Minnesota Homestead Document For Editing

Description

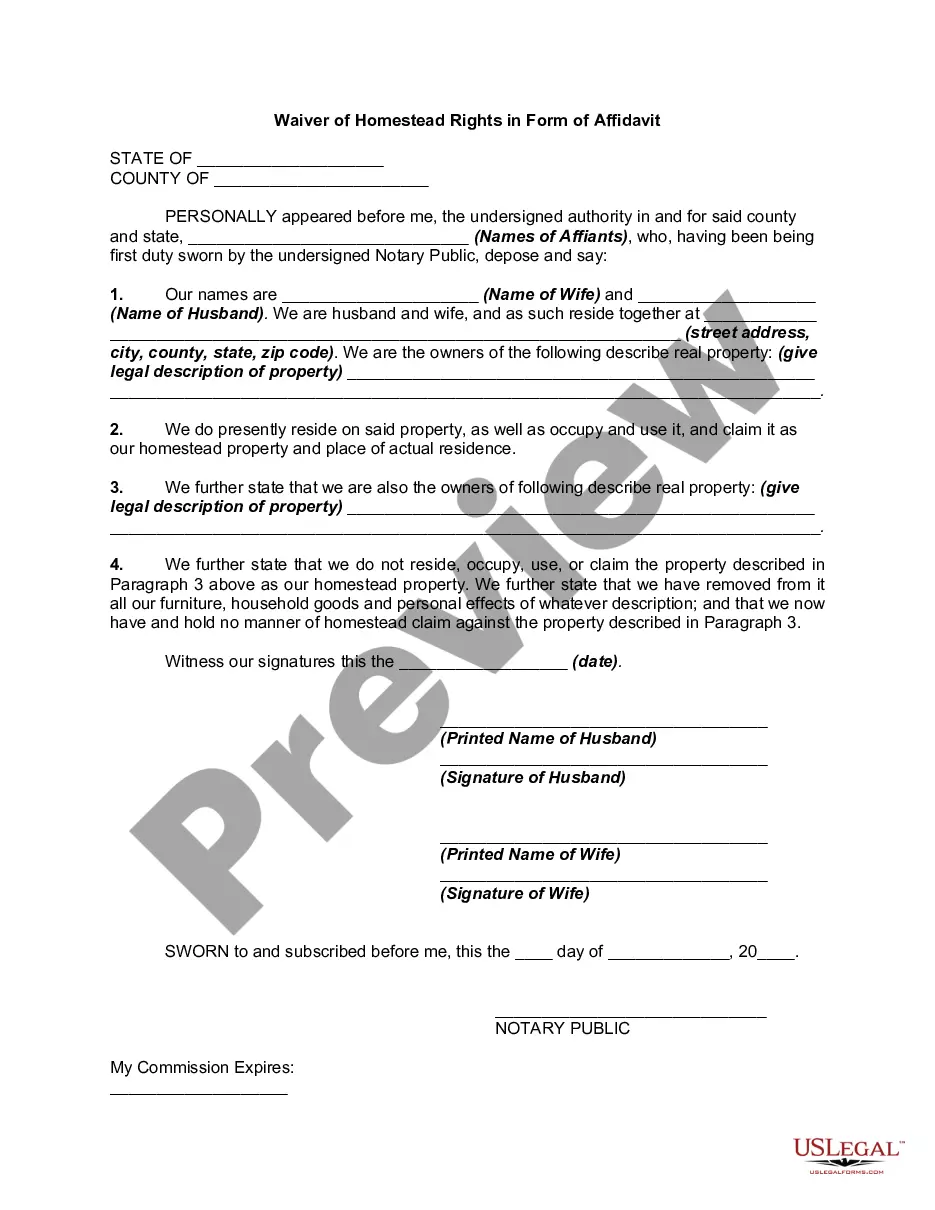

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

Creating legal documents from the ground up can occasionally feel quite daunting. Certain situations may require extensive research and significant financial investment.

If you’re looking for a more simple and cost-effective method for generating Minnesota Homestead Document For Editing or any other documents without unnecessary complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms encompasses nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-compliant templates meticulously crafted for you by our legal experts.

Utilize our platform whenever you require dependable and trustworthy services that allow you to swiftly find and download the Minnesota Homestead Document For Editing. If you are already familiar with our services and have previously registered with us, simply Log In to your account, find the form, and download it or access it again later in the My documents section.

Download the form, then complete it, sign it, and print it out. US Legal Forms enjoys a flawless reputation and more than 25 years of experience. Join us today and make form completion a straightforward and efficient process!

- Don’t have an account? No problem. It only takes a few minutes to create one and browse the catalog.

- Before you proceed to download the Minnesota Homestead Document For Editing, consider these suggestions.

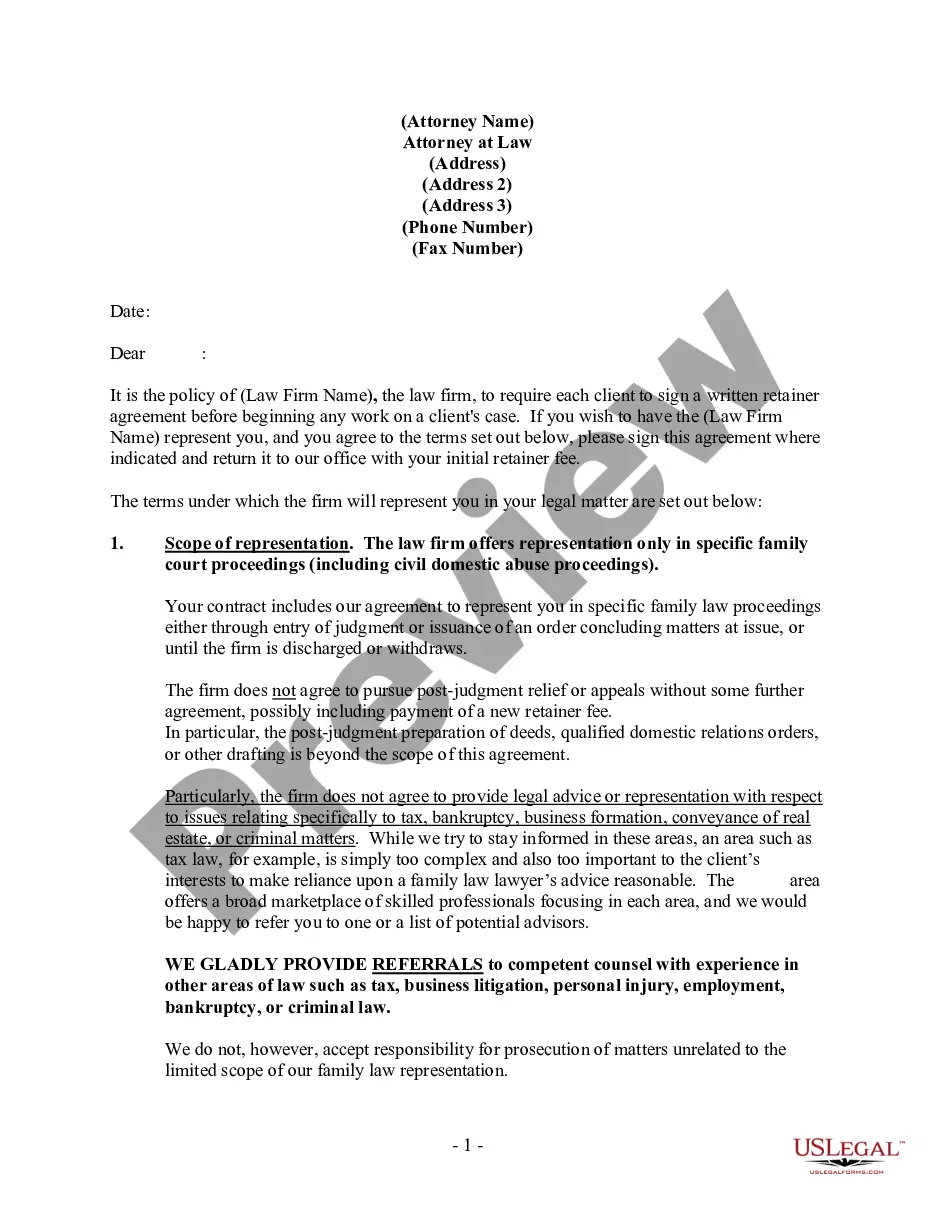

- Review the form preview and descriptions to confirm that you have located the document you need.

- Ensure that the template you select meets the standards of your state and county.

- Select the appropriate subscription plan to acquire the Minnesota Homestead Document For Editing.

Form popularity

FAQ

Effective beginning with assessment year 2024. EXPLANATION OF THE BILL Under current law, the homestead market value exclusion reduces the taxable market value for all homesteads valued below $413,800. The exclusion is 40% of the first $76,000 of market value, yielding a maximum exclusion of $30,400.

If you find a mistake on your Property Tax Refund return, amend it by filing Form M1PRX, Amended Homestead Credit Refund (for Homeowners) and Renter Property Tax Refund. Common reasons to amend your return include: Changing your household income. Receiving an additional or corrected Certificate of Rent Paid.

Many taxpayers in Minnesota, USA, are set to receive a tax refund over the coming days, thanks to a new tax rebate August 2023 law. Overall, over two million checks worth up to 1,300 dollars each will be sent out across August and September, thanks to a new initiative from Governor Tim Walz.

Must have the property classified as your homestead (or applied for the classification) must have a valid Social Security Number (If married filing jointly, at least one spouse must have a valid SSN) must have paid or have an arrangement to pay any delinquent property taxes on the home (if any).

What are the maximums? For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund. How are claims filed?