Statement Of Non Assessment Missouri Within Canada

Description

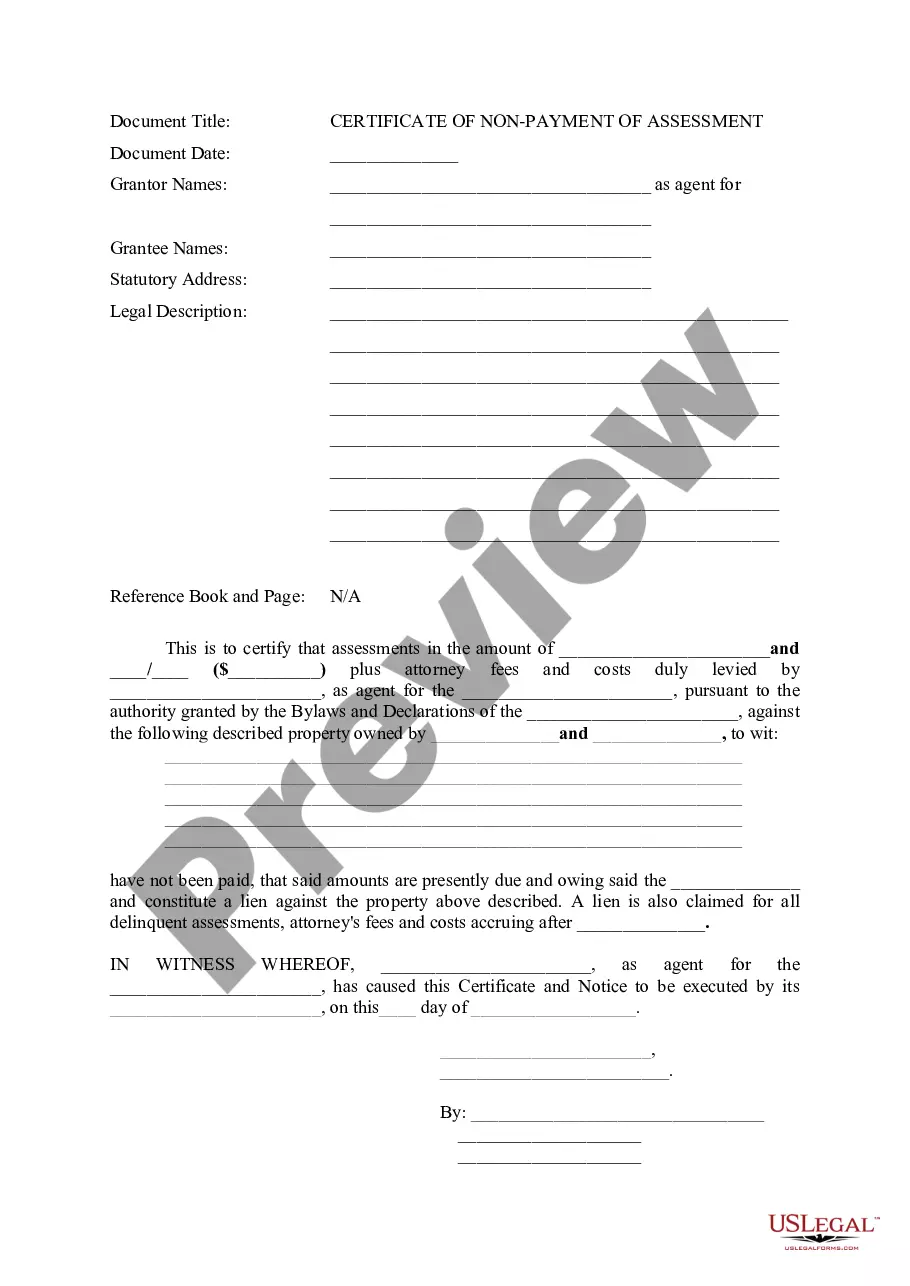

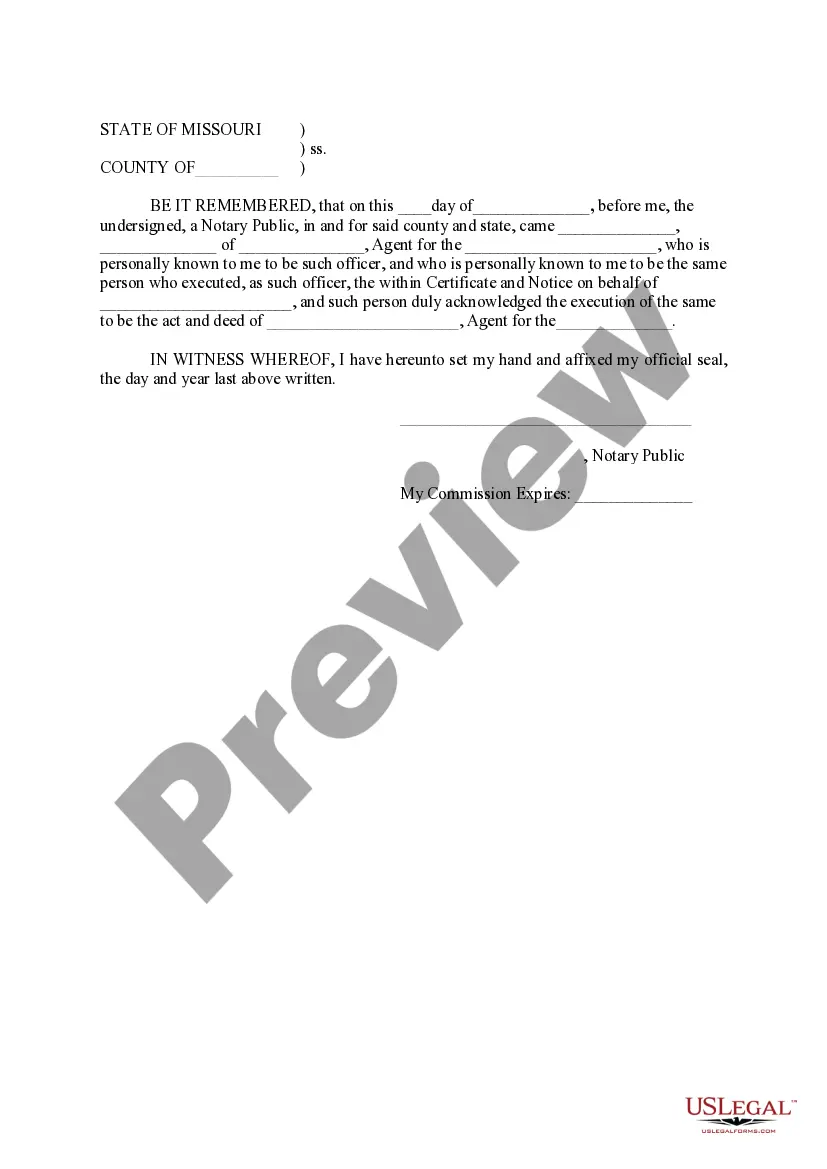

How to fill out Missouri Certificate Of Non-Payment Of Assessment?

Discovering a reliable location to obtain the latest and suitable legal forms is a significant part of navigating through bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it's essential to source Statement Of Non Assessment Missouri Within Canada exclusively from trustworthy providers, such as US Legal Forms.

Remove the frustration associated with your legal documents. Explore the extensive US Legal Forms collection to find legal templates, verify their suitability for your circumstances, and download them instantly.

- Utilize the library navigation or search bar to find your template.

- Examine the form's description to confirm it meets the criteria of your state and locality.

- View the form preview, if available, to make sure the template is indeed the one you seek.

- Return to the search to locate another document if the Statement Of Non Assessment Missouri Within Canada does not satisfy your requirements.

- If you are confident about the form's applicability, download it.

- As a registered user, click Log in to verify and access your selected templates in My documents.

- If you haven't created an account yet, click Buy now to acquire the form.

- Choose the pricing option that suits your needs.

- Proceed to the registration to complete your order.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Choose the file type for downloading Statement Of Non Assessment Missouri Within Canada.

- After obtaining the form on your device, you can edit it using the editor or print it and fill it out by hand.

Form popularity

FAQ

In Missouri, assessors do have the right to inspect properties, but they typically notify the homeowner in advance. It's best to check local regulations regarding this process. If you have concerns about property assessments, a Statement of non assessment missouri within Canada can help ensure you've complied with all tax laws.

Limited or full appointment You might have authority to make decisions about certain things, called a limited guardianship. Or you might have authority to make decisions about all aspects of the protected person's life, called a plenary or full guardianship.

Technically, ing to Utah Law, the ?desires of a child 14 years of age or older shall be given added weight but is not the single controlling factor.? Again, 14 and above, the court may consider the preference of children and what they have to say, but even that will be the exception and not the normal case.

A guardian is a person or institution appointed by a court to make decisions about the care of another, who is called a ?ward.? A conservator is a person or institution appointed by the court to manage the property and financial affairs of a ward.

Utah Rule of Judicial Administration 6-501 requires that, before a person can be appointed as guardian, the person must take a test about their authority and responsibilities and file a Certificate of Completion with the court.

In such a case, the parental rights are not really terminated. Rather, the rights are put on hold until the court deems it appropriate to reinstate them. During this period, the guardian will be responsible for making all of the major decisions about the child's life.

Utah Code Section 75-5-307. A request to terminate the guardianship may be made by filing a Motion to Review, Terminate, or Remove Guardian or Conservator.

Under Utah Code Section 75-5-408(3), the court may appoint a temporary conservator to serve until further order of the court. There are no court forms for requesting an emergency or temporary guardian or temporary conservator.

The State of Utah allows for two types of guardianship. These include a plenary (full) or limited guardianship. A Plenary guardianship transfers all rights from a ward to a guardian.