Mo Attorney Missouri Form Mo-60

Description

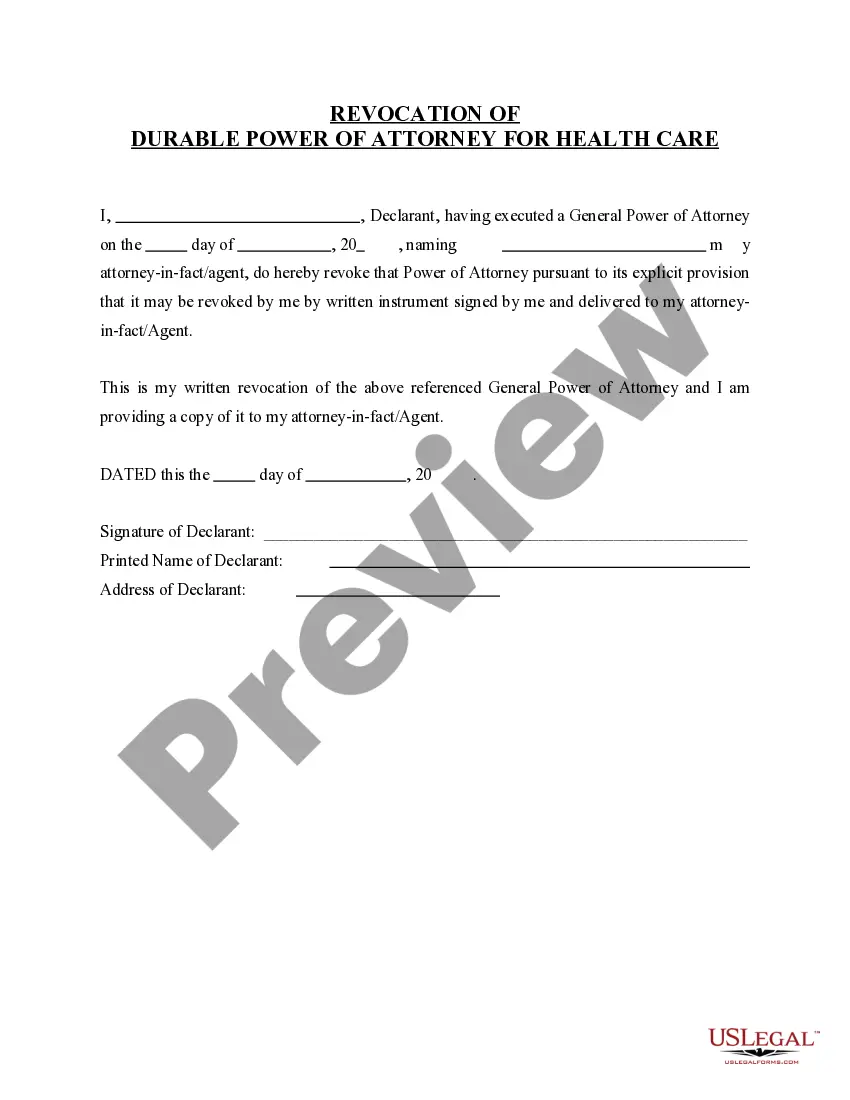

How to fill out Missouri Revocation Of Durable Power Of Attorney For Health Care?

Whether for commercial endeavors or personal issues, everyone must handle legal affairs at some stage in their life.

Completing legal paperwork requires meticulous care, starting with selecting the proper form template.

Pick the file format you desire and download the Mo Attorney Missouri Form Mo-60. Once downloaded, you can complete the form using editing software or print it and finalize it manually. With a vast US Legal Forms library available, you’ll never have to waste time searching for the correct template online. Utilize the library’s easy navigation to find the suitable form for any circumstance.

- For instance, if you choose an incorrect version of a Mo Attorney Missouri Form Mo-60, it will be rejected upon submission.

- Thus, it is essential to source trustworthy legal paperwork like US Legal Forms.

- If you need to obtain a Mo Attorney Missouri Form Mo-60 template, adhere to these straightforward steps.

- Identify the template you require by utilizing the search bar or browsing the catalog.

- Review the form’s details to confirm it suits your circumstances, state, and county.

- Click on the form’s preview to inspect it.

- Should it be the wrong document, return to the search feature to locate the Mo Attorney Missouri Form Mo-60 template you need.

- Download the template when it aligns with your requirements.

- If you have an existing US Legal Forms account, click Log in to access formerly saved documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Select your payment method: you may use a credit card or PayPal account.

Form popularity

FAQ

You will need to provide your First and Last Name, Phone Number, and e-mail address to create a user ID for the Missouri Department of Revenue's MyTax Missouri. Authorized Preparers: Once you have created a user ID you can provide it to an existing administrator on MyTax Missouri to grant you access to their accounts.

You will need to provide your First and Last Name, Phone Number, and e-mail address to create a user ID for the Missouri Department of Revenue's MyTax Missouri. Authorized Preparers: Once you have created a user ID you can provide it to an existing administrator on MyTax Missouri to grant you access to their accounts.

Form MO-60 must be filed on or before the end of the federal automatic extension period. You must complete a separate Form MO-60 for each return. Individual and composite income tax filers will be granted an automatic extension of time to file until October 17, 2022.

An approved Form MO-60 extends the due date up to six months for the individual income tax returns, and five months for fiduciary, and partnership income tax returns. You seek a Missouri extension exceeding the federal auto matic extension period.

A Missouri tax power of attorney (Form 2827), otherwise known as the ?Missouri Department of Revenue Power of Attorney,? can be used to assign power to a tax professional or qualified agent to make filings on your behalf, obtain your tax information, and resolve any tax-related issues you may have.