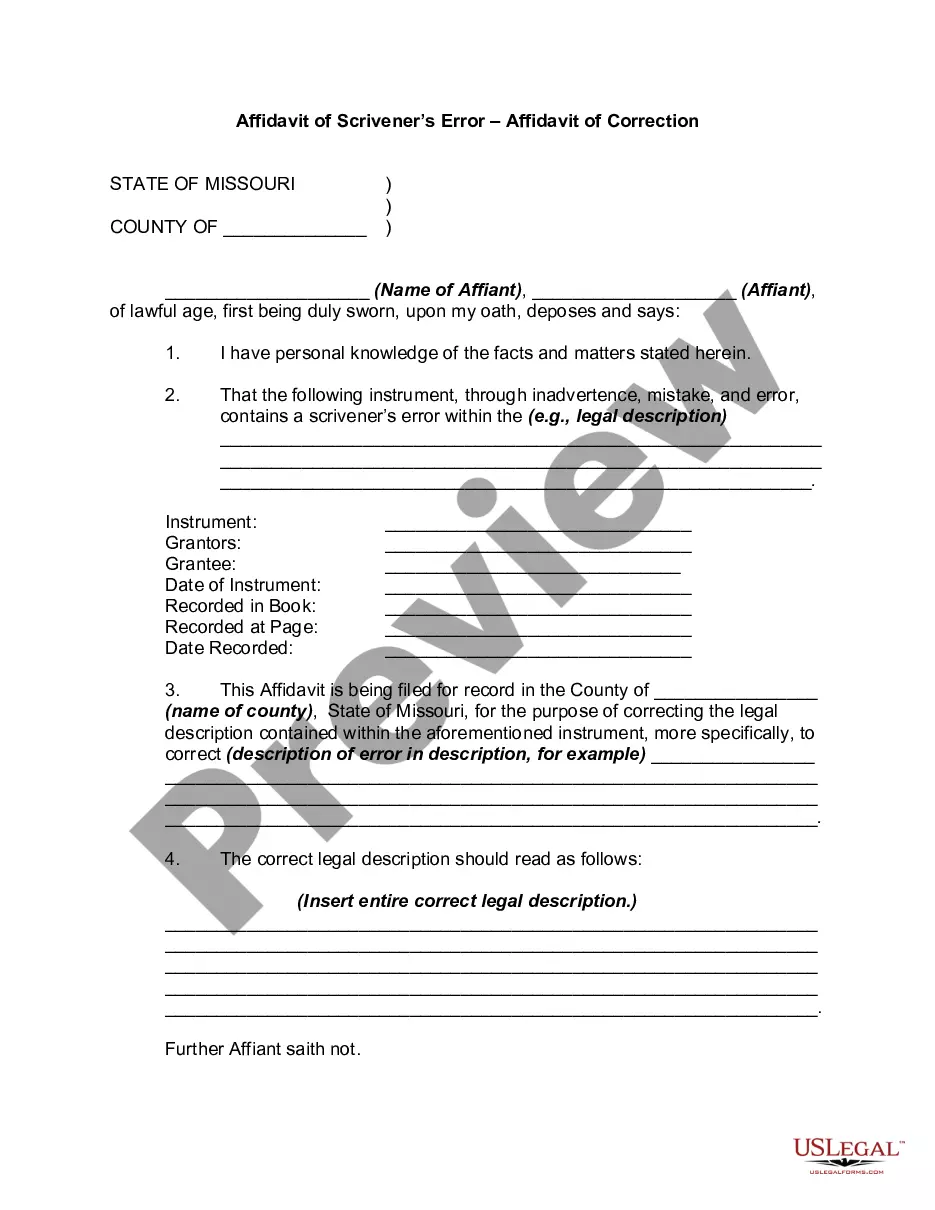

Example Of Affidavit Of Correction

Description

How to fill out Missouri Affidavit Of Scrivener's Error - Affidavit Of Correction?

Whether for commercial reasons or personal issues, every individual must confront legal matters at some stage in their life.

Completing legal paperwork demands meticulous focus, beginning with selecting the right template sample.

With an extensive US Legal Forms catalog available, you do not need to waste time searching for the suitable sample online. Utilize the library’s user-friendly navigation to find the right template for any circumstance.

- Acquire the sample you require by utilizing the search bar or catalog browsing.

- Review the form’s details to ensure it corresponds with your case, state, and county.

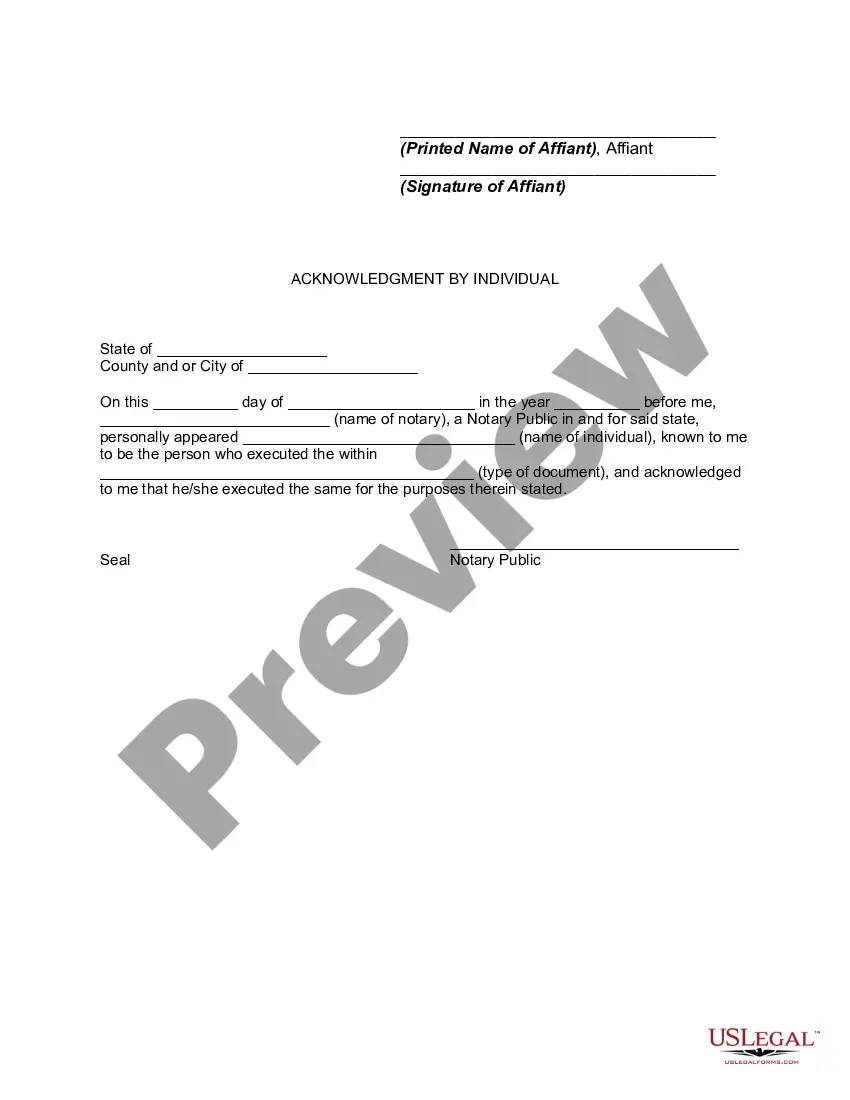

- Click on the form’s preview to examine it.

- If it is the incorrect document, return to the search function to find the Example Of Affidavit Of Correction sample you need.

- Download the file if it satisfies your conditions.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Select your payment method: you can use a credit card or PayPal account.

- Choose the document format you prefer and download the Example Of Affidavit Of Correction.

- Once downloaded, you can fill out the form using editing software or print it to complete it by hand.

Form popularity

FAQ

When correcting a name spelling mistake in an affidavit, you should indicate the incorrect name and then clearly state the correct name. Provide context for the error, making sure to be detailed but concise. An effective example of affidavit of correction can illustrate how to properly format these corrections so authorities recognize them without issue.

You do not pay federal income tax on state or local government bond interest. You must report this interest on your federal return for informational purposes, but it is not included in your taxable income. You do not pay Minnesota income tax on state or local government bond interest from bonds within Minnesota.

You do not need to pay Minnesota income tax if either of these apply: You are a full-year Minnesota resident who is not required to file a federal income tax return. You are a part-year resident or nonresident whose Minnesota gross income is below the minimum filing requirement ($12,900 for 2022).

Interest income you received from U.S. bonds, bills, notes and other obligations is taxable by the federal government and generally exempt from Minnesota income tax.

State Tax Forms To get forms by mail, call 651-296-3781 or 1-800-652-9094 to have forms mailed to you. You can pick up forms at our St. Paul office. Our office hours are a.m. to p.m., Monday - Friday. Minnesota Department of Revenue. 600 N. Robert St. St. Paul, MN 55101.

Interest income you received from U.S. bonds, bills, notes and other obligations is taxable by the federal government and generally exempt from Minnesota income tax.

U.S. government bonds issued by the U.S. Treasury are considered very safe and the income earned is exempt from state and local taxes.

Most munis pay interest that is exempt from federal and potentially state income taxes. However, interest on some municipal bonds is subject to both federal and state income taxes.