Minnesota Homestead Application With No Income

Description

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

Acquiring legal forms that adhere to national and local regulations is crucial, and the web provides numerous choices to choose from.

However, what’s the benefit of spending time hunting for the properly constructed Minnesota Homestead Application With No Income template online when the US Legal Forms digital repository already compiles such forms in a single location.

US Legal Forms boasts the largest digital legal database featuring more than 85,000 editable forms crafted by lawyers for various professional and personal situations. They are easy to navigate, with all documents categorized by state and intended use. Our experts stay informed on legislative changes, ensuring that your form is current and compliant when retrieving a Minnesota Homestead Application With No Income from our site.

Click Buy Now once you have identified the right form and choose a subscription plan. Create an account or Log In and make a payment via PayPal or credit card. Select your preferred format for the Minnesota Homestead Application With No Income and download it. All templates found through US Legal Forms are reusable. To redownload and fill out previously acquired documents, navigate to the My documents section in your profile. Benefit from the most comprehensive and user-friendly legal document service!

- Acquiring a Minnesota Homestead Application With No Income is straightforward and quick for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document sample you require in your desired format.

- If you are visiting our website for the first time, follow the steps outlined below.

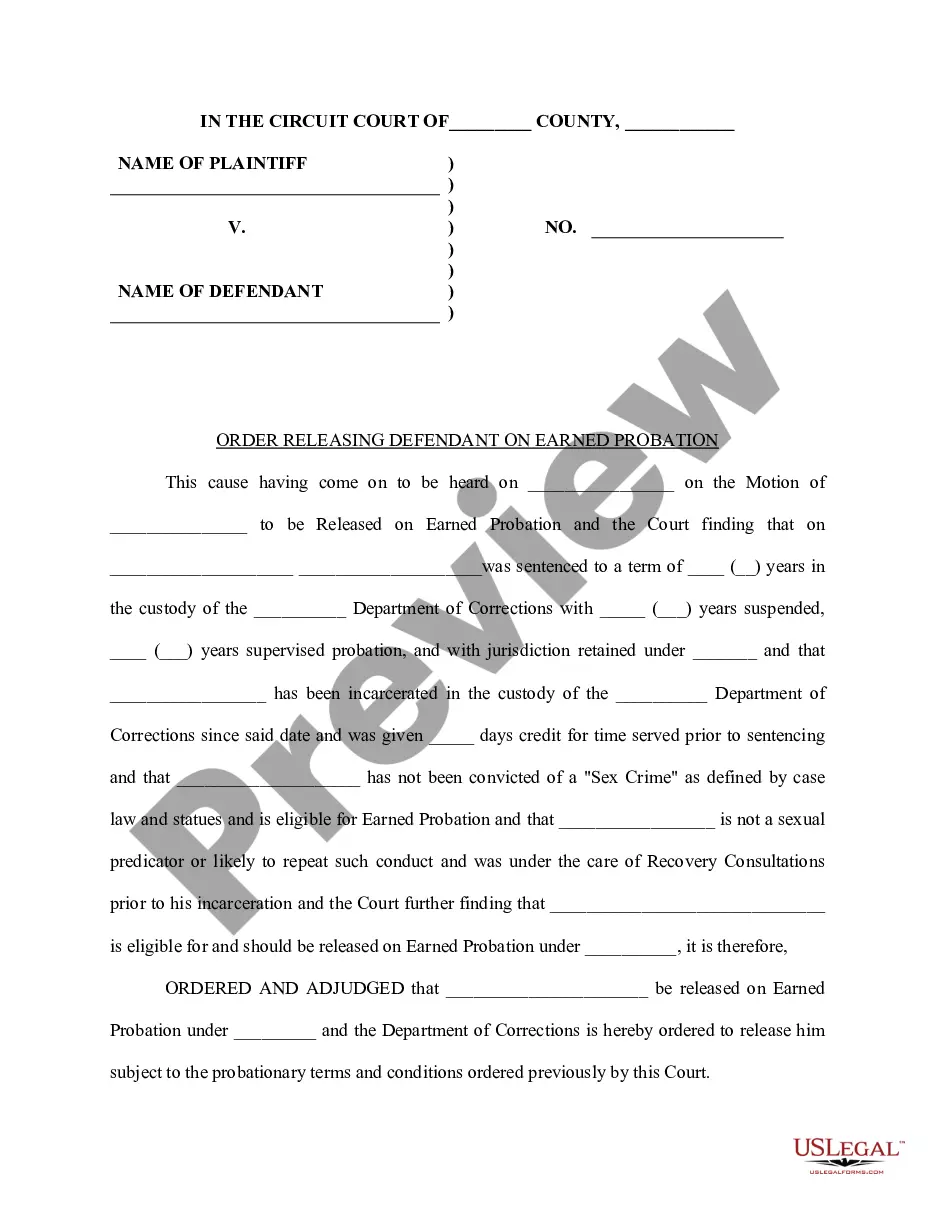

- Review the template using the Preview feature or through the textual description to ensure it fits your requirements.

- Search for a different template using the search bar at the top of the page if needed.

Form popularity

FAQ

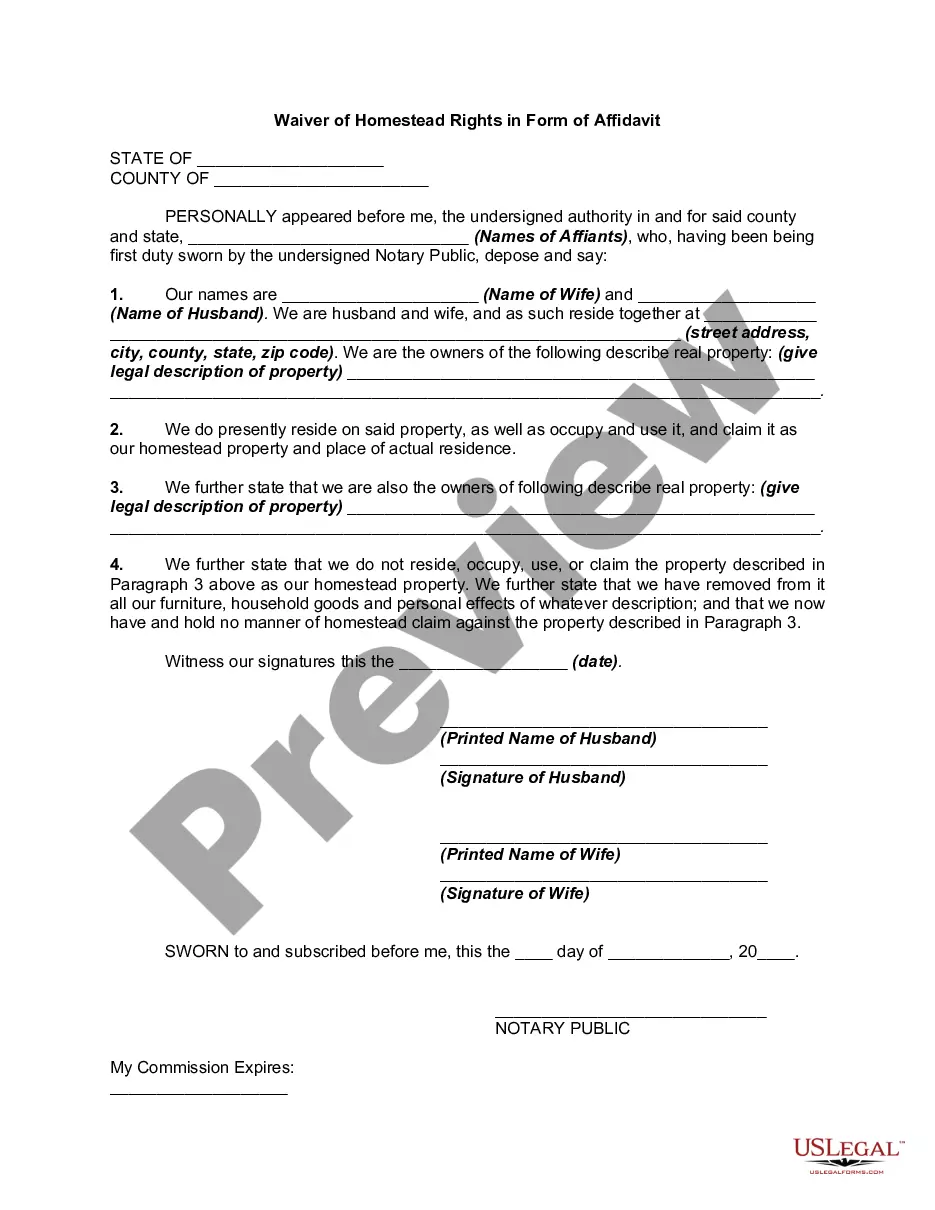

In Minnesota, a 'non-homestead' property refers to any real estate that is not designated as the owner’s primary residence. This classification usually applies to rental properties, vacant land, or second homes. Understanding this distinction is important when filing a Minnesota homestead application with no income. By qualifying your property as a homestead, you may gain access to property tax benefits that are not available for non-homestead properties.

For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund. How are claims filed?

You are a Minnesota resident. You own the property in your own name ? not as a business entity. You live in the property year-round. You or your property co-owner have a social security number or an individual taxpayer identification number.

The State of Minnesota maintains the homestead program for residents who own and occupy their home or have a qualifying relative who occupies the home called the Homestead Market Value Exclusion.

Effective beginning with assessment year 2024. EXPLANATION OF THE BILL Under current law, the homestead market value exclusion reduces the taxable market value for all homesteads valued below $413,800. The exclusion is 40% of the first $76,000 of market value, yielding a maximum exclusion of $30,400.

Must have the property classified as your homestead (or applied for the classification) must have a valid Social Security Number (If married filing jointly, at least one spouse must have a valid SSN) must have paid or have an arrangement to pay any delinquent property taxes on the home (if any).