Minnesota Release Of Mortgage Form Form

Description

How to fill out Minnesota Certificate Of Full Release Of Mortgage By Title Insurance Company Or Its Agent - Minn. Stat. 507.401 - UCBC Form 20.7.1?

Precisely composed official paperwork is one of the crucial assurances for preventing issues and legal disputes, yet acquiring it without the assistance of an attorney may require time.

Whether you need to swiftly locate a current Minnesota Release Of Mortgage Form or any other templates for employment, family, or business scenarios, US Legal Forms is always ready to assist.

The process is even simpler for existing users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button beside the selected file. Furthermore, you can retrieve the Minnesota Release Of Mortgage Form at any time, as all documents ever acquired on the platform remain accessible within the My documents tab of your profile. Save time and money on drafting official documents. Experience US Legal Forms today!

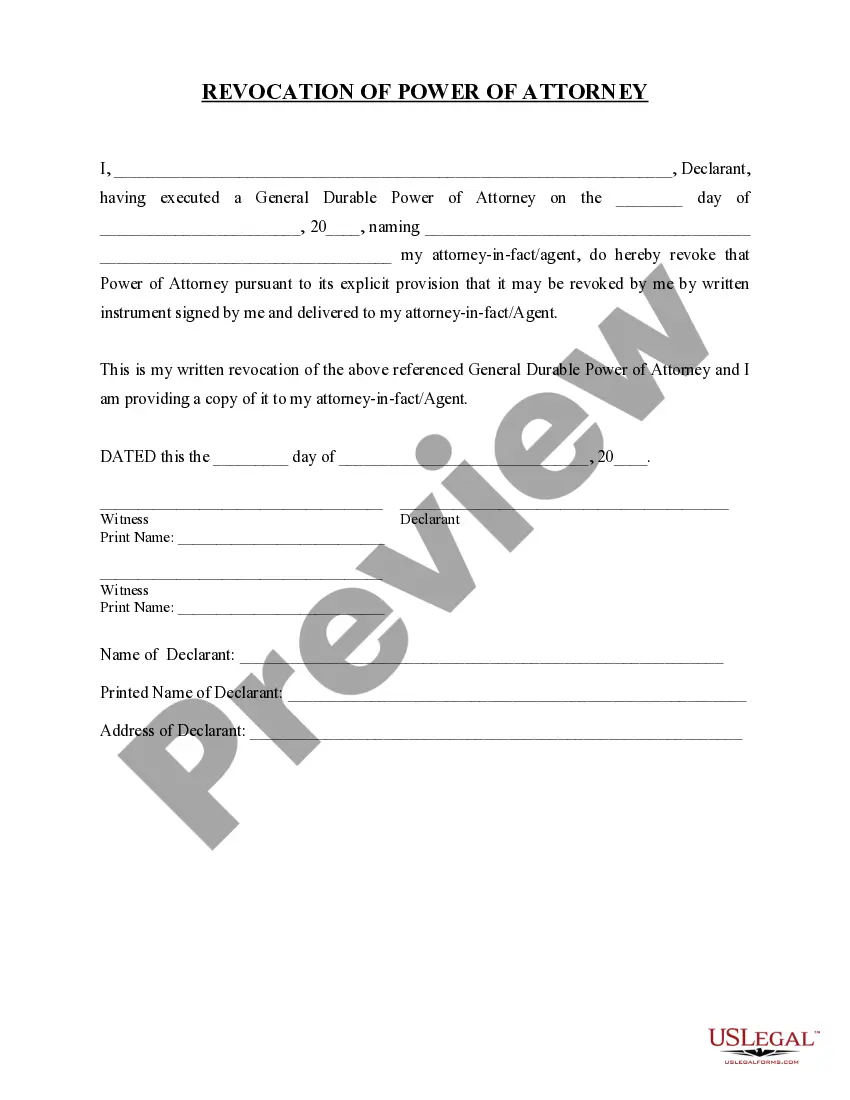

- Ensure that the form is appropriate for your situation and area by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Click Buy Now once you locate the suitable template.

- Choose the pricing plan, Log In to your account or create a new one.

- Select your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX file format for your Minnesota Release Of Mortgage Form.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

If you have cleared a debt, a mortgage satisfaction document will give you clear title to real property. In other words, mortgage satisfaction is a document that results in release or discharge of a mortgage lien, and indicates that a borrower has cleared his/her debt.

Satisfaction of mortgage vs.Both a satisfaction of mortgage and deed of reconveyance indicate that the loan has been fully paid and the lien on the property has been released. A deed of reconveyance, however, is typically used in states where a deed of trust is also utilized.

A Satisfaction of Mortgage, sometimes called a release of mortgage, is a document that acknowledges that the terms of a Mortgage Agreement have been satisfied, meaning that a borrower has repaid their mortgage loan to the lender.

Releasing a mortgage lien often involves two or three signatures. Depending on your state, the person who's given the mortgage, the borrower, and the lender may be required to sign the release. In many states, a notary public signature and, possibly, a seal, is also needed to have a legal release of lien.

In addition the following information should be included:The Payee Name.The Owner(s) of the mortgage holder.Total amount of mortgage.Mortgage date of execution.Full and legal description of the property to include tax parcel number.Acknowledgement that all payments have been made in full.More items...?