Modification Of Deed Of Trust With Refinance

Description

How to fill out Mississippi Change Or Modification Of Promissory Note Deed Of Trust And Security Agreement?

What is the most trustworthy service to obtain the Modification Of Deed Of Trust With Refinance and other updated versions of legal documents? US Legal Forms is the solution!

It boasts the largest assortment of legal forms for any situation. Each template is properly composed and validated for adherence to federal and local statutes and regulations. They are categorized by area and jurisdiction, making it simple to locate the one you require.

US Legal Forms is an excellent resource for anyone needing to handle legal documents. Premium members can benefit even more as they can complete and authorize previously saved forms electronically at any time using the built-in PDF editing tool. Try it out today!

- Experienced users of the platform only need to Log In to the system, verify if their subscription is active, and click the Download button next to the Modification Of Deed Of Trust With Refinance to obtain it.

- Once saved, the template remains accessible for additional use under the My documents section of your profile.

- If you do not yet possess an account with our library, here are the steps you must follow to create one.

- Form compliance verification. Before you receive any template, you need to confirm that it matches your usage criteria and complies with your state or county's regulations.

Form popularity

FAQ

The timing for refinancing after an initial refinance varies based on lender guidelines and your financial situation. Generally, many lenders require you to wait six months to a year before applying for another refinance. It's crucial to assess whether your current mortgage has improved in terms of interest rates or if your financial circumstances have changed. Using a reputable platform like UsLegalForms can provide guidance throughout this process.

When you refinance, a modification of deed of trust with refinance typically occurs. This means that while you may not receive a new deed, you will enter into a new agreement that alters the existing deed. This process updates the terms of your mortgage, which includes the interest rate and payment schedule. It's essential to understand that this modification is formalized in the trust deed documentation.

A trust can indeed be changed, but the flexibility depends on the type of trust. Revocable trusts allow changes at any time as long as the trust maker is alive and competent. However, irrevocable trusts have stricter rules, often requiring court approval for modifications. When navigating these options, consider the modification of deed of trust with refinance to ensure all adjustments align with your financial needs.

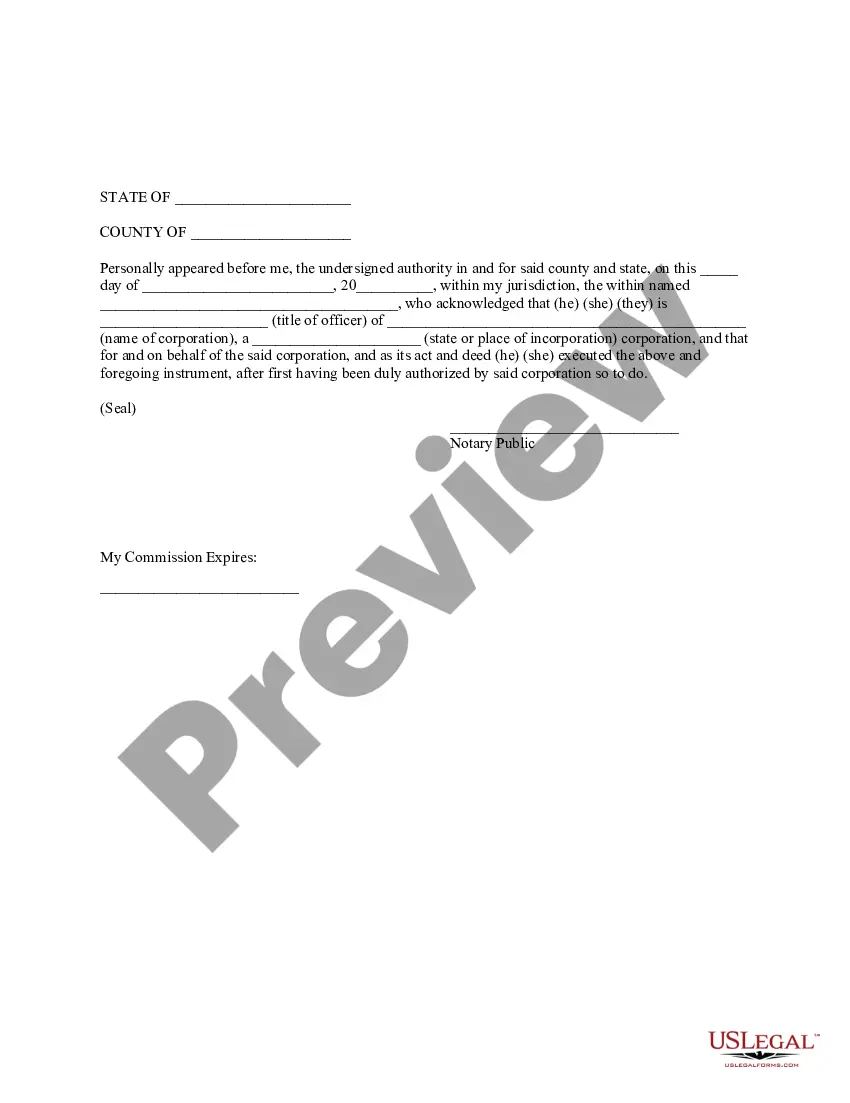

Making changes to a trust deed involves applying for a modification and preparing the necessary paperwork. You will need to identify the specific changes required and gather the signatures of all involved parties. Additionally, it is important to record this modification with your local authorities. Considering the modification of deed of trust with refinance can facilitate these changes and provide clarity on new terms.

Yes, you can modify a deed of trust, but it requires certain steps. Typically, this involves drafting a modification agreement that outlines the changes you wish to make. It is advisable to consult with a legal professional to ensure all modifications comply with local regulations. Using the modification of deed of trust with refinance can streamline this process and ensure everything is documented correctly.

To change the trust deed, you first need to obtain a modification document that reflects the desired changes. Then, you must complete this document accurately and have it signed by all relevant parties. After that, file the modification with your local land records office. This process often involves the modification of deed of trust with refinance to ensure the updated terms align with your financial goals.

Yes, a trust deed can be changed through a formal amendment process. This often includes updating the beneficiaries, trustees, or distribution clauses. If you are considering the modification of deed of trust with refinance, accessing a platform like uslegalforms can streamline the process and ensure that all changes meet legal requirements.

A deed of amendment is a document that enables parties to update the terms of an agreement or legal instrument. This legal tool is vital for ensuring that any modifications made reflect current arrangements accurately. In relation to the modification of deed of trust with refinance, this deed ensures that your financial document remains relevant and effective.

The deed of amendment of a trust is a legal instrument used to change the provisions in a trust. This amendment must be executed according to the legal requirements of the state. It is an essential component in the process of the modification of deed of trust with refinance, allowing you to adapt your trust to your evolving needs.

A deed of amendment to a trust deed is a document that updates the terms of an existing trust. This deed specifically outlines which sections of the original trust are changing. When undertaking the modification of deed of trust with refinance, using this deed ensures your trust accurately reflects your current intentions.