Minnesota Homestead Form With Mortgage

Description

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

The Minnesota Homestead Form With Mortgage you see on this page is a reusable formal template drafted by professional lawyers in compliance with federal and local regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, simplest and most trustworthy way to obtain the documents you need, as the service guarantees bank-level data security and anti-malware protection.

Acquiring this Minnesota Homestead Form With Mortgage will take you just a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or check the form description to confirm it satisfies your requirements. If it does not, make use of the search option to find the appropriate one. Click Buy Now once you have found the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and create an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Acquire the fillable template. Select the format you want for your Minnesota Homestead Form With Mortgage (PDF, Word, RTF) and download the sample on your device.

- Complete and sign the document. Print out the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your papers one more time. Make use of the same document once again whenever needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s circumstances at your disposal.

Form popularity

FAQ

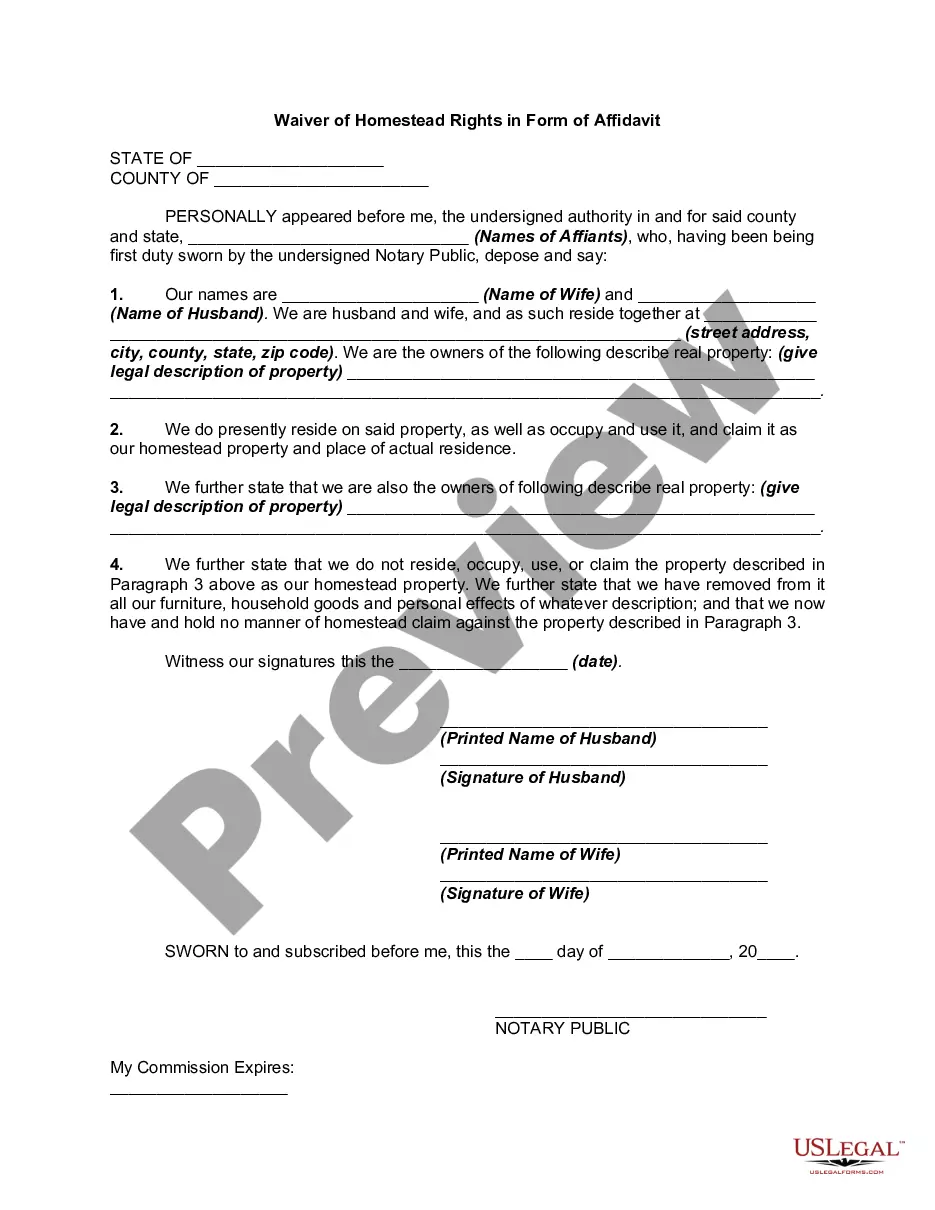

Effective beginning with assessment year 2024. EXPLANATION OF THE BILL Under current law, the homestead market value exclusion reduces the taxable market value for all homesteads valued below $413,800. The exclusion is 40% of the first $76,000 of market value, yielding a maximum exclusion of $30,400.

About Homestead Credit You must be one of the owners of the property or be a qualifying relative of one of the owners. You must occupy the property as your primary place of residence. occupancy does not qualify. You must be a Minnesota resident.

Homestead Credit Refund Program (?circuit breaker?) The program refunds a portion of the property taxes that exceed a certain percentage of household income, called the threshold percentage. Homeowners pay the full amount of their property tax bill and file for the refund with their state income tax return.

What are the maximums? For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund. How are claims filed?

You may qualify for homestead if you answer yes to any of these statements: You are a Minnesota resident. You own the property in your own name ? not as a business entity. You live in the property year-round. You or your property co-owner have a social security number or an individual taxpayer identification number.