Mo Attorney Missouri Withholding Form Mo-941

Description

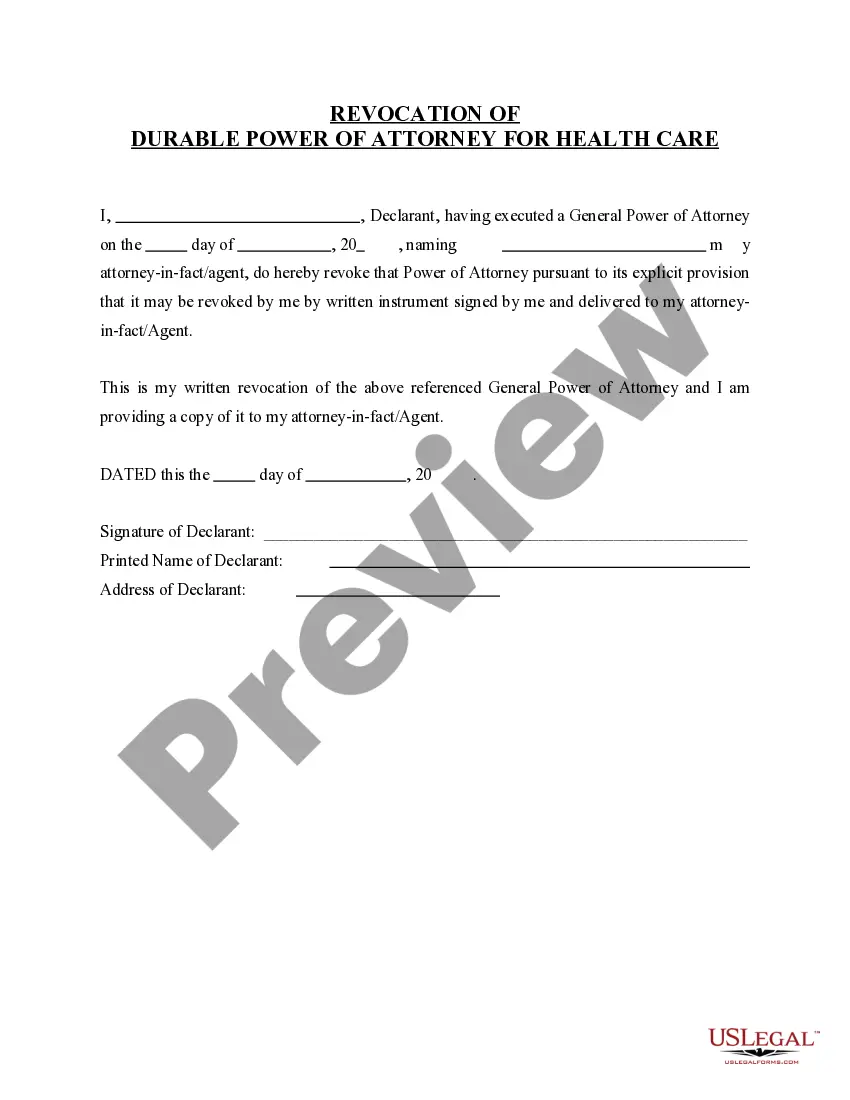

How to fill out Missouri Revocation Of Durable Power Of Attorney For Health Care?

Regardless of whether for commercial reasons or personal matters, everyone must confront legal issues at some point in their lives.

Filling out legal paperwork requires meticulous focus, beginning with choosing the proper form template.

With an extensive US Legal Forms library available, you don’t need to waste time searching for the right template online. Use the library’s straightforward navigation to find the ideal template for any situation.

- Locate the template you require using the search box or the catalog browsing.

- Review the form’s details to ensure it aligns with your situation, jurisdiction, and locality.

- Click on the form’s preview to examine it.

- If it is the wrong form, return to the search feature to find the Mo Attorney Missouri Withholding Form Mo-941 template you are looking for.

- Obtain the document when it meets your standards.

- If you possess a US Legal Forms account, just click Log in to access previously stored documents in My documents.

- If you have not created an account yet, you may download the form by selecting Buy now.

- Select the suitable pricing plan.

- Complete the account registration form.

- Choose your payment method: either a credit card or a PayPal account.

- Select your desired file format and download the Mo Attorney Missouri Withholding Form Mo-941.

- After downloading, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Missouri Withholding Tax ? Multiply the employee's Missouri taxable income by the applicable annual payroll period rate. Begin at the lowest rate and accumulate the total withholding amount for each rate. The result is the employee's annual Missouri withholding tax.

What is the timely compensation deduction? Amount of CompensationYear-to-Date Tax Withheld2 Percent0 to $5,0001 Percent$5,001 to $10,000½ Percentin Excess of $10,000

Withholding Formula (Effective Pay Period 06, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $1,1211.5%Over $1,121 but not over $2,242$16.82 plus 2.0% of excess over $1,121Over $2,242 but not over $3,363$39.24 plus 2.5% of excess over $2,2426 more rows ?

Box 1 (Required) Print first name, middle initial, last name, home address, city, state, and zip code. Box 2 (Required) Complete with nine-digit social security number. Box 3 (Required) Must have a check mark in one box only. Box 4 (Optional) Place a check mark in the box only if your last name differs from that shown ...

A new MO W-4 must be completed annually if you wish to continue the exemption. Military Spouses Residency Relief Act and have no Missouri tax liability. United States and I am eligible for the military income deduction. This certificate is for income tax withholding and child support enforcement purposes only.