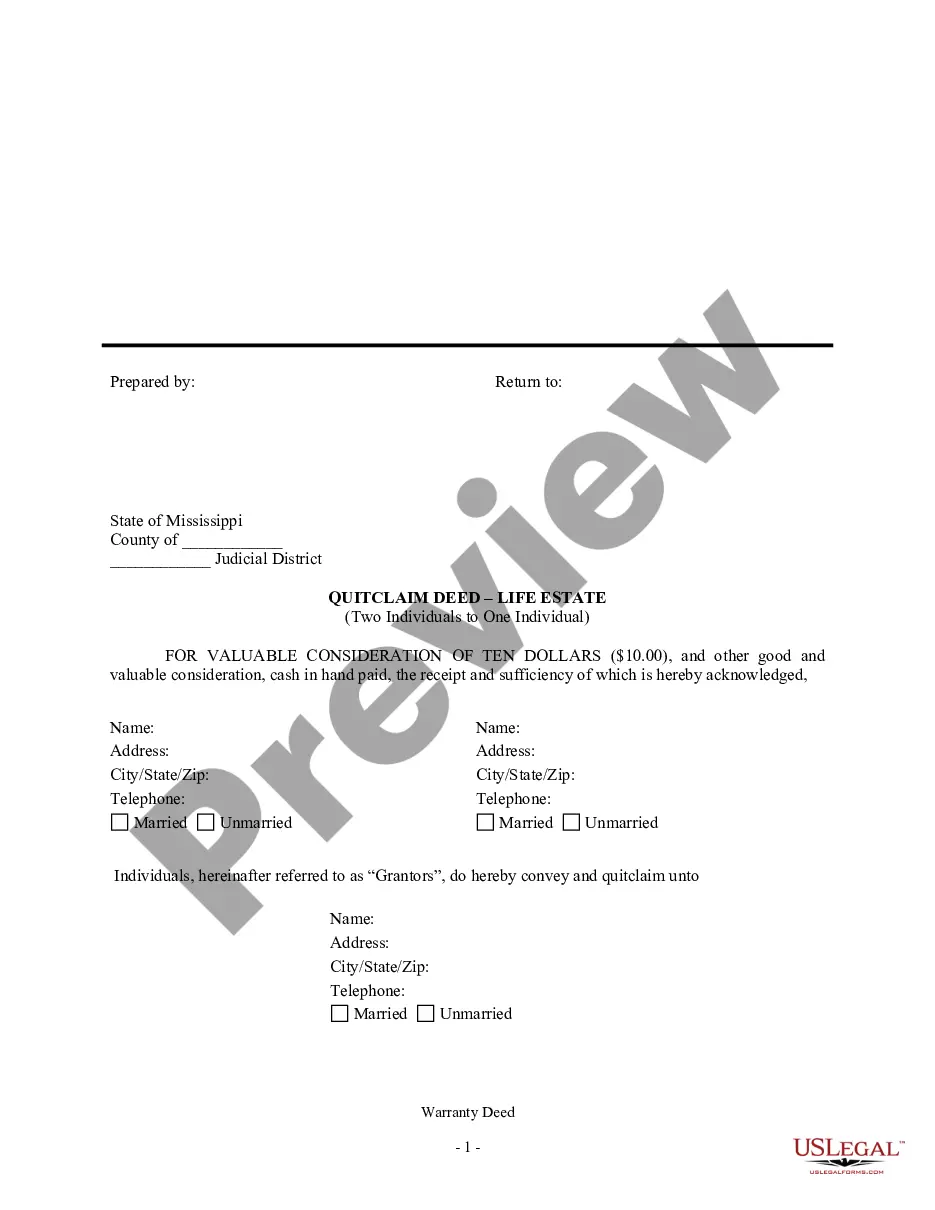

This form is a Quitclaim Deed conveying a life estate where the Grantors are Two Individuals or Husband and Wife and the Grantee is an Individual. Grantors convey and quitclaim a life estate in the described property to Grantee. This deed complies with all state statutory laws.

A quitclaim deed with a life estate clause is a legal document used in real estate transactions to transfer ownership and control of property while also ensuring that the original owner (granter) retains certain rights to their property during their lifetime. This type of deed is commonly used for estate planning purposes, allowing individuals to transfer property to their beneficiaries while retaining the right to live in or use the property until their death. In a quitclaim deed with a life estate clause, the granter transfers their interest in the property to the grantee, who becomes the owner. However, the granter retains a life estate, meaning they have exclusive possession and use of the property until they die. Once the granter passes away, the full ownership of the property is automatically transferred to the grantee. This type of deed can be beneficial for both parties involved. The granter can ensure their property is passed to their desired beneficiary without the need for probate or the interference of other potential heirs. Additionally, it provides the granter with the security of knowing they can continue to live in their home or enjoy the property's benefits during their lifetime. Here are a few examples of situations where a quitclaim deed with a life estate clause might be used: 1. Estate Planning: An aging individual wants to pass their property to their children but desires to retain the right to live on the property until they pass away. They can use a quitclaim deed with a life estate clause to transfer the property to their children while ensuring their continued use and enjoyment. 2. Blended Families: In a situation where a couple remarries and wants to provide for both their new spouse and their children from a previous relationship, a quitclaim deed with a life estate clause can be utilized. The granter can transfer ownership to their spouse while retaining the life estate, guaranteeing the spouse can live on the property until their death, after which ownership will pass to the granter's children. 3. Asset Protection: Someone wishes to protect their property from potential creditors while ensuring its eventual transfer to a loved one. By using a quitclaim deed with a life estate clause, they can transfer ownership to their designated beneficiary while retaining the right to use the property during their lifetime. Different variations of the quitclaim deed with a life estate clause may exist, depending on the specific needs and requirements of the parties involved. It is crucial to consult with a qualified attorney or real estate professional to ensure the deed is appropriate for the individual situation. In conclusion, a quitclaim deed with a life estate clause is a useful legal instrument for transferring property ownership while allowing the original owner to retain control and benefits until their death. Whether for estate planning, protecting assets, or ensuring fair distribution among blended families, this type of deed can effectively meet the needs of various real estate transactions.