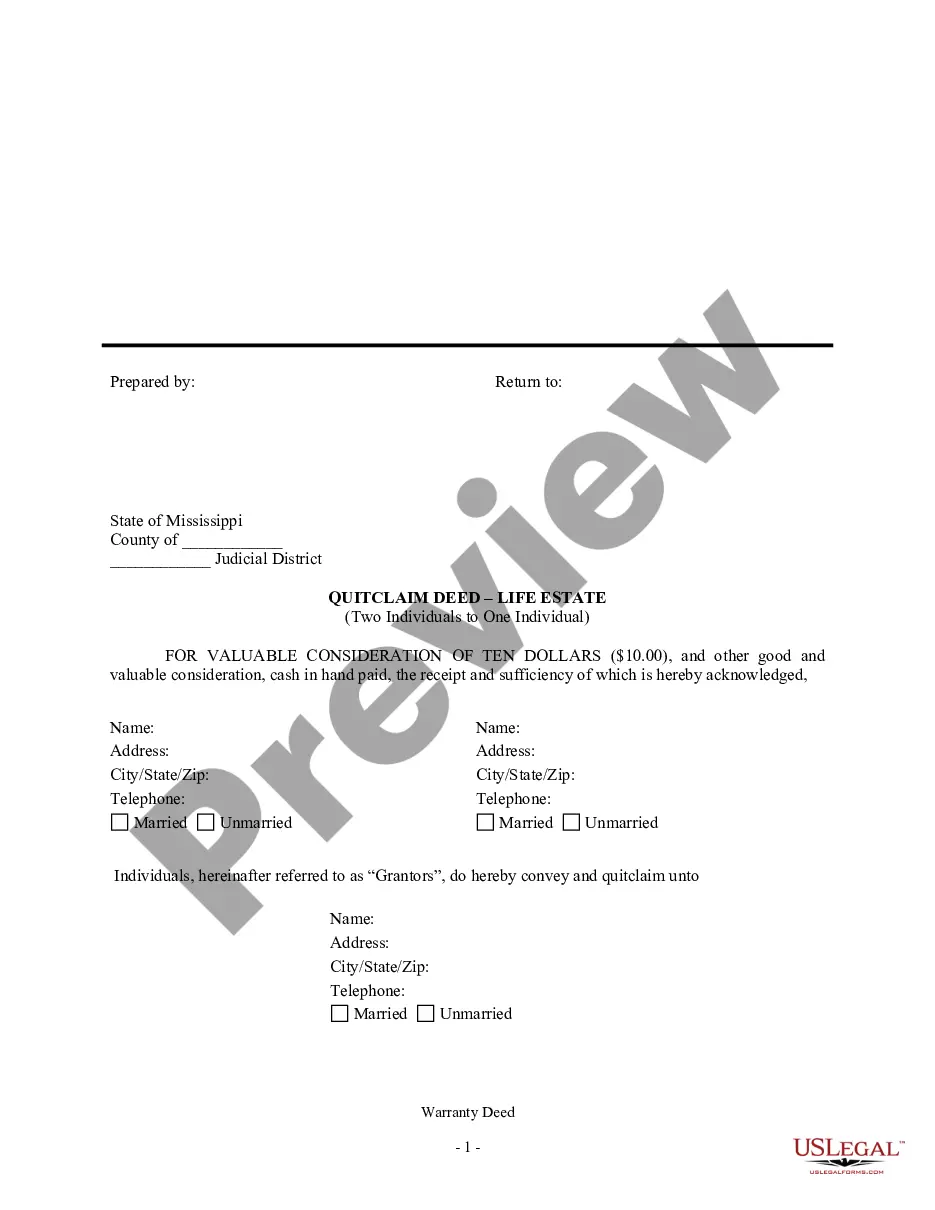

This form is a Quitclaim Deed conveying a life estate where the Grantors are Two Individuals or Husband and Wife and the Grantee is an Individual. Grantors convey and quitclaim a life estate in the described property to Grantee. This deed complies with all state statutory laws.

A quitclaim deed with a life estate clause is a legal document that grants ownership of a property while reserving a life estate interest for one or more individuals. This type of deed allows the granter to transfer their ownership rights to another person or entity, known as the grantee, while retaining the right to use and enjoy the property until their death. The deed specifies that the granter has a life estate, meaning they possess the property for the duration of their lifetime. The inclusion of the life estate clause ensures that the granter, or another designated individual, known as the life tenant, can continue to reside in the property and benefit from its use during their lifetime. The life estate can be limited to a single person or extended to multiple individuals, known as remainder men, who will gain full ownership rights upon the death of the last surviving life tenant. In a quitclaim deed with a life estate clause, the value of the property holds significance. The deed can be associated with different values, primarily considering the interests of the life tenant and the remainder men. Multiple values may come into play when determining the ownership shares of the life tenant and the remainder men, depending on the structure of the agreement. For example, the life tenant's share may be based on a specific percentage of the property's assessed value at the time of the transfer, or it could be determined by mutual agreement among all parties involved. Different types of quitclaim deeds with life estate clauses and multiple values may include: 1. Unequal Share Agreement: In this type of agreement, the life tenant and remainder men agree to assign different ownership shares based on their respective contributions and preferences. The values assigned to each share can vary based on factors such as financial contributions, property maintenance responsibilities, or any other relevant considerations. 2. Proportional Share Agreement: This type of agreement divides the property's ownership shares in proportion to the value of each party's investment or contribution. If multiple life tenants are involved, their collective shares may be determined by dividing the property equally among all life tenants. 3. Specified Percentage Agreement: In this agreement, the ownership shares are predetermined, with each party holding a specific percentage interest in the property, often calculated based on financial contributions or other agreed-upon criteria. It is important to consult with a qualified attorney or real estate professional to ensure that the quitclaim deed with a life estate clause is properly drafted, tailored to the specific circumstances, and complies with all legal requirements. Understanding the various types of quitclaim deeds with life estate clauses and multiple values allows parties involved to negotiate and establish ownership shares that align with their intentions and preferences.