Waiver Of Homestead Exemption Form Alberta

Description

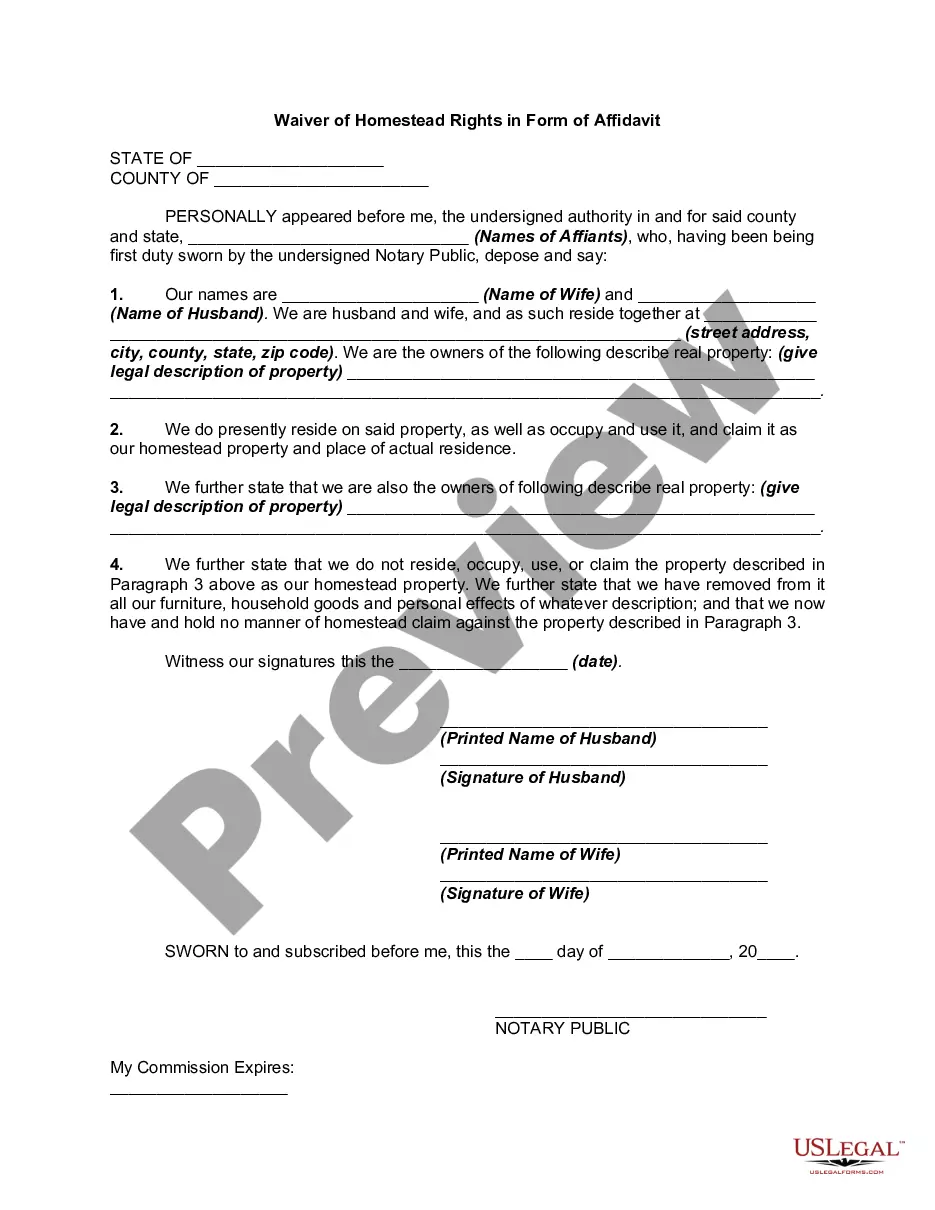

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

Drafting legal paperwork from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars invested. If you’re searching for an easier and more cost-effective way of preparing Waiver Of Homestead Exemption Form Alberta or any other forms without jumping through hoops, US Legal Forms is always at your fingertips.

Our online collection of more than 85,000 up-to-date legal forms addresses almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly access state- and county-compliant forms carefully prepared for you by our legal specialists.

Use our platform whenever you need a trustworthy and reliable services through which you can quickly find and download the Waiver Of Homestead Exemption Form Alberta. If you’re not new to our website and have previously set up an account with us, simply log in to your account, select the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes little to no time to set it up and explore the catalog. But before jumping directly to downloading Waiver Of Homestead Exemption Form Alberta, follow these recommendations:

- Review the document preview and descriptions to ensure that you are on the the form you are searching for.

- Make sure the form you choose complies with the regulations and laws of your state and county.

- Pick the best-suited subscription option to purchase the Waiver Of Homestead Exemption Form Alberta.

- Download the form. Then fill out, sign, and print it out.

US Legal Forms boasts a spotless reputation and over 25 years of expertise. Join us now and turn form execution into something easy and streamlined!

Form popularity

FAQ

HECHO! How to Fill out Texas Homestead Exemption 2022 YouTube Start of suggested clip End of suggested clip In. You do not need to worry about the legal description. If you do not know it. It can be found onMoreIn. You do not need to worry about the legal description. If you do not know it. It can be found on bcad.org. If you look up your property's.

The Alberta Indian Tax Exemption (AITE) program consists of: An exemption from taxes and levies for eligible consumers and bands at the time of purchase on: fuel products purchased on reserve in Alberta or delivered to reserve. tobacco products purchased on reserve in Alberta.

Overview. The Seniors Property Tax Deferral Program allows eligible senior homeowners to voluntarily defer all or part of their residential property taxes, including the education tax portion. This is done through a low-interest home equity loan with the Government of Alberta.

In fact, CADs encourage homeowners to apply for homestead exemption online for quicker filing and expedited processing. Benefits of applying for your homestead exemption online: Application is pre-filled with your information available in the CAD records. No need to print, mail or submit in person.

Tax arrears are taxes levied in prior calendar years. Any unpaid current year account balance will be penalized 7% on July 1. The penalty is a fixed percentage, not a daily interest charge. For example, if your unpaid taxes are $2,000 as of July 1, the penalty will be $140.