Waiver Of Homestead Exemption With Multiple Owners

Description

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

Getting a go-to place to access the most recent and relevant legal templates is half the struggle of dealing with bureaucracy. Discovering the right legal documents demands precision and attention to detail, which is the reason it is crucial to take samples of Waiver Of Homestead Exemption With Multiple Owners only from reliable sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You may access and check all the details regarding the document’s use and relevance for the situation and in your state or county.

Take the listed steps to finish your Waiver Of Homestead Exemption With Multiple Owners:

- Make use of the library navigation or search field to find your template.

- View the form’s information to ascertain if it fits the requirements of your state and area.

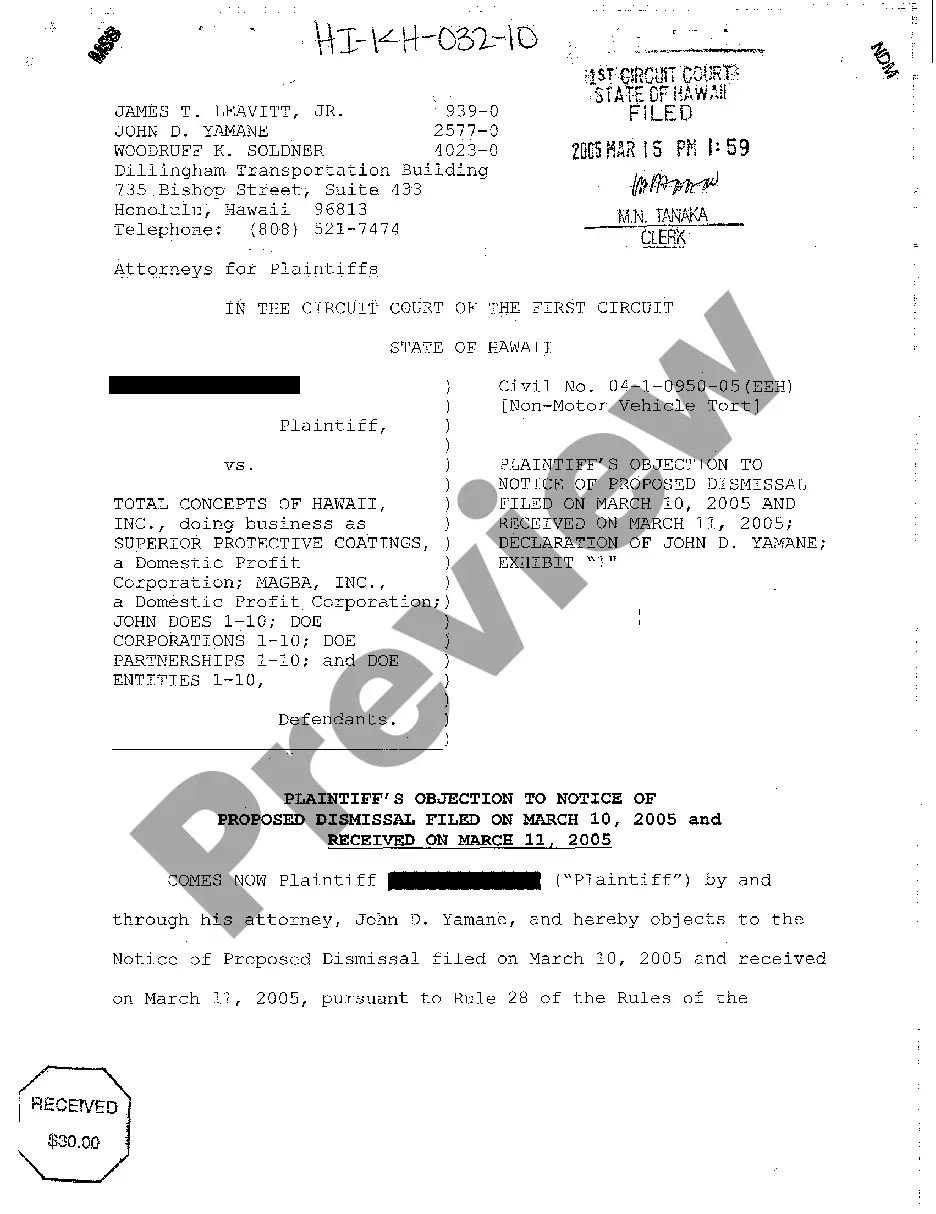

- View the form preview, if available, to make sure the template is the one you are looking for.

- Go back to the search and find the correct template if the Waiver Of Homestead Exemption With Multiple Owners does not fit your needs.

- If you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Select the pricing plan that suits your needs.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a transaction method (bank card or PayPal).

- Select the document format for downloading Waiver Of Homestead Exemption With Multiple Owners.

- Once you have the form on your device, you may change it using the editor or print it and complete it manually.

Get rid of the headache that accompanies your legal paperwork. Explore the extensive US Legal Forms library to find legal templates, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

Florida law recognizes that in some situations, married couples who are joint debtors can have separate homesteads. But two separate homesteads are a rare exception, and the multiple homestead exemption must be proven by applicable facts.

If the owners are married, can they claim two homestead exemptions? No. A married couple can claim only one homestead.

Both owners must sign the application form and, if both owners otherwise qualify, the homestead exemption will be granted for the entire home. This process is as simple as any other married couple or single individual applying for the exemption.

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube Start of suggested clip End of suggested clip Address is different make sure you type in your mailing. Address here for section 3 put in the dateMoreAddress is different make sure you type in your mailing. Address here for section 3 put in the date you became the owner of the property. And then put the date you began living in the property.

However, to be eligible for the homestead exemption, the owner must be a permanent resident of Florida and have a present intent of living at the property. Additionally, the owner must apply for the exemption. Generally, a married couple is entitled to only one homestead exemption.