Minnesota Corporation Form Withholding

Description

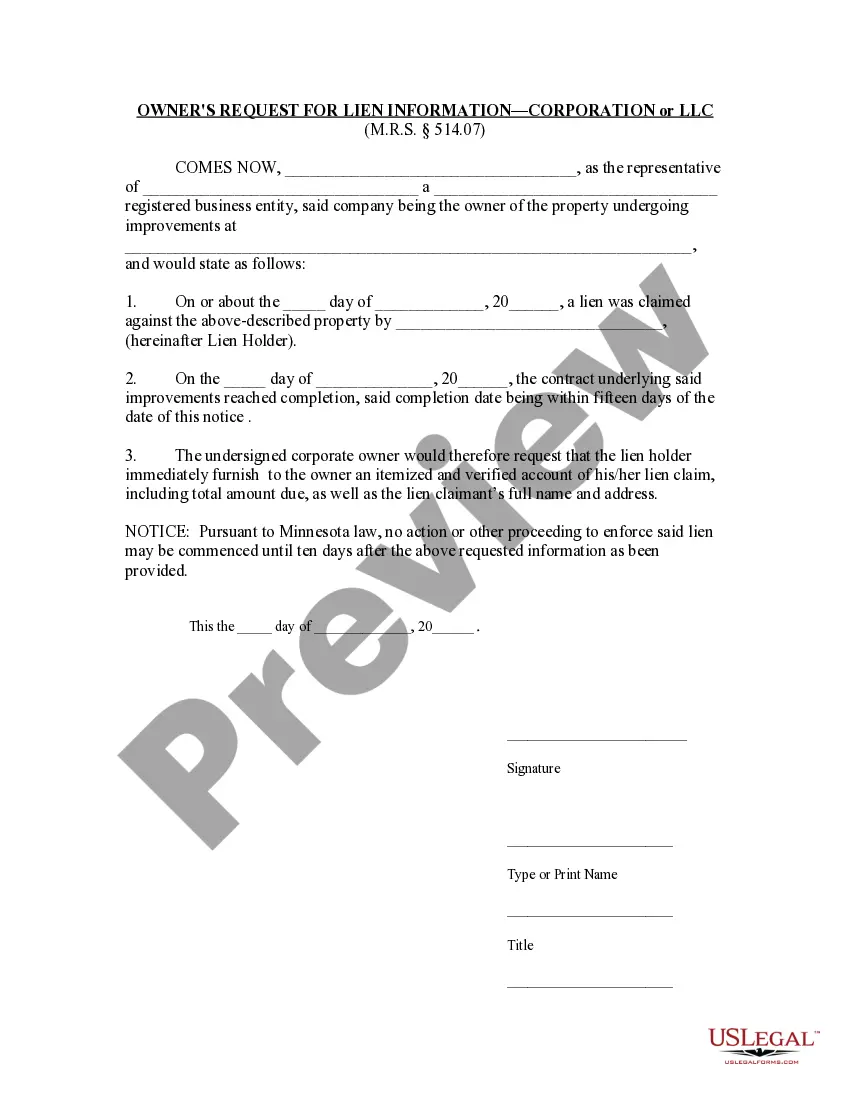

How to fill out Minnesota Corporation Form Withholding?

When you are required to submit the Minnesota Corporation Form Withholding in accordance with your local state's statutes and requirements, there may be numerous alternatives to select from.

There's no need to inspect every form to ensure it meets all the legal standards if you are a US Legal Forms member.

It is a reliable service that can assist you in obtaining a reusable and current template on any topic.

Using the Preview mode and reviewing the form description if available, find another sample using the Search bar in the header if needed. Click Buy Now once you locate the correct Minnesota Corporation Form Withholding. Choose the most suitable pricing plan, Log In to your account, or create a new one. Pay for a subscription (PayPal and credit card methods are available). Download the sample in your preferred file format (PDF or DOCX). Print the document or fill it out electronically in an online editor. Acquiring expertly prepared formal documents becomes effortless with US Legal Forms. Furthermore, Premium users can also take advantage of the robust integrated solutions for online document editing and signing. Try it today!

- US Legal Forms is the most extensive online directory with a collection of over 85k ready-to-use documents for business and personal legal situations.

- All templates are confirmed to comply with each state's regulations.

- Therefore, when downloading the Minnesota Corporation Form Withholding from our site, you can be assured that you possess a valid and up-to-date document.

- Acquiring the required sample from our platform is quite simple.

- If you already have an account, just Log In to the system, confirm that your subscription is active, and save the selected file.

- Later, you can access the My documents tab in your profile and retrieve the Minnesota Corporation Form Withholding at any time.

- If this is your first time using our library, please follow the instructions below.

- Browse the suggested page and verify it for adherence to your requirements.

Form popularity

FAQ

Yes, Minnesota has state income tax forms that individuals and businesses must complete annually. These forms include various options depending on your specific circumstances, such as the M1 or M2 forms. For guidance and to download the necessary documents, uslegalforms offers a user-friendly platform that helps you navigate the complexities associated with Minnesota corporation form withholding.

Yes, Minnesota does impose state withholding on employee wages. Employers must withhold a portion of an employee's income to cover state taxes, which is a critical aspect of the Minnesota corporation form withholding process. Ensuring proper withholding helps businesses avoid penalties and supports employees in meeting their tax obligations.

Minnesota Form M1W is used to report and remit state income tax withholdings from employee wages. It's a key document for employers, ensuring compliance with state laws surrounding Minnesota corporation form withholding. You can easily access the form and instructions on uslegalforms, which provides comprehensive resources for Minnesota business owners.

Your Minnesota state withholding ID is a unique number assigned to you by the Minnesota Department of Revenue for reporting income tax withholding. If you are unsure about your ID, you can find it in your registration paperwork or contact the revenue department directly. Using the correct ID is crucial for accurate reporting and compliance with Minnesota corporation form withholding.

The M1W form is Minnesota's income tax withholding form used by employers to report the amounts withheld from employee wages. This form is essential for complying with Minnesota corporation form withholding requirements. You can find the M1W form on the Minnesota Department of Revenue website or uslegalforms, where you can easily access the necessary documentation.

You can obtain Minnesota tax forms online through the Minnesota Department of Revenue website. Alternatively, you can visit uslegalforms to find various forms related to Minnesota corporation form withholding. This platform simplifies the process, making it easy for you to locate and download the necessary forms.

Minnesota form AWC, or the Annual Withholding Certificate, is essential for corporations operating in Minnesota. This form outlines the withholding amounts a corporation should deduct from employee wages for state tax purposes. By accurately completing the Minnesota corporation form withholding, businesses ensure compliance with state tax regulations and avoid potential penalties. Utilizing our platform, US Legal Forms, simplifies the process of obtaining and filing this form, making it easier for you to focus on your business.

You can determine your exemption status by analyzing your income sources and your residency situation in Minnesota. Additionally, review the Minnesota corporation form withholding criteria for exemptions. For a definitive assessment, consider seeking advice from a tax professional or utilizing the resources available through the state's Department of Revenue.

Certain individuals may be exempt from Minnesota state income tax, including some low-income earners, specific retirees, and non-residents. Also, specific sources of income may not be taxable under Minnesota law. To determine your eligibility for exemption, refer to the Minnesota corporation form withholding documentation or consult a qualified tax advisor.

You can change your Minnesota state tax withholding by submitting a new Form W-4, Employee's Withholding Certificate, to your employer. This form allows you to adjust your withholding amount based on your current financial situation. For employers, it is essential to update payroll systems in accordance with employee requests and Minnesota corporation form withholding requirements.