Minnesota Homestead Application With Mortgage

Description

How to fill out Minnesota Waiver Of Homestead Exemption By Client To Secure Attorney's Fees?

Creating legal documents from the beginning can occasionally be intimidating.

Certain situations may require extensive investigation and significant financial resources.

If you’re looking for a simpler and more economical method of preparing the Minnesota Homestead Application With Mortgage or other forms without having to navigate through complications, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal affairs.

Before rushing to download the Minnesota Homestead Application With Mortgage, keep these pointers in mind: Verify the form preview and descriptions to confirm you’ve located the correct document, ensure the chosen template meets your state and county regulations, select the appropriate subscription plan to purchase the Minnesota Homestead Application With Mortgage, and finally, download the file, complete it, certify it, and print it out. US Legal Forms has an excellent reputation and over 25 years of expertise. Join us today and make document management an effortless and efficient process!

- With just a few mouse clicks, you can swiftly access state- and county-compliant forms carefully organized for you by our professional legal team.

- Utilize our service whenever you require trustworthy and dependable options to quickly locate and download the Minnesota Homestead Application With Mortgage.

- If you’re already familiar with our website and have created an account with us before, just Log In, choose the form, and download it immediately or retrieve it later in the My documents section.

- Don’t have an account? No problem. Registering takes just a few moments, allowing you to browse the catalog.

Form popularity

FAQ

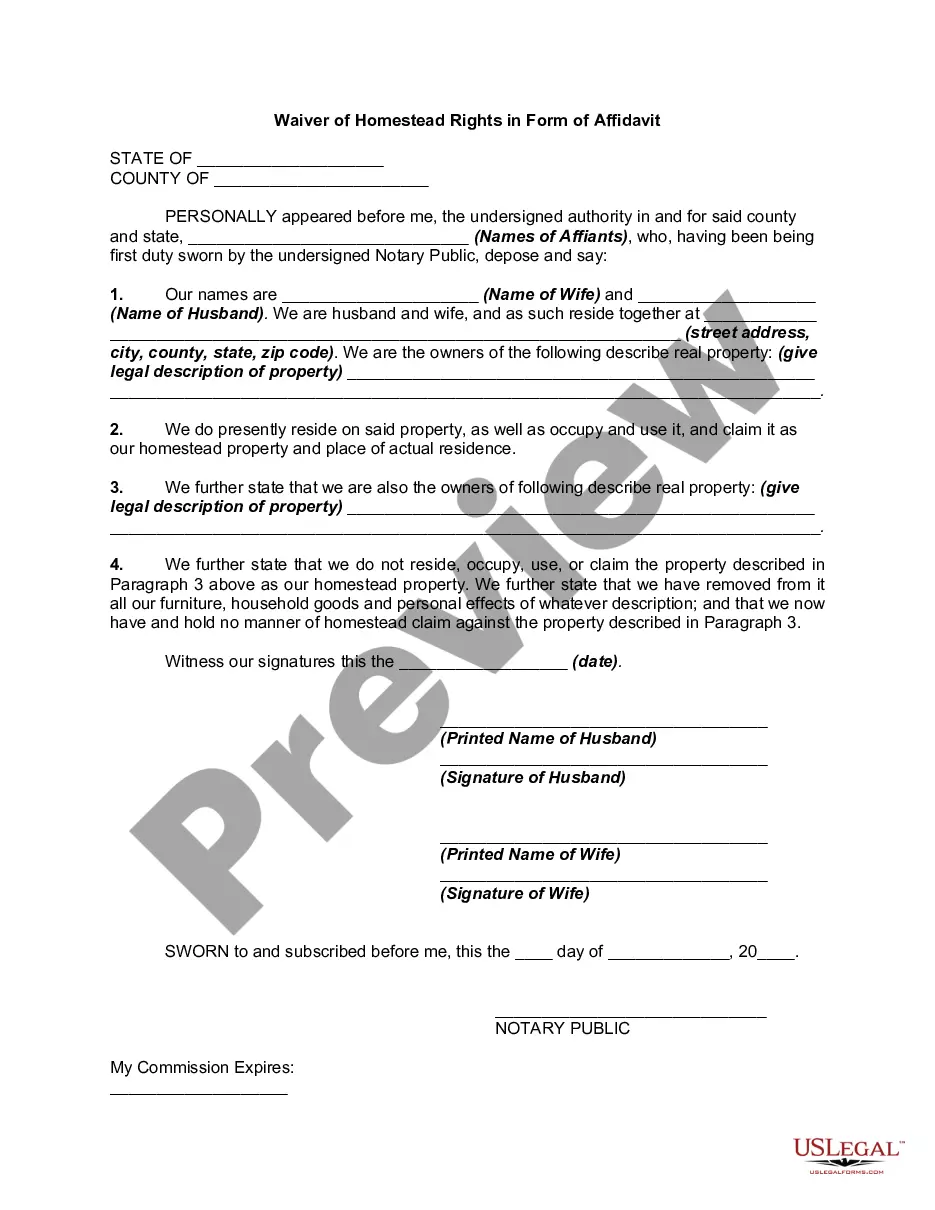

Homeowner's Homestead Credit Refund ?Type of refund?Regular?Requirements to claim the refund?You owned and lived in your home on January 2, 2023 Your household income for 2022 was less than $128,280 05-Jul-2023

Effective beginning with assessment year 2024. EXPLANATION OF THE BILL Under current law, the homestead market value exclusion reduces the taxable market value for all homesteads valued below $413,800. The exclusion is 40% of the first $76,000 of market value, yielding a maximum exclusion of $30,400.

What is the homestead credit refund program? the maximum refund decreases. The program uses household income, a broad measure that includes most types of income, including income that is not subject to income tax. Deductions are allowed for dependents and for claimants who are over age 65 or disabled.

For homesteads valued at $76,000 or less, the exclusion is 40% of the market value, creating a maximum exclusion of $30,400. The exclusion is reduced as property values increase, and phases out for homesteads valued at $413,800 or more.

To qualify for homestead: You must own the property, or be a relative or in-law of the owner (son, daughter, parent, grandchild, grandparent, brother, sister, aunt, uncle, niece or nephew). You or your relative must occupy the property as the primary place of residence. You must be a Minnesota resident.