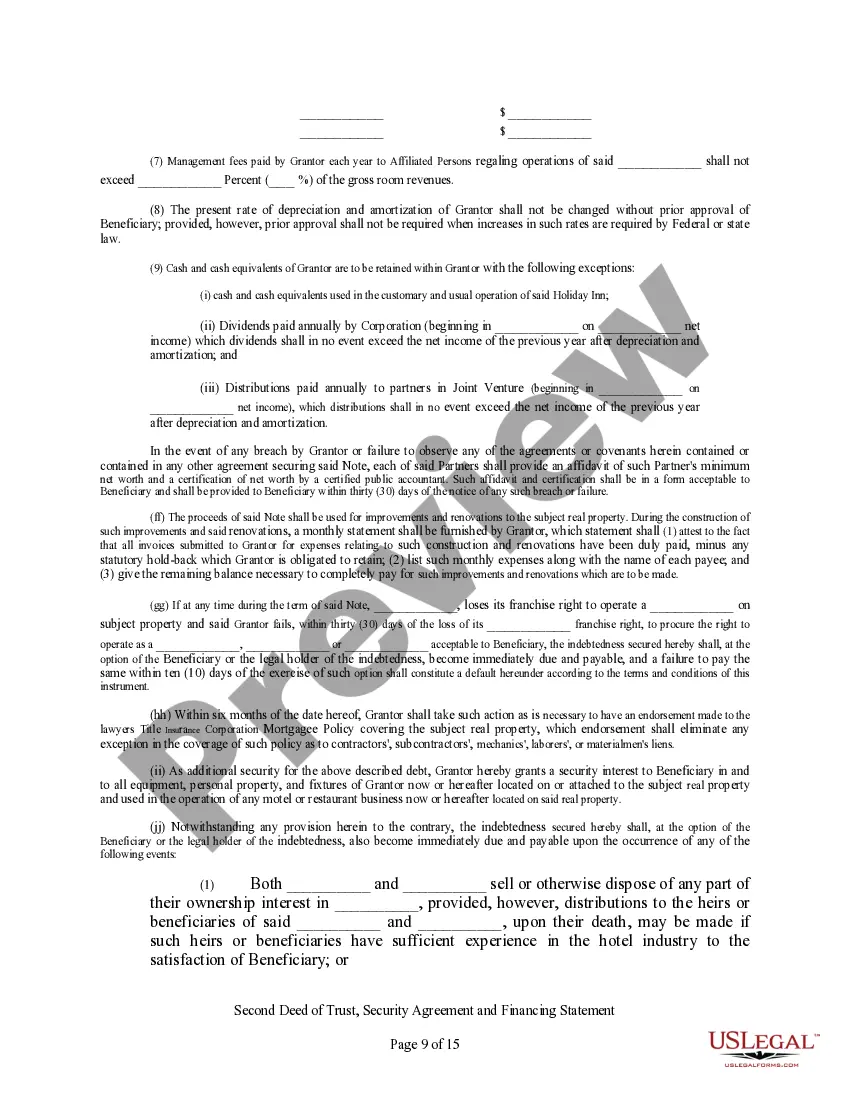

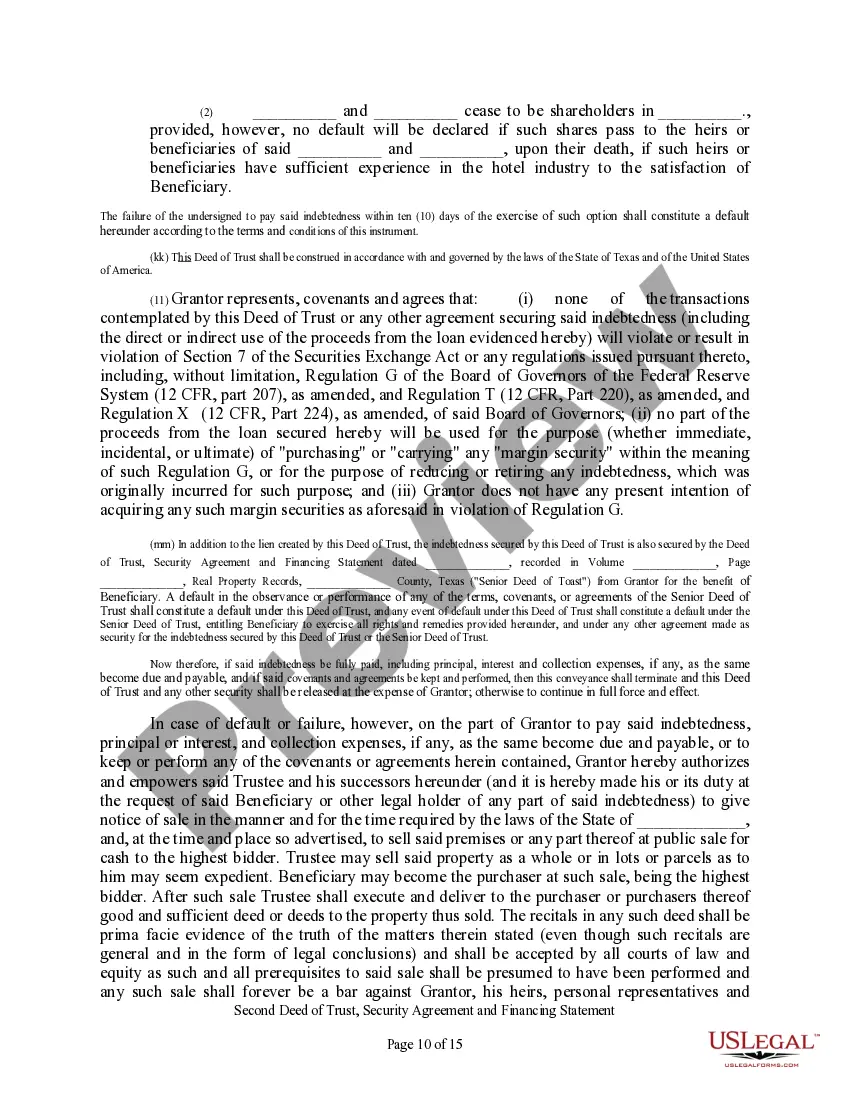

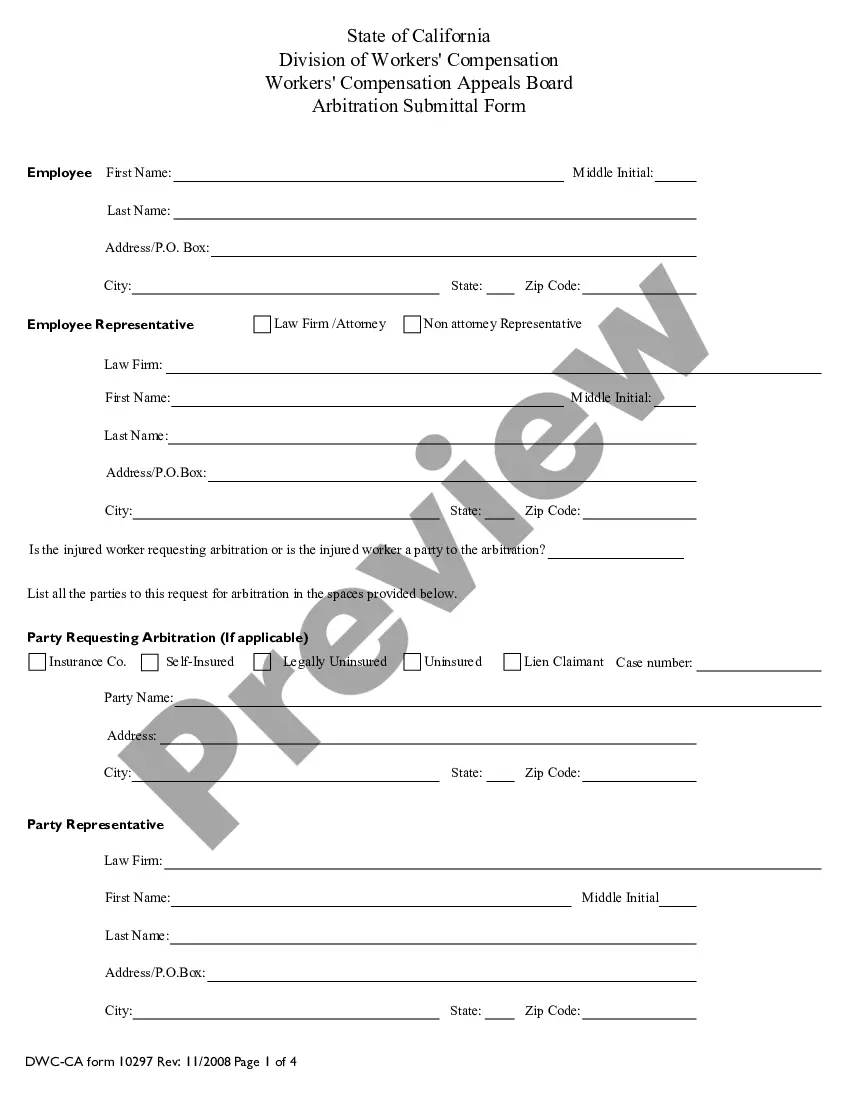

- Read the page content attentively to ensure it includes the sample you need.

- To do this, use the form description and preview options if available.

Form popularity

FAQ

In Texas, a trustee can be an individual or a legal entity authorized to act on behalf of the lender or borrower. The trustee must be reliable and capable of handling the responsibilities outlined in the deed of trust. This ensures that all legal procedures, particularly when dealing with a second deed of trust with HUD, are followed correctly. Using the services of US Legal Forms can help you find qualified trustees and navigate these requirements efficiently.

Yes, having more than one Trust Deed is possible and often used for refinancing or acquiring additional loans. Each Trust Deed operates independently, with specific terms and obligations for repayment. When managing a second deed of trust with HUD, be aware of how these multiple obligations might affect your finances. Utilizing resources like UsLegalForms can provide valuable insights into managing these documents effectively.

A HUD second mortgage is a type of subordinate financing that is backed by the Department of Housing and Urban Development. This mortgage can help a borrower to cover additional costs not included in the first mortgage. When dealing with a second deed of trust with HUD, it is crucial to understand the eligibility requirements and potential benefits. Seeking advice from a knowledgeable resource can clarify these aspects.

Yes, you can have multiple deeds of trust on a property. This is common in cases where a borrower secures additional financing, such as a second deed of trust with HUD. Each deed will have its own terms and priorities regarding repayment. Understanding how these deeds interact can help prevent financial complications.

One disadvantage of a Trust Deed is that it can sometimes result in foreclosure if the borrower defaults on their payments. Additionally, the process can be complex, especially with a second deed of trust with HUD involved. Borrowers may also lose flexibility regarding property use. It’s essential to fully understand the implications before entering into such an agreement.

Yes, a Trust Deed can be varied, which means the terms of the deed can be changed or modified. This typically requires consent from all parties involved, including the lender and borrower. If you have a second deed of trust with HUD, it’s important to ensure that these changes comply with any applicable regulations. Always consider consulting a legal professional for assistance with this process.

A floating deed of trust is a type of trust deed that allows for additional properties to be collateralized under a single agreement. This means that if you secure a second deed of trust with HUD, you can potentially expand your security to other investments. This flexibility can be beneficial if you plan to grow your real estate portfolio.

Yes, you can have two trust deeds on the same property. This often occurs when a second deed of trust is created to secure additional financing. The first trust deed usually takes priority in the event of foreclosure, but having a second deed of trust with HUD can provide valuable options for homeowners needing extra funds.

Entering into a Trust Deed can indeed impact your bank account and overall financial health. While the Trust Deed is active, you may find that your bank account experiences restrictions on transactions related to your debts. Therefore, it's important to consider how a second deed of trust with HUD might influence your banking arrangements and overall financial management.

At the end of a Trust Deed, provided all terms have been met, you typically regain full control of your financial situation. Any associated debts under the Trust Deed should be resolved, allowing you to move forward. It’s crucial to understand how this process relates to your second deed of trust with HUD, particularly regarding your credit and financial standing.