Minnesota Homestead Document Without Comments

Description

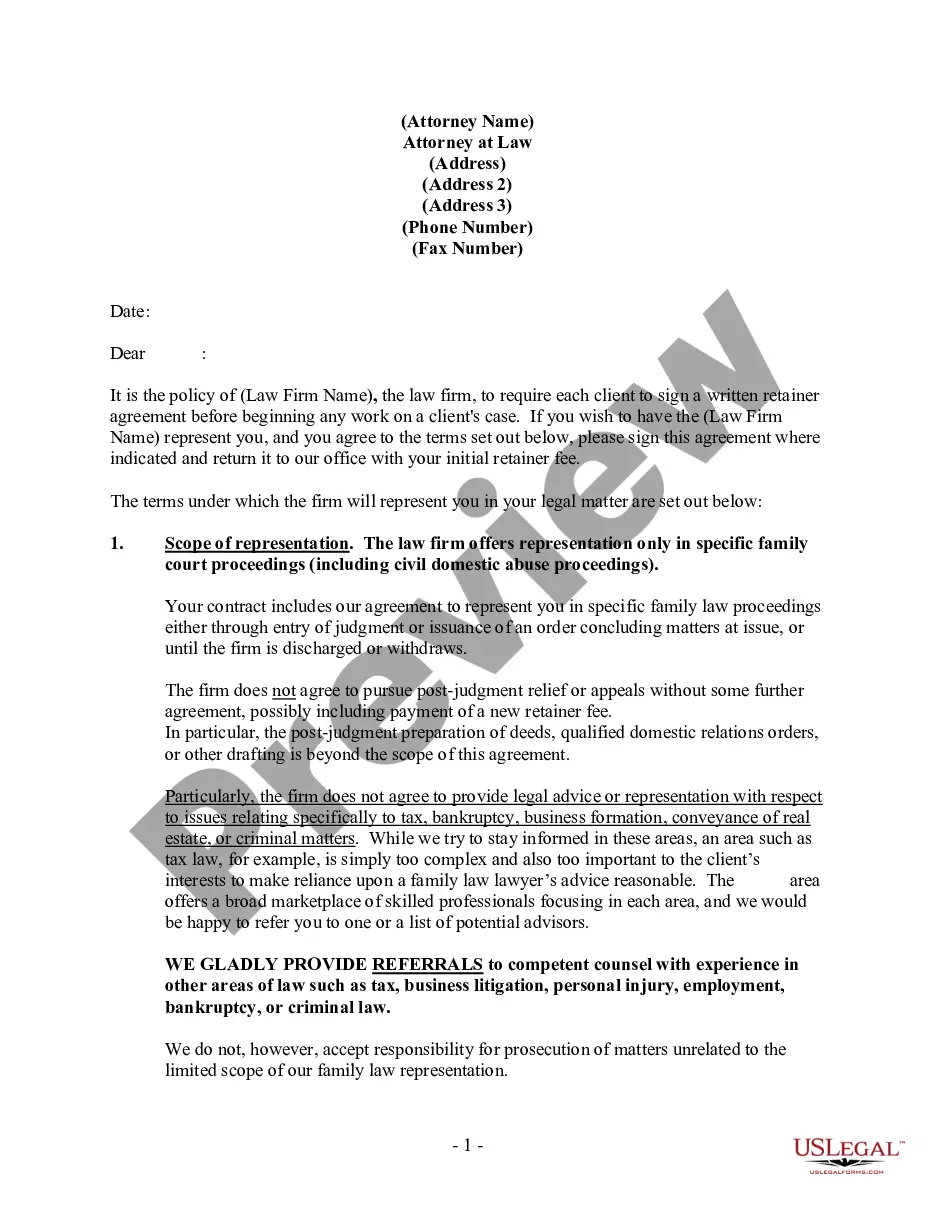

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

It’s clear that you cannot become a legal specialist instantly, nor can you comprehend how to swiftly draft the Minnesota Homestead Document Without Comments without possessing a unique set of expertise.

Producing legal documents is a lengthy process that demands specific training and abilities. So why not entrust the creation of the Minnesota Homestead Document Without Comments to the experts.

With US Legal Forms, one of the most comprehensive legal template collections, you can discover anything from court documents to templates for office communication. We understand the significance of compliance and adherence to federal and state regulations.

You can revisit your forms from the My documents tab at any time. If you’re a current customer, you can simply Log In, and find and download the template from the same tab.

Regardless of the purpose of your documents—whether they are financial and legal, or personal—our website has you covered. Give US Legal Forms a try now!

- Locate the document you require using the search bar at the top of the webpage.

- Preview it (if this option is available) and read the accompanying description to determine if the Minnesota Homestead Document Without Comments is what you need.

- Initiate your search again if you require a different form.

- Sign up for a free account and select a subscription plan to purchase the form.

- Select Buy now. Once the transaction is finalized, you can obtain the Minnesota Homestead Document Without Comments, fill it out, print it, and send it by mail to the specified individuals or entities.

Form popularity

FAQ

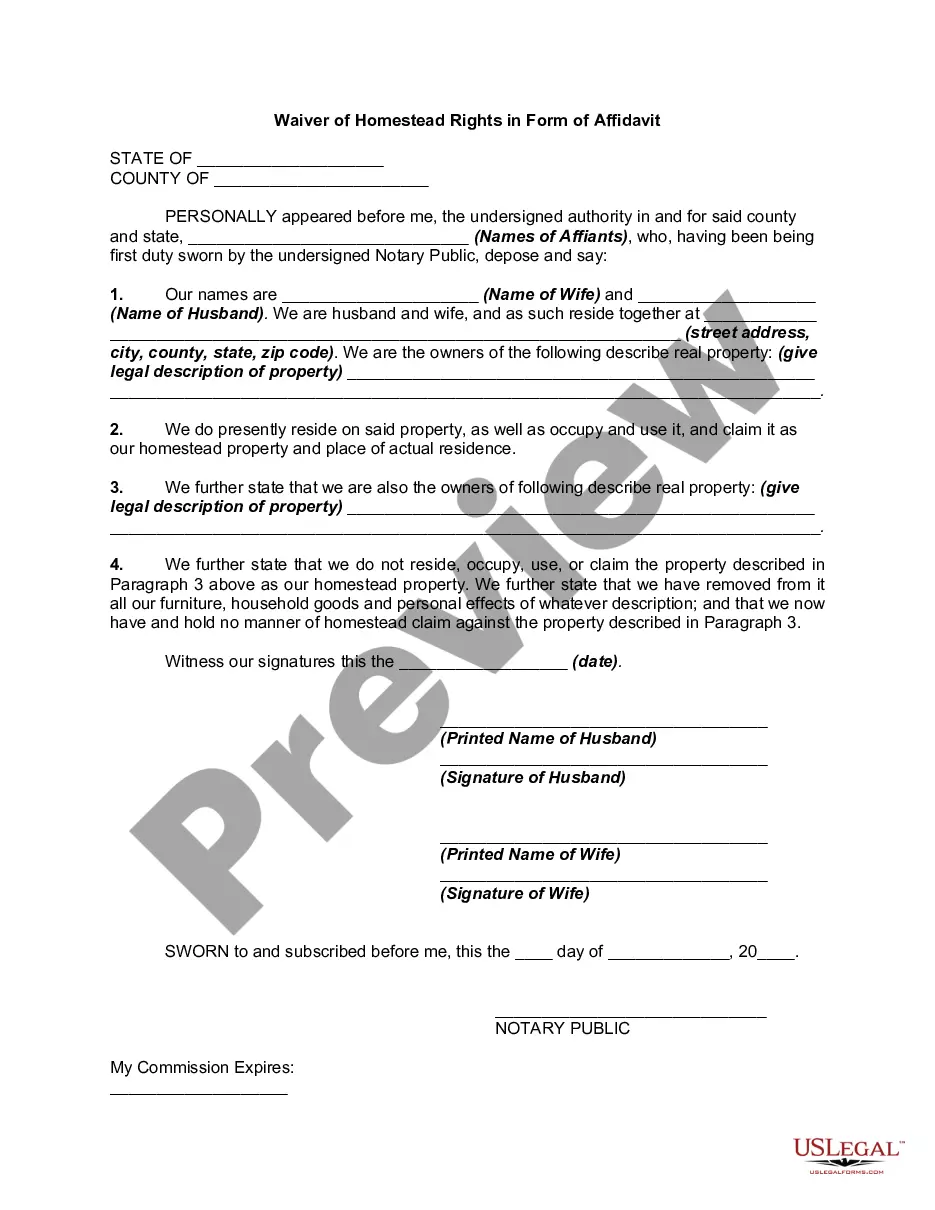

If you're a Minnesota homeowner or renter, you may qualify for a Property Tax Refund. The refund provides property tax relief depending on your income and property taxes. A recent law change increases the 2022 Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund (Form M1PR).

Must have the property classified as your homestead (or applied for the classification) must have a valid Social Security Number (If married filing jointly, at least one spouse must have a valid SSN) must have paid or have an arrangement to pay any delinquent property taxes on the home (if any).

Minnesota statute allows homeowners to claim up to $390,000 in property value, or $975,000 if agricultural, as a "homestead." State law limits this exemption to 160 acres, which in practice may apply to farms, but has removed what was once a half-acre limit on property within city limits.

You may be eligible for a refund based on your household income (see pages 8 and 9) and the property taxes or rent paid on your primary residence in Minnesota. You must be a Minnesota resident or part-year resident to qualify for a property tax refund. For more information, go to .revenue.state.mn.us/residents.

Remove your homestead status Notify the county assessor within 30 days if you sell, move, or for any reason no longer qualify for homestead. Complete the notice-of-move form (PDF).