Mo Affidavit Of Affixation

Description

How to fill out Missouri Survivorship Affidavit - Joint Tenants - Husband And Wife?

It’s no secret that you can’t become a legal expert overnight, nor can you grasp how to quickly draft Mo Affidavit Of Affixation without the need of a specialized background. Putting together legal forms is a long venture requiring a certain education and skills. So why not leave the preparation of the Mo Affidavit Of Affixation to the specialists?

With US Legal Forms, one of the most extensive legal document libraries, you can access anything from court documents to templates for in-office communication. We know how important compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s how you can get started with our website and get the document you require in mere minutes:

- Find the form you need by using the search bar at the top of the page.

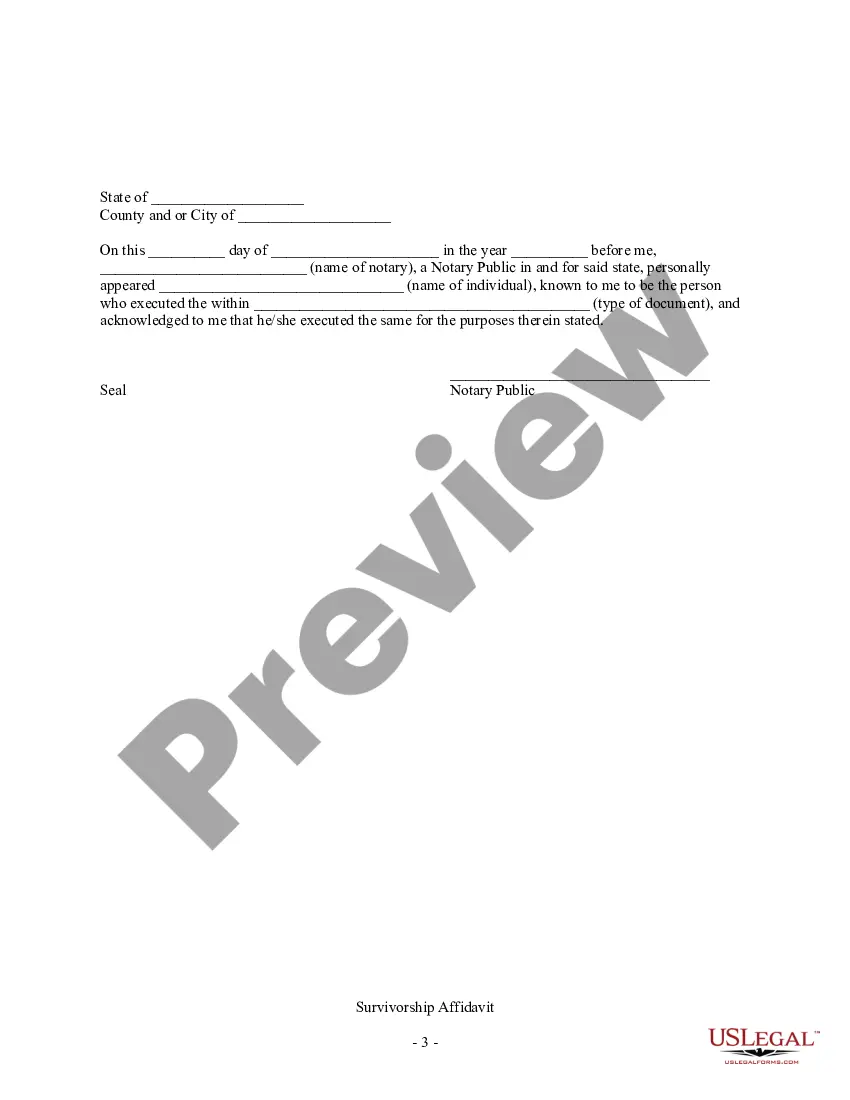

- Preview it (if this option provided) and read the supporting description to determine whether Mo Affidavit Of Affixation is what you’re searching for.

- Start your search over if you need any other form.

- Set up a free account and choose a subscription plan to buy the template.

- Pick Buy now. As soon as the transaction is through, you can get the Mo Affidavit Of Affixation, fill it out, print it, and send or mail it to the designated individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

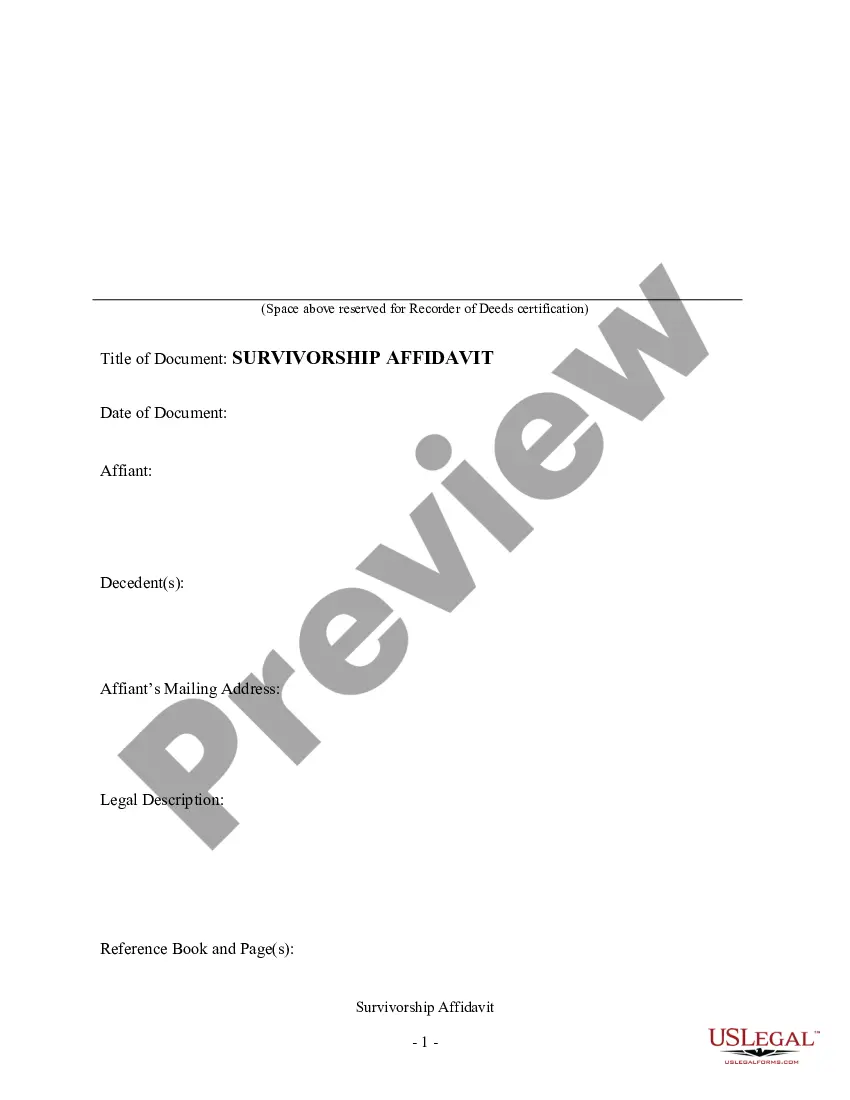

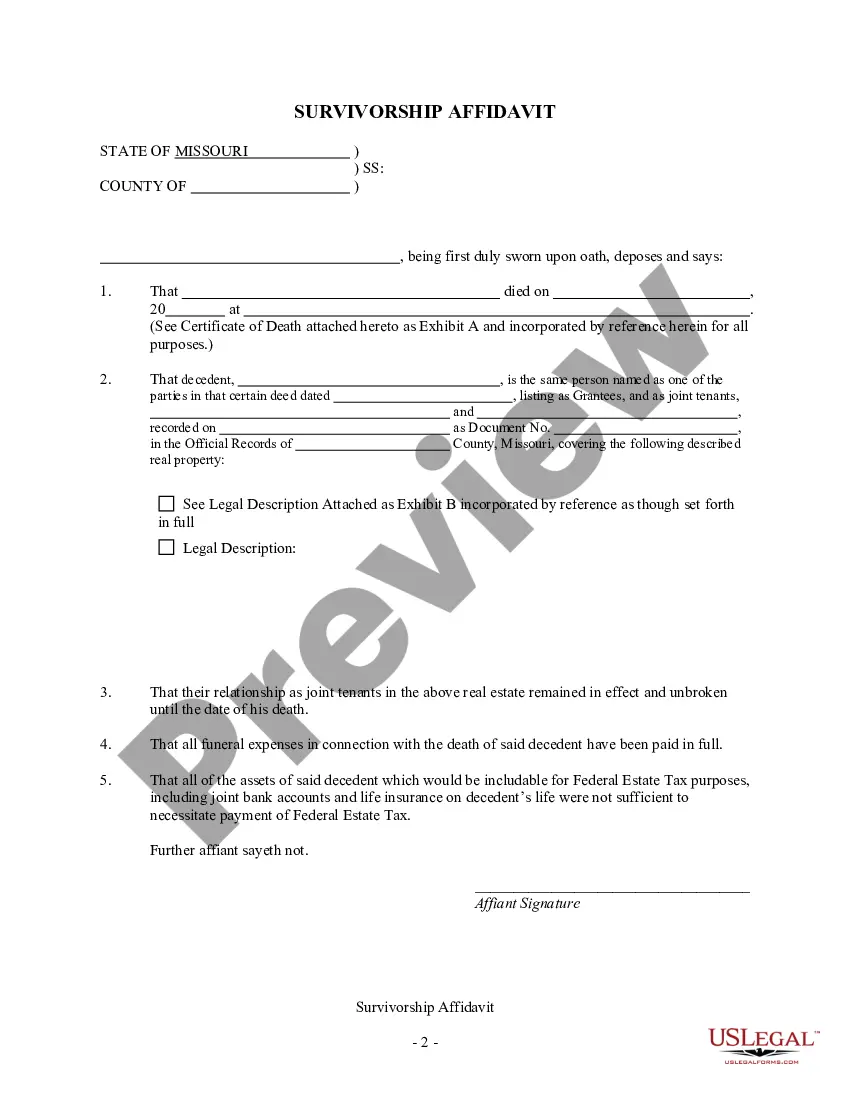

If you want to record your manufactured home as affixed, you must submit the following items to any Missouri license office: A completed Affidavit of Affixation (Form 5312); NOTE: The Form 5312 must be recorded with the Recorder of Deeds Office within 60 days of filing with the Department of Revenue.

Missouri Revised Statute 304.015 clearly states when driving on a highway with a total of two lanes (one lane in each direction) drivers must drive in the right-hand lane. Obviously, a driver may cross into the other lane to overtake a vehicle if the pass can be made safely.

Affixation is the process of recording manufactured home information in the Department of Revenue's titling system in order to provide proof that the manufactured home has been converted to real property.

442.015. Conveyance or encumbrance of manufactured homes, requirements ? affidavit of affixation ? deemed real estate, when ? detachment or severance from real estate, effect of. ? 1. For the purposes of this section, "manufactured home" means a manufactured home as defined in section 700.010.

Compensating tax and local option use tax is due on 60% of the purchase price based on the address where the manufactured home is first delivered in Missouri (if applicable). Refer to the Local Option Use Tax Rate Chart.